0001510295false00015102952025-02-042025-02-04

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

FORM 8-K

_____________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 4, 2025

_____________________________________________

Marathon Petroleum Corporation

(Exact name of registrant as specified in its charter)

_____________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-35054 | | 27-1284632 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

539 South Main Street, Findlay, Ohio 45840

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code: (419) 422-2121

_____________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading

symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $.01 | MPC | New York Stock Exchange |

| | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

Emerging growth company ☐

| | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

On February 4, 2025, Marathon Petroleum Corporation issued a press release announcing its financial results for the quarter and year ended December 31, 2024. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

In the fourth quarter of 2024, MPC established a Renewable Diesel segment, which includes renewable diesel activities and assets that were historically reported in the Refining & Marketing segment. Prior period results reflecting MPC’s segment changes are available under the “Investor & Market Data” tab on the Investors page of the MPC website at https://www.marathonpetroleum.com.

Information in this Item 2.02 and Exhibit 99.1 of Item 9.01 below shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise incorporated by reference into any filing pursuant to the Securities Act of 1933, as amended, or the Exchange Act except as otherwise expressly stated in such a filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description |

| |

| |

| | Press Release issued by Marathon Petroleum Corporation on February 4, 2025 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Marathon Petroleum Corporation |

| | | |

| | | |

| Date: February 4, 2025 | By: | | /s/ John J. Quaid |

| | | Name: John J. Quaid |

| | | Title: Executive Vice President and Chief Financial Officer |

Marathon Petroleum Corp. Reports Fourth-Quarter 2024 Results

and 2025 Capital Outlook

•Fourth-quarter net income attributable to MPC of $371 million, or $1.15 per diluted share; adjusted net income of $249 million, or $0.77 per adjusted diluted share

•Progresses Midstream Gulf Coast NGL strategy with MPLX’s announcement of fractionation complex and export terminal

•$10.2 billion of capital returned to shareholders through share repurchases and dividends in 2024

•Expect distributions from MPLX in 2025 will cover MPC’s dividends and $1.25 billion standalone capital outlook

FINDLAY, Ohio, Feb 4, 2025 – Marathon Petroleum Corp. (NYSE: MPC) today reported net income attributable to MPC of $371 million, or $1.15 per diluted share, for the fourth quarter of 2024, compared with net income attributable to MPC of $1.5 billion, or $3.84 per diluted share, for the fourth quarter of 2023.

Adjusted net income was $249 million, or $0.77 per diluted share, for the fourth quarter of 2024. This compares to adjusted net income of $1.5 billion, or $3.98 per diluted share, for the fourth quarter of 2023. Adjustments are shown in the accompanying release tables.

The fourth quarter of 2024 adjusted earnings before interest, taxes, depreciation, and amortization (adjusted EBITDA) was $2.1 billion, compared with $3.6 billion for the fourth quarter of 2023. Adjustments are shown in the accompanying release tables.

For the full year 2024, net income attributable to MPC was $3.4 billion, or $10.08 per diluted share, compared with net income attributable to MPC of $9.7 billion, or $23.63 per diluted share for the full year 2023. Adjusted net income was $3.3 billion, or $9.51 per diluted share for the full year 2024. This compares to adjusted net income of $9.7 billion, or $23.63 per diluted share for the full year 2023. Adjustments are shown in the accompanying release tables.

“In 2024, we generated net cash from operations of $8.7 billion, which enabled peer-leading capital return to shareholders of $10.2 billion,” said President and Chief Executive Officer Maryann Mannen. “Our strong cash flow generation was driven by our commitments to peer-leading operational excellence, commercial performance, and profitability per barrel in each of the regions in which we operate. Execution of our Midstream strategy delivered segment adjusted EBITDA growth of 6%. We expect distributions from MPLX in 2025 will cover MPC’s dividends and standalone capital outlook, further supporting our commitment to peer-leading capital return.”

Results from Operations

In the fourth quarter of 2024, MPC established a Renewable Diesel segment, which includes renewable diesel activities and assets historically reported in the Refining & Marketing segment. This change in reportable segments will enhance comparability of MPC’s reporting with direct peers who report both a refining and renewable diesel segment.

The Renewable Diesel segment includes:

•The Dickinson, North Dakota renewables facility, a wholly-owned renewable processing facility with the capacity to produce 184 million gallons per year of renewable diesel.

•The Martinez Renewable Fuels joint venture, a 50/50 partnership with Neste Corporation with the capacity to produce 730 million gallons per year of renewable diesel, and which includes pretreatment capabilities.

•Other renewable diesel activities and assets, such as a feedstock aggregation facility, pre-treatment facility, and an interest in the Spiritwood soybean processing complex through our ADM joint venture.

All prior periods have been recast for comparability.

Adjusted EBITDA (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, |

(In millions) | | 2024 | | | 2023 | | | 2024 | | | 2023 |

| Refining & Marketing segment adjusted EBITDA | $ | 559 | | | $ | 2,248 | | | $ | 5,703 | | | $ | 13,705 | |

| Midstream segment adjusted EBITDA | | 1,707 | | | | 1,570 | | | | 6,544 | | | | 6,171 | |

| Renewable Diesel segment adjusted EBITDA | | 28 | | | | (47) | | | | (150) | | | | (64) | |

| Subtotal | | 2,294 | | | | 3,771 | | | | 12,097 | | | | 19,812 | |

| Corporate | | (189) | | | | (224) | | | | (864) | | | | (837) | |

| Add: Depreciation and amortization | | 15 | | | | 20 | | | | 90 | | | | 100 | |

| Adjusted EBITDA | $ | 2,120 | | | $ | 3,567 | | | $ | 11,323 | | | $ | 19,075 | |

| | | | | | | | | | | |

Refining & Marketing (R&M)

Segment adjusted EBITDA was $559 million in the fourth quarter of 2024, versus $2.2 billion for the fourth quarter of 2023. R&M segment adjusted EBITDA was $2.03 per barrel for the fourth quarter of 2024, versus $8.36 per barrel for the fourth quarter of 2023. Segment adjusted EBITDA excludes refining planned turnaround costs, which totaled $281 million in the fourth quarter of 2024 and $297 million in the fourth quarter of 2023. The decrease in segment adjusted EBITDA was driven primarily by lower market crack spreads.

