Form N-CSRS - Certified Shareholder Report, Semi-Annual

05 August 2023 - 5:21AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSRS

Investment Company Act file number: 811-05655

DWS Municipal

Income Trust

(Exact Name of Registrant

as Specified in Charter)

875 Third Avenue

New York, NY 10022-6225

(Address of Principal

Executive Offices) (Zip Code)

Registrant’s

Telephone Number, including Area Code: (212) 454-4500

Diane Kenneally

100 Summer Street

Boston, MA 02110

(Name and Address of

Agent for Service)

| Date of fiscal year end: |

11/30 |

| |

|

| Date of reporting period: |

5/31/2023 |

| ITEM 1. |

REPORT TO STOCKHOLDERS |

| |

|

| |

(a) |

| |

|

May 31,

2023

Semiannual Report

to Shareholders

DWS Municipal Income Trust

Ticker Symbol: KTF

The Fund’s investment objective is to provide a high level of current income exempt from federal income tax.

Closed-end funds, unlike

open-end funds, are not continuously offered. There is a one time public offering and once issued, shares of closed-end funds are sold in the open market through a stock exchange. Shares of closed-end funds frequently trade at a discount to net asset value. The price

of the Fund’s shares is determined by a number of factors, several of which are beyond the control of the Fund. Therefore, the Fund cannot predict whether its shares will trade at, below or above net asset value.

Bond investments are subject to interest-rate, credit, liquidity and market risks to varying degrees. When interest rates

rise, bond prices generally fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. Municipal securities are subject to the risk that litigation, legislation or other political events, local business or economic

conditions or the bankruptcy of the issuer could have a significant effect on an issuer’s ability to make payments of principal and/or interest. The market for municipal bonds may be less liquid than for taxable bonds and there may be less information available on

the financial condition of issuers of municipal securities than for public corporations. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. Leverage results in

additional risks and can magnify the effect of any gains or losses. Although the Fund seeks income that is exempt from federal income taxes, a portion of the Fund’s distributions may be subject to federal, state and local taxes, including the alternative

minimum tax.

War, terrorism, sanctions, economic uncertainty, trade disputes, public health crises, natural disasters, climate change and related geopolitical events have led and, in the future, may lead to significant

disruptions in U.S. and world economies and markets, which may lead to increased market volatility and may have significant adverse effects on the Fund and its investments.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as

DWS Distributors, Inc. which offers investment products or DWS Investment Management Americas, Inc. and RREEF America L.L.C. which offer advisory services.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE

NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

| |

|

DWS Municipal Income Trust |

Performance SummaryMay 31, 2023 (Unaudited)

Performance is historical, assumes reinvestment of all dividend

and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when sold, shares may

be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please visit dws.com for the Fund’s most recent month-end performance.

Fund specific data and performance are provided for informational purposes only and are

not intended for trading purposes.

Average Annual Total Returns as of 5/31/23 |

DWS Municipal Income Trust |

|

|

|

|

Based on Net Asset

Value(a) |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

Morningstar Closed-End Municipal National Long Funds Category(c)

|

|

|

|

|

Growth of an

Assumed $10,000 Investment

Yearly periods ended May 31

The growth of $10,000 is cumulative.

| |

Total returns shown for periods less than one year are not annualized. |

DWS

Municipal Income Trust |

|

|

| |

Total return based on net asset value reflects changes in the Fund’s net asset value during each period. Total return based on market price reflects changes in market price. Each figure assumes that dividend and capital gain distributions, if any, were reinvested. These figures will differ depending upon the level of any discount from or premium to net asset value at which the Fund’s shares traded during the period. Expenses of the Fund include management fee, interest expense and other fund expenses. Total returns shown take into account these fees and expenses. The expense ratio of the Fund for the six months ended May 31, 2023 was 3.50% (0.94% excluding interest expense). |

| |

The unmanaged, unleveraged Bloomberg Municipal Bond Index covers the U.S. dollar-denominated long-term tax exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds and pre-refunded bonds. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index. |

| |

Morningstar’s Closed-End Municipal National Long Funds category represents muni national long portfolios that invest in municipal bonds. Such bonds are issued by various state and local governments to fund public projects and are free from federal taxes. To lower risk, these funds spread their assets across many states and sectors. They focus on bonds with durations of seven years or more. This makes them more sensitive to interest rates, and thus riskier, than muni funds that focus on bonds with shorter maturities. Morningstar figures represent the average of the total returns based on net asset value reported by all of the closed-end funds designated by Morningstar, Inc. as falling into the Closed-End Municipal National Long Funds category. Category returns assume reinvestment of all distributions. It is not possible to invest directly in a Morningstar category. |

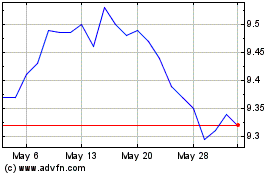

Net Asset Value and Market Price |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

Prices and net asset value fluctuate and are not guaranteed.

| |

|

DWS Municipal Income Trust |

| |

|

Six Months as of 5/31/23:

Income Dividends (common shareholders) |

|

May Income Dividend (common shareholders) |

|

Current Annualized Distribution Rate (based on Net Asset Value)

|

|

Current Annualized Distribution Rate (based on Market Price)

|

|

Tax Equivalent Distribution Rate (based on Net Asset Value)

|

|

Tax Equivalent Distribution Rate (based on Market Price)

|

|

| |

Current annualized distribution rate is the latest monthly dividend shown as an annualized percentage of net asset value/market price on May 31, 2023. Distribution rate simply measures the level of dividends and is not a complete measure of performance. Tax equivalent distribution rate is based on the Fund’s distribution rate and a marginal income

tax rate of 40.8%. Distribution rates are historical, not guaranteed and will fluctuate.

Distributions do not include return of capital or other non-income sources.

|

DWS

Municipal Income Trust |

|

|

Portfolio Management Team

Michael J.

Generazo, Senior Portfolio Manager Fixed Income

Portfolio Manager of the Fund. Began managing the Fund in 2010.

—Joined DWS in 1999.

—BS, Bryant College; MBA, Suffolk

University.

Chad H. Farrington, CFA, Head of Investment Strategy Fixed Income

Portfolio Manager of the Fund. Began managing the Fund in 2021.

—Joined DWS in 2018 with 20 years of industry experience; previously, worked as Portfolio Manager, Head of

Municipal Research, and Senior Credit Analyst at Columbia Threadneedle.

—Co-Head of Municipal Bond Department.

—BS, Montana State University.

| |

|

DWS Municipal Income Trust |

Portfolio Summary(Unaudited)

Asset Allocation (As a % of Investment Portfolio excluding Open-End Investment Companies) |

|

|

| |

|

|

| |

|

|

Escrow to Maturity/Prerefunded Bonds |

|

|

| |

|

|

Variable Rate Demand Notes |

|

|

Variable Rate Demand Preferred Shares |

|

|

| |

|

|

Quality (As a % of Investment Portfolio excluding Open-End Investment Companies) |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

The quality

ratings represent the higher of Moody’s Investors Service, Inc. (“Moody’s” ), Fitch

Ratings, Inc. (“Fitch” ) or

S&P Global Ratings (“S&P” ) credit ratings. The ratings of Moody’s, Fitch and S&P represent their opinions as to the quality of the securities they rate. Credit quality measures a bond

issuer’s ability to repay interest and principal in a timely manner. Ratings are relative and subjective and are not absolute standards of quality. Credit quality does not remove market risk and is subject to change.

Top Five State/Territory Allocations (As a % of

Investment Portfolio excluding Open-End Investment Companies) |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

DWS

Municipal Income Trust |

|

|

Interest Rate Sensitivity |

|

|

| |

|

|

| |

|

|

Leverage (As a % of Total Assets) |

|

|

| |

|

|

Effective maturity is the weighted average of the maturity date of

bonds held by the Fund taking

into consideration any available maturity shortening features.

Modified duration is an approximate measure of a fund’s sensitivity to movements in interest rates based on the current interest rate environment.

