false000164587300016458732023-11-132023-11-130001645873us-gaap:CommonStockMember2023-11-132023-11-130001645873cik0001645873:Seven375SeriesACumulativeRedeemablePerpetualPreferredMember2023-11-132023-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2023

Modiv Industrial, Inc.

(Exact name of registrant as specified in its charter)

|

Maryland

|

|

001-40814

|

|

47-4156046

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

200 S. Virginia Street,

Suite 800

Reno, Nevada

|

|

89501

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (888) 686-6348

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

Class C Common Stock, $0.001 par value per share

|

|

MDV

|

|

New York Stock Exchange

|

| |

|

|

|

|

|

7.375% Series A Cumulative Redeemable Perpetual Preferred

|

|

MDV.PA

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. |

Results of Operations and Financial Condition

|

On November 13, 2023, Modiv Industrial, Inc. (formerly known as Modiv Inc.), a Maryland corporation (the “Company”), issued an earnings press

release relating to the Company’s financial results for the third quarter ended September 30, 2023. A copy of the press release is available on the Company’s website, is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The

Company also released supplemental data on the Company’s website relating to the Company’s portfolio information as of September 30, 2023 and its financial results for the third quarter ended September 30, 2023. A copy of the supplemental data is

attached hereto as Exhibit 99.2. and is incorporated herein by reference.

The information in Item 2.02 of this Current Report, including Exhibits 99.1and 99.2 are being furnished and shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any

registration statement or other document pursuant to the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, unless it is specifically incorporated by reference therein. References to the Company’s website in this Current

Report on Form 8-K and in the attached Exhibits 99.1and 99.2 to this Current Report on Form 8-K do not incorporate by reference the information on such website into this Current Report on Form 8-K and the Company disclaims any such incorporation by

reference.

| Item 7.01. |

Regulation FD Disclosure

|

On November 13, 2023, the Company issued an earnings press release relating to the Company’s financial results for the third quarter ended September

30, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The Company also released supplemental data on the Company’s website relating to the Company’s portfolio information as of September 30,

2023 and its financial results for the third quarter ended September 30, 2023. A copy of the supplemental data is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

The furnishing of this earnings press release and supplemental data are not intended to constitute a representation that such furnishing is required

by Regulation FD or other securities laws, or that the earnings release and supplemental data include material investor information that is not otherwise publicly available. In addition, the Company does not assume any obligation to update such

information in the future.

The information in Item 7.01 of this Current Report, including Exhibits 99.1and 99.2 are being furnished and shall not be deemed to be “filed” for

purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the

Securities Act or the Exchange Act, unless it is specifically incorporated by reference therein.

| Item 9.01. |

Financial Statements and Exhibits

|

(d) Exhibits

|

Exhibit No.

|

Description

|

| |

|

|

|

Modiv Industrial, Inc. Earnings Press Release dated November 13, 2023

|

| |

|

|

|

Modiv Industrial, Inc. Quarterly Supplemental Data For The Quarter Ended September 30, 2023

|

| |

|

|

104

|

Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

MODIV INDUSTRIAL, INC.

(Registrant)

|

| |

|

|

| |

By:

|

/s/ RAYMOND J. PACINI

|

| |

|

Name: Raymond J. Pacini

|

| |

|

Title: Chief Financial Officer

|

| |

|

|

|

Date: November 13, 2023

|

|

|

Modiv Industrial Announces Third Quarter 2023 Results

Management Provides Forward-Looking Thoughts

Reno, Nevada, November 13, 2023 – Modiv Industrial, Inc. (“Modiv Industrial”, “Modiv”, the “Company”, “we” or “our”), (NYSE:MDV), the only public

REIT exclusively focused on acquiring industrial manufacturing real estate, today announced operating results for the third quarter ended September 30, 2023.

Key Financial Highlights:

|

◾ |

21% year-over-year increase in revenue generating $12.5 million compared with $10.3 million in the year-ago quarter.

|

|

◾ |

19% year-over-year increase in AFFO netting $3.7 million compared with $3.1 million in the year-ago quarter.

|

|

◾ |

$10 million reduction in leverage and a 14% reduction in net debt to adjusted EBITDA from prior quarter results released in August 2023.

|

|

◾ |

$5.4 million net proceeds from the sale of a non-core asset located in Rocklin, California.

|

|

◾ |

Portfolio consists of 44 properties with a weighted average lease term of 14.0 years and weighted average annual rental increases of 2.48%.

|

“Another solid quarter of no-nonsense execution. Given the increased market volatility and geo-political risk, we believe the greater benefit inures to

those that are thoughtful rather than rash. With crystal balls becoming even more opaque, today’s environment compels us to be incessantly focused on the execution of the variables in our control. As such, it feels imprudent to provide formal

guidance for 2024 but reasonable for us to be transparent as to our strategic thinking. The following business outlook lists our activity and perspective on topics we suspect will be germane to investors.

Business Outlook:

Acquisitions – Since our NYSE

listing last year, we have acquired over $214 million of industrial manufacturing assets, arguably the most active buyer of this property type and at a volume that is more commensurate with much larger REITs. As we discussed recently in a Nareit

podcast, we chose to be active in the latter half of last year and the first half of this year. Though we continue to look at every asset we can, we are finding the majority of the current supply

to be lacking in strategic value, having an insufficient credit profile and/or being offered with questionable pricing (that holds true for both too low and too high cap rates). Given the lackluster inventory, coupled with tepid markets, we don’t

see ourselves being that acquisitive in the near term. That could change if the broader capital markets improve or if we find truly compelling opportunities.

As we take a calculated pause on single asset purchases, we are spending a decent amount of time exploring portfolio consolidations and intriguing

M&A opportunities. In fact, over the past year, we have underwritten and dialogued on five such opportunities representing over $2.4 billion of aggregate value – all focused on industrial manufacturing. Though the timing and pricing haven’t been

right as of yet, all of those opportunities remain on our active radar.

We take the Buffett-esque view that, at this stage of the market cycle, we can afford to stand over the plate looking for the fat pitch without fear of

strikes being called.

