Form 424B3 - Prospectus [Rule 424(b)(3)]

11 July 2024 - 5:23AM

Edgar (US Regulatory)

Index supplement to the prospectus dated April 13, 2023, the prospectus supplement dated April 13, 2023, the product supplement no. 3 - I dated April 13, 2023 and the underlying supplement no. 2 - IV dated October 20, 2023. Registration Statement Nos. 333 - 270004 and 333 - 270004 - 01 D ate d Jul y 10 , 2024 Rul e 424(b)(3) Hypothetical and Actual Historical Monthly and Annual Returns Bac k tested usi ng p r o xies Backtested A c tual Year Dec Nov Oct Sep Aug Jul Jun May Apr Mar Feb Jan 7.20% 3.22% 0.65% 2.81% - 1.78% - 0.40% - 2.27% 2.77% - 1.48% 1.74% 1.71% - 1.61% 1.83% 1999 - 9.78% 0.09% - 3.96% - 1.52% - 3.86% 3.03% - 1.18% 0.71% - 0.80% - 1.68% 3.83% - 1.06% - 3.51% 2000 - 11.25% 0.42% 3.26% 0.40% - 5.26% - 3.85% - 0.71% - 1.30% 0.06% 2.43% - 3.37% - 4.61% 1.09% 2001 - 13.23% - 2.17% 1.87% 2.58% - 3.53% 0.14% - 4.33% - 3.55% - 0.61% - 3.79% 1.90% - 1.32% - 0.98% 2002 16.28% 4.27% 0.63% 3.77% - 0.85% 1.27% 0.94% 0.58% 2.45% 3.35% 0.67% - 0.59% - 1.13% 2003 7.05% 3.03% 3.32% 1.36% 0.77% - 0.27% - 3.25% 1.59% 1.14% - 1.37% - 1.95% 1.18% 1.48% 2004 - 1.32% - 0.49% 2.68% - 2.65% 0.50% - 1.29% 3.41% - 0.31% 2.10% - 2.27% - 2.00% 1.92% - 2.68% 2005 10.39% 1.11% 1.75% 2.97% 2.09% 1.62% 0.03% - 0.16% - 3.58% 1.13% 0.92% - 0.06% 2.27% 2006 - 0.82% - 0.43% - 3.01% 0.60% 1.69% 0.78% - 2.49% - 2.01% 2.82% 3.20% 0.34% - 3.29% 1.25% 2007 - 14.18% 0.36% - 0.85% - 3.33% - 3.38% 0.54% - 0.62% - 4.69% 0.47% 1.84% - 0.18% - 1.64% - 3.49% 2008 11.17% 1.10% 3.02% - 1.16% 1.78% 1.50% 2.81% 0.02% 1.52% 2.14% 2.02% - 2.35% - 1.58% 2009 9.53% 4.44% 0.02% 2.12% 4.36% - 2.23% 2.90% - 2.30% - 3.89% 1.33% 3.80% 1.57% - 2.49% 2010 - 2.09% 0.41% 0.14% 3.42% - 2.09% - 6.26% - 1.38% - 1.81% - 0.94% 2.39% - 0.34% 2.84% 1.92% 2011 7.00% 0.81% 0.08% - 1.69% 1.96% 1.44% 1.03% 2.13% - 4.47% - 0.48% 2.18% 2.24% 1.78% 2012 24.98% 2.51% 2.74% 3.82% 2.80% - 2.72% 3.43% - 1.17% 1.74% 1.10% 3.14% 1.16% 4.19% 2013 7.26% - 0.61% 2.01% 0.41% - 1.61% 3.96% - 1.69% 2.16% 2.21% 0.21% 0.76% 2.90% - 3.43% 2014 - 3.77% - 1.06% 0.17% 3.95% - 0.96% - 7.43% 1.83% - 1.88% 1.05% 0.62% - 1.26% 3.64% - 2.00% 2015 6.12% 1.94% 3.56% - 1.68% - 0.55% 0.03% 2.07% - 1.02% 1.41% 0.11% 3.54% 0.03% - 3.27% 2016 27.73% 1.52% 4.47% 3.27% 2.54% - 0.04% 2.48% 0.53% 1.38% 1.36% 0.11% 5.15% 2.09% 2017 - 3.13% - 4.72% 0.93% - 7.88% 0.55% 3.10% 2.92% 0.07% 1.26% 0.10% - 1.68% - 4.88% 8.04% 2018 15.11% 2.86% 2.90% 1.34% 0.79% - 2.43% 0.90% 5.14% - 5.33% 2.76% 1.12% 1.49% 3.02% 2019 2.86% 2.14% 4.89% - 1.44% - 1.82% 2.82% 1.65% 0.49% 1.07% 1.85% - 2.33% - 5.99% - 0.05% 2020 17.39% 2.74% - 0.99% 5.24% - 4.56% 2.83% 2.05% 1.89% 0.46% 3.43% 2.67% 1.51% - 0.78% 2021 - 10.69% - 2.46% 2.15% 3.22% - 4.05% - 2.00% 3.47% - 3.18% - 0.03% - 4.28% 1.50% - 1.46% - 3.69% 2022 11.54% 3.42% 6.09% - 2.22% - 4.47% - 1.92% 2.31% 4.41% 0.05% 0.79% 1.79% - 1.48% 2.71% 2023 10.25% 2.88% 3.48% - 4.11% 2.40% 4.32% 1.10% 2024 Please refer to the “Selected Risks” and “Disclaimer” on the following page. Historical performance measures for the Index represent hypothetical backtested performance from December 31, 1998 through May 12, 2009 and the actual performance of the Index from May 13, 2009 through June 28, 2024. Please see “Use of hypothetical backtested returns” at the end of this presentation for additional information related to backtesting. Except as noted above and in the sections entitled “Use of hypothetical backtested returns” at the end of this document, the hypothetical monthly and annual returns set forth above were determined using the methodology currently used to calculate the Index. PAST PERFORMANCE AND BACKTESTED PERFORMANCE ARE NOT INDICATIVE OF FUTURE RESULTS. JU L Y 2024 S&P 500® D aily Risk C o n t r ol 10% Ind e x

