Form 8-K - Current report

25 February 2025 - 8:33AM

Edgar (US Regulatory)

false000109634300010963432025-02-242025-02-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________________________________________________________

FORM 8-K

_______________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 24, 2025

_______________________________________________

MARKEL GROUP INC.

(Exact name of registrant as specified in its charter)

_______________________________________________

| | | | | | | | |

Virginia | 001-15811 | 54-1959284 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

4521 Highwoods Parkway, Glen Allen, Virginia 23060-6148

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (804) 747-0136

Not Applicable

(Former name or former address, if changed since last report)

_______________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | |

| Common Stock, no par value | MKL | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 7.01 | Regulation FD Disclosure |

On February 24, 2025, Markel Group Inc. (Markel Group or the Company) posted a copy of the 2024 Letter to Shareholders, from Thomas S. Gayner, the Company’s Chief Executive Officer, on the Company’s website at ir.mklgroup.com/investor-relations.

A copy of the letter is furnished as Exhibit 99.1 and is incorporated into this Item 7.01 by reference.

The letter may include statements about Markel Group’s future economic performance, finances, expectations, plans and prospects that are forward-looking statements. There are risks and uncertainties that could cause actual results to differ materially from those expressed in or suggested by such statements. Additional information about factors that could cause actual results to differ materially from those projected in the forward-looking statements can be found in the Company's 2024 Annual Report on Form 10-K, which was filed with the Securities and Exchange Commission (SEC) on February 24, 2025, including in Item 1A Risk Factors and Item 7 Management's Discussion and Analysis of Financial Condition and Results of Operations under "Safe Harbor and Cautionary Statement." The letter may also include or discuss certain non-GAAP financial measures. You may find the most directly comparable GAAP measures and a reconciliation to GAAP for these measures in the Company's 2024 Annual Report on Form 10-K. The letter discusses the Company's growth in "intrinsic value per share." For more information regarding this metric, see the press release for the Company’s 2024 results, which was filed with the SEC by a Current Report on Form 8-K on February 5, 2025.

The Company's 2024 Annual Report on Form 10-K and the press release for the Company’s 2024 results also can be found on the Markel Group website at ir.mklgroup.com/investor-relations in the “Financials” section.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| MARKEL GROUP INC. |

| | | |

| | | |

| | | |

February 24, 2025 | By: | | /s/ Richard R. Grinnan |

| Name: | | Richard R. Grinnan |

| Title: | | Senior Vice President, Chief Legal Officer and Secretary |

2024

To Our Business Partners,

Markel is a company built for people.

We follow a simple mission at Markel Group.

We aspire to build one of the world’s great companies.

This journey animates and motivates us.

Our desire to ensure that our customers, associates, and shareholders all win as part of Markel Group underpins everything we do. We do not walk this journey alone. We enjoy a bedrock of unique shareholders who share and support this goal.

We’ve spent decades building enduring relationships with our long-term owners and aim to continue doing so. We believe that you, as shareholders, are our partners and not distant unnamed institutional entities on a statement.

I write this letter as if we swapped places—to give you as fulsome a report as we would hope to receive if our roles were reversed. I write as if we were sitting together and having a conversation.

As a public company, we always keep the welcome mat out for new investors. We also hope that once you arrive, you stay indefinitely.

We decided to discuss some of the most important elements of the Markel Group “owner’s manual” to

welcome new investors and refresh our long-term owners on why it might be a good idea to stay. We run the company using these key principles, and the whole company is stronger when we're all aligned with them.

Those principles include:

•The Markel Style, our company’s creed, grounds and guides us.

•Our approach to business and investing is always done through a long-term lens, and with a win-win-win mentality.

•Our focus on the long term is never an excuse for short-term underperformance or complacency. Our zealous pursuit of excellence requires continually looking to improve.

•We're a diverse and resilient family of businesses, spanning insurance underwriting and beyond.

•We empower these businesses through local autonomy with accountability. We seek to become the best home in the world for our businesses.

•These businesses are focused on serving their customers and the points of differentiation through which they do so.

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share data) | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

| Total operating revenues | $ | 16,621 | | 15,804 | | 11,675 | | 12,846 | | 9,735 | | 9,526 | | 6,841 | | 6,062 | | 5,612 | |

Total operating income | $ | 3,713 | | 2,929 | | (93) | | 3,242 | | 1,274 | | 2,477 | | 40 | | 217 | | 805 | |

5-Year average operating income | $ | 2,213 | | 1,966 | | 1,388 | | 1,450 | | 963 | | 880 | | 496 | | 583 | | 621 | |

| Comprehensive income (loss) to shareholders | $ | 2,608 | | 2,285 | | (1,206) | | 2,076 | | 1,192 | | 2,094 | | (376) | | 1,175 | | 667 | |

| Shareholders' equity | $ | 16,916 | | 14,984 | | 13,151 | | 14,700 | | 12,822 | | 11,071 | | 9,081 | | 9,504 | | 8,461 | |

| Closing stock price per share | $ | 1,726.23 | | 1,419.90 | | 1,317.49 | | 1,234.00 | | 1,033.30 | | 1,143.17 | | 1,038.05 | | 1,139.13 | | 904.50 | |