Dispositions – Similar to our

acquisition volume, we have been busy disposing of our non-industrial assets since we listed, with over $120 million sold across 22 assets (including 10 office properties). We are focused on recycling those assets that we do not believe are a

strategic long-term fit but at the same time we are also not in a rush to throw away good AFFO just to clear these assets off the books. Given that we still hold office assets and office has become a six-letter curse word, one might think we would

be verklempt and, in turn, hasty in our retreat. We are not. We are, however, patient and we draw this patience from the facts that we have observed firsthand. For example, as it relates to our three largest office properties: in the past year we

have received three unsolicited bids on our asset located in Issaquah, Washington; we have been in conversations with the AA-rated tenant of our asset located in Rancho Cordova, California, about their intent to begin their lengthy government

process to exercise their purchase option; and we are reviewing flex conversion proposals we have received on our asset located in Nashville, Tennessee. If parties are kicking the tires of our office assets in today’s market, then that suggests to

us that interested parties will also likely kick the tires at a later time when the market landscape has settled and after we have collected more of our contractual rents.

We aren’t being stubborn or idealistic, but we are being balanced and patient.

Equity – A study of REIT history

shows us, time and time again, that those REITs that are disciplined with their use of equity and debt win over the long term as investors reward those companies that can grow, yet also preserve, the capital entrusted to them. There is no REIT in

existence today that hasn’t, over the course of its lifespan, accessed both equity and debt on a routine basis. However, it is the amount and timing of each capital source that creates a clear divide between those that are rewarded and those that

languish. There may be few, if any, examples of a REIT of our size, with the acquisition volume we have delivered, who have gone so long without accessing the equity markets. It is with this knowledge that we have chosen a disciplined, yet arduous,

path forward over the past 21 months. We recognized early on that we could remain both disciplined and opportunistic by accessing affordable debt when it was still available last year while at the same time recycling assets into higher yielding

alternatives and by strategically identifying UPREIT transactions that made sense (factoid: we have issued over $37 million of OP units at a weighted average price greater than $23 since the beginning of 2022).

Combined, these activities have allowed us to prolong our need to access the market until such time that we see greater receptivity to equity issuances

and as our share price draws closer to fair value. We believe we have upwards of $100 million of additional assets, both the identified non-core properties and a few industrial distribution properties, that we can recycle advantageously into

manufacturing properties while we wait for the equity markets to regain their footing. We believe our investor outreach efforts, which we discuss below, have helped raise awareness of our historical mispricing and have recently closed the value gap.

Going forward, we will identify those opportunities where issuing shares via our ATM makes sense from a price standpoint but also to further our goal of increasing our tradeable float. Though we have no present-day designs to access the equity

markets in the near term, we will be prepared to act efficiently should the markets improve. Further, we believe that even small amounts of capital can go far given our discipline and the math of the denominator effect. By hypothetical example, a

small raise of just $15 million could generate $0.10 of unlevered AFFO per share and, at today’s P/AFFO, result in a 7%+ increase in our share value on top of our existing 7%+ dividend rate.

Yes, we will eventually access the equity markets but we feel no pressure to do so prematurely or excessively.

Debt – Modiv Industrial now has

less than $285 million of indebtedness, 100% of which is fixed rate, with a weighted average interest rate of 4.52% and a weighted average maturity of 3.6 years with the earliest meaningful maturity not until 2027. Our debt to asset ratio is 48%,

our Debt to Adjusted EBITDA multiple is 6.7 and our debt service coverage is 2.3x. These metrics are in line with, or better than, our previously announced intentions over the past two years and represent, to us, a thoughtful use of leverage at a

time when equity was unavailable.

Barring a compelling consolidation or M&A opportunity, we do not see any further benefit in using additional debt and intend to make single asset

purchases on an unlevered basis. As such, it is our intent to only use the capacity of our $150 million revolver in those instances where there may be a short-term timing mismatch. We recently paid down $10 million of mortgage debt and will be

focused on the gradual reduction of our leverage profile over the next three years. The fruits of that focus will provide the opportunity for price multiple expansion and a more favorable refinancing posture when our loans are scheduled to mature.

Through our own prior career experiences, our entire management team, as well as our board of directors, holds a very healthy perspective on the use of

debt which includes the beliefs that you should never take on an amount that you cannot handle and that we must never forget that in risky times it is normal to expect embedded differences between lenders and borrowers to become more prominent.

Like the flame from a hot stove, debt can be used to nourish an enterprise or burn it – we are proactively turning down the heat.

Strategic Partner – February of

this year we informed the public that we had received some inquiries from institutional investors about making a strategic investment into Modiv. Throughout the year we have also had numerous bankers pitch capital ideas to us with most sounding

very similar to the “Madison-Plymouth” deal from a few years back. We elected not to spend much time on these concepts as we were focused on our acquisition pipeline and the portfolio sale of non-core assets to Generation Income Properties, Inc

(NASDAQ: GIPR). In early September, we began to think more deeply about the concept of accepting strategic partner capital and what we would want to accomplish if we did.

Commonly, smaller REITs entertain such capital infusions either due to financial necessity or some contrived urgency to get bigger as soon as possible.

Modiv doesn’t suffer from any financial desperation, and we believe it is more intelligent to pursue actions that make us a better company rather than simply a bigger company. That said, we understand the benefits of scale particularly as it relates

to tradeable float, industry consolidation opportunities and, over time, improved cost of capital. As we currently see it, the litany of structured preferred deals available to a REIT like us feel a lot like debt in sheep’s clothing – giving the

private equity sponsor equity-like upside participation and leaving us with debt-like responsibility.

At Modiv we understand that we may owe our lenders, but we know we must always serve our (equity) owners. As such, we have been more inclined to

explore truer economic joint venture arrangements whereby we have better alignment of mutual interests and both parties can achieve success. For a joint venture to work for us, any strategic partner would need to be more than just money and we would

want to understand that they also believe in our investment thesis of owning manufacturing assets, that they see long-term upside value in our equity and that by associating with them we benefit from a “halo effect” that helps introduce other future

investors to Modiv. Presently we are under numerous nondisclosure agreements and are having exploratory talks with multiple potential partners. At this stage, we can offer no outlook as to the prospects of any future announcement. For those who are

interested or intrigued, please contact us.

We recognize that what we want from a joint venture might not at all be what a potential strategic partner wants, and we are ok with that – if it

doesn’t happen, then we won’t force it. At the same time, we also recognize that there is a vast amount of capital out there with very few good ideas to invest in – we honestly believe we are one of those good ideas.