JULY 2024 | S&P 500® Daily Risk Control 10% Index S elected Risks JPMorgan Chase & Co. is currently one of the companies that make up the underlying index The Index may not be successful and may not outperform or underperform the underlying index The Index may not approximate its target volatility of 10% The daily adjustment of the exposure of the Index to the underlying index may cause the Index not to reflect fully any appreciation of the underlying index or to magnify any depreciation of the underlying index The Index may be significantly uninvested, which will result in a portion of the Index reflecting no return The level of the Index reflects the deduction of a notional financing cost The Index’s methodology for calculating the notional financing cost was recently changed The risks identified above are not exhaustive. You should also review carefully the related “Risk Factors” section in the relevant disclosure statement and underlying supplement and the “Selected Risk Considerations” in the relevant term sheet or disclosure supplement. Disclaimer Impo r ta n t Inf orma tion The information contained in this document is for discussion purposes only . Any information relating to performance contained in these materials is illustrative and no assurance is given that any indicative returns, performance or results, whether historical or hypothetical, will be achieved . All information herein is subject to change without notice, however, J . P . Morgan undertakes no duty to update this information . In the event of any inconsistency between the information presented herein and any offering documents, the offering documents shall govern . Us e o f h ypothetic a l ba c k tested r eturns Any backtested historical performance information included herein is hypothetical . The constituents and proxy constituents may not have traded together in the manner shown in the hypothetical backtest of the Index included herein, and no representation is being made that the Index will achieve similar performance . There are frequently significant differences between hypothetical backtested performance and actual subsequent performance . The use of alternative “proxy” information may create additional differences between hypothetical backtested and actual performance and allocations . The results obtained from backtesting information should not be considered indicative of the actual results that might be obtained from an investment or participation in a financial instrument or transaction referencing the Index . J . P . Morgan provides no assurance or guarantee that investments linked to the Index will operate or would have operated in the past in a manner consistent with these materials . The hypothetical historical levels presented herein have not been verified by an independent third party, and such hypothetical historical levels have inherent limitations . Alternative simulations, techniques, modeling or assumptions might produce significantly different results and prove to be more appropriate . Actual results will vary, perhaps materially, from the hypothetical backtested returns and allocations presented in this document . HISTORICAL AND BACKTESTED PERFORMANCE AND ALLOCATIONS ARE NOT INDICATIVE OF FUTURE RESULTS . Investment suitability must be determined individually for each investor, and investments linked to the Index may not be suitable for all investors . This material is not a product of J . P . Morgan Research Departments . Copyright © 2024 JPMorgan Chase & Co . All rights reserved . For additional regulatory disclosures, please consult : www . jpmorgan . com/disclosures . Information contained on this website is not incorporated by reference in, and should not be considered part of, this document . This monthly update document replaces and supersedes all prior written materials of this type previously provided with respect to the Index .

JP Morgan Chase (NYSE:JPM-M)

Historical Stock Chart

From Oct 2024 to Nov 2024

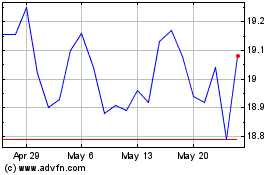

JP Morgan Chase (NYSE:JPM-M)

Historical Stock Chart

From Nov 2023 to Nov 2024