5-Year CAGR in closing stock price per share (1) | 9 | % | 6 | % | 3 | % | 6 | % | 3 | % | 11 | % | 12 | % | 21 | % | 17 | % |

| Combined ratio | 95 | % | 98 | % | 92 | % | 90 | % | 98 | % | 94 | % | 98 | % | 105 | % | 92 | % |

Markel Ventures operating income | $ | 520 | | 520 | | 404 | | 330 | | 307 | | 210 | | 133 | | 147 | | 161 | |

| Invested assets | $ | 34,247 | | 30,854 | | 27,420 | | 28,292 | | 24,927 | | 22,258 | | 19,238 | | 20,570 | | 19,059 | |

(1)CAGR - compound annual growth rate

•Our stable and conservative balance sheet, strong cash flows, cost efficiency, and safety-first decision-making support our capital system.

•We always aim to put capital to its best and highest use.

When we recently analyzed our shareholders versus a large peer group, we found that only Berkshire Hathaway's shareholder base turns over less frequently than ours.

Many of our long-term shareholders could have easily written this list themselves. We believe having uniquely aligned and stable capital partners is a competitive advantage. For those newer to Markel Group, we hope this letter is helpful.

Beyond discussing essential aspects of our owner’s manual, we also will update you on our 2024 performance and the results we achieved over longer timeframes.

As Ken Kesey wrote in Sometimes a Great Notion1, “That’s the whole ball of wax.”

The good, the bad, and the ugly

When it comes to reviewing our performance, we often borrow a phrase from Clint Eastwood and break down our operations into three categories: the good, the bad, and the ugly.

| | | | | |

1 Ken Kesey's film is sometimes referred to by alternative titles. | |

Clint was a harsh grader and didn’t include “the great” on his list.

Neither do we.

No matter how good something is, we tend to describe it with modesty. We know how fragile good and great things are in this world.

None of what we do is easy, and there always seems to be a competitor, some disruptive technology, or worse—a smug sense of self-satisfaction and complacency that can infect us and start a downward spiral.

I don’t think head coaches of successful teams or great orchestra conductors ever feel completely satisfied.

Neither do we.

Satisfaction can breed rot. We must balance celebration and accomplishments with the correct dose of paranoia. We’re working on keeping that balance in place.

As in all years, we will err on grading great-good, good-bad, and bad-ugly.

Talking about our business's good, bad, and ugly—with transparency, humility, and conservatism—has always served our business's and shareholders' long-term best interests well. This year is no different.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 20-Year CAGR (1) |

| 5,370 | | 5,134 | | 4,323 | | 3,000 | | 2,630 | | 2,225 | | 2,069 | | 1,977 | | 2,551 | | 2,576 | | 2,200 | | 2,262 | | 10 | % |

| 860 | | 558 | | 476 | | 405 | | 276 | | 369 | | 253 | | (112) | | 630 | | 619 | | 250 | | 280 | | 14 | % |

| 515 | | 417 | | 356 | | 238 | | 283 | | 352 | | 328 | | 333 | | 403 | | 308 | | 158 | | 108 | | 16 | % |

| 233 | | 936 | | 459 | | 504 | | 252 | | 431 | | 591 | | (403) | | 337 | | 551 | | 64 | | 273 | | 12 | % |

| 7,834 | | 7,595 | | 6,674 | | 3,889 | | 3,388 | | 3,172 | | 2,774 | | 2,181 | | 2,641 | | 2,296 | | 1,705 | | 1,657 | | 12 | % |

| 883.35 | | 682.84 | | 580.35 | | 433.42 | | 414.67 | | 378.13 | | 340.00 | | 299.00 | | 491.10 | | 480.10 | | 317.05 | | 364.00 | | 8 | % |

| 18 | % | 15 | % | 14 | % | (2) | % | (3) | % | 4 | % | (1) | % | 3 | % | 19 | % | 22 | % | 12 | % | 19 | % | |

| 89 | % | 95 | % | 97 | % | 97 | % | 102 | % | 97 | % | 95 | % | 99 | % | 88 | % | 87 | % | 101 | % | 96 | % | |

| 84 | | 77 | | 73 | | 56 | | 42 | | 20 | | 5 | | 5 | | 5 | | 5 | | 2 | | — | | |

| 18,181 | | 18,638 | | 17,612 | | 9,333 | | 8,728 | | 8,224 | | 7,849 | | 6,893 | | 7,775 | | 7,524 | | 6,588 | | 6,317 | | 9 | % |

Markel Group is like a redwood tree

The Markel Group has been public for 38 years, but we’re approaching 95 years since Sam Markel founded the company in 1930. The lifespan and majesty of a giant redwood tree stand as a good simile for our aspirations.

Why?

Redwood trees symbolize enduring growth. They can live for more than a thousand years. The only way to think about them is through a long-term lens. In redwood terms, we’re just getting started.