Leverage results in additional risks and can magnify the effect of any gains or losses to a greater extent than if leverage were not used.

Portfolio holdings and characteristics are subject to change.

For more complete details about the Fund’s investment portfolio, see page 9. A quarterly Fact Sheet is available on dws.com or upon

request. Please see the Additional Information section on page 47 for contact information.

| |

|

DWS Municipal Income Trust |

Investment Portfolioas of May 31, 2023

(Unaudited)

| |

|

|

Municipal Investments 142.9% |

|

| |

|

Alabama, Black Belt Energy Gas District Gas Project Revenue, Series B, 5.25% (a), 12/1/2053, GTY: Royal Bank of Canada, LIQ: Royal Bank of Canada |

|

|

|

Alabama, UAB Medicine Finance Authority Revenue, Series B2, 5.0%, 9/1/2041 |

|

|

|

| |

|

|

|

| |

|

Alaska, Industrial Development & Export Authority, Tanana Chiefs Conference Project, Series A, 4.0%, 10/1/2044 |

|

|

|

Alaska, Northern Tobacco Securitization Corp., Tobacco Settlement Revenue, “1” , Series A, 4.0%, 6/1/2050 |

|

|

|

| |

|

|

|

| |

|

Arizona, Salt Verde Financial Corp., Gas Revenue: |

|

|

|

5.0%, 12/1/2037, GTY: Citigroup Global Markets |

|

|

|

5.5%, 12/1/2029, GTY: Citigroup Global Markets |

|

|

|

Arizona, State University, Green Bond, Series A, 5.0%, 7/1/2043 |

|

|

|

Maricopa County, AZ, Industrial Development Authority, Hospital Revenue, Series A, 5.0%, 9/1/2042 |

|

|

|

Phoenix, AZ, Civic Improvement Corp., Rental Car Facility Revenue, Series A, 4.0%, 7/1/2045 |

|

|

|

| |

|

|

|

| |

|

California, Golden State Tobacco Securitization Corp., Tobacco Settlement: |

|

|

|

Series A-1, Prerefunded, 5.0%, 6/1/2034 |

|

|

|

Series A-1, Prerefunded, 5.0%, 6/1/2035 |

|

|

|

California, Housing Finance Agency, Municipal Certificates, “A” , Series 2021-1, 3.5%, 11/20/2035 |

|

|

|

California, Morongo Band of Mission Indians Revenue, Series B, 144A, 5.0%, 10/1/2042 |

|

|

|

California, M-S-R Energy Authority, Series A, 7.0%, 11/1/2034, GTY: Citigroup Global Markets |

|

|

|

California, State General Obligation, 5.0%, 11/1/2043 |

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS

Municipal Income Trust |

|

|

| |

|

|

California, State Municipal Finance Authority Revenue, LAX Integrated Express Solutions LLC, LINXS Apartment Project: |

|

|

|

Series A, AMT, 5.0%, 12/31/2043 |

|

|

|

Series A, AMT, 5.0%, 6/1/2048 |

|

|

|

California, Tobacco Securitization Authority, Tobacco Settlement Revenue, San Diego County Tobacco Asset Securitization Corp., Series A, 5.0%, 6/1/2048 |

|

|

|

Long Beach, CA, Harbor Revenue, Series D, 5.0%, 5/15/2039 |

|

|

|

Los Angeles, CA, Department of Airports Revenue: |

|

|

|

Series C, AMT, 5.0%, 5/15/2044 |

|

|

|

Series A, AMT, 5.0%, 5/15/2045 |

|

|

|

Los Angeles, CA, Department of Airports Revenue, Los Angeles International Airport, Series A, AMT, 5.0%, 5/15/2044 |

|

|

|

Nuveen California Quality Municipal Income Fund, Series 7, 144A, 3.48% (b), 6/7/2023 |

|

|

|

San Diego County, CA, Regional Airport Authority Revenue, Series B, AMT, Prerefunded, 5.0%, 7/1/2043 |

|

|

|

San Diego, CA, Unified School District, Election 2012, Series C, Prerefunded, 5.0%, 7/1/2035 |

|

|

|

San Diego, CA, Unified School District, Proposition Z Bonds, Series M2, 3.0%, 7/1/2050 |

|

|

|

San Francisco City & County, CA, Airports Commission, International Airport Revenue, Series D, AMT, 5.0%, 5/1/2048 |

|

|

|

San Francisco, CA, City & County Airports Commission, International Airport Revenue, Series E, AMT, 5.0%, 5/1/2045 |

|

|

|

| |

|

|

|

| |

|

Colorado, State Health Facilities Authority Revenue, School Health Systems, Series A, Prerefunded, 5.5%, 1/1/2035 |

|

|

|

Colorado, State Health Facilities Authority, Hospital Revenue, CommonSpirit Health Obligation Group, Series A-1, 4.0%, 8/1/2044 |

|

|

|

Colorado, State Health Facilities Authority, Hospital Revenue, Covenant Retirement Communities Obligated Group, Series A, 5.0%, 12/1/2048 |

|

|

|

Denver, CO, City & County Airport Revenue: |

|

|

|

Series A, AMT, 5.25%, 11/15/2043 |

|

|

|

The accompanying notes are an integral part of the financial statements.

| |

|

DWS Municipal Income Trust |

| |

|

|

Series A, AMT, 5.25%, 12/1/2043 |

|

|

|

Denver, CO, Health & Hospital Authority, Healthcare Revenue, Series A, 4.0%, 12/1/2040 |

|

|

|

| |

|

|

|

| |

|

Delaware, State Economic Development Authority, Retirement Communities Revenue, Acts Retirement Life Communities, Series B, 5.0%, 11/15/2048 |

|

|

|

District of Columbia 2.3% |

|

District of Columbia, International School Revenue, 5.0%, 7/1/2039 |

|

|

|

District of Columbia, KIPP Project Revenue, 4.0%, 7/1/2049 |

|

|

|

District of Columbia, Metropolitan Airport Authority Systems Revenue: |

|

|

|

Series A, AMT, 5.0%, 10/1/2038 |

|

|

|

Series A, AMT, 5.0%, 10/1/2043 |

|

|

|

District of Columbia, Metropolitan Airport Authority, Dulles Toll Road Revenue, Dulles Metrorail & Capital Improvement Project, Series B, 4.0%, 10/1/2049 |

|

|

|

District of Columbia, Two Rivers Public Charter School, Inc., 5.0%, 6/1/2050 |

|

|

|

| |

|

|

|

| |

|

Brevard County, FL, Health Facilities Authority, Hospital Revenue, Health First, Inc., Series A, 4.0%, 4/1/2052 |

|

|

|

Broward County, FL, Airport Systems Revenue, Series A, AMT, 4.0%, 10/1/2049 |

|

|

|

Collier County,FL, State Educational Facilities Authority Revenue, Ave Maria University Inc., 5.0%, 6/1/2043 |

|

|

|

Florida, Development Finance Corp., Educational Facilities Revenue, Mater Academy Projects: |

|

|

|

Series A, 5.0%, 6/15/2047 |

|

|

|

Series A, 5.0%, 6/15/2052 |

|

|

|

Series A, 5.0%, 6/15/2055 |

|

|

|

Series A, 5.0%, 6/15/2056 |

|

|

|

Florida, Development Finance Corp., Educational Facilities Revenue, River City Science Academy Project: |

|

|

|

Series A-1, 5.0%, 7/1/2042 |

|

|

|

| |

|

|

|

Series A-1, 5.0%, 7/1/2051 |

|

|

|

| |

|

|

|

Series A-1, 5.0%, 2/1/2057 |

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS

Municipal Income Trust |

|

|

| |

|

|

| |

|

|

|

Florida, State Atlantic University Finance Corp., Capital Improvements Revenue, Student Housing Project, Series B, 4.0%, 7/1/2044 |

|

|

|

Florida, State Higher Educational Facilities Financial Authority Revenue, Florida Institute of Technology, Series A, 4.0%, 10/1/2044 |

