A Third of Americans are Less Confident They Can Afford a Home Compared to Five Years Ago, According to MeridianLink Survey

20 September 2023 - 11:05PM

Business Wire

MeridianLink offers financial institutions

tools to better support consumers throughout the entire mortgage

lending process

MeridianLink, Inc. (NYSE: MLNK), a leading provider of modern

software platforms for financial institutions and consumer

reporting agencies, today announced the results of a nationwide

survey of more than 1,000 Americans about consumer behavior and

expectations during the mortgage lending process. The survey found

that a third (31%) of Americans are less confident in their ability

to afford a home today compared to five years ago, and a majority

of consumers (55%) expect mortgage rates to continue rising through

the end of 2023. Lack of knowledge may be a factor too, as a fifth

of Americans (22%) reported not understanding the mortgage process

at all.

Nearly half (45%) of Americans will shop for other options

before getting a mortgage through their primary financial

institution, and 41% said their primary financial institution

offered no mortgage lending support of any kind. The top reasons

consumers reported in selecting a mortgage lender were low closing

costs and comparatively better rates (53%), positive brand

reputation (40%), and flexible repayment options (36%).

“These findings demonstrate why financial institutions need to

be better equipped with the right tools to support their consumers

during major financial milestones like buying a home,” said JP

Kelly, SVP of Mortgage at MeridianLink®. “We are proud to provide

credit unions and banks with a platform that allows them to offer

personalized mortgage support, facilitate a convenient lending

process, and reach more potential consumers during that initial

shopping phase.”

Based on the insights from this study and the Company’s work

with over 2,000 financial institutions, MeridianLink provides the

following tips to lenders who are looking for ways to grow their

mortgage business:

- Make the mortgage lending process as easy to understand and

convenient as possible. With so many consumers willing to shop

around, creating an end-to-end experience with as little friction

as possible will be critical to consumer retention. MeridianLink®

Mortgage—the mortgage loan origination component of the Company's

multi-product platform MeridianLink® One—is an excellent way to

create and manage that seamless process.

- Be proactive about providing consumers with offers and support

that are tailored to their individual needs, or risk losing them to

an institution that does. MeridianLink® Engage, the Company’s

marketing automation solution, is a powerful tool that can assist

credit unions and banks in making this consumer outreach as

efficient and effective as possible.

To access a report with more detailed survey findings, please

download the report here.

ABOUT MERIDIANLINK

MeridianLink® (NYSE: MLNK) powers digital lending and account

opening for financial institutions and provides data verification

solutions for consumer reporting agencies. MeridianLink’s scalable,

cloud-based platforms help customers build deeper relationships

with consumers through data-driven, personalized experiences across

the entire lending life cycle.

MeridianLink enables customers to accelerate revenue growth,

reduce risk, and exceed consumer expectations through seamless

digital experiences. Its partner marketplace supports hundreds of

integrations for tailored innovation. For more than 20 years,

MeridianLink has prioritized the democratization of lending for

consumers, businesses, and communities. Learn more at

www.meridianlink.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230920448556/en/

Becky Frost (714) 784-5839 Media@meridianlink.com

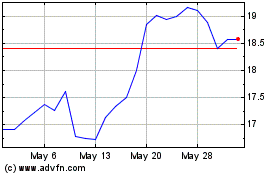

MeridianLink (NYSE:MLNK)

Historical Stock Chart

From Oct 2024 to Nov 2024

MeridianLink (NYSE:MLNK)

Historical Stock Chart

From Nov 2023 to Nov 2024