Distributions – Based on Modiv’s

most recent closing price on November 10, 2023, our annual cash dividend of $1.15, distributed in twelve monthly payments, is yielding 7.77% and we are maintaining a dividend coverage ratio of over 110%. In our short history we have made 87

consecutive distributions totaling over $60 million. We feel comfortable with the current strength of our dividend but feel it can always be stronger. At this juncture, we do not see a near-term need to increase the cash distribution rate but, as

we previously disclosed, we do anticipate making a meaningful in-kind distribution of GIPR shares as early as January 2024.

On November 9, 2023, GIPR obtained the necessary approval of its stockholders to issue up to 3,000,000 shares of its common stock to redeem the Series

A Redeemable Preferred Stock that we received in partial consideration for our sale of 13 legacy retail and office assets to GIPR on August 10, 2023. The actual amount of GIPR shares that could be issued to Modiv ranges from 2.2 million to a maximum

of 3.0 million, dependent upon the 60-day volume weighted average price (VWAP) of GIPR’s common stock on the date when they might choose to provide us notice of redemption. Net of any advanced private-party sales made by us or any technical reasons

that may necessitate holding shares for future sale, the GIPR shares issued to Modiv would be distributed to all holders of Modiv’s then outstanding Class C Common Stock and Class C Operating Partnership Units. Obviously, there is no guarantee that

GIPR will submit a redemption notice and even if they did, the amounts of any future dividends could change and are subject to the approval by each respective board of directors.

Based on our current projection, Modiv’s Class C Common Stock and Class C Operating Partnership Units could potentially receive anywhere from 0.24 to

0.32 of GIPR shares for every one share/unit of MDV. Assuming the midpoint of that potential range, the implied ratio would be approximately 0.28 GIPR shares and would represent a potential dividend of ~$1.14 based on GIPR’s share price as of

November 10, 2023. When compared to our most recent closing price, that potential ~$1.14 in-kind dividend would equal a 7.7% special, one-time dividend rate. For those who don’t know, GIPR is also a monthly dividend paying stock that currently pays

an annualized dividend of approximately $0.468 per share. So Modiv Class C holders, over a twelve-month period, could potentially receive $1.15 (MDV’s cash dividend) + ~$1.14 (GIPR shares) + ~$0.13 (GIPR’s cash dividend) for a potential total of

~$2.42 – a greater than 16% annualized dividend yield based on our most recent closing price.

We will leave it to investors to decide, but we believe our distribution rate, our growth rate and our upside potential make for compelling financial

reasons to own our shares.

Investor Outreach – On August 14,

2023, when we announced our second quarter results and our name change to Modiv Industrial, we also informed the public that we would, for the first time, begin to actively seek to increase investor awareness. Our initial outreach efforts have been

focused on individual investors and the financial advisors that advise them. In less than three months we have already emailed over 30,000 potential investors and held over 2,000 phone conversations. Additionally, we rang the bell at the New York

Stock Exchange on September 29th and participated on a recent Nareit podcast.

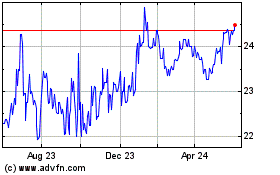

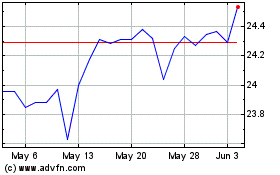

In total, these ongoing efforts have already resulted in a 59% increase in our trading volume and a 26% positive relative performance when compared to

the FTSE Nareit All Equities Index for the same time period. Though we are pleased with these results, we recognize this activity requires a long-term continuous effort to inform as many investors as possible through our candid and transparent

communication. We recognize that it will take us a long time before we achieve any semblance of critical mass as pertains to investor awareness.

We are not presently focused on the institutional investor community and that is by design. We believe our audience today lies with individual

investors and we hope that as many willing individual investors can buy our shares before we become a larger REIT that is held by institutions. Even though we know many of the portfolio managers at the leading REIT-dedicated investment shops on a

first name basis, we understand the reality of our size, and more importantly, the limits that result. On more than one occasion we have received positive institutional feedback which tells us they are paying attention. We know that when they are

ready, they can make a reverse inquiry via our ATM or participate in any future follow-on offerings. They know that we are patient and will, in the meantime, keep our nose to grindstone. Despite not making any formal efforts to attract the

institutional crowd, we do have a robust schedule of meetings scheduled for our participation at Nareit’s REITWorld 2023 Investor Conference in Los Angeles, CA, November 14-16, 2023.

We are a persistent (and candid) bunch, and we know we will find our following in good time. With GRIT and GRIND, we will GET IT DONE!” – Aaron

Halfacre, CEO of Modiv Industrial.

Conference Call and Webcast

A conference call and audio webcast with analysts and investors will be held on Monday, November 13, 2023, at 11:00 a.m. Eastern Time / 8:00 a.m.

Pacific Time, to discuss the third quarter 2023 operating results and answer questions.

Live conference call: 1-877-407-0789

at 8:00 a.m. Pacific Time, Monday, November 13, 2023

Webcast: To listen to the webcast,

either live or archived, please use this link:

https://viavid.webcasts.com/starthere.jsp?ei=1643126&tp_key=7c99a456f0 or visit the investor relations

page of Modiv’s website at www.modiv.com.

About Modiv Industrial

Modiv Industrial, Inc. is an internally managed REIT that is focused on single-tenant net-lease industrial

manufacturing real estate. The Company actively acquires critical industrial manufacturing properties with long-term leases to tenants that fuel the national economy and strengthen the nation’s supply chains. Driven by an investor-first focus,

Modiv Industrial has over $600 million real estate assets (based on estimated fair value) comprising more than 4.5 million square feet of aggregate leasable area. For more information, please visit: www.modiv.com.

Forward-looking Statements

Certain statements contained in this press release, other than historical facts, may be considered forwardlooking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements regarding our plans, strategies and prospects, both business and

financial. Such forward-looking statements are subject to various risks and uncertainties, including but not limited to those described under the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December

31, 2022 filed with the SEC on March 13, 2023. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as

exhaustive and should be read in conjunction with the other cautionary statements that are included in this press release and in the Company’s other filings with the SEC. Any forward-looking statements herein speak only as of the time when made and

are based on information available to the Company as of such date and are qualified in their entirety by this cautionary statement. The Company assumes no obligation to revise or update any such statement now or in the future, unless required by law.