|

|

|

Greater Orlando, FL, Aviation Authority Airport Facilities Revenue: |

|

|

|

Series A, AMT, 5.0%, 10/1/2042 |

|

|

|

Series A, AMT, 5.0%, 10/1/2047 |

|

|

|

Hillsborough County, FL, Aviation Authority, Tampa International Airport: |

|

|

|

Series A, AMT, 4.0%, 10/1/2052 |

|

|

|

Series A, AMT, 5.0%, 10/1/2048 |

|

|

|

Miami-Dade County, FL, Aviation Revenue: |

|

|

|

Series A, AMT, 5.0%, 10/1/2035 |

|

|

|

Series B, AMT, 5.0%, 10/1/2040 |

|

|

|

Miami-Dade County, FL, Expressway Authority, Toll Systems Revenue, Series A, 5.0%, 7/1/2035, INS: AGMC |

|

|

|

Miami-Dade County, FL, Health Facilities Authority Hospital Revenue, Nicklaus Children’s Hospital, 5.0%, 8/1/2047 |

|

|

|

Miami-Dade County, FL, Seaport Revenue, Series A, AMT, 5.25%, 10/1/2052 |

|

|

|

Miami-Dade County, FL, Transit System, Series A, 4.0%, 7/1/2050 |

|

|

|

Osceola County, FL, Transportation Revenue, Series A-1, 4.0%, 10/1/2054 |

|

|

|

Palm Beach County, FL, Health Facilities Authority, Acts Retirement-Life Communities, Inc., Series A, 5.0%, 11/15/2045 |

|

|

|

Palm Beach County, FL, Health Facilities Authority, Jupiter Medical Center, Series A, 5.0%, 11/1/2052 |

|

|

|

Tampa, FL, The University of Tampa Project, Series A, 4.0%, 4/1/2050 |

|

|

|

Tampa, FL, Water & Waste Water System Revenue, Series A, 5.25%, 10/1/2057 |

|

|

|

| |

|

|

|

| |

|

Atlanta, GA, Airport Passenger Facility Charge Revenue, Series D, AMT, 4.0%, 7/1/2038 |

|

|

|

Cobb County, GA, Kennestone Hospital Authority, Revenue Anticipation Certificates, Wellstar Health System, Inc. Project, Series A, 4.0%, 4/1/2052 |

|

|

|

The accompanying notes are an integral part of the financial statements.

| |

|

DWS Municipal Income Trust |

| |

|

|

Fulton County, GA, Development Authority Hospital Revenue, Revenue Anticipation Certificates, Wellstar Health System, Series A, 5.0%, 4/1/2042 |

|

|

|

Fulton County, GA, Development Authority Hospital Revenue, Wellstar Health System, Obligated Inc. Project, Series A, 4.0%, 4/1/2050 |

|

|

|

George L Smith II, GA, Congress Center Authority, Convention Center Hotel First Tier, Series A, 4.0%, 1/1/2054 |

|

|

|

Georgia, Main Street Natural Gas, Inc., Gas Project Revenue: |

|

|

|

Series A, 5.5%, 9/15/2024, GTY: Merrill Lynch & Co. |

|

|

|

Series A, 5.5%, 9/15/2028, GTY: Merrill Lynch & Co. |

|

|

|

Georgia, Main Street Natural Gas, Inc., Gas Supply Revenue, Series B, 5.0% (a), 7/1/2053, GTY: Royal Bank of Canada |

|

|

|

Georgia, Municipal Electric Authority Revenue, Project One: |

|

|

|

| |

|

|

|

| |

|

|

|

Georgia, Private Colleges & Universities Authority Revenue, Mercer University Project, 4.0%, 10/1/2047 |

|

|

|

| |

|

|

|

| |

|

Hawaii, State Airports Systems Revenue, Series A, AMT, 5.0%, 7/1/2041 |

|

|

|

| |

|

Chicago, IL, General Obligation: |

|

|

|

| |

|

|

|

| |

|

|

|

Chicago, IL, Metropolitan Pier & Exposition Authority, McCormick Place Expansion Project, Series B, Zero Coupon, 6/15/2044, INS: AGMC |

|

|

|

Chicago, IL, O’Hare International Airport Revenue, Series A, AMT, 5.5%, 1/1/2055 |

|

|

|

Chicago, IL, O’Hare International Airport Revenue, Senior Lien, Series D, AMT, 5.0%, 1/1/2047 |

|

|

|

Chicago, IL, O’Hare International Airport, Special Facility Revenue, AMT, 5.0%, 7/1/2048 |

|

|

|

Chicago, IL, Transit Authority, Sales Tax Receipts Revenue, Second Lien: |

|

|

|

Series A, 4.0%, 12/1/2050 |

|

|

|

Series A, 5.0%, 12/1/2052 |

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS

Municipal Income Trust |

|

|

| |

|

|

Illinois, Metropolitan Pier & Exposition Authority, Dedicated State Tax Revenue, Capital Appreciation-McCormick, Series A, Zero Coupon, 6/15/2036, INS: NATL |

|

|

|

Illinois, State Finance Authority Revenue, Bradley University Project, Series A, 4.0%, 8/1/2046 |

|

|

|

Illinois, State Finance Authority Revenue, OSF Healthcare Systems, Series A, 5.0%, 11/15/2045 |

|

|

|

Illinois, State Finance Authority Revenue, University of Chicago, Series A, 5.0%, 10/1/2038 |

|

|

|

Illinois, State General Obligation: |

|

|

|

| |

|

|

|

Series C, 4.0%, 10/1/2037 |

|

|

|

Series B, 5.0%, 10/1/2033 |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

Springfield, IL, Electric Revenue, Senior Lien, 5.0%, 3/1/2040, INS: AGMC |

|

|

|

| |

|

|

|

| |

|

Indiana, Finance Authority Revenue, DePauw University, Series A, 5.5%, 7/1/2052 |

|

|

|

Indiana, State Finance Authority Revenue, BHI Senior Living Obligated Group, 5.0%, 11/15/2053 |

|

|

|

Indiana, State Finance Authority, Health Facilities Revenue, Baptist Healthcare System, Series A, 5.0%, 8/15/2051 |

|

|

|

Indiana, State Finance Authority, Hospital Revenue, Parkview Health System Obligated Group, Series A, 5.0%, 11/1/2043 |

|

|

|

Indiana, State Housing & Community Development Authority, Single Family Mortgage Revenue, Series C-1, 5.0%, 7/1/2053 |

|

|

|

| |

|

|

|

| |

|

Iowa, Higher Education Loan Authority, Des Moines University Project, 5.375%, 10/1/2052 |

|

|

|

Iowa, State Higher Education Loan Authority Revenue, Private College Facility, Des Moines University Project, 4.0%, 10/1/2045 |

|

|

|

| |

|

|

|

The accompanying notes are an integral part of the financial statements.

| |

|

DWS Municipal Income Trust |

| |

|

|

| |

|

Kentucky, State Economic Development Finance Authority, Owensboro Health, Inc., Obligated Group: |

|

|

|

| |

|

|

|

Series A, 5.25%, 6/1/2041 |

|

|

|

Louisville & Jefferson County, KY, Metro Government Hospital Revenue, UOFL Health Project: |

|

|

|

Series A, 5.0%, 5/15/2047 |

|

|

|

Series A, 5.0%, 5/15/2052 |

|

|

|

| |

|

|

|

| |

|

Louisiana, Public Facilities Authority Revenue, Ochsner Clinic Foundation Project, 5.0%, 5/15/2047 |

|

|

|

Louisiana, Public Facilities Authority Revenue, Tulane University, Series A, 5.0%, 10/15/2052 |

|

|

|

New Orleans, LA, Aviation Board Special Facility Revenue, Parking Facilities Corp., Consol Garage System: |

|

|

|

Series A, 5.0%, 10/1/2043, INS: AGMC |

|

|

|

Series A, 5.0%, 10/1/2048, INS: AGMC |

|

|

|

| |

|

|

|

| |

|

Maryland, Stadium Authority Built To Learn Revenue, Series A, 4.0%, 6/1/2047 |

|

|

|

Maryland, State Economic Development Corp., Student Housing Revenue, Morgan State University Project: |

|

|

|

| |

|

|

|

Series A, 5.75%, 7/1/2053 |

|

|

|

Maryland, State Health & Higher Educational Facilities Authority Revenue, Adventist Healthcare, Obligated Group, Series A, 5.5%, 1/1/2046 |

|

|

|

Maryland, State Health & Higher Educational Facilities Authority Revenue, Broadmead Inc.: |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