R&M margin was $12.93 per barrel for the fourth quarter of 2024, versus $17.81 per barrel for the fourth quarter of 2023. Crude capacity utilization was approximately 94%, resulting in total throughput of 3.0 million barrels per day (bpd) for the fourth quarter of 2024.

Refining operating costs were $5.26 per barrel for the fourth quarter of 2024, versus $5.55 per barrel for the fourth quarter of 2023.

Midstream

Segment adjusted EBITDA was $1.7 billion in the fourth quarter of 2024, versus $1.6 billion for the fourth quarter of 2023. The results were primarily driven by higher rates and volumes, including growth from equity affiliates and contributions from recently acquired assets in the Utica and Permian basins.

Renewable Diesel

Segment adjusted EBITDA was $28 million in the fourth quarter of 2024, versus $(47) million for the fourth quarter of 2023. The increase was primarily due to increased utilization particularly at our Martinez Renewable Fuels joint venture.

Corporate and Items Not Allocated

Corporate expenses totaled $189 million in the fourth quarter of 2024, compared with $224 million in the fourth quarter of 2023.

Financial Position, Liquidity, and Return of Capital

As of Dec. 31, 2024, MPC had $3.2 billion of cash, cash equivalents, and short-term investments, including $1.5 billion of cash at MPLX, and $5 billion available on its bank revolving credit facility.

In the fourth quarter, the company returned approximately $1.6 billion of capital to shareholders through $1.3 billion of share repurchases and $292 million of dividends.

As of Dec. 31, 2024, the company has $7.8 billion available under its share repurchase authorizations.

Strategic and Operations Update

MPC’s standalone (excluding MPLX) capital spending outlook for 2025 is $1.25 billion. Approximately 70% of its overall spending is focused on value enhancing capital and 30% on sustaining capital. MPC’s 2025 capital spending outlook includes continued high return investments at its Los Angeles, Galveston Bay and Robinson refineries. In addition to these multi-year investments, the company is executing shorter-term projects that offer high returns through margin enhancement and cost reduction.

MPLX's capital spending outlook for 2025 is $2.0 billion. MPLX is expanding its Permian to Gulf Coast integrated value chain, progressing long-haul pipeline growth projects to support expected increased producer activity, and investing in Permian and Marcellus processing capacity in response to producer demand. Updates on projects include:

Newly Announced

•A Gulf Coast fractionation complex consisting of two, 150 thousand bpd fractionation facilities adjacent to MPC’s Galveston Bay refinery. The fractionation facilities are expected in service in 2028 and 2029. MPLX is contracting with MPC to purchase offtake from the fractionation complex, which MPC intends to market globally.

•A strategic partnership with ONEOK, Inc. (NYSE: OKE) to develop a 400 thousand bpd LPG export terminal and an associated pipeline, which is anticipated in service in 2028.

•The BANGL NGL pipeline partners have sanctioned an expansion from 250 thousand bpd to 300 thousand bpd, which is anticipated to come online in the second half of 2026. This pipeline will enable liquids to reach MPLX’s Gulf Coast fractionation complex.

Ongoing

•The Blackcomb and Rio Bravo pipelines are progressing with an expected in-service date in the second half of 2026. These pipelines are designed to transport natural gas from the Permian to domestic and export markets along the Gulf Coast.

•Secretariat, a 200 million cubic feet per day (mmcf/d) processing plant is expected online in the second half of 2025. This plant will bring MPLX's gas processing capacity in the Permian basin to 1.4 billion cubic feet per day (bcf/d).

•Harmon Creek III, a 300 mmcf/d processing plant and 40 thousand bpd de-ethanizer, is expected online in the second half of 2026. This complex will bring MPLX's processing capacity in the Northeast to 8.1 bcf/d and fractionation capacity to 800 thousand bpd.

2025 Capital Outlook ($ millions)

| | | | | | | | |

MPC Standalone (excluding MPLX) | | |

Refining & Marketing Segment: | | |

Value Enhancing - Traditional | $ | 750 |

| Value Enhancing - Low Carbon | | 100 |

Maintenance | | 350 |

Refining & Marketing Segment | | 1,200 |

| Renewable Diesel | | 5 |

Midstream Segment (excluding MPLX) | | |

Corporate and Other(a) | | 45 |

Total MPC Standalone (excluding MPLX) | $ | 1,250 |

| | |

MPLX Total(b) | $ | 2,000 |

(a) Does not include capitalized interest.

(b) Excludes $240 million of reimbursable capital.

First-Quarter 2025 Outlook

| | | | | | | | |

| Refining & Marketing Segment: | | |

Refining operating costs per barrel(a) | $ | 5.70 | |

| Distribution costs (in millions) | $ | 1,525 | |

| Refining planned turnaround costs (in millions) | $ | 450 | |

| Depreciation and amortization (in millions) | $ | 380 | |

| | |

| Refinery throughputs (mbpd): | | |

| Crude oil refined | | 2,510 | |

| Other charge and blendstocks | | 260 | |

| Total | | 2,770 | |

| | |

| Corporate (includes $20 million of D&A) | $ | 220 | |

| | |

(a)Excludes refining planned turnaround and depreciation and amortization expense.

Conference Call

At 11:00 a.m. ET today, MPC will hold a conference call and webcast to discuss the reported results and provide an update on company operations. Interested parties may listen by visiting MPC’s website at www.marathonpetroleum.com. A replay of the webcast will be available on the company’s website for two weeks. Financial information, including the earnings release and other investor-related materials, will also be available online prior to the conference call and webcast at www.marathonpetroleum.com.

###

About Marathon Petroleum Corporation

Marathon Petroleum Corporation (MPC) is a leading, integrated, downstream energy company headquartered in Findlay, Ohio. The company operates the nation’s largest refining system. MPC’s marketing system includes branded locations across the United States, including Marathon brand retail outlets. MPC also owns the general partner and majority limited partner interest in MPLX LP, a midstream company that owns and operates gathering, processing, and fractionation assets, as well as crude oil and light product transportation and logistics infrastructure. More information is available at www.marathonpetroleum.com.

