Mach Natural Resources LP (NYSE: MNR) (“Mach” or the “Company”)

today reported financial and operating results for the three months

ended June 30, 2024. The Company also announced its quarterly cash

distribution and updated its full year 2024 outlook.

Second Quarter 2024 Highlights

- Averaged total net production of 89.3 thousand barrels of oil

equivalent per day (“Mboe/d”) exceeded the high-end of

guidance

- Produced an average of 20.9 thousand barrels of oil per day

(“MBbl/d”)

- Lease operating expense of $5.72 per barrel of oil equivalent

(“Boe”) was below the low-end of guidance

- Reported net income and Adjusted EBITDA of $40 million and $136

million, respectively

- Generated net cash provided by operating activities of $117

million

- Divested a portion of Western Anadarko acreage for $38 million

with no associated production

- Made first quarterly term loan amortization payment of $21

million

- Declared a quarterly cash distribution of $0.90 per unit

Tom L. Ward, Mach’s Chief Executive Officer, noted, "Mach's

second quarter results reflect the continuation of our 2024 plan. A

steady adherence to low leverage and disciplined cash flow

management allow us to announce a distribution of $0.90 per unit

for the period. Our Company was founded on a distribution-focused

strategy, and this quarter's cash distribution demonstrates Mach's

commitment to rewarding its unitholders while navigating the

challenges of the market."

Second Quarter 2024 Financial Results

Mach reported total revenue and net income of $240 million and

$40 million in the second quarter of 2024, respectively.

Additionally, during the second quarter, the average realized price

was $79.27 per barrel of oil, $1.33 per Mcf of natural gas, and

$23.83 per barrel of natural gas liquids (“NGLs”). These prices

exclude the effects of derivatives.

At the end of the second quarter, Mach had a cash balance of

$145 million and a pro forma net-debt-to-Adjusted-EBITDA ratio of

0.9x.

Second Quarter 2024 Operational Results

During the second quarter of 2024, Mach achieved average oil

equivalent production of 89.3 Mboe/d, which consisted of 23% oil,

53% natural gas and 24% NGLs. Also, for the second quarter of 2024,

Mach’s production revenues from oil, natural gas, and NGLs sales

totaled $232 million, comprised of 65% oil, 15% natural gas, and

20% NGLs.

The Company spud 12 gross (10 net) operated wells and brought

online 14 gross (12 net) operated wells in the second quarter of

2024. As of June 30, 2024, the Company had 5 gross (4 net) operated

wells in various stages of drilling and completion.

Mach’s lease operating expense in the second quarter of 2024 was

$46 million, or $5.72 per Boe. Mach incurred $24 million, or $2.93

per Boe, of gathering and processing expenses in the second quarter

of 2024. Furthermore, during the second quarter of 2024, production

taxes as a percentage of oil, natural gas, and NGL sales were

approximately 4.9%, midstream operating profit was approximately $5

million, general and administrative expenses—excluding equity-based

compensation of $2 million—was $9 million, and interest expense was

$27 million.

In the second quarter of 2024, Mach’s total capital

expenditures—excluding acquisitions—were $46 million, including $41

million of upstream capital and $5 million of other capital

(including midstream and land).

Distributions

Mach announced today that the board of directors of its general

partner declared a quarterly cash distribution for the second

quarter of 2024 of $0.90 per common unit. The quarterly cash

distribution is to be paid on September 10, 2024, to common

unitholders of record as of the close of trading on August 27,

2024.

2024 Operating Plan and Guidance

Today the Company provided updated guidance for 2024 that

incorporates the impact of a rig-count reduction, as well as

operational efficiencies achieved year-to-date.

During the second quarter, Mach lowered its operated rig count

in the Oswego from two rigs to one rig. As a result, the midpoint

of full-year capital expenditure guidance is reduced by 15%. Oil

volumes for the third quarter 2024 and fourth quarter 2024 are

expected to range between 18.6 MBbl/d to 19.9 MBbl/d. Full-year

2024 oil volumes are expected to range between 19.4 MBbl/d to 20.6

MBbl/d. The decision to reduce rig count is fully consistent with

the Company's strategic framework that prioritizes a disciplined

reinvestment rate.

In order to account for better-than-expected operational

efficiencies achieved year-to-date, the midpoint of full-year 2024

guidance for lease operating expense per BOE has been lowered by

3%. In addition, full-year 2024 total oil-equivalent volumes are

expected to range between 82.2 Mboe/d to 87.2 Mboe/d, representing

a midpoint improved by 1%. Additional details of Mach's

forward-looking guidance are available on the Company's website at

www.machnr.com.

Conference Call and Webcast Information

Mach will host a conference call and webcast at 8:00 a.m.

Central (9:00 a.m. Eastern) on Wednesday, August 14, 2024, to

discuss its second quarter 2024 results. Participants can access

the conference call by dialing 877-407-2984. A webcast link to the

conference call will be provided on the Company’s website at

https://ir.machnr.com/. A replay will also be available on the

Company’s website following the call.

About Mach Natural Resources LP

Mach Natural Resources LP is an independent upstream oil and gas

Company focused on the acquisition, development and production of

oil, natural gas and NGL reserves in the Anadarko Basin region of

Western Oklahoma, Southern Kansas and the panhandle of Texas. For

more information, please visit www.machnr.com.