If you ever cut down a redwood tree, you will see a ring marking each year of the tree’s life. Some rings would be thin and some would be thick. They demonstrate resilience and survival. They tell stories of fires, droughts, and endurance through time. Similarly, the 94 rings of Markel Group tell the story of enduring growth.

Along with so many of our colleagues, I have dedicated my life to growing and stewarding the Markel Group. This is a company where people do that.

I believe that Markel Group provides a rare environment. People can and do choose to dedicate their lives to the win-win-win philosophy of service to others. With this central idea, we attract colleagues from multiple industries all over the world.

Our team includes experts in insurance underwriting and services, investments, bakery equipment, car haulers, IT consulting, medicine, industrial gas storage, affordable housing, ornamental plants, precast concrete, construction, fire protection, furniture, dredges, leather goods, trailer flooring, building products distribution, educational services, investment management, data services, environmental services, and other areas. Our values extend across these industries. Enduring values drive the value of your company.

As the chief steward of this redwood tree, my calling is to create and foster the conditions that help the tree achieve durable, healthy, and resilient growth over time.

What our win-win-win philosophy means

We believe that great companies do things for their customers, colleagues, and shareholders rather than to them.

Win-win-win describes an infinite, self-reinforcing, and enjoyable game. Everybody wins, and everybody wants to keep playing. In zero-sum or finite games, somebody wins, and somebody loses, or too often, participants decide to stop.

We intend to keep going.

Win #1 - Our customers

The 22,000 people of the Markel Group get up every morning to provide solutions for our customers. We work to build durable relationships based on providing a product or service that meets their needs. Transactions happen in the now, whereas relationships are built over lifetimes. We think that there’s a big difference between the two.

Win #2 - Our associates

This is a team sport. We can’t serve our customers without a team of skilled and dedicated players. As such, we care deeply about our colleagues. We’re members of an orchestra, not solo musicians, and we enjoy playing a song that'll last for many generations.

Win #3 - Our shareholders

Over 38 years, the company’s share price has grown from $8.33 to a recent price of around $1,900, a compound annual growth rate of roughly 15%. This growth rate mirrors internal measurement of the growth in our intrinsic value per share (more on this later). When we serve our customers and care for each other, the value of the company grows, and our shareholders win.

A system built for forever, and right now

My team has often heard me say that, in service of win-win-win, we must operate with the dual time horizons of “forever, and right now.” A long-term lens must never be an excuse for short-term underperformance or complacency. Our call to a zealous pursuit of excellence requires continually looking to improve.

Our plan over the long term is simple but ambitious: to build one of the world’s great companies. The quality of the redwood we’re growing must be measured over a longer time horizon. To get to forever though, we need to design and operate a system that gets through whatever right now we encounter.

We designed the system with the explicit goal of resilience. What properties of Markel Group give it this resilience?

Diversification and specialization

Since our beginning as a public company, we’ve employed a strategy of diversification and specialization. Our diversification gives us the patience and strength to endure tough market cycles that may impact some of our businesses, while our specialization positions us to lead, not just participate, in the markets in which we operate.

While this strategy was originally developed when we only had insurance operations, it continues to serve us well as a diverse family of businesses.

A home for great leaders

Our resilience comes from building a home that attracts and retains great leaders. Winners flourish with equal parts autonomy and accountability, allowing them to operate and apply their craft—it’s the only way our leaders and their teams can reach their full potential. Winners want to be around other winners, and this contagious energy compounds.

A strong, low-debt balance sheet

We see our strong capital position and low-debt philosophy as necessary preconditions for long-term thinking. We can always put our customers’ interests first, as we're not under undue time pressure to service debt at the expense of making the right long-term decisions for the business.

Frugality

My friend and accomplished investor, Shelby Davis, once told me about a study of great investors. It sought to identify the principles, qualities, educational backgrounds, training, demographics, or other characteristics linked to future investment performance.

The study only found one common characteristic among great investors: they were all frugal.

We agree.

That’s why we manage your capital at extraordinarily low costs. The returns we earn flow through to the company's value with minimal friction, which also compounds.

Another unheralded, but incredibly important, component of our resilience is the frugality of our tax efficiency. The ability to select securities and hold businesses over long periods defers tax liabilities and compounds your company's value.

Humility

Celebrating humility is tricky, but it is a core part of who we are and how we operate. Being open-eyed about the limits of our knowledge and what isn’t in our control informs long-term decision-making. It tends to push us away from over-optimization. It nudges us to favor incremental improvements that compound day after day after day over moonshots.

We’ve entered many new markets over the years and made several acquisitions over the decades that have landed us in new and different territories. In doing so, we’ve taken a crawl, walk, run approach.

Sometimes, life calls for dramatic choices and big decisions. We don’t shy away from those moments either. We’ve done a series of “double the size of the company” deals over the decades in our underwriting businesses, but that ability stems from our continual paranoia that we never assume we know more than we do—and that too much certainty can breed fragility in the system.

Focus on capital efficiency

We are blessed with a 360-degree capital allocation view at Markel Group. We can invest in the businesses that are proven winners. We can buy new businesses, or minority stakes in great public companies. We can repurchase our shares (or buy more of everything we already own).