Notice Involving Non-GAAP Financial Measures

In addition to U.S. GAAP financial measures, this press release and the supplemental financial and operating report included in our Form 8-K dated

November 13, 2023 contain and may refer to certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. These

non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Reconciliations to the most directly comparable GAAP financial measures and statements of why

management believes these measures are useful to investors are provided below.

AFFO is a measure that is not calculated in accordance with accounting principles generally accepted in the United States of America (“GAAP”). See the Reconciliation of Non-GAAP Measures later in this press release.

The Company defines “initial cap rate” for property acquisitions as the initial annual

cash rent divided by the purchase price of the property. The Company defines “weighted average cap rate” for property acquisitions as the average annual cash rent including rent escalations over the lease term, divided by the purchase price of the

property.

Inquiries:

management@modiv.com

MODIV INDUSTRIAL, INC.

Consolidated Statements of Operations

For the Three and Nine Months Ended September 30, 2023 and 2022

(Unaudited)

|

|

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

|

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Rental income

|

|

$

|

12,500,338

|

|

|

$

|

10,303,402

|

|

|

$

|

34,648,083

|

|

|

$

|

30,017,493

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

|

1,735,104

|

|

|

|

1,838,388

|

|

|

|

5,240,935

|

|

|

|

5,559,753

|

|

|

Stock compensation expense

|

|

|

8,469,867

|

|

|

|

549,240

|

|

|

|

9,790,206

|

|

|

|

1,740,852

|

|

|

Depreciation and amortization

|

|

|

4,175,209

|

|

|

|

3,598,592

|

|

|

|

11,403,603

|

|

|

|

10,581,765

|

|

|

Property expenses

|

|

|

1,195,224

|

|

|

|

1,415,621

|

|

|

|

4,429,936

|

|

|

|

5,009,701

|

|

|

Impairment of real estate investment property

|

|

|

-

|

|

|

|

-

|

|

|

|

3,499,438

|

|

|

|

-

|

|

|

Impairment of goodwill

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

17,320,857

|

|

|

Total operating expenses

|

|

|

15,575,404

|

|

|

|

7,401,841

|

|

|

|

34,364,118

|

|

|

|

40,212,928

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) gain on sale of real estate investments

|

|

|

(1,708,801

|

)

|

|

|

3,932,028

|

|

|

|

(1,708,801

|

)

|

|

|

11,527,185

|

|

|

Operating (loss) income

|

|

|

(4,783,867

|

)

|

|

|

6,833,589

|

|

|

|

(1,424,836

|

)

|

|

|

1,331,750

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

26,386

|

|

|

|

1,665

|

|

|

|

296,921

|

|

|

|

16,863

|

|

|

Dividend income

|

|

|

190,000

|

|

|

|

-

|

|

|

|

190,000

|

|

|

|

-

|

|

|

Income from unconsolidated investment in a real estate property

|

|

|

79,164

|

|

|

|

64,358

|

|

|

|

207,506

|

|

|

|

226,690

|

|

|

Interest expense, net of derivative settlements and unrealized gain on interest rate swaps

|

|

|

(2,922,918

|

)

|

|

|

(2,514,838

|

)

|

|

|

(6,761,779

|

)

|

|

|

(5,280,167

|

)

|

|

Increase in fair value of investment in preferred stock

|

|

|

440,000

|

|

|

|

-

|

|

|

|

440,000

|

|

|

|

-

|

|

|

Loss on early extinguishment of debt

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(1,725,318

|

)

|

|

Other

|

|

|

65,993

|

|

|

|

65,993

|

|

|

|

197,978

|

|

|

|

198,129

|

|

|

Other expense, net

|

|

|

(2,121,375

|

)

|

|

|

(2,382,822

|

)

|

|

|

(5,429,374

|

)

|

|

|

(6,563,803

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income

|

|

|

(6,905,242

|

)

|

|

|

4,450,767

|

|

|

|

(6,854,210

|

)

|

|

|

(5,232,053

|

)

|

|

Less: net loss (income) attributable to noncontrolling interest in Operating Partnership

|

|

|

1,368,896

|

|

|

|

(528,540

|

)

|

|

|

1,535,452

|

|

|

|

1,180,275

|

|

|

Net (loss) income attributable to Modiv Industrial, Inc.

|

|

|

(5,536,346

|

)

|

|

|

3,922,227

|

|

|

|

(5,318,758

|

)

|

|

|

(4,051,778

|

)

|

|

Preferred stock dividends

|

|

|

(921,875

|

)

|

|

|

(921,875

|

)

|

|

|

(2,765,625

|

)

|

|

|

(2,765,625

|

)

|

|

Net (loss) income attributable to common stockholders

|

|

$

|

(6,458,221

|

)

|

|

$

|

3,000,352

|

|

|

$

|

(8,084,383

|

)

|

|

$

|

(6,817,403

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per share attributable to common stockholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.86

|

)

|

|

$

|

0.40

|

|

|

$

|

(1.07

|

)

|

|

$

|

(0.91

|

)

|

|

Diluted

|

|

$

|

(0.86

|

)

|

|

$

|

0.35

|

|

|

$

|

(1.07

|

)

|

|

$

|

(0.91

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average number of common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

7,548,052

|

|

|

|

7,449,968

|

|

|

|

7,537,505

|

|

|

|

7,486,945

|

|

|

Diluted

|

|

|

7,548,052

|

|

|

|

10,180,543

|

|

|

|

7,537,505

|

|

|

|

7,486,945

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributions declared per common stock

|

|

$

|

0.2875

|

|

|

$

|

0.2875

|

|

|

$

|

0.8625

|

|

|

$

|

0.9625

|

|

MODIV INDUSTRIAL, INC.