Investor Relations Contacts: (419) 421-2071

Kristina Kazarian, Vice President Finance and Investor Relations

Brian Worthington, Director, Investor Relations

Alyx Teschel, Manager, Investor Relations

Media Contact: (419) 421-3577

Jamal Kheiry, Communications Manager

References to Earnings and Defined Terms

References to earnings mean net income attributable to MPC from the statements of income. Unless otherwise indicated, references to earnings and earnings per share are MPC’s share after excluding amounts attributable to noncontrolling interests.

Forward-Looking Statements

This press release contains forward-looking statements regarding MPC. These forward-looking statements may relate to, among other things, MPC’s expectations, estimates and projections concerning its business and operations, financial priorities, strategic plans and initiatives, capital return plans, capital expenditure plans, operating cost reduction objectives, and environmental, social and governance (“ESG”) plans and goals, including those related to greenhouse gas emissions and intensity reduction targets, freshwater withdrawal intensity reduction targets, diversity, equity and inclusion and ESG reporting. Forward-looking and other statements regarding our ESG plans and goals are not an indication that these statements are material to investors or are required to be disclosed in our filings with the Securities Exchange Commission (SEC). In addition, historical, current, and forward-looking ESG-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future. You can identify forward-looking statements by words such as “anticipate,” “believe,” “commitment,” “could,” “design,” “endeavor”, “estimate,” “expect,” “focus”, “forecast,” “goal,” “guidance,” “intend,” “may,” “objective,” “opportunity,” “outlook,” “plan,“ “policy,” “position,” “potential,” “predict,” “priority,” “progress”, “project,” “prospective,” “pursue,” “seek,” “should,” “strategy,” “strive”, “target,” “trends”, “will,” “would” or other similar expressions that convey the uncertainty of future events or outcomes. MPC cautions that these statements are based on management’s current knowledge and expectations and are subject to certain risks and uncertainties, many of which are outside of the control of MPC, that could cause actual results and events to differ materially from the statements made herein. Factors that could cause MPC’s actual results to differ materially from those implied in the forward-looking statements include but are not limited to: political or regulatory developments, including changes in governmental policies relating to refined petroleum products, crude oil, natural gas, natural gas liquids (“NGLs”), or renewables, or taxation; volatility in and degradation of general economic, market, industry or business conditions, including as a result of pandemics, other infectious disease outbreaks, natural hazards, extreme weather events, regional conflicts such as hostilities in the Middle East and in Ukraine, inflation or rising interest rates; the regional, national and worldwide demand for refined products and renewables and related margins; the regional, national or worldwide availability and pricing of crude oil, natural gas, NGLs and

other feedstocks and related pricing differentials; the adequacy of capital resources and liquidity and timing and amounts of free cash flow necessary to execute our business plans, effect future share repurchases and to maintain or grow our dividend; the success or timing of completion of ongoing or anticipated projects; the timing and ability to obtain necessary regulatory approvals and permits and to satisfy other conditions necessary to complete planned projects or to consummate planned transactions within the expected timeframes if at all; the availability of desirable strategic alternatives to optimize portfolio assets and the ability to obtain regulatory and other approvals with respect thereto; the inability or failure of our joint venture partners to fund their share of operations and development activities; the financing and distribution decisions of joint ventures we do not control; our ability to successfully implement our sustainable energy strategy and principles and to achieve our ESG plans and goals within the expected timeframes if at all; changes in government incentives for emission-reduction products and technologies; the outcome of research and development efforts to create future technologies necessary to achieve our ESG plans and goals; our ability to scale projects and technologies on a commercially competitive basis; changes in regional and global economic growth rates and consumer preferences, including consumer support for emission-reduction products and technology; industrial incidents or other unscheduled shutdowns affecting our refineries, machinery, pipelines, processing, fractionation and treating facilities or equipment, means of transportation, or those of our suppliers or customers; the imposition of windfall profit taxes, maximum refining margin penalties or minimum inventory requirements on companies operating within the energy industry in California or other jurisdictions; the impact of adverse market conditions or other similar risks to those identified herein affecting MPLX; and the factors set forth under the heading “Risk Factors” and “Disclosures Regarding Forward-Looking Statements” in MPC’s and MPLX’s Annual Reports on Form 10-K for the year ended Dec. 31, 2023, and in other filings with the SEC. Any forward-looking statement speaks only as of the date of the applicable communication and we undertake no obligation to update any forward-looking statement except to the extent required by applicable law.

Copies of MPC's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other SEC filings are available on the SEC’s website, MPC's website at https://www.marathonpetroleum.com/Investors/ or by contacting MPC's Investor Relations office. Copies of MPLX's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other SEC filings are available on the SEC’s website, MPLX's website at http://ir.mplx.com or by contacting MPLX's Investor Relations office.

Consolidated Statements of Income (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, |

(In millions, except per-share data) | | 2024 | | | 2023 | | | 2024 | | | 2023 |

| Revenues and other income: | | | | | | | | | | | |

| Sales and other operating revenues | $ | 33,137 | | | $ | 36,255 | | | $ | 138,864 | | | $ | 148,379 | |

| Income from equity method investments | | 252 | | | | 195 | | | | 1,048 | | | | 742 | |

| Net gain on disposal of assets | | 11 | | | | 91 | | | | 28 | | | | 217 | |

| Other income | | 66 | | | | 282 | | | | 472 | | | | 969 | |

| Total revenues and other income | | 33,466 | | | | 36,823 | | | | 140,412 | | | | 150,307 | |

| Costs and expenses: | | | | | | | | | | | |

| Cost of revenues (excludes items below) | | 30,558 | | | | 32,582 | | | | 126,240 | | | | 128,566 | |

| Depreciation and amortization | | 826 | | | | 828 | | | | 3,337 | | | | 3,307 | |

| Selling, general and administrative expenses | | 804 | | | | 820 | | | | 3,221 | | | | 3,039 | |