Massachusetts, Educational Financing Authority, Issue M: |

|

|

|

Series C, AMT, 3.0%, 7/1/2051 |

|

|

|

Series C, AMT, 4.125%, 7/1/2052 |

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS

Municipal Income Trust |

|

|

| |

|

|

Massachusetts, State Development Finance Agency Revenue, Northeastern University, Series A, 5.25%, 3/1/2037 |

|

|

|

Massachusetts, State Educational Financing Authority, Educational Loan Revenue Bonds, Issue M, Series B, AMT, 3.625%, 7/1/2038 |

|

|

|

| |

|

|

|

| |

|

Michigan, State Finance Authority Ltd. Obligation Revenue, Albion College: |

|

|

|

| |

|

|

|

| |

|

|

|

Michigan, State Finance Authority Revenue, Tobacco Settlement Revenue, “1” , Series A, 4.0%, 6/1/2049 |

|

|

|

Michigan, State Finance Authority, Hospital Revenue, McLaren Health Care, Series A, 4.0%, 2/15/2047 |

|

|

|

Michigan, Strategic Fund, 75 Improvement P3 Project, AMT, 5.0%, 6/30/2048 |

|

|

|

Wayne County, MI, Airport Authority Revenue, Series F, AMT, 5.0%, 12/1/2034 |

|

|

|

| |

|

|

|

| |

|

Duluth, MN, Economic Development Authority, Health Care Facilities Revenue, Essentia Health Obligated Group: |

|

|

|

Series A, 5.0%, 2/15/2048 |

|

|

|

Series A, 5.0%, 2/15/2053 |

|

|

|

Minneapolis, MN, Health Care Systems Revenue, Fairview Health Services, Series A, 5.0%, 11/15/2049 |

|

|

|

Minnesota, State Office of Higher Education Revenue, AMT, 4.0%, 11/1/2042 (c) |

|

|

|

Rochester, MN, Health Care Facilities Revenue, Mayo Clinic, Series B, 5.0%, 11/15/2035 |

|

|

|

| |

|

|

|

| |

|

Missouri, State Health & Educational Facilities Authority Revenue, Medical Research, Lutheran Senior Services: |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

The accompanying notes are an integral part of the financial statements.

| |

|

DWS Municipal Income Trust |

| |

|

|

| |

|

Douglas County, NE, Hospital Authority No.2, Health Facilities, Children’s Hospital Obligated Group, 5.0%, 11/15/2047 |

|

|

|

| |

|

New Hampshire, Business Finance Authority Revenue, Series 2022-2, 4.0%, 10/20/2036 |

|

|

|

| |

|

Camden Country, NJ, Improvement Authority School Revenue, KIPP Cooper Norcross Obligated Group, 6.0%, 6/15/2062 |

|

|

|

New Jersey, Economic Development Authority, Self Designated Social Bonds: |

|

|

|

Series QQQ, 4.0%, 6/15/2046 |

|

|

|

Series QQQ, 4.0%, 6/15/2050 |

|

|

|

New Jersey, State Economic Development Authority Revenue, Series BBB, Prerefunded, 5.5%, 6/15/2030 |

|

|

|

New Jersey, State Economic Development Authority Revenue, The Goethals Bridge Replacement Project, Series A, AMT, 5.125%, 7/1/2042, INS: AGMC |

|

|

|

New Jersey, State Economic Development Authority, State Government Buildings Project: |

|

|

|

Series A, 5.0%, 6/15/2042 |

|

|

|

Series A, 5.0%, 6/15/2047 |

|

|

|

New Jersey, State Educational Facilities Authority Revenue, Steven Institute of Technology, Series A, 4.0%, 7/1/2050 |

|

|

|

New Jersey, State Educational Facilities Authority Revenue, Stockton University, Series A, 5.0%, 7/1/2041 |

|

|

|

New Jersey, State Higher Education Assistance Authority, Student Loan Revenue, Series B, AMT, 2.5%, 12/1/2040 |

|

|

|

New Jersey, State Transportation Trust Fund Authority, Series AA, 4.0%, 6/15/2045 |

|

|

|

New Jersey, State Transportation Trust Fund Authority, Transportation Program, Series AA, 5.0%, 6/15/2046 |

|

|

|

New Jersey, State Transportation Trust Fund Authority, Transportation Systems: |

|

|

|

Series AA, 4.0%, 6/15/2050 |

|

|

|

Series A, 5.0%, 12/15/2034 |

|

|

|

Series A, 5.0%, 12/15/2036 |

|

|

|

New Jersey, State Turnpike Authority Revenue, Series B, 5.0%, 1/1/2040 |

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS

Municipal Income Trust |

|

|

| |

|

|

New Jersey, Tobacco Settlement Financing Corp., Series A, 5.25%, 6/1/2046 |

|

|

|

South Jersey, NJ, Transportation Authority System Revenue, Series A, 5.25%, 11/1/2052 |

|

|

|

| |

|

|

|

| |

|

New York, Metropolitan Transportation Authority Revenue: |

|

|

|

Series E-1, 4.0% (b), 6/1/2023, LOC: Barclays Bank PLC |

|

|

|

Series A-1, 4.0%, 11/15/2044 |

|

|

|

Series A-1, 4.0%, 11/15/2045 |

|

|

|

Series C, 5.0%, 11/15/2038 |

|

|

|

Series D, 5.0%, 11/15/2038 |

|

|

|

Series C, 5.0%, 11/15/2042 |

|

|

|

Series A-1, 5.25%, 11/15/2039 |

|

|

|

Series C-1, 5.25%, 11/15/2055 |

|

|

|

New York, Metropolitan Transportation Authority Revenue, Green Bond, Series A-1, 5.0%, 11/15/2048 |

|

|

|

New York, Port Authority of New York & New Jersey Consolidated, One Hundred Eighty-Fourth: |

|

|

|

| |

|

|

|

| |

|

|

|

New York, State Dormitory Authority Revenues, Non-State Supported Debt, The New School: |

|

|

|

| |

|

|

|

| |

|

|

|

New York, State Transportation Development Corp., Special Facilities Revenue, Delta Air Lines, Inc., LaGuardia Airport C&D Redevelopment, Series A, AMT, 5.0%, 1/1/2031 |

|

|

|

New York, State Transportation Development Corp., Special Facilities Revenue, Terminal 4 John F. Kennedy, International Project, AMT, 5.0%, 12/1/2041 |

|

|

|

New York, State Urban Development Corp. Revenue, Personal Income Tax, Series A, 4.0%, 3/15/2045 |

|

|

|

New York, State Urban Development Corp. Revenue, State Personal Income Tax, Series C, 5.0%, 3/15/2047 |

|

|

|

New York, State Urban Development Corp., Income Tax, Series A, 3.0%, 3/15/2050 |

|

|

|

New York, State Urban Development Corp., State Personal Income Tax Revenue, Series C, 3.0%, 3/15/2048 |

|

|

|

New York, TSASC, Inc., Series A, 5.0%, 6/1/2041 |

|

|

|

New York City, NY, General Obligation, Series A-1, 4.0%, 8/1/2042 |

|

|

|

New York City, NY, Housing Development Corp., Series C-1, 4.25%, 11/1/2052 |

|

|

|

The accompanying notes are an integral part of the financial statements.

