CALHOUN, Ga., April 27 /PRNewswire-FirstCall/ -- Mohawk Industries,

Inc. (NYSE:MHK) today announced first quarter net sales of

$1,925,106,000 in 2006 compared to net sales of $1,493,222,000 in

2005, an increase of 29%. The net sales growth was primarily

attributable to the Unilin acquisition, internal growth and price

increases. Adjusted net earnings for the first quarter of 2006 were

$72,862,000 (4% above last year) or $1.07 diluted earnings per

share (EPS), representing a 3% improvement above last year's

earnings. The adjusted net earnings exclude a $3 million stock

option charge that was not required in 2005. During the first

quarter of 2006, a non-cash LIFO charge impacted earnings by $14

million ($8.7 million, net of tax) or $.13 EPS compared to $6

million ($4.0 million, net of tax) or $.06 EPS in the first quarter

of 2005. In accordance with U.S. Generally Accepted Accounting

Principles (GAAP) net earnings for the first quarter of 2006 were

$71,120,000 and EPS were $1.04 per share. The first quarter of 2005

net earnings were $70,020,000 or $1.03 in EPS. The Mohawk segment

net sales of $1,150,546,000 in the first quarter of 2006 were up 5%

from $1,091,346,000. This was primarily attributable to increases

in prices in all product lines as well as growth in hard surface

sales. The Dal-Tile segment net sales of $473,910,000 in the first

quarter grew 18% from $401,876,000 from internal growth and

improved product mix. The Unilin segment net sales were

$302,630,000. In commenting on the first quarter results, Jeffrey

S. Lorberbaum, Chairman and CEO stated, "The results for the

quarter were in line with our guidance that we revised earlier. The

revision was attributable to our Mohawk segment which was

negatively impacted by a $14 million non-cash LIFO charge as well

as lower sales growth and margins in the residential replacement

carpet category. The slower carpet industry sales also impacted

pricing on some opening price point products more than we

anticipated. Our material costs moderated slightly from the high

levels after the hurricanes and remained relatively stable through

the quarter. "During the quarter, we started up a new manufacturing

facility to increase capacity of fiber extrusion and yarn

manufacturing in South Carolina. A carpet padding plant in the

Northwest was started up during the period. We completed the

purchase of a carpet backing plant early in the second quarter of

this year. We anticipate improving residential replacement carpet

demand which is historically affected by gains in employment levels

and consumer confidence. In addition, homeowners usually replace

their flooring at a faster rate when interest rates rise and people

move less frequently. "Our Dal-Tile segment results included strong

sales and operating profit growth. All product categories performed

well as this business continues to gain market share. The Oklahoma

ceramic expansion is progressing as planned while the Mexican

expansion was completed at the end of last year. The management has

transitioned smoothly to Harold Turk from Chris Wellborn who was

promoted to Mohawk COO. "Unilin results included growing sales in

both the U.S. and Europe. Our U.S. laminate strategy is in the

implementation stage and we expect a sales benefit in the second

half of 2006. The Unilin operating margin is lower in the first

quarter due to seasonally lower sales, distribution inventory

adjustments, higher wood and energy costs, and slightly lower

laminate prices. Our U.S. laminate plant expansion was completed

during the quarter to support additional growth in the U.S. The

first quarter sales results were negatively impacted by inventory

reductions of our distributors' due to shorter delivery times from

this facility. There will be additional adjustments in the second

quarter. Board price increases are being implemented to reflect

higher wood and chemical costs. New products are being introduced

under the Mohawk brand to increase our laminate distribution. "Our

balance sheet continues to strengthen as the debt to capitalization

ratio was further reduced to 51%. Our inventory turnover also

improved to 4.8 times from 3.9 times the prior year. We will

continue to focus on debt reduction in the future." The strong

economy along with improving consumer confidence should positively

affect our business in future periods. We continue to anticipate

continued growth in commercial and an improvement in the

replacement category, which is our largest channel, with some

slowing of new residential construction business later this year.

The recent change in oil prices has not presently impacted our raw

materials. We cannot predict the affect on our costs or customer

demand in the future. After considering these factors, we estimate

the earnings forecast for the second quarter of 2006 to range from

$1.51 to $1.60. Certain of the statements in the immediately

preceding paragraphs, particularly anticipating future performance,

business prospects, growth and operating strategies, proposed

acquisitions, and similar matters, and those that include the words

"believes," "anticipates," "forecast," "estimates," or similar

expressions constitute "forward-looking statements." For those

statements, Mohawk claims the protection of the safe harbor for

forward- looking statements contained in the Private Securities

Litigation Reform Act of 1995. There can be no assurance that the

forward-looking statements will be accurate because they are based

on many assumptions which involve risks and uncertainties. The

following important factors could cause future results to differ:

changes in economic or industry conditions; competition; raw

material and energy prices; timing and level of capital

expenditures; integration of acquisitions; introduction of new

products; rationalization of operations; litigation; and other

risks identified in Mohawk's SEC reports and public announcements.