| Other taxes | | 137 | | | | 198 | | | | 818 | | | | 881 | |

| Total costs and expenses | | 32,325 | | | | 34,428 | | | | 133,616 | | | | 135,793 | |

| Income from operations | | 1,141 | | | | 2,395 | | | | 6,796 | | | | 14,514 | |

| Net interest and other financial costs | | 245 | | | | 111 | | | | 839 | | | | 525 | |

| Income before income taxes | | 896 | | | | 2,284 | | | | 5,957 | | | | 13,989 | |

| Provision for income taxes | | 111 | | | | 407 | | | | 890 | | | | 2,817 | |

| Net income | | 785 | | | | 1,877 | | | | 5,067 | | | | 11,172 | |

| Less net income attributable to: | | | | | | | | | | | |

| Redeemable noncontrolling interest | | 6 | | | | 23 | | | | 27 | | | | 94 | |

| Noncontrolling interests | | 408 | | | | 403 | | | | 1,595 | | | | 1,397 | |

| Net income attributable to MPC | $ | 371 | | | $ | 1,451 | | | $ | 3,445 | | | $ | 9,681 | |

| | | | | | | | | | | |

| Per share data | | | | | | | | | | | |

| Basic: | | | | | | | | | | | |

| Net income attributable to MPC per share | $ | 1.16 | | | $ | 3.86 | | | $ | 10.11 | | | $ | 23.73 | |

| Weighted average shares outstanding (in millions) | | 320 | | | | 376 | | | | 340 | | | | 407 | |

| | | | | | | | | | | |

| Diluted: | | | | | | | | | | | |

| Net income attributable to MPC per share | $ | 1.15 | | | $ | 3.84 | | | $ | 10.08 | | | $ | 23.63 | |

| Weighted average shares outstanding (in millions) | | 321 | | | | 377 | | | | 341 | | | | 409 | |

| | | | | | | | | | | |

Capital Expenditures and Investments (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, |

| (In millions) | | 2024 | | | 2023 | | | 2024 | | | 2023 |

| Refining & Marketing | $ | 484 | | | $ | 285 | | | $ | 1,445 | | | $ | 998 | |

Midstream(a) | | 379 | | | | 357 | | | | 1,504 | | | | 1,105 | |

| Renewable Diesel | | 2 | | | | 107 | | | | 8 | | | | 313 | |

Corporate(b) | | 56 | | | | 31 | | | | 119 | | | | 138 | |

| Total | $ | 921 | | | $ | 780 | | | $ | 3,076 | | | $ | 2,554 | |

| | | | | | | | | | | |

(a) The twelve months ended December 31, 2024 includes $228 million related to acquisitions of additional interests in BANGL, LLC and Wink to Webster Pipeline LLC.

(b)Includes capitalized interest of $18 million, $12 million, $56 million and $55 million for the fourth quarter 2024, the fourth quarter 2023, the year 2024 and the year 2023, respectively.

Refining & Marketing Operating Statistics (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dollar per Barrel of Net Refinery Throughput | | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, |

| | 2024 | | | 2023 | | | 2024 | | | 2023 |

Refining & Marketing margin, excluding LIFO inventory charge(a) | $ | 12.55 | | | $ | 18.40 | | | $ | 15.91 | | | $ | 23.15 | |

| LIFO inventory (charge) credit | | 0.38 | | | | (0.59) | | | | 0.10 | | | | (0.15) | |

Refining & Marketing margin(a) | | 12.93 | | | | 17.81 | | | | 16.01 | | | | 23.00 | |

| Less: | | | | | | | | | | | |

Refining operating costs(b) | | 5.26 | | | | 5.55 | | | | 5.34 | | | | 5.31 | |

Distribution costs(c) | | 5.34 | | | | 5.57 | | | | 5.48 | | | | 5.33 | |

| LIFO inventory (charge) credit | | 0.38 | | | | (0.59) | | | | 0.10 | | | | (0.15) | |

Other income(d) | | (0.08) | | | | (1.08) | | | | (0.24) | | | | (0.43) | |

| Refining & Marketing segment adjusted EBITDA | $ | 2.03 | | | $ | 8.36 | | | $ | 5.33 | | | $ | 12.94 | |

| | | | | | | | | | | |

| Refining planned turnaround costs | $ | 1.02 | | | $ | 1.11 | | | $ | 1.31 | | | $ | 1.11 | |

| Depreciation and amortization | | 1.53 | | | | 1.71 | | | | 1.65 | | | | 1.72 | |

| Fees paid to MPLX included in distribution costs above | | 3.60 | | | | 3.65 | | | | 3.70 | | | | 3.62 | |

| | | | | | | | | | | |

(a)Sales revenue less cost of refinery inputs and purchased products, divided by net refinery throughput.

(b)Excludes refining planned turnaround and depreciation and amortization expense.

(c)Excludes depreciation and amortization expense.

(d)Includes income or loss from equity method investments, net gain or loss on disposal of assets and other income or loss.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Refining & Marketing - Supplemental Operating Data | | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, |

| | 2024 | | | 2023 | | | 2024 | | | 2023 |

Refining & Marketing refined product sales volume (mbpd)(a) | | 3,747 | | | | 3,583 | | | | 3,585 | | | | 3,510 | |

Crude oil refining capacity (mbpcd)(b) | | 2,950 | | | | 2,936 | | | | 2,950 | | | | 2,917 | |