The way we dynamically triage these opportunities is by putting capital to its best and highest use. This reinforces the accountability of operators across the system. As one leader or business reaches new heights, and has more growth opportunities, it raises the opportunity cost of capital across the system.

That rounds out the key, though not comprehensive, aspects of the owner’s manual. So, how did this all work in 2024?

Is our redwood healthy and growing?

Like every other public company, we report our numbers annually. Looking at the redwood ring of 2024, it was a good, but not great, year. In 2024, we exceeded our target with strong returns from our public equity portfolio, continued growth in Ventures, and notable performance in many areas of our insurance business.

However, we prefer to look at more than a single year’s data because, as Aristotle wrote, “One swallow does not a summer make.”

To make the measurements more robust and accurate, we provide our full results to you in five-year and one-year increments. We also share key financial highlights from the last 21 years in the table on the first two pages of this letter. We think this practice of updating long-term results annually, and the discipline associated with doing so, sets us apart from most public companies.

Further, our operating income's compound annual growth rate over five-year periods is a key indicator of how our system is doing. Over such a timeframe, the noise of annual equity portfolio returns or from the underwriting businesses normalizes. If one’s scorekeeping lens gets much shorter, it can be difficult to find the signal. In the results below, you’ll see both our short- and long-term progress.

Table 1: One-year financial results

| | | | | | | | |

| (dollars in millions, except per share data) | 2024 | 2023 |

| Total revenues | $ | 16,621 | | $ | 15,804 | |

Total operating income | $ | 3,713 | | $ | 2,929 | |

| Earned premiums | $ | 8,432 | | $ | 8,295 | |

ILS and program services revenues | $ | 286 | | $ | 272 | |

Insurance operating income | $ | 601 | | $ | 348 | |

| Markel Ventures revenues | $ | 5,120 | | $ | 4,985 | |

Markel Ventures operating income | $ | 520 | | $ | 520 | |

| Net investment income | $ | 920 | | $ | 735 | |

Mark to market on equity securities | $ | 1,803 | | $ | 1,566 | |

Comprehensive income to shareholders | $ | 2,608 | | $ | 2,285 | |

| | |

Closing stock price

per share, at end of period | $ | 1,726.23 | | $ | 1,419.90 | |

Table 2: Five-year financial results

| | | | | | | | | | | |

| (dollars in millions, except per share data) | 2020 - 2024 | 2015 - 2019 | 2010 - 2014 |

| Total revenues | $ | 66,681 | | $ | 33,411 | | $ | 17,312 | |

Total operating income | $ | 11,063 | | $ | 4,399 | | $ | 2,084 | |

| Earned premiums | $ | 36,431 | | $ | 21,699 | | $ | 12,930 | |

ILS and program services revenues | $ | 1,697 | | $ | 566 | | N/A |

Insurance operating income | $ | 2,734 | | $ | 1,033 | | 305 |

| Markel Ventures revenues | $ | 21,301 | | $ | 7,563 | | $ | 2,498 | |

Markel Ventures operating income | $ | 2,081 | | $ | 735 | | $ | 269 | |

| Net investment income | $ | 2,845 | | $ | 1,989 | | $ | 1,439 | |

Mark to market on equity securities | $ | 4,358 | | $ | 2,447 | | $ | 1,873 | |

| Comprehensive income to shareholders | $ | 6,955 | | $ | 3,793 | | $ | 2,582 | |

| | | |

Closing stock price

per share, at end of period | $ | 1,726.23 | | $ | 1,143.17 | | $ | 682.84 | |

Insurance

We begin discussing the different components of Markel Group with our cornerstone business: insurance. In 2024, many parts of our insurance business performed very well, while in other areas, we continue to work to meet our standards.

Our aggregate insurance combined ratio was 95.2% in 2024, compared to 98.4% in 2023. That three-point improvement in the combined ratio is encouraging, but we have more work to do.

Our combined ratio comprises over one hundred and fifty different products. With our vast array of products and geographies, there always seems to be some good, bad, and ugly in the mix.

The "good” in 2024 included the results from our international operations. In 2024, Simon Wilson and his Markel International team delivered a sub-80%

combined ratio and high-single-digit net earned premium growth.

Markel International, which now represents roughly one-third of our total insurance revenues, continues to deliver on its promise to put Markel on the Map.

Andrew McMellin and his team delivered a stellar year for our London wholesale operations within Markel International. Beyond our historical presence in the UK, we continued to grow in continental Europe under the outstanding leadership of Frederik Wulff. We also grew our operations in Asia under the able leadership of Christian Stobbs, who oversees our Asian operations out of Singapore and opened Australian Markel offices in 2024.

Markel International now comprises an over two-decade story of resilient growth. When we bought Terra Nova in 2000, it was a “scratch and dent” acquisition, with many “ugly” dimensions as we integrated their operations into the Markel fold.

However, the team brought discipline, focus, and our practices of conservative reserving, customer centricity, and specialized underwriting expertise to the forefront. We approached the business with a long-term mindset of building excellence over time.