Mohawk is a leading supplier of flooring for both residential and

commercial applications. Mohawk offers a complete selection of

carpet, ceramic tile, laminate, wood, stone, vinyl, rugs and other

home products. These products are marketed under the premier brands

in the industry, which include Mohawk, Karastan, Ralph Lauren,

Lees, Bigelow, Dal-Tile, American Olean, Unilin and Quick Step.

Mohawk's unique merchandising and marketing assist our customers in

creating the consumers' dream. Mohawk provides a premium level of

service with its own trucking fleet and over 250 local distribution

locations. There will be a conference call Friday, April 28, 2006

at 11:00 AM Eastern Time. The telephone number to call is

1-800-603-9255. A conference call replay will also be available

until Monday, May 1, 2006 by dialing 1-800-642-1687 for US/local

calls and (706) 645-9291 for international calls and entering

Conference ID # 8208904. MOHAWK INDUSTRIES, INC. AND SUBSIDIARIES

Consolidated Statement of Earnings Data (Amounts in thousands,

except per Three months ended share data) April 1, 2006 April 2,

2005 Net sales $1,925,106 1,493,222 Cost of sales 1,422,096

1,108,520 Gross profit 503,010 384,702 Selling, general and

administrative expenses 352,443 261,072 Operating income 150,567

123,630 Interest expense 40,335 11,876 Other (income) expense, net

2,727 2,004 Earnings before income taxes 107,505 109,750 Income

taxes 36,385 39,730 Net earnings $71,120 70,020 Basic earnings per

share $1.05 1.05 Weighted-average shares outstanding 67,564 66,804

Diluted earnings per share $1.04 1.03 Weighted-average common and

dilutive potential common shares outstanding 68,079 67,692 Other

Financial Information (Amounts in thousands) Net cash provided by

operating activities $104,526 50,701 Depreciation &

amortization $64,853 32,265 Capital expenditures $45,632 34,521

Consolidated Balance Sheet Data (Amounts in thousands) April 1,

2006 April 2, 2005 ASSETS Current assets: Cash and cash equivalents

$82,174 - Receivables 948,229 739,789 Inventories 1,186,626

1,145,747 Prepaid expenses 140,194 46,428 Deferred income taxes

34,857 55,311 Total current assets 2,392,080 1,987,275 Property,

plant and equipment, net 1,822,424 940,086 Goodwill 2,642,389

1,377,349 Tradenames 630,402 272,280 Intangible assets 542,734

49,366 Other assets 30,704 14,672 $8,060,733 4,641,028 LIABILITIES

AND STOCKHOLDERS' EQUITY Current liabilities: Current portion of

long-term debt $100,156 218,501 Accounts payable and accrued

expenses 1,033,726 756,895 Total current liabilities 1,133,882

975,396 Long-term debt, less current portion 3,148,000 700,000

Deferred income taxes and other long- term liabilities 628,020

221,531 Total liabilities 4,909,902 1,896,927 Total stockholders'

equity 3,150,831 2,744,101 $8,060,733 4,641,028 Segment Information

As of or for the Three Months Ended (Amounts in thousands) April 1,

2006 April 2, 2005 Net sales: Mohawk $1,150,546 1,091,346 Dal-Tile

473,910 401,876 Unilin 302,630 - Corporate and eliminations (1,980)

- Consolidated net sales $1,925,106 1,493,222 Operating income:

Mohawk $52,279 65,625 Dal-Tile 69,602 58,470 Unilin 40,019 -

Corporate and eliminations (11,333) (465) Consolidated operating

income $150,567 123,630 Assets: Mohawk $2,458,587 2,472,133

Dal-Tile 2,257,052 2,117,843 Unilin 3,255,582 - Corporate and

eliminations 89,512 51,052 Consolidated assets $8,060,733 4,641,028

Reconciliation of reported net earnings to adjusted net earnings

Three Months Ended April 1, 2006 April 2, 2005 Net earnings

reported $71,120 70,020 Add: Stock option expense, net of taxes of

$1,008 1,742 - Adjusted net earnings $72,862 70,020 Adjusted net

earnings per common share (basic) $ 1.08 1.05 Adjusted net earnings

per common share (diluted) $ 1.07 1.03 The Company believes it is

useful for itself and investors to review, as applicable, both GAAP

information that includes the stock compensation impact of SFAS

123R, and the non-GAAP measure that excludes such information in

order to assess the performance of the Company's business for

planning and forecasting in subsequent periods. DATASOURCE: Mohawk

Industries, Inc. CONTACT: Frank H. Boykin, Chief Financial Officer

of Mohawk Industries, Inc., +1-706-624-2695 Web site:

http://www.mohawkind.com/

Copyright

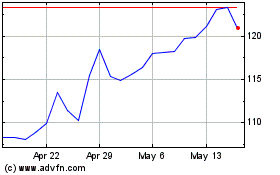

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Jun 2024 to Jul 2024

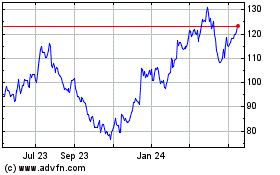

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Jul 2023 to Jul 2024