Crude oil capacity utilization (percent)(b) | | 94 | | | | 91 | | | | 92 | | | | 92 | |

| | | | | | | | | | | |

| Refinery throughputs (mbpd): | | | | | | | | | | | |

| Crude oil refined | | 2,783 | | | | 2,668 | | | | 2,714 | | | | 2,677 | |

| Other charge and blendstocks | | 214 | | | | 254 | | | | 208 | | | | 226 | |

| Net refinery throughputs | | 2,997 | | | | 2,922 | | | | 2,922 | | | | 2,903 | |

| | | | | | | | | | | |

| Sour crude oil throughput (percent) | | 43 | | | | 45 | | | | 44 | | | | 44 | |

| Sweet crude oil throughput (percent) | | 57 | | | | 55 | | | | 56 | | | | 56 | |

| | | | | | | | | | | |

| Refined product yields (mbpd): | | | | | | | | | | | |

| Gasoline | | 1,570 | | | | 1,588 | | | | 1,490 | | | | 1,526 | |

| Distillates | | 1,109 | | | | 1,059 | | | | 1,070 | | | | 1,037 | |

| Propane | | 69 | | | | 65 | | | | 67 | | | | 66 | |

| NGLs and petrochemicals | | 154 | | | | 142 | | | | 192 | | | | 182 | |

| Heavy fuel oil | | 57 | | | | 41 | | | | 59 | | | | 52 | |

| Asphalt | | 80 | | | | 69 | | | | 81 | | | | 80 | |

| Total | | 3,039 | | | | 2,964 | | | | 2,959 | | | | 2,943 | |

| Inter-region refinery transfers excluded from throughput and yields above (mbpd) | | 96 | | | | 75 | | | | 87 | | | | 61 | |

| | | | | | | | | | | |

(a)Includes intersegment sales.

(b)Based on calendar day capacity, which is an annual average that includes downtime for planned maintenance and other normal operating activities.

Refining & Marketing - Supplemental Operating Data by Region (unaudited)

The per barrel for Refining & Marketing margin is calculated based on net refinery throughput (excludes inter-refinery transfer volumes). The per barrel for the refining operating costs, refining planned turnaround costs and refining depreciation and amortization for the regions, as shown in the tables below, is calculated based on the gross refinery throughput (includes inter-refinery transfer volumes).

Refining operating costs exclude refining planned turnaround costs and refining depreciation and amortization expense.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gulf Coast Region | | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, |

| | 2024 | | | 2023 | | | 2024 | | | 2023 |

| Dollar per barrel of refinery throughput: | | | | | | | | | | | |

| Refining & Marketing margin | $ | 12.36 | | | $ | 16.62 | | | $ | 15.05 | | | $ | 20.83 | |

| Refining operating costs | | 4.04 | | | | 4.28 | | | | 4.14 | | | | 4.11 | |

| Refining planned turnaround costs | | 0.74 | | | | 0.88 | | | | 1.23 | | | | 1.11 | |

| Refining depreciation and amortization | | 1.14 | | | | 1.34 | | | | 1.35 | | | | 1.38 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gulf Coast Region | | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, |

| | 2024 | | | 2023 | | | 2024 | | | 2023 |

| | | | | | | | | | | |

| Refinery throughputs (mbpd): | | | | | | | | | | | |

| Crude oil refined | | 1,190 | | | | 1,144 | | | | 1,119 | | | | 1,085 | |

| Other charge and blendstocks | | 186 | | | | 186 | | | | 181 | | | | 182 | |

| Gross refinery throughputs | | 1,376 | | | | 1,330 | | | | 1,300 | | | | 1,267 | |

| | | | | | | | | | | |

| Sour crude oil throughput (percent) | | 55 | | | | 55 | | | | 56 | | | | 53 | |

| Sweet crude oil throughput (percent) | | 45 | | | | 45 | | | | 44 | | | | 47 | |

| | | | | | | | | | | |

| Refined product yields (mbpd): | | | | | | | | | | | |

| Gasoline | | 671 | | | | 702 | | | | 621 | | | | 654 | |

| Distillates | | 509 | | | | 475 | | | | 476 | | | | 445 | |

| Propane | | 40 | | | | 38 | | | | 38 | | | | 37 | |

| NGLs and petrochemicals | | 118 | | | | 107 | | | | 124 | | | | 112 | |

| Heavy fuel oil | | 51 | | | | 27 | | | | 52 | | | | 33 | |

| Asphalt | | 17 | | | | 15 | | | | 16 | | | | 17 | |

| Total | | 1,406 | | | | 1,364 | | | | 1,327 | | | | 1,298 | |

| Inter-region refinery transfers included in throughput and yields above (mbpd) | | 72 | | | | 39 | | | | 58 | | | | 35 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mid-Continent Region | | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, |

| | 2024 | | | 2023 | | | 2024 | | | 2023 |

| Dollar per barrel of refinery throughput: | | | | | | | | | | | |

| Refining & Marketing margin | $ | 11.31 | | | $ | 17.75 | | | $ | 15.77 | | | $ | 23.35 | |

| Refining operating costs | | 5.21 | | | | 5.02 | | | | 5.10 | | | | 4.88 | |

| Refining planned turnaround costs | | 1.49 | | | | 0.79 | | | | 1.40 | | | | 0.77 | |

| Refining depreciation and amortization | | 1.40 | | | | 1.41 | | | | 1.39 | | | | 1.40 | |

| | | | | | | | | | | |

| Refinery throughputs (mbpd): | | | | | | | | | | | |

| Crude oil refined | | 1,095 | | | | 1,061 | | | | 1,103 | | | | 1,108 | |

| Other charge and blendstocks | | 79 | | | | 92 | | | | 70 | | | | 67 | |

| Gross refinery throughputs | | 1,174 | | | | 1,153 | | | | 1,173 | | | | 1,175 | |

| | | | | | | | | | | |

| Sour crude oil throughput (percent) | | 22 | | | | 27 | | | | 24 | | | | 26 | |

| Sweet crude oil throughput (percent) | | 78 | | | | 73 | | | | 76 | | | | 74 | |

| | | | | | | | | | | |

| Refined product yields (mbpd): | | | | | | | | | | | |

| Gasoline | | 636 | | | | 637 | | | | 622 | | | | 623 | |

| Distillates | | 423 | | | | 413 | | | | 413 | | | | 417 | |

| Propane | | 20 | | | | 19 | | | | 20 | | | | 20 | |

| NGLs and petrochemicals | | 20 | | | | 20 | | | | 42 | | | | 43 | |

| Heavy fuel oil | | 18 | | | | 12 | | | | 15 | | | | 13 | |

| Asphalt | | 63 | | | | 54 | | | | 65 | | | | 63 | |

| Total | | 1,180 | | | | 1,155 | | | | 1,177 | | | | 1,179 | |

| Inter-region refinery transfers included in throughput and yields above (mbpd) | | 14 | | | | 18 | | | | 11 | | | | 10 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| West Coast Region | | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, |