The journey had some bumps along the way, including elevated losses during the pandemic, but the team kept at it. Simon stepped in to lead the division in 2021, and they've since modernized their technology and operations, articulated a clear strategy, attracted top talent, and empowered local managers.

It’s working. Their performance in 2024 exceeded our expectations. While pricing is decelerating somewhat in these markets, we remain confident in this team’s long-term ability to perform.

Markel International exemplifies what a business with our design can and should become over time. To Simon, Andrew, Frederik, Christian, and many others: thank you, danke, gracias, bedankt, merci, terimah kasih, ta, and do jeh nei (that exhausts my Google search skills).

Within our US specialty business, we enjoyed several bright spots. Our personal lines, property, marine, healthcare, environmental, programs, commercial professional liability products, and most small commercial offerings produced better than target results.

State National put in another great year, with continued solid revenue and operating income performance. We continue to invest behind this strength and bring State National capabilities to new markets.

While these areas of our insurance business performed exceptionally, we continued to experience pockets of challenge within our US specialty business. Some of our biggest challenges and disappointments occurred in construction defects, general liability, and risk-managed professional liability lines.

Some context might be helpful regarding these areas of challenge: two years ago, we implemented a series of actions to drive improved company performance across all of Markel Group. These included defining the holding company’s purpose and functions, then reorganizing around that purpose.

We switched to a sole CEO and made several key leadership changes. Our goal was to create clear decision rights governing capital allocation decisions and to place greater emphasis on profitability and returns across the Markel Group. This led to increased focus and urgency around actions to address underperformance within our US specialty business, where we took steps to rebalance portfolios. We exited several product lines early last year, including primary casualty retail, business owner's policy, risk-managed excess construction, architects and engineers, and intellectual property collateral protection insurance. We re-underwrote others while investing in areas of strength.

The improving results in 2024 bear some fruit from those efforts, and we are optimistic about ongoing improvements.

Our results improved in 2024 as a direct result of these actions, and we anticipate additional improvements in 2025 as we get past the expiration and costs of subpar products.

Earlier this month, we announced that the foremost focus of our broader board-led review would be the performance of our market-leading specialty insurance business. Insurance is at the heart of what we do; we’re fully committed to supporting areas within insurance that are excelling, while also addressing underperformance. External consultants and advisors will assist with the review. We look forward to updating our shareholders once that work is completed.

On a final note, we’ve had more than a bellyful of selling insurance to sophisticated players looking to do risk arbitrage and financial engineering transactions. We are no longer writing the intellectual property collateralized protection insurance product and have no intentions of writing any similar product in the future.

As the boxer Roberto Duran said, “No mas.”

On insurance simplification, technology, and expenses

One meaningful opportunity for improvement within our US specialty operations is increasing efficiency through better processes and technology.

In a recent conversation, one of our shareholders told me he likes to think of any company's technology as its “brain and nervous system.” He contended that, without a healthy brain or nervous system, a company cannot know where it’s been, where it is, or where it might be going. It can’t quickly and effectively sense the world around it.

He’s right.

While technology will never provide a company with its soul or heartbeat, it can certainly enhance a company’s senses. We know that we need to improve our technology and systems—which will, in turn, increase speed and lower expenses. While we have made strides in the last two years, we know more needs to be done.

We expect to find ways to accelerate this work through the review.

Another arrow in our technology quiver is CapTech, a leading IT consultant with a national reputation for solving thorny technological issues for large organizations. CapTech embarked on meaningful and innovative work for Markel in 2024. Whether at CapTech or Markel, I am confident we have the talent and focus we need to tackle the technology issues that come our way.

With the notion that we can stand to improve our “sensory system,” it would be a mistake and an oversimplification for investors to use our insurance expense ratio as a proxy by which they judge our technological prowess.

While our 2024 expense ratio was higher than what it should have been, it is not the sole measure of the health of our insurance business’s brain and sensory systems (or “tech stack,” as the cool kids say).

The expense ratio retains limitations as a standalone and peer-comparative measure. We underwrite various insurance products worldwide and in all business classes. That’s a complicated task and various threads of that tapestry carry very different natural rates of expenses.

The natural expense ratio for personal lines products with automatable processes and large numbers of small claims is at one end of the spectrum. For any serious scale operator in that business, it should be closer to 20%.

By contrast, the expense ratio for a product we write, like surety, would be much higher.

Complicated, large, and sophisticated projects that involve construction, engineering, and project management skills require meaningful expenses to manage well.

Finally, expense ratios isolated from factors like growth and the amount of capital deployed can lead to faulty conclusions.

For example, in 2024, Markel International had a significantly higher expense ratio than US specialty, but the former generated much better profitability and return on capital. In that case, the higher expense ratios required to operate Markel International served shareholders well.

A more meaningful measure is Markel's return on capital after you factor in everything—including how long we hold on to the investments associated with our insurance liabilities.

Owner’s manual aside: the promise of reserve redundancy

In 2024, we reported 5.4 points of favorable development in our insurance underwriting results, compared to only 0.5 points of favorable development in 2023.

As we have consistently stated since 1986, “We want our reserves to be more likely redundant than deficient.” If the publisher were looking to highlight an excerpt for the back cover of our owner’s manual, they might choose that line.