Condensed Consolidated Balance Sheets

(Unaudited)

| |

|

As of

|

|

| |

|

September 30,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Assets

|

|

|

|

|

|

|

|

Real estate investments:

|

|

|

|

|

|

|

|

Land

|

|

$

|

106,263,557

|

|

|

$

|

103,657,237

|

|

|

Building and improvements

|

|

|

402,036,084

|

|

|

|

329,867,099

|

|

|

Equipment

|

|

|

4,429,000

|

|

|

|

4,429,000

|

|

|

Tenant origination and absorption costs

|

|

|

15,929,385

|

|

|

|

19,499,749

|

|

|

Total investments in real estate property

|

|

|

528,658,026

|

|

|

|

457,453,085

|

|

|

Accumulated depreciation and amortization

|

|

|

(47,587,670

|

)

|

|

|

(46,752,322

|

)

|

|

Total investments in real estate property, net, excluding unconsolidated investment in real estate

property and real estate investments held for sale, net

|

|

|

481,070,356

|

|

|

|

410,700,763

|

|

|

Unconsolidated investment in a real estate property

|

|

|

10,035,805

|

|

|

|

10,007,420

|

|

|

Total real estate investments, net, excluding real estate investments held for sale, net

|

|

|

491,106,161

|

|

|

|

420,708,183

|

|

|

Real estate investments held for sale, net

|

|

|

8,628,186

|

|

|

|

5,255,725

|

|

|

Total real estate investments, net

|

|

|

499,734,347

|

|

|

|

425,963,908

|

|

|

Cash and cash equivalents

|

|

|

5,641,610

|

|

|

|

8,608,649

|

|

|

Tenant receivables

|

|

|

11,211,058

|

|

|

|

7,263,202

|

|

|

Above-market lease intangibles, net

|

|

|

1,332,458

|

|

|

|

1,850,756

|

|

|

Prepaid expenses and other assets

|

|

|

4,881,383

|

|

|

|

6,100,937

|

|

|

Investment in preferred stock

|

|

|

10,060,000

|

|

|

|

-

|

|

|

Interest rate swap derivatives

|

|

|

6,156,179

|

|

|

|

4,629,702

|

|

|

Other assets related to real estate investments held for sale

|

|

|

46,158

|

|

|

|

12,765

|

|

|

Total assets

|

|

$

|

539,063,193

|

|

|

$

|

454,429,919

|

|

|

Liabilities and Equity

|

|

|

|

|

|

|

|

|

|

Mortgage notes payable, net

|

|

$

|

34,118,748

|

|

|

$

|

44,435,556

|

|

|

Credit facility revolver

|

|

|

-

|

|

|

|

3,000,000

|

|

|

Credit facility term loan, net

|

|

|

248,385,927

|

|

|

|

148,018,164

|

|

|

Accounts payable, accrued and other liabilities

|

|

|

8,893,630

|

|

|

|

7,649,806

|

|

|

Below-market lease intangibles, net

|

|

|

9,098,703

|

|

|

|

9,675,686

|

|

|

Interest rate swap derivative

|

|

|

-

|

|

|

|

498,866

|

|

|

Liabilities related to real estate investments held for sale

|

|

|

162,349

|

|

|

|

117,881

|

|

|

Total liabilities

|

|

|

300,659,357

|

|

|

|

213,395,959

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7.375% Series A cumulative redeemable perpetual preferred stock, $0.001 par value, 2,000,000 shares authorized, issued and

outstanding as of September 30, 2023 and December 31, 2022

|

|

|

2,000

|

|

|

|

2,000

|

|

|

Class C common stock, $0.001 par value, 300,000,000 shares authorized; 7,920,926 shares issued and 7,577,416 shares

outstanding as of September 30, 2023 and 7,762,506 shares issued and 7,512,353 shares outstanding as of December 31, 2022

|

|

|

7,921

|

|

|

|

7,762

|

|

|

Class S common stock, $0.001 par value, 100,000,000 shares authorized; no shares issued and outstanding as of September 30,

2023 and December 31, 2022

|

|

|

-

|

|

|

|

-

|

|

|

Additional paid-in-capital

|

|

|

289,837,352

|

|

|

|

278,339,020

|

|

|

Treasury stock, at cost, 343,510 and 250,153 shares held as of September 30, 2023 and December 31, 2022, respectively

|

|

|

(5,290,780

|

)

|

|

|

(4,161,618

|

)

|

|

Cumulative distributions and net losses

|

|

|

(132,524,459

|

)

|

|

|

(117,938,876

|

)

|

|

Accumulated other comprehensive income

|

|

|

2,871,866

|

|

|

|

3,502,616

|

|

|

Total Modiv Industrial, Inc. equity

|

|

|

154,903,900

|

|

|

|

159,750,904

|

|

|

Noncontrolling interests in the Operating Partnership

|

|

|

83,499,936

|

|

|

|

81,283,056

|

|

|

Total equity

|

|

|

238,403,836

|

|

|

|

241,033,960

|

|

|

Total liabilities and equity

|

|

$

|

539,063,193

|

|

|

$

|

454,429,919

|

|

MODIV INDUSTRIAL, INC.

Reconciliation of Non-GAAP Measures - FFO and AFFO

For the Three and Nine Months Ended September 30, 2023 and 2022

(Unaudited)

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

|

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Net (loss) income (in accordance with GAAP)

|

|

$

|

(6,905,242

|

)

|

|

$

|

4,450,767

|

|

|

$

|

(6,854,210

|

)

|

|

$

|

(5,232,053

|

)

|

|

Preferred stock dividends

|

|

|

(921,875

|

)

|

|

|

(921,875

|

)

|

|

|

(2,765,625

|

)

|

|

|

(2,765,625

|

)

|

|

Net (loss) income attributable to common stockholders and Class C OP Unit holders

|

|

|

(7,827,117

|

)

|

|

|

3,528,892

|

|

|

|

(9,619,835

|

)

|

|

|

(7,997,678

|

)

|

|

FFO adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization of real estate properties

|

|

|

4,175,209

|

|

|

|

3,598,592

|

|

|

|

11,403,603

|

|

|

|

10,581,765

|

|

|

Amortization of lease incentives

|

|

|

40,397

|

|

|

|

176,296

|

|

|

|

217,537

|

|

|

|

323,347

|

|

|

Depreciation and amortization for unconsolidated investment in a real estate property

|

|

|

187,479

|

|

|

|

192,551

|

|

|

|

567,721

|

|

|

|

573,487

|

|

|

Impairment of real estate investment property

|

|

|

-

|

|

|

|

-

|

|

|

|

3,499,438

|

|

|

|

-

|

|

|

Loss (gain) on sale of real estate investments, net

|

|

|

1,708,801

|

|

|

|

(3,932,028

|

)

|

|

|

1,708,801

|

|

|

|

(11,527,185

|

)

|

|

FFO attributable to common stockholders and Class C OP Unit holders

|

|

|

(1,715,231

|

)

|

|

|

3,564,303

|

|

|

|

7,777,265

|

|

|

|

(8,046,264

|

)

|

|

AFFO adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impairment of goodwill