| |

|

DWS Municipal Income Trust |

| |

|

|

New York, NY, General Obligation, Series B-1, 5.25%, 10/1/2047 |

|

|

|

Port Authority of New York & New Jersey, Series 207, AMT, 5.0%, 9/15/2048 |

|

|

|

Port Authority of New York & New Jersey, One Hundred Ninety-Third, AMT, 5.0%, 10/15/2035 |

|

|

|

| |

|

|

|

| |

|

North Carolina, Charlotte-Mecklenburg Hospital Authority, Atrium Health Obligated Group, Series E, 3.95% (b), 6/1/2023, LOC: Royal Bank of Canada |

|

|

|

| |

|

Buckeye, OH, Tobacco Settlement Financing Authority, “1” , Series A, 4.0%, 6/1/2048 |

|

|

|

Chillicothe, OH, Hospital Facilities Revenue, Adena Health System Obligated Group Project, 5.0%, 12/1/2047 |

|

|

|

Franklin County, OH, Trinity Health Corp. Revenue, Series 2017, 5.0%, 12/1/2046 |

|

|

|

Ohio, Akron, Bath & Copley Joint Township Hospital District Revenue, 5.25%, 11/15/2046 |

|

|

|

| |

|

|

|

| |

|

Oregon, Portland Airport Revenue, Series 25B, AMT, 5.0%, 7/1/2049 |

|

|

|

| |

|

Allegheny County, PA, Hospital Development Authority, Allegheny Health Network Obligated Group, Series A, 5.0%, 4/1/2047 |

|

|

|

Pennsylvania, Certificate of Participations, Series A, 5.0%, 7/1/2043 |

|

|

|

Pennsylvania, Commonwealth Financing Authority, Series A, 5.0%, 6/1/2035 |

|

|

|

Pennsylvania, Commonwealth Financing Authority, Tobacco Master Settlement Payment Revenue Bonds: |

|

|

|

| |

|

|

|

| |

|

|

|

Pennsylvania, Economic Development Financing Authority, Series A, 4.0%, 10/15/2051 |

|

|

|

Pennsylvania, Geisinger Authority Health System Revenue, Series A-1, 5.0%, 2/15/2045 |

|

|

|

Pennsylvania, State Economic Development Financing Authority, The Penndot Major Bridges, AMT, 6.0%, 6/30/2061 |

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS

Municipal Income Trust |

|

|

| |

|

|

Pennsylvania, State Higher Educational Facilities Authority Revenue, University of Pennsylvania Health System, 5.0%, 8/15/2049 |

|

|

|

Pennsylvania, State Housing Finance Agency, Single Family Mortgage Revenue, Series 141A, 5.75%, 10/1/2053 |

|

|

|

Pennsylvania, State Turnpike Commission Revenue: |

|

|

|

Series A, 5.0%, 12/1/2038 |

|

|

|

Series B-1, 5.0%, 6/1/2042 |

|

|

|

Series A, 5.0%, 12/1/2044 |

|

|

|

Series B, 5.0%, 12/1/2051 |

|

|

|

Philadelphia, PA, Airport Revenue, Series B, AMT, 5.0%, 7/1/2047 |

|

|

|

Philadelphia, PA, School District, Series B, 5.0%, 9/1/2043 |

|

|

|

| |

|

|

|

| |

|

Charleston County, SC, Airport District, Airport System Revenue, Series A, AMT, Prerefunded, 5.875%, 7/1/2032 |

|

|

|

South Carolina, State Ports Authority Revenue, Series B, AMT, 4.0%, 7/1/2059 |

|

|

|

South Carolina, State Public Service Authority Revenue, Series E, 5.25%, 12/1/2055 |

|

|

|

South Carolina, State Public Service Authority Revenue, Santee Cooper, Series A, Prerefunded, 5.75%, 12/1/2043 |

|

|

|

| |

|

|

|

| |

|

Lincon County, SD, Economic Development Revenue, Augustana College Association Project, Series A, 4.0%, 8/1/2056 |

|

|

|

| |

|

Greeneville, TN, Health & Educational Facilities Board Hospital Revenue, Ballad Health Obligation Group: |

|

|

|

| |

|

|

|

| |

|

|

|

Nashville & Davidson County, TN, Metropolitan Government Health & Education Facilities Board Revenue, Blakeford At Green Hills Corp., Series A, 4.0%, 11/1/2055 |

|

|

|

Tennessee, State Energy Acquisition Corporation Revenue, Series A, 5.0% (a), 5/1/2052, GTY: Goldman Sachs Group, INC. |

|

|

|

| |

|

|

|

The accompanying notes are an integral part of the financial statements.

| |

|

DWS Municipal Income Trust |

| |

|

|

| |

|

Central Texas, Regional Mobility Authority Revenue, Senior Lien: |

|

|

|

Series A, Prerefunded, 5.0%, 1/1/2040 |

|

|

|

| |

|

|

|

Clifton, TX, Higher Education Finance Corp., Idea Public Schools, Series T, 4.0%, 8/15/2042 |

|

|

|

Houston, TX, Airport System Revenue, Series A, AMT, 5.0%, 7/1/2041 |

|

|

|

Newark, TX, Higher Education Finance Corp., Texas Revenue, Abilene Christian University Project, Series A, 4.0%, 4/1/2057 |

|

|

|

North Texas, Tollway Authority Revenue: |

|

|

|

| |

|

|

|

| |

|

|

|

San Antonio, TX, Education Facilities Corp. Revenue, University of the Incarnate Word Project: |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

Tarrant County, TX, Cultural Education Facilities Finance Corp. Revenue, Christus Health Obligated Group, Series B, 5.0%, 7/1/2048 |

|

|

|

Temple, TX, Tax Increment, Reinvestment Zone No. 1: |

|

|

|

Series A, 4.0%, 8/1/2039, INS: BAM |

|

|

|

Series A, 4.0%, 8/1/2041, INS: BAM |

|

|

|

Texas, Dallas/Fort Worth International Airport Revenue, Series F, 5.25%, 11/1/2033 |

|

|

|

Texas, Grand Parkway Transportation Corp., System Toll Revenue: |

|

|

|

Series C, 4.0%, 10/1/2049 |

|

|

|

Series B, Prerefunded, 5.0%, 4/1/2053 |

|

|

|

Series B, Prerefunded, 5.25%, 10/1/2051 |

|

|

|

Texas, Lower Colorado River Authority, LCRA Transmission Services Corp., Project, 5.0%, 5/15/2048 |

|

|

|

Texas, New Hope Cultural Education Facilities Finance Corp., Retirement Facilities Revenue, Westminster Project, 4.0%, 11/1/2049 |

|

|

|

Texas, Private Activity Bond, Surface Transportation Corp. Revenue, Senior Lien, North Mobility Partners Segments LLC, AMT, 5.0%, 6/30/2058 |

|

|

|

Texas, Regional Mobility Authority Revenue, Senior Lien, Series B, 4.0%, 1/1/2051 |

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS

Municipal Income Trust |

|

|

| |

|

|

Texas, SA Energy Acquisition Public Facility Corp., Gas Supply Revenue, 5.5%, 8/1/2025, GTY: Goldman Sachs Group, Inc. |

|

|

|

Texas, State Municipal Gas Acquisition & Supply Corp. I, Gas Supply Revenue, Series D, 6.25%, 12/15/2026, GTY: Merrill Lynch & Co. |

|

|

|

Texas, State Transportation Commission, Turnpike Systems Revenue, Series C, 5.0%, 8/15/2034 |

|

|

|

Texas, State Water Development Board Revenue, State Water Implementation Revenue Fund, Series A, 4.0%, 10/15/2049 |

|

|

|

Texas, University of Texas Revenue, Series B, 5.0%, 8/15/2049 |

|

|

|

| |

|

|

|

| |

|

Salt Lake City, UT, Airport Revenue: |

|

|

|

Series A, AMT, 5.0%, 7/1/2043 |

|

|

|

Series A, AMT, 5.0%, 7/1/2048 |

|

|

|

Utah, Infrastructure Agency Telecommunications & Franchise Tax Revenue, Pleasant Gove City Project: |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