| | 2024 | | | 2023 | | | 2024 | | | 2023 |

| Dollar per barrel of refinery throughput: | | | | | | | | | | | |

| Refining & Marketing margin | $ | 15.70 | | | $ | 24.53 | | | $ | 18.29 | | | $ | 28.35 | |

| Refining operating costs | | 7.48 | | | | 9.19 | | | | 7.92 | | | | 8.56 | |

| Refining planned turnaround costs | | 0.55 | | | | 2.24 | | | | 1.07 | | | | 1.75 | |

| Refining depreciation and amortization | | 1.38 | | | | 1.39 | | | | 1.37 | | | | 1.37 | |

| | | | | | | | | | | |

| Refinery throughputs (mbpd): | | | | | | | | | | | |

| Crude oil refined | | 498 | | | | 463 | | | | 492 | | | | 484 | |

| Other charge and blendstocks | | 45 | | | | 51 | | | | 44 | | | | 38 | |

| Gross refinery throughputs | | 543 | | | | 514 | | | | 536 | | | | 522 | |

| | | | | | | | | | | |

| Sour crude oil throughput (percent) | | 60 | | | | 63 | | | | 61 | | | | 68 | |

| Sweet crude oil throughput (percent) | | 40 | | | | 37 | | | | 39 | | | | 32 | |

| | | | | | | | | | | |

| Refined product yields (mbpd): | | | | | | | | | | | |

| Gasoline | | 278 | | | | 268 | | | | 273 | | | | 271 | |

| Distillates | | 198 | | | | 184 | | | | 197 | | | | 182 | |

| Propane | | 9 | | | | 8 | | | | 9 | | | | 9 | |

| NGLs and petrochemicals | | 30 | | | | 23 | | | | 33 | | | | 34 | |

| Heavy fuel oil | | 34 | | | | 37 | | | | 30 | | | | 31 | |

| Asphalt | | — | | | | — | | | | — | | | | — | |

| Total | | 549 | | | | 520 | | | | 542 | | | | 527 | |

| Inter-region refinery transfers included in throughput and yields above (mbpd) | | 10 | | | | 18 | | | | 18 | | | | 16 | |

| | | | | | | | | | | |

Midstream Operating Statistics (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, |

| | 2024 | | | 2023 | | | 2024 | | | 2023 |

Pipeline throughputs (mbpd)(a) | | 5,939 | | | | 5,866 | | | | 5,874 | | | | 5,895 | |

| Terminal throughputs (mbpd) | | 3,128 | | | | 3,023 | | | | 3,131 | | | | 3,130 | |

Gathering system throughputs (million cubic feet per day)(b) | | 6,734 | | | | 6,252 | | | | 6,579 | | | | 6,257 | |

Natural gas processed (million cubic feet per day)(b) | | 9,934 | | | | 9,375 | | | | 9,663 | | | | 8,971 | |

C2 (ethane) + NGLs fractionated (mbpd)(b) | | 683 | | | | 599 | | | | 654 | | | | 597 | |

| | | | | | | | | | | |

(a)Includes common-carrier pipelines and private pipelines contributed to MPLX. Excludes equity method affiliate pipeline volumes.

(b)Includes operating data for entities that have been consolidated into the MPLX financial statements as well as operating data for partnership-operated equity method investments.

Renewable Diesel Financial Data (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, |

| (In millions) | | 2024 | | | 2023 | | | 2024 | | | 2023 |

Renewable Diesel margin, excluding LIFO inventory credit(a) | $ | 82 | | | $ | 58 | | | $ | 131 | | | $ | 292 | |

| LIFO inventory credit | | 55 | | | | 12 | | | | 55 | | | | 12 | |

Renewable Diesel margin(a) | | 137 | | | | 70 | | | | 186 | | | | 304 | |

| Less: | | | | | | | | | | | |

Operating costs(b) | | 68 | | | | 74 | | | | 269 | | | | 242 | |

Distribution costs(c) | | 28 | | | | 23 | | | | 95 | | | | 82 | |

| LIFO inventory credit | | 55 | | | | 12 | | | | 55 | | | | 12 | |

Other (income) loss(d) | | (42) | | | | 8 | | | | (83) | | | | 32 | |

| Renewable Diesel segment adjusted EBITDA | $ | 28 | | | $ | (47) | | | $ | (150) | | | $ | (64) | |

| | | | | | | | | | | |

| Planned turnaround costs | $ | 2 | | | $ | 2 | | | $ | 7 | | | $ | 20 | |

| JV planned turnaround costs | | 9 | | | | 18 | | | | 9 | | | | 25 | |

| Depreciation and amortization | | 25 | | | | 16 | | | | 75 | | | | 65 | |

| JV depreciation and amortization | | 22 | | | | 21 | | | | 89 | | | | 65 | |

| | | | | | | | | | | |

(a)Sales revenue less cost of renewable inputs and purchased products.

(b)Excludes planned turnaround and depreciation and amortization expense.

(c)Excludes depreciation and amortization expense.

(d)Includes income or loss from equity method investments, net gain or loss on disposal of assets and other income or loss.

Select Financial Data (unaudited)

| | | | | | | | | | | | | | | | | |

| | December 31,

2024 | | | September 30,

2024 |

| (in millions of dollars) | | | | | |

Cash and cash equivalents | $ | 3,210 | | | $ | 4,002 | |

| Short-term investments | | — | | | | 1,141 | |

Total consolidated debt(a) | | 27,481 | | | | 28,220 | |

MPC debt | | 6,533 | | | | 6,134 | |

MPLX debt | | 20,948 | | | | 22,086 | |

Redeemable noncontrolling interest | | 203 | | | | 203 | |

Equity | | 24,303 | | | | 25,509 | |

| | | | | |

| (in millions) | | | | | |

Shares outstanding | | 316 | | | | 325 | |

| | | | | |

(a) Net of unamortized debt issuance costs and unamortized premium/discount, net.