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

17,320,857

|

|

|

Stock compensation

|

|

|

8,469,867

|

|

|

|

549,240

|

|

|

|

9,790,206

|

|

|

|

1,740,852

|

|

|

Deferred financing costs

|

|

|

165,709

|

|

|

|

101,783

|

|

|

|

556,134

|

|

|

|

1,470,289

|

|

|

Non-recurring loan prepayment penalties

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

615,336

|

|

|

Swap termination costs

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

733,000

|

|

|

Due diligence expenses, including abandoned pursuit costs

|

|

|

1,208

|

|

|

|

44,863

|

|

|

|

347,598

|

|

|

|

636,171

|

|

|

Deferred rents

|

|

|

(1,772,403

|

)

|

|

|

(976,420

|

)

|

|

|

(4,528,120

|

)

|

|

|

(2,593,698

|

)

|

|

Unrealized gain on interest rate swap valuation

|

|

|

(795,425

|

)

|

|

|

59,000

|

|

|

|

(2,781,838

|

)

|

|

|

(1,319,013

|

)

|

|

Amortization of (below) above market lease intangibles, net

|

|

|

(204,011

|

)

|

|

|

(214,889

|

)

|

|

|

(596,194

|

)

|

|

|

(862,861

|

)

|

|

Unrealized gain on investment in preferred stock

|

|

|

(440,000

|

)

|

|

|

-

|

|

|

|

(440,000

|

)

|

|

|

-

|

|

|

Other adjustments for unconsolidated investment in a real estate property

|

|

|

11,819

|

|

|

|

(188

|

)

|

|

|

35,457

|

|

|

|

(564

|

)

|

|

AFFO attributable to common stockholders and Class C OP Unit holders

|

|

$

|

3,721,533

|

|

|

$

|

3,127,692

|

|

|

$

|

10,160,508

|

|

|

$

|

9,694,105

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

7,548,052

|

|

|

|

7,449,968

|

|

|

|

7,537,505

|

|

|

|

7,486,945

|

|

|

Fully Diluted (1)

|

|

|

11,128,772

|

|

|

|

10,180,543

|

|

|

|

11,022,386

|

|

|

|

10,217,361

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO Per Share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.23

|

)

|

|

$

|

0.48

|

|

|

$

|

1.03

|

|

|

$

|

(1.07

|

)

|

|

Fully Diluted

|

|

$

|

(0.23

|

)

|

|

$

|

0.35

|

|

|

$

|

0.71

|

|

|

$

|

(1.07

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AFFO Per Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

0.49

|

|

|

$

|

0.42

|

|

|

$

|

1.35

|

|

|

$

|

1.29

|

|

|

Fully Diluted

|

|

$

|

0.33

|

|

|

$

|

0.31

|

|

|

$

|

0.92

|

|

|

$

|

0.95

|

|

|

(1)

|

Includes the Class C, Class M, Class P and Class R OP Units (time vesting and performance) to compute the weighted average number of shares.

|

FFO is defined by the National Association of Real Estate Investment Trusts (“Nareit”) as net income or loss computed in accordance with GAAP,

excluding extraordinary items, as defined by GAAP, and gains and losses from sales of depreciable operating property, plus real estate-related depreciation and amortization (excluding amortization of deferred financing costs and depreciation of

non-real estate assets), and after adjustment for unconsolidated partnerships, joint ventures, preferred distributions and real estate impairments. Because FFO calculations adjust for such items as depreciation and amortization of real estate assets

and gains and losses from sales of operating real estate assets (which can vary among owners of identical assets in similar conditions based on historical cost accounting and useful-life estimates), they facilitate comparisons of operating

performance between periods and between other REITs. As a result, we believe that the use of FFO, together with the required GAAP presentations, provides a more complete understanding of our performance relative to our competitors and a more informed

and appropriate basis on which to make decisions involving operating, financing, and investing activities. It should be noted, however, that other REITs may not define FFO in accordance with the current Nareit definition or may interpret the current

Nareit definition differently than we do, making comparisons less meaningful.

Additionally, we use AFFO as a non-GAAP financial measure to evaluate our operating performance. AFFO excludes non-routine and certain non-cash

items such as revenues in excess of cash received, amortization of stock-based compensation, deferred rents, amortization of in-place lease valuation intangibles, deferred financing fees, gain or loss from the extinguishment of debt, unrealized gains

(losses) on derivative instruments, and write-offs of due diligence expenses for abandoned pursuits. We also believe that AFFO is a recognized measure of sustainable operating performance by the REIT industry. Further, we believe AFFO is useful in

comparing the sustainability of our operating performance with the sustainability of the operating performance of other real estate companies. Management believes that AFFO is a beneficial indicator of our ongoing portfolio performance and ability to

sustain our current distribution level. More specifically, AFFO isolates the financial results of our operations. AFFO, however, is not considered an appropriate measure of historical earnings as it excludes certain significant costs that are

otherwise included in reported earnings. Further, since the measure is based on historical financial information, AFFO for the period presented may not be indicative of future results or our future ability to pay our dividends.

By providing FFO and AFFO, we present information that assists investors in aligning their analysis with management’s analysis of long-term

operating activities. For all of these reasons, we believe the nonGAAP measures of FFO and AFFO, in addition to income (loss) from operations, net income (loss) and cash flows from operating activities, as defined by GAAP, are helpful supplemental

performance measures and useful to investors in evaluating the performance of our real estate portfolio. However, a material limitation associated with FFO and AFFO is that they are not indicative of our cash available to fund distributions since

other uses of cash, such as capital expenditures at our properties and principal payments of debt, are not deducted when calculating FFO and AFFO. AFFO is useful in assisting management and investors in assessing our ongoing ability to generate cash

flow from operations and continue as a going concern in future operating periods. Therefore, FFO and AFFO should not be viewed as a more prominent measure of performance than income (loss) from operations, net income (loss) or cash flows from

operating activities and each should be reviewed in connection with GAAP measurements.