Vermont, State Educational & Health Buildings Financing Agency Revenue, St Michael’s College Inc., 144A, 5.25%, 10/1/2052 |

|

|

|

| |

|

Stafford County, VA, Economic Development Authority, Hospital Facilities Revenue, Mary Washington Healthcare: |

|

|

|

Series A, 5.0%, 10/1/2042 |

|

|

|

Series A, 5.0%, 10/1/2047 |

|

|

|

Series A, 5.0%, 10/1/2052 |

|

|

|

Virginia, Small Business Financing Authority Revenue, 95 Express Lanes LLC Project, AMT, 4.0%, 1/1/2048 |

|

|

|

Virginia, Small Business Financing Authority, Elizabeth River Crossings OPCO LLC Project, AMT, 4.0%, 1/1/2039 |

|

|

|

Virginia, Small Business Financing Authority, Private Activity Revenue, Transform 66 P3 Project: |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

The accompanying notes are an integral part of the financial statements.

| |

|

DWS Municipal Income Trust |

| |

|

|

| |

|

Washington, Port of Seattle Revenue: |

|

|

|

Series A, AMT, 5.0%, 5/1/2043 |

|

|

|

| |

|

|

|

Washington, State Convention Center Public Facilities District, 5.0%, 7/1/2043 |

|

|

|

Washington, State Housing Finance Commission Municipal Certificates, “A” , Series A-1, 3.5%, 12/20/2035 |

|

|

|

| |

|

|

|

| |

|

West Virginia, State Hospital Finance Authority, State University Health System Obligated Group: |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

Wisconsin, Public Finance Authority Revenue, Triad Educational Services Ltd., Series 2021 A, 4.0%, 6/15/2061 |

|

|

|

Wisconsin, Public Finance Authority, Eastern Michigan University, Series A-1, 5.625%, 7/1/2055, INS: BAM |

|

|

|

Wisconsin, Public Finance Authority, Fargo-Moorhead Metropolitan Area Flood Risk Management Project, AMT, 4.0%, 9/30/2051 |

|

|

|

Wisconsin, Public Finance Authority, Hospital Revenue, Series A, 5.0%, 10/1/2044 |

|

|

|

| |

|

|

|

| |

|

Guam, International Airport Authority Revenue: |

|

|

|

Series C, AMT, 6.375%, 10/1/2043 |

|

|

|

Series C, AMT, Prerefunded, 6.375%, 10/1/2043 |

|

|

|

| |

|

|

|

Total Municipal Investments (Cost $575,958,605) |

|

The accompanying notes are an integral part of the financial statements.

DWS

Municipal Income Trust |

|

|

| |

|

|

Underlying Municipal Bonds of Inverse Floaters (d) 19.2% |

|

| |

|

Orange County, FL, School Board, Certificates of Participations, Series C, 5.0%, 8/1/2034 (e) |

|

|

|

Trust: Florida, School Board, Series 2016-XM0182, 144A, 7.7%, 2/1/2024, Leverage Factor at purchase date: 4 to 1

|

|

|

|

| |

|

Massachusetts, State Development Finance Agency Revenue, Partners Healthcare System, Inc., Series Q, 5.0%, 7/1/2035 (e) |

|

|

|

Trust: Massachusetts, State Development Finance Agency Revenue, Series 2016-XM0137, 144A, 7.785%, 1/1/2024, Leverage Factor at purchase date: 4 to 1

|

|

|

|

| |

|

New York, State Urban Development Corp. Revenue, Personal Income Tax, Series C-3, 5.0%, 3/15/2040 (e) |

|

|

|

Trust: New York, State Urban Development Corp. Revenue, Personal Income Tax, Series 2018-XM0580, 144A, 8.225%, 9/15/2025, Leverage Factor at purchase date: 4 to 1 |

|

|

|

New York City, NY, Transitional Finance Authority, Building AID Revenue, Series S-4A, 5.0%, 7/15/2034 (e) |

|

|

|

Trust: New York, Transitional Finance Authority, Building AID Revenue, Series 2018-XM0620, 144A, 8.126%, 1/15/2026, Leverage Factor at purchase date: 4 to 1 |

|

|

|

New York City, NY, Transitional Finance Authority, Building AID Revenue, Series S-3, 5.0%, 7/15/2038 (e) |

|

|

|

Trust: New York, Transitional Finance Authority, Building AID Revenue, Series 2018-XM0620, 144A, 8.143%, 1/15/2026, Leverage Factor at purchase date: 4 to 1 |

|

|

|

| |

|

|

|

| |

|

Pennsylvania, Southeastern Pennsylvania Transportation Authority, 5.25%, 6/1/2047 (e) |

|

|

|

Trust: Pennsylvania, Southeastern Pennsylvania Transportation Authority, Series 2022-XM1057, 144A, 9.24%, 6/1/2030, Leverage Factor at purchase date: 4 to 1

|

|

|

|

The

accompanying notes are an integral part of the financial statements.

| |

|

DWS Municipal Income Trust |

| |

|

|

| |

|

Texas, State General Obligation, Series B, 5.0%, 2/1/2045 (e) |

|

|

|

Trust: Texas, State General Obligation, Series 2022-XM1063, 144A, 8.3%, 2/1/2030, Leverage Factor at purchase date: 4 to 1

|

|

|

|

| |

|

Washington, State General Obligation, Series D, 5.0%, 2/1/2035 (e) |

|

|

|

Trust: Washington, State General Obligation, Series 2017-XM0477, 144A, 7.79%, 8/1/2024, Leverage Factor at purchase date: 4 to 1

|

|

|

|

Total Underlying Municipal Bonds of Inverse Floaters (Cost

$75,253,901) |

|

| |

|

|

Open-End Investment Companies 0.0% |

|

BlackRock Liquidity Funds MuniCash Portfolio, Institutional Shares, 3.26% (f) (Cost $48,242) |

|

|

|

| |

|

|

|

Total Investment Portfolio (Cost $651,260,748)

|

|

|

| |

|

|

Series 2020-1 VMTPS, net of deferred offering costs |

|

|

Other Assets and Liabilities, Net |

|

|

Net Assets Applicable to Common Shareholders |

|

|

| |

Variable or floating rate security. These securities are shown at their current rate as of May 31, 2023. For securities based on a published reference rate and spread, the reference rate and spread are indicated within the description above. Certain variable rate securities are not based on a published reference rate and spread but adjust periodically based on current market conditions, prepayment of underlying positions and/or other variables. Securities with a floor or ceiling feature are disclosed at the inherent rate, where applicable. |

| |

Variable rate demand notes and variable rate demand preferred shares are securities whose interest rates are reset periodically (usually daily mode or weekly mode) by remarketing agents based on current market levels, and are not directly set as a fixed spread to a reference rate. These securities may be redeemed at par by the holder through a put or tender feature, and are shown at their current rates as of May 31, 2023. Date shown reflects the earlier of demand date or stated maturity date. |

| |

|

The

accompanying notes are an integral part of the financial statements.

DWS

Municipal Income Trust |

|

|

| |

Securities represent the underlying municipal obligations of inverse floating rate obligations held by the Fund. The Floating Rate Notes represents leverage to the Fund and is the amount owed to the floating rate note holders. |

| |

Security forms part of the below inverse floater. The Fund accounts for these inverse floaters as a form of secured borrowing, by reflecting the value of the underlying bond in the investments of the Fund and the amount owed to the floating rate note holder as a liability. |

| |

Current yield; not a coupon rate. |

144A: Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

AGMC: Assured Guaranty Municipal Corp. |

AMT: Subject to alternative minimum tax. |

BAM: Build America Mutual |

| |

| |

| |

| |

NATL: National Public Finance Guarantee Corp. |

Prerefunded: Bonds which are prerefunded are collateralized usually by U.S. Treasury

securities which are held in escrow and used to pay principal and interest on tax-exempt

issues and to retire the bonds in full at the earliest refunding date. |

Fair Value Measurements

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad

levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable

inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of May 31, 2023 in valuing the Fund’s investments. For information on

the Fund’s policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| |

|

|

|

|

Municipal Investments (a) |

|

|

|

|

Open-End Investment Companies |

|

|

|

|

| |

|

|

|

|

| |

See

Investment Portfolio for additional detailed categorizations. |

The accompanying notes are an integral part of the financial statements.

| |

|

DWS Municipal Income Trust |

Statement of Assets and Liabilities

as of May 31, 2023 (Unaudited)

| |

|

Investment in securities, at value (cost $651,260,748) |

|

| |

|

Receivable for investments sold |

|

| |

|

| |

|

| |

|

| |

|

Payable for investments purchased |

|

Payable for investments purchased — when-issued securities |

|

Payable for Fund shares repurchased |

|

Payable for floating rate notes issued |

|

Interest expense payable on preferred shares |

|

| |

|

| |

|

Other accrued expenses and payables |

|

Series 2020-1 VMTPS, net of deferred offering costs (liquidation value $198,750,000, see page 37 for more details) |

|

| |

|

Net assets applicable to common shareholders, at value |

|

Net Assets Applicable to Common Shareholders Consist of |

|

Distributable earnings (loss) |

|

| |

|

Net assets applicable to common shareholders, at value |

|

| |

|

Net Asset Value per common share

($393,720,463 ÷ 39,227,200 outstanding shares of beneficial interest,

$.01 par value, unlimited number of common shares authorized) |

|

The accompanying notes are an integral part of the financial statements.