I can’t think of a more critical commitment for any insurance operation to make to its stakeholders.

I am confident in our track record of demonstrated redundancy in our reserves year after year. While some reserve releases over the years have been smaller or larger, there is one in nearly every ring of the Markel Group’s redwood.

I appreciate that the fourth quarters of 2023 and 2022 jarred our investors. In those two quarters, we reported reserve deficiencies, which almost never happens at Markel.

The rise of inflation and loss costs that followed the pandemic in 2020 caught us (and the industry) a bit by surprise. Our business skews towards longer-tail casualty lines rather than shorter-tail property risks, so feedback loops are longer.

We could have responded more quickly.

Still, I’m proud of the team for taking the hard steps to make our goal of conservative reserving real. This episode taught us a valuable lesson, and I’m confident that we will respond quicker in the future.

It will take more time to fully validate and recognize what we’ve accomplished through all our underwriting changes.

I can assure you, though, that we will keep swinging hammers, driving nails, screwing screws, and cutting planks to work on this project. And along the way, we'll keep ensuring our reserves are more likely redundant than deficient.

Investments

Our 2024 investment results were good (maybe even very good).

In our equity investments, we earned a return of 20.1% for the year. While that trailed the S&P 500 returns of 25.0%2, we are nonetheless pleased with that result. Regardless of how that might compare with various indices, we’ll never complain about earning a return like 20.1% in a year—or 12.8% per year over the last five years. Maintaining disciplined underwriting in a market of ever-expanding and high absolute price-to-earnings multiples, while sticking to our four-part investment principles, ultimately supports resilient compounding. As a reminder: our four-part investment principles span minority stakes in public companies and private businesses, and include buying long-term ownership in businesses that have:

•Good return on capital and low debt;

•Management teams with equal parts talent and integrity;

•Reinvestment opportunities to grow and/or capital discipline;

•All while paying a reasonable price.

We manage our investments to protect and preserve your family’s capital for generations, rather than win short-term performance derbies. We run marathons, not sprints. Our name is on some marathon trophies, and we try not to lose the focus that got us there or let others' sprint times distract us.

At 2024’s year-end, we enjoyed an unrealized gain on our equity portfolio of roughly $7.9 billion. Assuming a tax rate of 25%, our unrealized gain of $7.9 billion means we have a deferred tax liability of approximately $2 billion. This deferred tax liability is part of our funding structure. This low-cost source of funds is a significant tailwind to our financial performance and our reward for being patient, long-term owners of businesses.

It sounds so simple. Why don’t more companies pursue this strategy?

Well, among other things, it takes a while. Most companies don’t have the same time horizon as us.

2 S&P Dow Jones Indices S&P 500 Equity Factsheet - S&P Global (January 31, 2024)

We compounded this interest-free loan steadily and unrelentingly, year by year and decade by decade.

We crawl, walk, then run. Replicating this low-cost funding would take discipline, constant resistance to short-term pressures, and three decades plus. It’s simple, not easy.

We do our best to invest in long-term, enduring, durable companies. We want to buy and hold as much as possible, dramatically improving our after-tax returns. Beyond tax efficiency, this approach minimizes transaction costs and reduces reinvestment risk.

Our design does not emphasize realizing gains and paying excess taxes. Shifting to short-term trading might (or might not) increase pre-tax profits—but not cash available after tax. Given that many individuals and families that own our shares pay taxes, we think the focus on after-tax returns makes sense.

In our fixed-income operations, our 2024 performance matched our strategy.

That strategy is grounded in resilience and humility. Our conservative fixed-income approach allows us to take more risks where our talents and strategy offer more long-term opportunities (e.g., equity risks in the form of public and private businesses).

We take little credit or currency risk in our fixed-income investments: 98% of our fixed-income securities (i.e., treasury, agency, municipal, and sovereign credit securities) are AA-rated or better.

We don’t bet on interest rates; we attempt to match the duration (or interest-rate sensitivity) and currency of our fixed-income portfolio with those of the liabilities in our insurance operations.

We tend to hold our bonds until they mature. While GAAP accounting requires that we mark the bonds to market and not the liabilities, this creates quarterly financial changes that do not mirror the economic reality of our buy-and-hold, asset-liability management approach. Fortunately, unlike banks, our liabilities can’t run out the door. That allows the time and space to match things up and ride out any accounting volatility. We earn the spread between the positive yields on those securities and the “negative” cost of float (i.e., the underwriting profit) of our insurance liabilities.

That process proceeded as designed in 2024, and nearly every year since we went public in 1986. Our fixed-income investment process is resilient, grounded in humility and frugality—and it works.

To put some numbers behind that statement: in 2024, our insurance liabilities cost us a negative $402 million (i.e., our underwriting profits), and we earned $778 million of net interest income. The positive spread between those two amounts is $1.2 billion.

Here's a graph of our collective net interest and underwriting income in insurance over the last 21 years.

Despite underwriting profitability volatility in any given year, the “spread” trend over time has been up and to the right. As Martha Stewart might say about this, “It’s a good thing.”

