Mirant Announces Final Results of Tender Offer

30 August 2006 - 7:29AM

PR Newswire (US)

ATLANTA, Aug. 29 /PRNewswire-FirstCall/ -- Mirant Corporation

(NYSE:MIR) today announced the final results of its modified "Dutch

auction" tender offer to purchase up to 43,000,000 shares of the

company's common stock, which expired at 5:00 p.m., New York City

time, on Monday, August 21, 2006. Mirant has accepted for payment

an aggregate of 43,000,000 shares of its common stock at a purchase

price of $28.50 per share. These shares represent approximately 14

percent of the shares outstanding as of June 30, 2006. Mirant has

been informed by Mellon Investor Services, the depositary for the

tender offer, that the final proration factor for the tender offer

is approximately 85.6 percent. Based on the final count by the

depositary (and excluding any conditional tenders that were not

accepted due to the specified condition not being satisfied),

50,218,254 shares were properly tendered and not withdrawn at or

below a price of $28.50 per share. Payment for the shares accepted

for purchase, and return of all shares tendered and delivered and

not accepted for purchase, will be carried out promptly by the

depositary. As a result of the completion of the tender offer,

Mirant has approximately 257,068,663 shares of common stock

outstanding (basic). Any questions with regard to the tender offer

may be directed to Innisfree M&A Incorporated, the Information

Agent for the Offer, at 1 877 750 5836, or J.P. Morgan Securities

Inc., the Dealer Manager for the Offer, at 1 877 371 5947. Mirant

is a competitive energy company that produces and sells electricity

in the United States, the Caribbean, and the Philippines. Mirant

owns or leases approximately 17,300 megawatts of electric

generating capacity globally. The company operates an asset

management and energy marketing organization from its headquarters

in Atlanta. For more information, please visit

http://www.mirant.com/. Some of the statements included herein

involve forward-looking information. Mirant cautions that these

statements involve known and unknown risks and that there can be no

assurance that such results will occur. There are various important

factors that could cause actual results to differ materially from

those indicated in the forward-looking statements, such as, but not

limited to, the ability of Mirant and the depositary to timely

complete the remaining steps in the tender offer and other factors

discussed in Mirant's Form 10-K for the year ended December 31,

2005, and its Form 10-Q for the quarter ended June 30, 2006. Mirant

undertakes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. Stockholder inquiries: 678 579 7777 DATASOURCE:

Mirant CONTACT: Media contact: Corry Leigh, +1-678-579-3111, ,

Investor Relations contacts: Mary Ann Arico, +1-678-579-7553, ,

Sarah Stashak, +1-678-579-6940, , all of Mirant, or Stockholder

inquiries: +1-678-579-7777 Web site: http://www.mirant.com/

Copyright

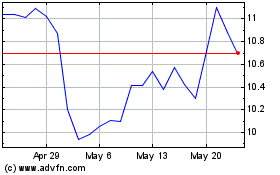

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jun 2024 to Jul 2024

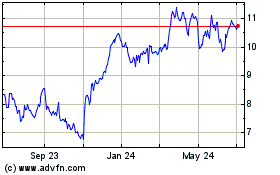

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jul 2023 to Jul 2024