DWS

Municipal Income Trust |

|

|

Statement of Operations

for the six

months ended May 31, 2023 (Unaudited)

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Trustees' fees and expenses |

|

Interest expense and amortization of deferred cost on Series 2020-1 VMTPS |

|

Interest expense on floating rate notes |

|

Stock Exchange listing fees |

|

| |

|

| |

|

| |

|

Realized and Unrealized Gain (Loss) |

|

Net realized gain (loss) from: |

|

| |

|

Payments by affiliates (see Note E) |

|

| |

|

Change in net unrealized appreciation (depreciation) on investments |

|

| |

|

Net increase (decrease) in net assets resulting from operations |

|

The accompanying notes are an integral part of the financial statements.

| |

|

DWS Municipal Income Trust |

Statement of Cash Flows

for the six

months ended May 31, 2023 (Unaudited)

Increase (Decrease) in Cash:

Cash Flows from Operating Activities |

|

Net increase (decrease) in net assets resulting from operations |

|

Adjustments to reconcile net increase (decrease) in net assets resulting

from operations to net cash provided by (used in) operating activities: |

|

Purchases of long-term investments |

|

Net amortization of premium/(accretion of discount) |

|

Proceeds from sales and maturities of long-term investments |

|

Amortization of deferred offering cost on Series 2020-1 VMTPS |

|

(Increase) decrease in interest receivable |

|

(Increase) decrease in other assets |

|

(Increase) decrease in receivable for investments sold |

|

Increase (decrease) in payable for investments purchased |

|

Increase (decrease) in payable for investments purchased - when issued securities |

|

Increase (decrease) in other accrued expenses and payables |

|

Change in unrealized (appreciation) depreciation on investments |

|

Net realized (gain) loss from investments |

|

Cash provided by (used in) operating activities |

|

Cash Flows from Financing Activities |

|

| |

|

Distributions paid (net of reinvestment of distributions) |

|

Cash provided by (used in) financing activities |

|

Increase (decrease) in cash |

|

Cash at beginning of period |

|

| |

|

| |

|

Interest expense paid on preferred shares |

|

Interest expense paid and fees on floating rate notes issued |

|

The accompanying notes are an integral part of the financial statements.

DWS

Municipal Income Trust |

|

|

Statements of Changes in Net Assets

| |

Six Months

Ended

May 31, 2023 |

|

Increase (Decrease) in Net Assets |

|

|

| |

|

|

| |

|

|

| |

|

|

Change in net unrealized appreciation

(depreciation) |

|

|

Net increase (decrease) in net assets applicable to common shareholders |

|

|

Distributions to common shareholders |

|

|

| |

|

|

Payments for shares repurchased |

|

|

Net increase (decrease) in net assets from Fund share transactions |

|

|

Increase (decrease) in net assets |

|

|

Net assets at beginning of period applicable to common shareholders |

|

|

Net assets at end of period applicable to common shareholders |

|

|

| |

|

|

Common shares outstanding at beginning of period |

|

|

| |

|

|

Net increase (decrease) in Fund shares |

|

|

Common shares outstanding at end of period |

|

|

The

accompanying notes are an integral part of the financial statements.

| |

|

DWS Municipal Income Trust |

Financial Highlights

| |

|

|

| |

|

|

|

|

|

|

Selected Per Share Data Applicable to Common Shareholders |

Net asset value, beginning of period |

|

|

|

|

|

|

Income (loss) from investment operations: |

|

|

|

|

|

|

| |

|

|

|

|

|

|

Net realized and

unrealized gain (loss) |

|

|

|

|

|

|

Total from investment operations |

|

|

|

|

|

|

Less distributions applicable to common shareholders from: |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

Net asset value, end of period |

|

|

|

|

|

|

Market price, end of period |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS

Municipal Income Trust |

|

|

Financial Highlights (continued)

| |

|

|

| |

|

|

|

|

|

|

Ratios to Average Net Assets Applicable to Common Shareholders and

Supplemental Data |

Net assets, end of period ($ millions) |

|

|

|

|

|

|

Ratio of expenses before expense

reductions (%)

(including interest

|

|

|

|

|

|

|

Ratio of expenses after expense

reductions (%)

(including interest

|

|

|

|

|

|

|

Ratio of expenses after expense

reductions (%)

(excluding interest

|

|

|

|

|

|

|

Ratio of net investment income (%) |

|

|

|

|

|

|

Portfolio turnover rate (%) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

Preferred Shares

information at period end,

aggregate amount outstanding: |

|

|

|

|

|

|

Series 2018 MTPS ($

millions) |

|

|

|

|

|

|

Series 2020-1 VMTPS

($ millions) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

Liquidation and market price per share ($) |

|

|

|

|

|

|

| |

Based on average common shares outstanding during the period. |

| |

Total return based on net asset value reflects changes in the Fund’s net asset value during each period. Total return based on market price reflects changes in market price. Each figure assumes that dividend and capital gain distributions, if any, were reinvested. These figures will differ depending upon the level of any discount from or premium to net asset value at which the Fund’s shares traded during the period. |

| |

For the year ended November 30, 2020, the Advisor had agreed to voluntarily reduce its management fee. Total return would have been lower had expenses not been reduced. |

| |

Interest expense represents interest and fees on short-term floating rate notes issued in conjunction with inverse floating rate securities and interest paid to shareholders of Series 2018 MTPS and Series 2020-1 VMTPS. |

The

accompanying notes are an integral part of the financial statements.

| |

|

DWS Municipal Income Trust |

Financial Highlights (continued)

| |

The ratio of expenses before expense reductions (based on net assets of common and Preferred Shares, including interest expense) was 2.34%, 1.44%, 1.06%, 1.30%, 1.57% and 1.52% for the periods ended May 31, 2023, November 30, 2022, 2021, 2020, 2019 and 2018, respectively. |

| |

The ratio of expenses after expense reductions (based on net assets of common and Preferred Shares, including interest expense) was 2.34%, 1.44%, 1.06%, 1.17%, 1.57% and 1.52% for the periods ended May 31, 2023, November 30, 2022, 2021, 2020, 2019 and 2018, respectively. |

| |

The ratio of expenses after expense reductions (based on net assets of common and Preferred Shares, excluding interest expense) was 0.63%, 0.62%, 0.61%, 0.50%, 0.61% and 0.61% for the periods ended May 31, 2023, November 30, 2022, 2021, 2020, 2019 and 2018, respectively. |

| |

Asset coverage per share equals net assets of common shares plus the liquidation value of the Preferred Shares divided by the total number of Preferred Shares outstanding at the end of the period. |

| |

|

| |

|

The

accompanying notes are an integral part of the financial statements.

DWS

Municipal Income Trust |

|

|

Notes to Financial Statements (Unaudited)

A.