Ventures

Our Ventures operations also had a good year of operating income and returns in 2024.

Ventures' revenues grew 3% from $5.0 billion to $5.1 billion in 2024. Our sales included contributions from Valor Environmental, which we were excited to welcome to the Markel Group in 2024.

Operating income was flat year-over-year at $520 million.

Some of the year-over-year comparisons for Markel Ventures companies were tough. 2023 was a year of white-hot favorable conditions in a few of our transportation-related businesses, which experienced an unprecedented super cycle in the wake of the pandemic’s shockwaves starting in 2020. That provided a strong tailwind that began to moderate in 2024.

These businesses typically experience five- to 10-year cycles, with the rising need for transportation equipment and predictable replacement cycles fueling growth from one cycle to the next. We expect that to continue.

While revenues diminished slightly from the high points of the cycle, these businesses in particular benefit from our long-term, low-debt capital approach.

As to possible acquisitions of additional Markel Ventures operations, we watch largely from the sidelines. We sense that prices, in general, remain on the high end. We hope to find specific and unique opportunities to add additional product lines, people, and geographies, but remain cautious about the overall acquisition pricing levels.

We’ve written almost these exact same words for several years now.

Eventually, we expect higher interest rates to create more opportunities for us. We'll remain patient, disciplined, and pick our spots carefully until they do.

The people who joined the Markel Group family of companies in recent years seek long-term relationships. They want to see their people flourish and their businesses grow for generations. They are redwood people. We can’t predict when we will encounter people like that, but they keep showing up.

Some history…

Let me tell you about the first person who showed up: Ken Newsome. The year was 2005.

We partnered with AMF Bakery Systems twenty years ago. Ken ran the business then and still does,

but there are some notable differences.

When we partnered with AMF, it had too much debt. However, it was well-managed, served its customers well, and had a great culture and team of people. Providing high-quality equipment to industrial bakeries around the world was not an issue. It was a good business with a bad balance sheet. That seemed like a problem we could solve—and we did.

Another challenge was the irregular intervals when customers needed equipment. Not ideal for a company with debt, but our long-term orientation solved that, too.

Over the last two decades, Ken and his team have done great work in building their business free and clear from the shackles of debt and short-termism.

Customers were treated well, even during tougher years (as paths are never linear). Consequently, they looked to AMF for more equipment, parts, and services needed to keep their facilities running. Their success depended on our reliability.

Others took notice and joined AMF on its journey. Following several expansions, the Markel Food Group (MFG) was born. This meant more customers, bigger projects, and the addition of great leaders like Jason Ward and Chip Czulada.

As a result, our equipment made products that fed millions. MFG grew revenues sixfold and operating income tenfold, all while returning every dollar invested … and then some. That's a pretty good result for a maiden voyage.

The story of MFG illustrates how businesses flourish with our long-term mindset.

Sometimes, I describe my job at Markel Group as the “CEO of CEOs.” My first job is to attract and retain people like Ken.

Second, I need to ensure that leaders like Ken share the Markel Style.

Third, as an investor and capital allocator, I retain the final say regarding our business’s discretionary cash flows.

Every dollar in the Markel Group system is used in a competing way. The balancing mechanism of opportunity-cost thinking and competition for capital helps keep the system resilient and flourishing.

The spectacular CEOs of our businesses are top-rate people and hold values that align with ours. They wouldn’t want to join the Markel Group, nor would they last within it, if they didn’t share our values. So, thank you, Ken. Thank you to all the CEOs who run and operate our businesses.

How might you measure our success over time?

The Markel Group seems like a modern-day version of Aesop’s The Goose That Laid the Golden Eggs. Fairy tales provide useful metaphors, and the goose is a metaphor for the people of the Markel Group.

Part of my challenge every year in this letter is to describe intangible things in a tangible way. Our intangible (but real) culture doesn’t appear on a quarterly or annual scorecard. Without quantifiable marks and audited numbers, how can we understand the future of golden egg production?

Just like in the fairy tale, golden eggs flow from daily work.

More than 22,000 beating hearts within the Markel Group go to work across our businesses worldwide, every day. They work to produce the next golden egg. Then, the next day, they get up and do it again. 525,600 minutes a year.

But how can one measure their performance?

As the former Chief Accountant of the Securities and Exchange Commission John (Sandy) Burton phrased it, “How you keep score determines how you play the game.”

In a world that has become increasingly focused on the short term, the most essential daily pledge we can make is to remain committed to thoughtful, long-term rationality.

We emphasize returns on capital over long periods.

At resilient 10% compounding annual returns across Markel Group, the intrinsic value of your money will double roughly every seven years (and the stock price should follow). If we achieve 15% compound annual returns, it will double roughly every five years.

At Markel Group, we’ve produced outstanding absolute returns over decades—and intend to keep doing so.

Our stock price has compounded at approximately 15% a year since 1986. A recent share price of $2,000 marked our eighth doubling of your money. That’s a 250-bagger, if you like to count it that way.

In the most recent five-year period, the compound annual growth in our intrinsic value stood at approximately 18%. Above-average equity returns pushed the number up.