Neither the SEC, Nareit, nor any other applicable regulatory body has opined on the acceptability of the adjustments contemplated to adjust FFO in

order to calculate AFFO and its use as a non-GAAP performance measure. In the future, the SEC or Nareit may decide to standardize the allowable exclusions across the REIT industry, and we may have to adjust the calculation and characterization of

this non-GAAP measure.

MODIV INDUSTRIAL, INC.

Reconciliation of Non-GAAP Measures - Adjusted EBITDA

For the Three and Nine Months Ended September 30, 2023 and 2022

(Unaudited)

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Net (loss) income (in accordance with GAAP)

|

|

$

|

(6,905,242

|

)

|

|

$

|

4,450,767

|

|

|

$

|

(6,854,210

|

)

|

|

$

|

(5,232,053

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

4,175,209

|

|

|

|

3,598,592

|

|

|

|

11,403,603

|

|

|

|

10,581,765

|

|

|

Depreciation and amortization for unconsolidated investment in a real estate property

|

|

|

187,479

|

|

|

|

192,551

|

|

|

|

567,721

|

|

|

|

573,487

|

|

|

Interest expense, net of derivative settlements and unrealized gain on interest rate swaps

|

|

|

2,922,918

|

|

|

|

2,514,838

|

|

|

|

6,761,779

|

|

|

|

5,280,167

|

|

|

Loss on early extinguishment of debt

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,725,318

|

|

|

Interest expense on unconsolidated investment in real estate property

|

|

|

96,375

|

|

|

|

98,624

|

|

|

|

287,793

|

|

|

|

294,404

|

|

|

Impairment of real estate investment property

|

|

|

-

|

|

|

|

-

|

|

|

|

3,499,438

|

|

|

|

-

|

|

|

Impairment of goodwill

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

17,320,857

|

|

|

Stock compensation expense

|

|

|

8,469,867

|

|

|

|

549,240

|

|

|

|

9,790,206

|

|

|

|

1,740,852

|

|

|

Due diligence expenses, including abandoned pursuit costs

|

|

|

1,208

|

|

|

|

44,863

|

|

|

|

347,598

|

|

|

|

636,171

|

|

|

Loss (gain) on sale of real estate investments, net

|

|

|

1,708,801

|

|

|

|

(3,932,028

|

)

|

|

|

1,708,801

|

|

|

|

(11,527,185

|

)

|

|

Adjusted EBITDA

|

|

$

|

10,656,615

|

|

|

$

|

7,517,446

|

|

|

$

|

27,512,730

|

|

|

$

|

21,393,783

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized Adjusted EBITDA

|

|

$

|

42,626,460

|

|

|

$

|

30,069,784

|

|

|

$

|

36,683,640

|

|

|

$

|

28,525,044

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net debt:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated debt

|

|

$

|

284,284,849

|

|

|

$

|

201,365,536

|

|

|

$

|

284,284,849

|

|

|

$

|

201,365,536

|

|

|

Debt of unconsolidated investment in real estate property (a)

|

|

|

9,315,322

|

|

|

|

9,544,130

|

|

|

|

9,315,322

|

|

|

|

9,544,130

|

|

|

Consolidated cash and cash equivalents

|

|

|

(5,641,610

|

)

|

|

|

(5,726,888

|

)

|

|

|

(5,641,610

|

)

|

|

|

(5,726,888

|

)

|

|

Cash of unconsolidated investment in real estate property (a)

|

|

|

(387,278

|

)

|

|

|

(341,007

|

)

|

|

|

(387,278

|

)

|

|

|

(341,007

|

)

|

|

|

|

$

|

287,571,283

|

|

|

$

|

204,841,771

|

|

|

$

|

287,571,283

|

|

|

$

|

204,841,771

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net debt / Adjusted EBITDA

|

|

|

6.7

|

x

|

|

|

6.8

|

x

|

|

|

7.8

|

x

|

|

|

7.2

|

x

|

(a) Reflects the Company's 72.71% pro rata share of the tenant-in-common's mortgage note payable and cash.

We define Net Debt as gross debt less cash and cash equivalents and restricted cash. We define Adjusted EBITDA as GAAP net income or loss adjusted

to exclude real estate related depreciation and amortization, gains or losses from the sales of depreciable property, extraordinary items, provisions for impairment on real estate investments and goodwill, interest expense, non-cash items such as

non-cash compensation expenses and write-offs of transaction costs and other one-time transactions. We believe these non-GAAP financial measures are useful to investors because they are widely accepted industry measures used by analysts and investors

to compare the operating performance of REITs. EBITDA is not a measure of financial performance under GAAP, and our EBITDA may not be comparable to similarly titled measures of other companies. You should not consider our EBITDA as an alternative to

net income or cash flows from operating activities determined in accordance with GAAP.

###

Exhibit 99.2

NYSE: MDV

QUARTERLY SUPPLEMENTAL DATA

September 30, 2023

Financial Information

and

Portfolio Information

Modiv Industrial, Inc.

Supplemental Information - Third Quarter 2023

|

Table of Contents

|

| |

|

|

About the Data

|

3

|

| |

|

|

Company Overview

|

4

|

| |

|

|

Financial Results

|

|

|

Earnings Release

|

5

|

|

Consolidated Statements of Operations - Last Five Quarters

|

11

|

|

Property Portfolio - Statements of Operations - Third Quarter of 2023

|

13

|

|

Consolidated Statements of Comprehensive (Loss) Income - Last Five Quarters

|

14

|

|

(Loss) Earnings Per Share - Last Five Quarters

|

15

|

|

FFO and AFFO - Last Five Quarters

|

16

|

|

Property Portfolio - FFO and AFFO - Third Quarter of 2023

|

17

|

|

Adjusted EBITDA - Last Five Quarters

|

18

|

|

Leverage Ratio

|

19

|

|

Balance Sheets and Capitalization

|

|

|

Capitalization

|

20

|

|

Consolidated Balance Sheets

|

21

|

|

Property Portfolio - Balance Sheets - As of September 30, 2023

|

22

|

|

Debt Overview

|

23

|

|

Credit Facility and Mortgage Notes Covenants

|

24

|

| |

|

|

Real Estate

|

|

|

Real Estate Acquisitions

|

25

|

|

Real Estate Dispositions

|

26

|

|

Top 20 Tenants

|

27

|

|

Property Type

|

27

|

|

Tenant Industry Diversification

|

28

|

|

Tenant Geographic Diversification

|

28

|

|

Lease Expirations

|

29

|

| |

|

|

Appendix

|

|

|

Disclosures Regarding Non-GAAP and Other Metrics

|

30 |

About the Data

This data and other information described herein are as of and for the three months ended September 30,