Non-GAAP Financial Measures

Management uses certain financial measures to evaluate our operating performance that are calculated and presented on the basis of methodologies other than in accordance with GAAP. The non-GAAP financial measures we use are as follows:

Adjusted Net Income Attributable to MPC and Adjusted Diluted Income Per Share

Adjusted net income attributable to MPC is defined as net income attributable to MPC excluding the items in the table below, along with their related income tax effect. We have excluded these items because we believe that they are not indicative of our core operating performance. Adjusted diluted income per share is defined as adjusted net income attributable to MPC divided by the number of weighted-average shares outstanding in the applicable period, assuming dilution.

We believe the use of adjusted net income attributable to MPC and adjusted diluted income per share provides us and our investors with important measures of our ongoing financial performance to better assess our underlying business results and trends. Adjusted net income attributable to MPC or adjusted diluted income per share should not be considered as a substitute for, or superior to net income attributable to MPC, diluted net income per share or any other measure of financial performance presented in accordance with GAAP. Adjusted net income attributable to MPC and adjusted diluted income per share may not be comparable to similarly titled measures reported by other companies.

Reconciliation of Net Income Attributable to MPC to Adjusted Net Income Attributable to MPC (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, |

(In millions) | | 2024 | | | 2023 | | | 2024 | | | 2023 |

| Net income attributable to MPC | $ | 371 | | | $ | 1,451 | | | $ | 3,445 | | | $ | 9,681 | |

Pre-tax adjustments: | | | | | | | | | | | |

| Garyville incident response costs | | — | | | | (47) | | | | — | | | | 16 | |

| Gain on sale of assets | | — | | | | (92) | | | | (151) | | | | (198) | |

| LIFO inventory charge (credit) | | (161) | | | | 145 | | | | (161) | | | | 145 | |

| | | | | | | | | | | |

Tax impact of adjustments(a) | | 39 | | | | (1) | | | | 62 | | | | 8 | |

Non-controlling interest impact of adjustments | | — | | | | 49 | | | | 55 | | | | 27 | |

| Adjusted net income attributable to MPC | $ | 249 | | | $ | 1,505 | | | $ | 3,250 | | | $ | 9,679 | |

| | | | | | | | | | | |

| Diluted income per share | $ | 1.15 | | | $ | 3.84 | | | $ | 10.08 | | | $ | 23.63 | |

Adjusted diluted income per share | $ | 0.77 | | | $ | 3.98 | | | $ | 9.51 | | | $ | 23.63 | |

| | | | | | | | | | | |

| Weighted average diluted shares outstanding | | 321 | | | | 377 | | | | 341 | | | | 409 | |

| | | | | | | | | | | |

(a)Income taxes for the three and twelve months ended December 31, 2024 were calculated by applying a federal statutory rate and a blended state tax rate to the pre-tax adjustments after non-controlling interest. The corresponding adjustments to reported income taxes are shown in the table above.

Adjusted EBITDA

Amounts included in net income (loss) attributable to MPC and excluded from adjusted EBITDA include (i) net interest and other financial costs; (ii) provision/benefit for income taxes; (iii) noncontrolling interests; (iv) depreciation and amortization; (v) refining planned turnaround costs and (vi) other adjustments as deemed necessary, as shown in the table below. We believe excluding turnaround costs from this metric is useful for comparability to other companies as certain of our competitors defer these costs and amortize them between turnarounds.

Adjusted EBITDA is a financial performance measure used by management, industry analysts, investors, lenders, and rating agencies to assess the financial performance and operating results of our ongoing business operations. Additionally, we believe adjusted EBITDA provides useful information to investors for trending, analyzing and benchmarking our operating results from period to period as compared to other companies that may have different financing and capital structures. Adjusted EBITDA should not be considered as a substitute for, or superior to income (loss) from operations, net income attributable to MPC, income before income taxes, cash flows from operating activities or any other measure of financial performance presented in accordance with GAAP. Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies.

Reconciliation of Net Income Attributable to MPC to Adjusted EBITDA (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, |

(In millions) | | 2024 | | | 2023 | | | 2024 | | | 2023 |

| Net income attributable to MPC | $ | 371 | | | $ | 1,451 | | | $ | 3,445 | | | $ | 9,681 | |

| Net income attributable to noncontrolling interests | | 414 | | | | 426 | | | | 1,622 | | | | 1,491 | |

| Provision for income taxes | | 111 | | | | 407 | | | | 890 | | | | 2,817 | |

Net interest and other financial costs | | 245 | | | | 111 | | | | 839 | | | | 525 | |

Depreciation and amortization | | 826 | | | | 828 | | | | 3,337 | | | | 3,307 | |

| Renewable Diesel JV depreciation and amortization | | 22 | | | | 21 | | | | 89 | | | | 65 | |

| Refining & Renewable Diesel planned turnaround costs | | 283 | | | | 299 | | | | 1,404 | | | | 1,201 | |

| Renewable Diesel JV planned turnaround costs | | 9 | | | | 18 | | | | 9 | | | | 25 | |

| Garyville incident response costs (recoveries) | | — | | | | (47) | | | | — | | | | 16 | |

| LIFO inventory charge (credit) | | (161) | | | | 145 | | | | (161) | | | | 145 | |

Gain on sale of assets | | — | | | | (92) | | | | (151) | | | | (198) | |

| | | | | | | | | | | |

Adjusted EBITDA | $ | 2,120 | | | $ | 3,567 | | | $ | 11,323 | | | $ | 19,075 | |

| | | | | | | | | | | |

Refining & Marketing Margin

Refining & Marketing margin is defined as sales revenue less cost of refinery inputs and purchased products. We use and believe our investors use this non-GAAP financial measure to evaluate our Refining & Marketing segment’s operating and financial performance as it is the most comparable measure to the industry’s market reference product margins. This measure should not be considered a substitute for, or superior to, Refining & Marketing gross margin or other measures of financial performance prepared in accordance with GAAP, and our calculation thereof may not be comparable to similarly titled measures reported by other companies.