Financial Statements and Non-GAAP Financial Measures and

Disclosures

This press release includes non-GAAP financial measures.

Pursuant to regulatory disclosure requirements, Mach is required to

reconcile non-GAAP financial measures to the related GAAP

information (GAAP refers to generally accepted accounted

principles). Reconciliations of these non-GAAP measures, along with

other financial and operational disclosures, are provided within

the supplemental tables that are available on the Company’s website

at www.machnr.com and in the related Form 10-Q filed with the

Securities and Exchange Commission (the “SEC”).

Adjusted EBITDA and Cash Available for Distribution are non-GAAP

financial measures. Such non-GAAP measures are used as a

supplemental financial performance measure by our management and by

external users of our financial statements, such as industry

analysts, investors, lenders, rating agencies and others, to more

effectively evaluate our operating performance and our results of

operation from period to period and against our peers without

regard to financing methods, capital structure or historical cost

basis. Such non-GAAP measures are not alternatives to GAAP

measures.

Such non-GAAP measures should not be considered in isolation or

as a substitute for analysis of results as reported under GAAP.

Such non-GAAP measures are used as a supplemental financial

performance measure by our management and by external users of our

financial statements, such as industry analysts, investors,

lenders, rating agencies and others, to more effectively evaluate

our operating performance and our results of operation from period

to period and against our peers without regard to financing

methods, capital structure or historical cost basis. Such non-GAAP

measures are not alternatives to GAAP measures.

Cautionary Note Regarding Forward-Looking Statements

This release contains statements that express the Company’s

opinions, expectations, beliefs, plans, objectives, assumptions or

projections regarding future events or future results, in contrast

with statements that reflect historical facts. All statements,

other than statements of historical fact included in this release

regarding our strategy, future operations, financial position,

estimated revenues and losses, projected costs, prospects, plans

and objectives of management are forward-looking statements When

used in this release, words such as “may,” “assume,” “forecast,”

“could,” “should,” “will,” “plan,” “believe,” “anticipate,”

“intend,” “estimate,” “expect,” “project,” “budget” and similar

expressions are used to identify forward-looking statements,

although not all forward-looking statements contain such

identifying words. These forward-looking statements are based on

management’s current belief, based on currently available

information as to the outcome and timing of future events at the

time such statement was made. Such statements are subject to a

number of assumptions, risk and uncertainties, many of which are

beyond the control of the Company. These include, but are not

limited to, commodity price volatility; the impact of epidemics,

outbreaks or other public health events, and the related effects on

financial markets, worldwide economic activity and our operations;

uncertainties about our estimated oil, natural gas and natural gas

liquids reserves, including the impact of commodity price declines

on the economic producibility of such reserves, and in projecting

future rates of production; the concentration of our operations in

the Anadarko Basin; difficult and adverse conditions in the

domestic and global capital and credit markets; lack of

transportation and storage capacity as a result of oversupply,

government regulations or other factors; lack of availability of

drilling and production equipment and services; potential financial

losses or earnings reductions resulting from our commodity price

risk management program or any inability to manage our commodity

risks; failure to realize expected value creation from property

acquisitions and trades; access to capital and the timing of

development expenditures; environmental, weather, drilling and

other operating risks; regulatory changes, including potential

shut-ins or production curtailments mandated by the Railroad

Commission of Texas, the Oklahoma Corporation Commission and/or the

Kansas Corporation Commission; competition in the oil and natural

gas industry; loss of production and leasehold rights due to

mechanical failure or depletion of wells and our inability to

re-establish their production; our ability to service our

indebtedness; any downgrades in our credit ratings that could

negatively impact our cost of and ability to access capital; cost

inflation; political and economic conditions and events in foreign

oil and natural gas producing countries, including embargoes,

continued hostilities in the Middle East and other sustained

military campaigns, the war in Ukraine and associated economic

sanctions on Russia, conditions in South America, Central America,

China and Russia, and acts of terrorism or sabotage; evolving

cybersecurity risks such as those involving unauthorized access,

denial-of-service attacks, malicious software, data privacy

breaches by employees, insider or other with authorized access,

cyber or phishing-attacks, ransomware, social engineering, physical

breaches or other actions; and risks related to our ability to

expand our business, including through the recruitment and

retention of qualified personnel. Please read the Company’s filings

with the U.S. Securities and Exchange Commission (the “SEC”),

including “Risk Factors” in the Company’s Annual Report on Form

10-K, which is on file with the SEC, for a discussion of risks and

uncertainties that could cause actual results to differ from those

in such forward-looking statements.

As a result, these forward-looking statements are not a

guarantee of our performance, and you should not place undue

reliance on such statements. Any forward-looking statement speaks

only as of the date on which such statement is made, and the

Company undertakes no obligation to correct or update any

forward-looking statement, whether as a result of new information,

future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240813348526/en/

Mach Natural Resources LP Investor Relations Contact:

ir@machnr.com

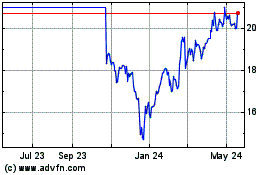

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Oct 2024 to Nov 2024

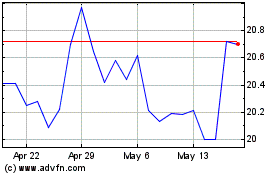

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Nov 2023 to Nov 2024