2023 unless otherwise indicated. Future performance may not be consistent with past performance and is subject to change and inherent risks and uncertainties. This information should be read in conjunction with Modiv Industrial, Inc.'s

(f/k/a Modiv Inc.) Annual Report on Form 10-K for the year ended December 31, 2022 filed on March 13, 2023 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 filed on November 13, 2023, including the financial statements and management's discussion and analysis of financial condition and results of operations.

Forward-Looking Statements

Information set forth herein contains forward-looking statements, which reflect our current views regarding our business, financial performance, growth prospects and

strategies, market opportunities, and market trends. Forward-looking statements include all statements that are not historical facts. In some cases, you can identify these forward-looking statements by the use of words such as “outlook,” “believes,”

“expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of these words or other comparable words. All of the

forward-looking statements herein are subject to various risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions, and future business

decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual

results, performance, and achievements could differ materially from those expressed in or by the forward-looking statements and may be affected by a variety of risks and other factors. Accordingly, there are or will be important factors that could

cause actual outcomes or results to differ materially from such forward-looking statements. These factors include, but are not limited to, increases in the rate of inflation and interest rates, general economic conditions, local real estate

conditions, tenant financial health, property acquisitions and dispositions and the timing of any acquisitions and dispositions, risks and uncertainties related to the COVID-19 pandemic and its related impacts on us and our tenants, supply-chain

disruptions and negative impacts associated with the violence and unrest in the Middle East, which started with the war by Hamas militants against Israel, and the ongoing Russian war against Ukraine and sanctions which have been implemented by the

United States and other countries against Russia. These and other risks, assumptions, and uncertainties are described in our filings with the SEC, which are available on the SEC’s website at www.sec.gov.

You are cautioned not to place undue reliance on any forward-looking statements included herein. All forward-looking statements are made as of the date of this document and the risk that actual results, performance, and achievements will differ

materially from the expectations expressed or referenced herein will increase with the passage of time. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future

developments, or otherwise, except as required by law.

Company Overview

Modiv Industrial, Inc. (NYSE:MDV) (“Modiv Industrial”, the “Company”, “we”, “us” and “our”) is a real estate investment trust (“REIT”) that acquires,

owns and manages a portfolio of single-tenant net-lease real estate. The Company actively acquires critical industrial manufacturing properties with long-term leases to tenants that fuel the national economy and strengthen the nation's supply chains.

Driven by an investor-first focus, the Modiv name reflects its commitment to providing investors with MOnthly DIVidends.

As of November 13, 2023, Modiv Industrial had over $600 million real estate assets (based on estimated fair value) comprised of 4.6 million square feet of aggregate leasable area. For more information, please visit: www.modiv.com.

Modiv Industrial strives towards a “best-in-class” corporate governance structure through a board of directors and management team with decades of

institutional real estate industry experience.

|

Management Team:

|

Independent Directors:

|

| |

|

|

Aaron S. Halfacre

|

Adam S. Markman

|

|

Chief Executive Officer and Director

|

Chairman of the Board

|

| |

|

|

Raymond J. Pacini

|

Curtis B. McWilliams

|

|

Chief Financial Officer and Secretary

|

|

| |

|

|

Sandra G. Sciutto

|

Thomas H. Nolan, Jr.

|

|

Chief Accounting Officer

|

|

| |

|

|

John C. Raney

|

Kimberly Smith

|

|

Chief Legal Officer

|

|

| |

|

|

William R. Broms

|

Connie Tirondola

|

|

Chief Investment Officer

|

|

Investor Inquiries:

management@modiv.com

Transfer Agent:

Computershare Trust Company, N.A.

150 Royall Street

Canton, MA 02021

800-736-3001

Modiv Industrial Announces Third Quarter 2023 Results

Management Provides Forward-Looking Thoughts

Reno, Nevada, November 13, 2023 – Modiv Industrial, Inc. (“Modiv Industrial”, “Modiv”, the “Company”, “we” or “our”), (NYSE:MDV), the only public REIT exclusively

focused on acquiring industrial manufacturing real estate, today announced operating results for the third quarter ended September 30, 2023.

Key Financial Highlights:

|

◾ |

21% year-over-year increase in revenue generating $12.5 million compared with $10.3 million in the year-ago quarter.

|

|

◾ |

19% year-over-year increase in AFFO netting $3.7 million compared with $3.1 million in the year-ago quarter.

|

|

◾ |

$10 million reduction in leverage and a 14% reduction in net debt to adjusted EBITDA from prior quarter results released in August 2023.

|

|

◾ |

$5.4 million net proceeds from the sale of a non-core asset located in Rocklin, California.

|

|

◾ |

Portfolio consists of 44 properties with a weighted average lease term of 14.0 years and weighted average annual rental increases of 2.48%.

|

“Another solid quarter of no-nonsense execution. Given the increased market volatility and geo-political risk, we believe the greater benefit inures to those that are

thoughtful rather than rash. With crystal balls becoming even more opaque, today’s environment compels us to be incessantly focused on the execution of the variables in our control. As such, it feels imprudent to provide formal guidance for 2024 but

reasonable for us to be transparent as to our strategic thinking. The following business outlook lists our activity and perspective on topics we suspect will be germane to investors.

Business Outlook:

Acquisitions – Since our NYSE listing last year, we

have acquired over $214 million of industrial manufacturing assets, arguably the most active buyer of this property type and at a volume that is more commensurate with much larger REITs. As we discussed recently in a Nareit podcast, we chose to be