Organization and Significant Accounting Policies

DWS Municipal Income Trust (the “Fund” ) is registered under the Investment

Company Act of 1940, as amended (the “1940 Act” ), as a closed-end, diversified management investment company organized as a Massachusetts business trust.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP” ) which require the use of management estimates. Actual results could differ from those estimates. The Fund qualifies as an investment company under Topic 946 of Accounting

Standards Codification of U.S. GAAP. The policies described below are followed consistently by the Fund in the

preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

The Fund’s Board has designated DWS Investment Management Americas, Inc. (the “Advisor” ) as

the valuation designee for the Fund pursuant to Rule 2a-5 under the 1940 Act. The Advisor’s Pricing

Committee (the “Pricing Committee” ) typically values securities using readily available market quotations or prices supplied by independent pricing services (which are considered fair values under Rule 2a-5). The Advisor has adopted fair valuation procedures that

provide methodologies for fair valuing securities.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad

levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other

significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value

of investments). The level assigned to the securities valuations may not be an indication of the risk or

liquidity associated with investing in those securities.

Municipal debt securities are valued at prices

supplied by independent pricing services approved by the Pricing Committee, whose valuations are intended to

reflect the mean between the bid and asked prices. Such services may use various pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics and other data, as

well as broker quotes. If the pricing services are unable to provide valuations, the securities are valued at

the mean of the most recent bid and asked quotations or

| |

|

DWS Municipal Income Trust |

evaluated prices, as applicable, obtained from broker-dealers. These securities are generally categorized as Level

2.

Investments in open-end investment companies are valued at their net asset value each business day and are categorized as Level 1.

Securities and other assets for which market quotations are not readily available or for which the above valuation

procedures are deemed not to reflect fair value are valued in a manner that is intended to reflect their fair

value as determined in accordance with procedures approved by the Pricing Committee and are generally

categorized as Level 3. In accordance with the Fund’s valuation procedures, factors considered in determining value may include, but are not limited to, the type of the security; the size of the holding; the initial cost of the

security; the existence of any contractual restrictions on the security’s disposition; the price and extent

of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated

prices from broker-dealers and/or pricing services; information obtained from the issuer, analysts, and/or the

appropriate stock exchange (for exchange-traded securities); an analysis of the company’s or

issuer’s financial statements; an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold; and with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination and

the movement of the market in which the security is normally traded. The value determined under these

procedures may differ from published values for the same securities.

Disclosure about the classification of fair value measurements is included in a table following the Fund’s Investment

Portfolio.

Inverse Floaters. The Fund invests in inverse floaters. Inverse floaters are debt instruments with a weekly floating rate of interest that bears an inverse relationship to changes in the short-term

interest rate market. Inverse floaters are created by depositing a fixed-rate long-term municipal bond into a

special purpose Tender Option Bond trust (the “TOB Trust” ). In turn the TOB Trust issues a short-term floating rate note and an inverse floater. The short-term floating rate note is

issued in a face amount equal to some fraction of the underlying bond’s par amount and is sold to a third

party, usually a tax-exempt money market fund. The Fund receives the proceeds from the sale of the short-term

floating rate note and uses the cash proceeds to make additional investments. The short-term floating rate note

represents leverage to the Fund. The Fund, as the holder of the inverse floater, has full exposure to any increase or decrease in the value of the underlying bond. The income stream from the underlying bond in the TOB Trust is divided between the floating rate

note and the inverse floater. The inverse floater earns all of the interest from the underlying long-term

fixed-rate bond less the amount of interest paid on the floating

DWS

Municipal Income Trust |

|

|

rate note and the expenses of the TOB Trust. The floating rate notes issued by the TOB Trust are valued at cost, which

approximates fair value.

By holding the inverse floater, the Fund has the right to collapse the TOB Trust by causing the holders of the floating rate instrument to tender their notes at par and have the broker transfer the

underlying bond to the Fund. The floating rate note holder can also elect to tender the note for redemption at

par at each reset date. The Fund accounts for these transactions as a form of secured borrowing, by reflecting the value of the underlying bond in the investments of the Fund and the amount owed to the floating rate note holder as a liability under the

caption “Payable for floating rate notes issued” in the Statement of Assets and Liabilities. Income earned on the underlying bond is included in interest income, and

interest paid on the floaters and the expenses of the TOB Trust are included in “Interest expense on

floating rate notes” in the Statement of Operations. For the six months ended May 31, 2023, interest expense related to floaters amounted to $937,059. The weighted

average outstanding daily balance of the floating rate notes issued during the six months ended May 31, 2023

was $52,700,000, with a weighted average interest rate of 3.56%.

The Fund may enter into shortfall and forbearance agreements by which the Fund agrees to reimburse the TOB Trust, in certain

circumstances, for the difference between the liquidation value of the underlying bond held by the TOB Trust

and the liquidation value of the floating rate notes plus any shortfalls in interest cash flows. This could potentially expose the Fund to losses in excess of the value of the Fund’s inverse floater investments. In addition, the value of inverse

floaters may decrease significantly when interest rates increase. The market for inverse floaters may be more

volatile and less liquid than other municipal bonds of comparable maturity. The TOB Trust could be terminated outside of the Fund’s control, resulting in a reduction of leverage and disposal of portfolio investments at inopportune times and

prices. Investments in inverse floaters generally involve greater risk than in an investment in fixed-rate

bonds.

When-Issued/Delayed Delivery Securities. The Fund may purchase or sell

securities with delivery or payment to occur at a later date beyond the normal settlement period. At the time

the Fund enters into a commitment to purchase or sell a security, the transaction is recorded and the value of

the transaction is reflected in the net asset value. The price of such security and the date when the security

will be delivered and paid for are fixed at the time the transaction is negotiated. The value of the security

may vary with market fluctuations.

Certain risks may arise upon entering into when-issued or delayed delivery transactions from the potential inability of counterparties to meet the terms of their contracts or if the issuer does not

issue the securities due

| |

|

DWS Municipal Income Trust |

to political, economic, or other factors. Additionally, losses may arise due to changes in the value of the underlying

securities.

Federal Income Taxes. The Fund’s policy is to comply with the requirements of the Internal Revenue Code of 1986, as amended, which are applicable to regulated investment companies, and

to distribute all of its taxable and tax-exempt income to its shareholders.

At November 30, 2022, the Fund had net tax basis capital loss carryforwards of approximately $21,823,000, including

short-term losses ($10,386,000) and long-term losses ($11,437,000), which may be applied against realized net

taxable capital gains indefinitely.

At May 31, 2023, the aggregate cost of investments for federal income

tax purposes was $594,960,715. The net unrealized depreciation for all investments based on tax cost was

$9,485,029. This consisted of aggregate gross unrealized appreciation for all investments for which there was

an excess of value over tax cost of $14,499,252 and aggregate gross unrealized depreciation for all investments for which there was an excess of tax cost over value of $23,984,281.

The

Fund has reviewed the tax positions for the open tax years as of November 30, 2022 and has determined that no provision for income tax and/or uncertain tax positions is required in the Fund’s financial statements. The Fund’s federal tax returns

for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Distributions from net investment income of the Fund are declared and distributed to shareholders monthly. Net realized gains from investment transactions, in

excess of available capital loss carryforwards, would be taxable to the Fund if not distributed, and,

therefore, will be distributed to shareholders at least annually. The Fund may also make additional distributions for tax purposes if necessary.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations which may differ from accounting principles

generally accepted in the United States of America. These differences primarily relate to certain securities

sold at a loss and premium amortization on debt securities. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such

period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts

without impacting the net asset value of the Fund.

The tax character of current year distributions will be

determined at the end of the current fiscal year.

Preferred Shares. At May 31, 2023, the Fund had issued and outstanding 3,975 Variable Rate MuniFund Term Preferred Shares, Series 2020-1

(“Series 2020-1 VMTPS” )

with an aggregate liquidation preference of

DWS

Municipal Income Trust |

|

|

$198,750,000 ($50,000 per share). The Series 2020-1 VMTPS were issued on November 10, 2020 in a private offering and are

variable rate preferred shares with a stated maturity of November 10, 2049 and an early termination date six