Reconciliation of Refining & Marketing Segment Adjusted EBITDA to Refining & Marketing Gross Margin and Refining & Marketing Margin (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, |

| (In millions) | | 2024 | | | 2023 | | | 2024 | | | 2023 |

| Refining & Marketing segment adjusted EBITDA | $ | 559 | | | $ | 2,248 | | | $ | 5,703 | | | $ | 13,705 | |

| Plus (Less): | | | | | | | | | | | |

| Depreciation and amortization | | (422) | | | | (460) | | | | (1,767) | | | | (1,822) | |

| Refining planned turnaround costs | | (281) | | | | (297) | | | | (1,397) | | | | (1,181) | |

| LIFO inventory (charge) credit | | 106 | | | | (157) | | | | 106 | | | | (157) | |

| Selling, general and administrative expenses | | 562 | | | | 644 | | | | 2,472 | | | | 2,443 | |

| Income from equity method investments | | (11) | | | | (29) | | | | (57) | | | | (66) | |

| Net (gain) loss on disposal of assets | | (2) | | | | 1 | | | | (1) | | | | (2) | |

| Other income | | (33) | | | | (265) | | | | (342) | | | | (870) | |

| Refining & Marketing gross margin | | 478 | | | | 1,685 | | | | 4,717 | | | | 12,050 | |

| Plus (Less): | | | | | | | | | | | |

| Operating expenses (excluding depreciation and amortization) | | 2,823 | | | | 2,840 | | | | 11,321 | | | | 10,833 | |

| Depreciation and amortization | | 422 | | | | 460 | | | | 1,767 | | | | 1,822 | |

Gross margin excluded from and other income included in Refining & Marketing margin(a) | | (103) | | | | (124) | | | | (425) | | | | (45) | |

| Other taxes included in Refining & Marketing margin | | (54) | | | | (71) | | | | (259) | | | | (288) | |

| Refining & Marketing margin | | 3,566 | | | | 4,790 | | | | 17,121 | | | | 24,372 | |

| LIFO inventory charge (credit) | | (106) | | | | 157 | | | | (106) | | | | 157 | |

| Refining & Marketing margin, excluding LIFO inventory charge/credit | $ | 3,460 | | | $ | 4,947 | | | $ | 17,015 | | | $ | 24,529 | |

| | | | | | | | | | | |

| Refining & Marketing margin by region: | | | | | | | | | | | |

| Gulf Coast | $ | 1,483 | | | $ | 1,972 | | | $ | 6,839 | | | $ | 9,365 | |

| Mid-Continent | | 1,207 | | | | 1,855 | | | | 6,705 | | | | 9,925 | |

| West Coast | | 770 | | | | 1,120 | | | | 3,471 | | | | 5,239 | |

| Refining & Marketing margin | $ | 3,460 | | | $ | 4,947 | | | $ | 17,015 | | | $ | 24,529 | |

| | | | | | | | | | | |

(a)Reflects the gross margin, excluding depreciation and amortization, of other related operations included in the Refining & Marketing segment and processing of credit card transactions on behalf of certain of our marketing customers, net of other income.

Renewable Diesel Margin

Renewable Diesel margin is defined as sales revenue less cost of renewable inputs and purchased products. We use and believe our investors use this non-GAAP financial measure to evaluate our Renewable segment’s operating and financial performance. This measure should not be considered a substitute for, or superior to, Renewable gross margin or other measures of financial performance prepared in accordance with GAAP, and our calculation thereof may not be comparable to similarly titled measures reported by other companies.

Reconciliation of Renewable Diesel Segment Adjusted EBITDA to Renewable Diesel Gross Margin and Renewable Diesel Margin (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | | Twelve Months Ended

December 31, |

| (In millions) | | 2024 | | | 2023 | | | 2024 | | | 2023 |

| Renewable Diesel segment adjusted EBITDA | $ | 28 | | | $ | (47) | | | $ | (150) | | | $ | (64) | |

| Plus (Less): | | | | | | | | | | | |

| Depreciation and amortization | | (25) | | | | (16) | | | | (75) | | | | (65) | |

| JV depreciation and amortization | | (22) | | | | (21) | | | | (89) | | | | (65) | |

| Planned turnaround costs | | (2) | | | | (2) | | | | (7) | | | | (20) | |

| JV planned turnaround costs | | (9) | | | | (18) | | | | (9) | | | | (25) | |

| LIFO inventory credit | | 55 | | | | 12 | | | | 55 | | | | 12 | |

| Selling, general and administrative expenses | | 19 | | | | 14 | | | | 59 | | | | 61 | |

| (Income) loss from equity method investments | | (31) | | | | 27 | | | | (70) | | | | 59 | |

| Net gain on disposal of assets | | — | | | | — | | | | — | | | | (1) | |

| Other income | | — | | | | (1) | | | | — | | | | (1) | |

| Renewable Diesel gross margin | | 13 | | | | (52) | | | | (286) | | | | (109) | |

| Plus (Less): | | | | | | | | | | | |

| Operating expenses (excluding depreciation and amortization) | | 78 | | | | 86 | | | | 312 | | | | 284 | |

| Depreciation and amortization | | 25 | | | | 16 | | | | 75 | | | | 65 | |

| Martinez JV depreciation and amortization | | 21 | | | | 20 | | | | 85 | | | | 64 | |

| Renewable Diesel margin | | 137 | | | | 70 | | | | 186 | | | | 304 | |

| LIFO inventory credit | | (55) | | | | (12) | | | | (55) | | | | (12) | |

| Renewable Diesel margin, excluding LIFO inventory credit | $ | 82 | | | $ | 58 | | | $ | 131 | | | $ | 292 | |

| | | | | | | | | | | |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

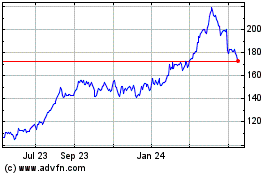

Marathon Petroleum (NYSE:MPC)

Historical Stock Chart

From Jan 2025 to Feb 2025

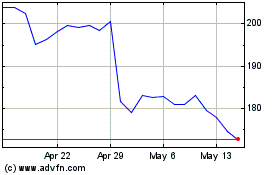

Marathon Petroleum (NYSE:MPC)

Historical Stock Chart

From Feb 2024 to Feb 2025