Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

05 February 2025 - 9:27AM

Edgar (US Regulatory)

|

|

|

|

|

Filed Pursuant to Rule 433

Registration Nos. 333-278184

and 333-278184-02 |

NextEra Energy Capital Holdings, Inc.

Pricing Term Sheet

February 4, 2025

|

|

|

| Issuer: |

|

NextEra Energy Capital Holdings, Inc. |

| Designations: |

|

Series S Junior Subordinated Debentures due August 15, 2055 (“Series S Junior

Subordinated Debentures”) |

|

|

Series T Junior Subordinated Debentures due August 15, 2055 (“Series T Junior

Subordinated Debentures” and together with the Series S Junior Subordinated Debentures, the “Junior Subordinated Debentures”) |

| Registration Format: |

|

SEC Registered |

| Principal Amount: |

|

Series S Junior Subordinated Debentures: |

|

|

$1,500,000,000 |

|

|

Series T Junior Subordinated Debentures: |

|

|

$1,000,000,000 |

| Date of Maturity: |

|

August 15, 2055 |

| Interest Payment Dates: |

|

Semi-annually in arrears on February 15 and August 15, beginning August 15,

2025 |

| Coupon Rate: |

|

Series S Junior Subordinated Debentures: (i) from and including the date of original issuance

to but excluding August 15, 2030 (“Series S Junior Subordinated Debentures First Interest Reset Date”) at an annual rate of 6.375% and (ii) from and including the Series S Junior Subordinated Debentures First Interest Reset Date

during each Interest Reset Period at an annual rate equal to the Five-Year Treasury Rate as of the most recent Reset Interest Determination Date plus 2.053%; provided, that the interest rate during any Interest Reset Period for the Series S

Junior Subordinated Debentures will not reset below 6.375% (which equals the initial interest rate on the Series S Junior Subordinated Debentures). |

|

|

Series T Junior Subordinated Debentures: (i) from and including the date of original issuance

to but excluding August 15, 2035 (“Series T Junior Subordinated Debentures First Interest Reset Date”) at an annual rate of 6.500% and (ii) from and including the Series T Junior Subordinated Debentures First Interest Reset Date

during each Interest Reset Period at an annual rate equal to the |

|

|

|

|

|

Five-Year Treasury Rate as of the most recent Reset Interest Determination Date plus 1.979%; provided, that the

interest rate during any Interest Reset Period for the Series T Junior Subordinated Debentures will not reset below 6.500% (which equals the initial interest rate on the Series T Junior Subordinated Debentures) |

| Optional Deferral: |

|

Maximum of 10 consecutive years per deferral |

| Price to Public: |

|

Series S Junior Subordinated Debentures: |

|

|

100.000% of the principal amount thereof |

|

|

Series T Junior Subordinated Debentures: |

|

|

100.000% of the principal amount thereof |

| Optional Redemption: |

|

Series S Junior Subordinated Debentures: In whole or in part (i) on any day in the period

commencing on the date falling 90 days prior to the Series S Junior Subordinated Debentures First Interest Reset Date and ending on and including the Series S Junior Subordinated Debentures First Interest Reset Date and (ii) after the

Series S Junior Subordinated Debentures First Interest Reset Date, on any interest payment date, at 100% of the principal amount of the Series S Junior Subordinated Debentures to be redeemed, plus, in either case, accrued and unpaid interest

thereon to the redemption date |

|

|

Series T Junior Subordinated Debentures: In whole or in part (i) on any day in the period

commencing on the date falling 90 days prior to the Series T Junior Subordinated Debentures First Interest Reset Date and ending on and including the Series T Junior Subordinated Debentures First Interest Reset Date and (ii) after the

Series T Junior Subordinated Debentures First Interest Reset Date, on any interest payment date, at 100% of the principal amount of the Series T Junior Subordinated Debentures to be redeemed, plus, in either case, accrued and unpaid interest

thereon to the redemption date |

| Call for Tax Event: |

|

In whole but not in part, at 100% of the principal amount plus accrued and unpaid interest thereon to the redemption date |

| Call for Rating Agency Event: |

|

In whole but not in part, at 102% of the principal amount plus accrued and unpaid interest thereon to the redemption date |

| Trade Date: |

|

February 4, 2025 |

| Settlement Date: |

|

February 6, 2025 (T+2) |

| CUSIP / ISIN Number: |

|

Series S Junior Subordinated Debentures: |

|

|

65339K DE7/ US65339KDE73 |

|

|

Series T Junior Subordinated Debentures: |

|

|

65339K DF4/ US65339KDF49 |

|

|

|

| Expected Credit Ratings:* |

|

|

| Moody’s Investors Service Inc. |

|

“Baa2” (stable) |

| S&P Global Ratings |

|

“BBB” (stable) |

| Fitch Ratings, Inc. |

|

“BBB” (stable) |

|

|

| Joint Book-Running Managers: |

|

|

| BofA Securities, Inc.

J.P. Morgan Securities LLC

Mizuho Securities USA LLC

RBC Capital Markets, LLC

Santander US Capital Markets LLC

Scotia Capital (USA) Inc.

Truist Securities, Inc.

Wells Fargo Securities, LLC

ANZ Securities, Inc.

Barclays Capital Inc.

BBVA Securities Inc. BMO

Capital Markets Corp. BNP Paribas Securities Corp.

BNY Mellon Capital Markets, LLC

Citigroup Global Markets Inc.

Commerz Markets LLC

Credit Agricole Securities (USA) Inc.

Goldman Sachs & Co. LLC

KeyBanc Capital Markets Inc.

Morgan Stanley & Co. LLC

MUFG Securities Americas Inc.

Natixis Securities Americas LLC

SG Americas Securities, LLC

SMBC Nikko Securities America, Inc.

TD Securities (USA) LLC

U.S. Bancorp Investments, Inc. |

|

|

|

|

| Co-Manager: |

|

|

| WR Securities, LLC |

|

|

| * |

A security rating is not a recommendation to buy, sell or hold securities and should be evaluated independently

of any other rating. The rating is subject to revision or withdrawal at any time by the assigning rating organization. |

The terms

“Five-Year Treasury Rate,” “Interest Reset Period,” “Rating Agency Event,” “Reset Interest Determination Date” and “Tax Event” have the meanings ascribed to each such term in the Issuer’s

Preliminary Prospectus Supplement, dated February 4, 2025.

The Issuer has filed a registration statement (including a prospectus) with the SEC for the offering to

which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get

these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling BofA

Securities, Inc. toll-free at (800) 294-1322 or by email at dg.prospectus_requests@bofa.com; J.P. Morgan Securities LLC collect at (212) 834-4533; Mizuho

Securities USA LLC toll-free at (866) 271-7403; RBC Capital Markets, LLC toll-free at (866) 375-6829; Santander US Capital Markets LLC toll-free at (855) 403-3636; Scotia Capital (USA) Inc. toll-free at (800) 372-3930; Truist Securities, Inc. toll-free at

(800) 685-4786; or Wells Fargo Securities, LLC toll-free at (800) 645-3751.

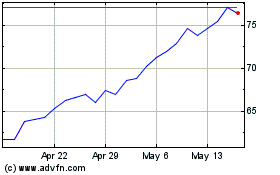

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Jan 2025 to Feb 2025

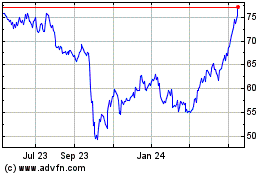

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Feb 2024 to Feb 2025