Looking towards the next five years, we don’t expect the same sort of overall equity market returns. To earn double-digit returns in line with our targets, our

US specialty insurance business will need to continue improving.

I am usually highly reluctant to make statements about the valuation of our shares. Doing so risks being perceived as promotional.

That said, starting in 2022, I believe the gap between the market price of our shares and the intrinsic value of our company had grown to such a level that either: a) We did not have an accurate sense of how the value of our shares’ value was growing; or b) There was a communication gap, leading to a lack of external understanding of the rate at which our intrinsic value was growing.

Consequently, we sought to share more on how we think about tracking value creation in an effort to close any communication gap.

Part of our investors' confusion was warranted because, when Markel was just an insurance company, book value per share was the metric they historically relied on to count our golden eggs. As we’ve evolved into a diverse financial holding company, book value per share no longer works as the best metric to evaluate our performance. So, we removed that metric, and for some that left a void.

If book value per share is no longer the best metric to monitor our value creation over time, what is? We suggest intrinsic value growth over time.

As a “Surgeon General’s warning,” we completely believe that no intrinsic value calculation is perfect. Any calculation involves estimates and trade-offs between simplicity, understandability, and precision.

We didn’t create a spreadsheet with fifty lines. We don’t wish to communicate any false sense of precision. But we realize we can’t draw a line with a slope of ascent without some point estimates along the way.

Everybody can and should determine their own method for valuing Markel. We neither endorse nor criticize any model you might adopt; our only request is that, whatever model you choose, apply it consistently over long periods of time. We suggest that a measurement period of less than five years would not be as useful.

Here’s how we calculate an estimate of Markel's intrinsic value per share, as described in an appendix of our fourth quarter press release:

First, we take the operating earnings from our three engines-insurance, ventures, and investments, and apply a multiple to arrive at an earnings valuation. We exclude certain non-cash items, such as amortization and income attributed to our public equity portfolio, which is

valued separately in our calculation. We apply a multiple of 12 to a three-year average of the calculated earnings. This multiple was selected as it falls within a conservative range when considering the sources of our cash flow. Using a three-year earnings average helps normalize the impact of cyclicality and non-recurring items to provide a broad measure of earnings-based value.

Second, we add items from our balance sheet that are not included in the earnings valuation. The balance sheet component of the valuation consists of adding cash, short-term investments, and equity securities, then subtracting debt and noncontrolling interest. The sum of the earnings and balance sheet valuation divided by the number of shares outstanding represents our estimate of intrinsic value per share.

Given its simplified nature, this calculation should be viewed as a directional indicator rather than a precise valuation. As of December 31, 2024, our intrinsic value estimate was $2,610 per share, reflecting an 18% five-year CAGR, compared to a 9% CAGR in our stock price. While the five-year CAGR of intrinsic value provides an initial view of value creation, we consider additional factors in evaluating shareholder returns and in making capital allocation decisions.

Any metric is, by definition, limited in accuracy. The map is not the territory. That said, we think this is a reasonable map providing directionally correct information over time.

Any sensible method you choose, applied consistently over time, will result in some growth rate that should give a sense of intrinsic value growth. The longer the time frame you use, the more confident I am that our estimated rates of growth will converge and increase in accuracy and validity.

Your map—and our map—should continue to improve over time.

The growth rates we each calculate should also act as a pulley for the long-term price of our shares. As stewards of the business we own together, we feel a duty to tell you how we think about value creation over time.

We’re trying to close any communication gaps. If we aren’t achieving such ends, we welcome your feedback.

The forest for the trees

As your CEO, I describe my job as being your steward.

The word “stewardship” denotes guardianship over something bigger than us—something meant to last longer than us.

In 2023, I assumed leadership over the Markel Group and became the latest steward of this promising redwood tree. I take that responsibility very seriously.

To borrow a phrase from Walt Whitman, such responsibility “contains multitudes.” He wrote about “leaves of grass,” not a “leaf of grass.” I share and understand that idea. The Markel Group contains multitudes.

I hope and trust that this letter (and my attempt at sketching out a rough owner’s manual) offers you some guideposts to see and feel the multitudes of our past, as well as our promise for the future.

Along with many of my colleagues, I've dedicated my life to growing and stewarding the Markel Group. What we do is worthy.

We dedicate ourselves to taking care of our customers and taking care of each other. We laugh, cry, and live meaningful lives because of what this company does every day.

We’ve also made some pretty good money along the way for our shareholders and ourselves.

I hope you share our optimism and joy in continuing to do so. We continue to create win-win-win outcomes for everybody connected to the Markel Group.

It’s tough to think about all this and not agree with The Who and their song “Blue, Red and Grey” when they sang, “I like every minute of the day.”

Your steward,

Thomas S. Gayner, Chief Executive Officer

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

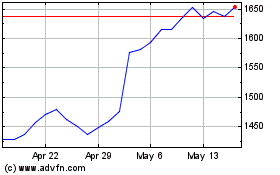

Markel (NYSE:MKL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Markel (NYSE:MKL)

Historical Stock Chart

From Feb 2024 to Feb 2025