| 19

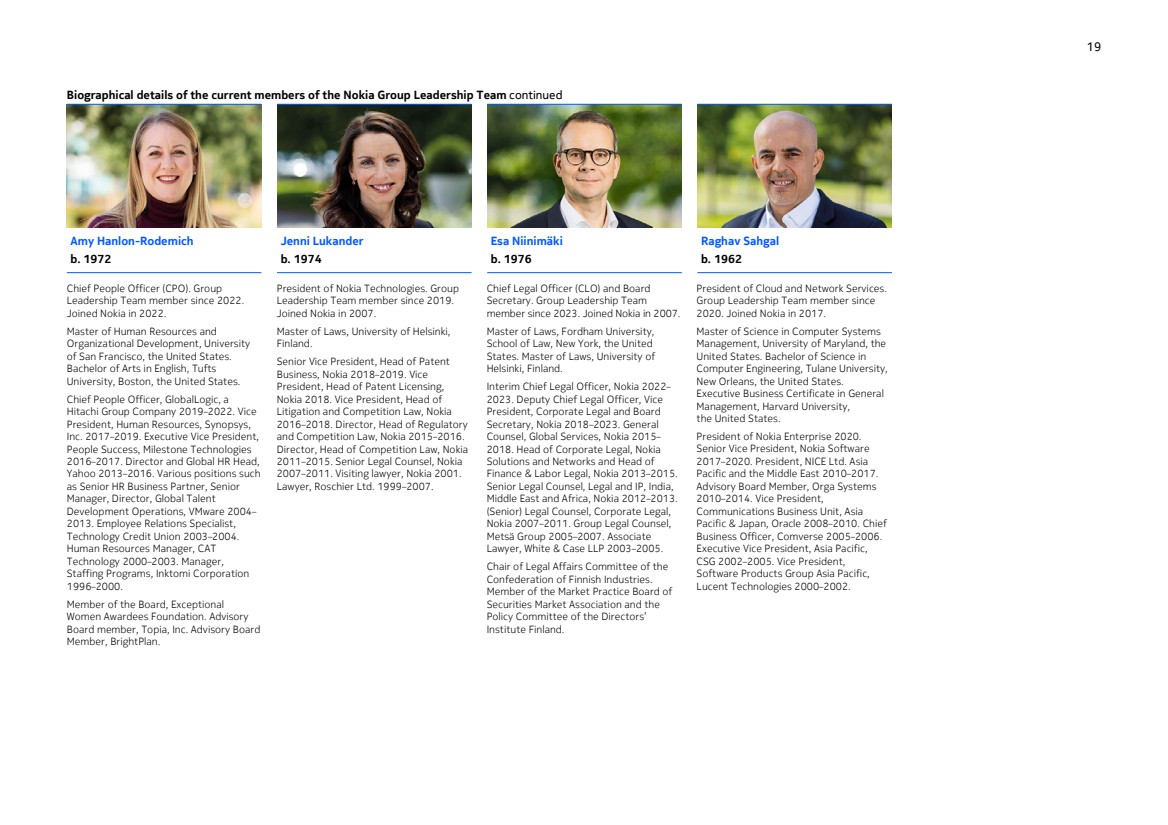

Biographical details of the current members of the Nokia Group Leadership Team continued

Amy Hanlon-Rodemich Jenni Lukander Esa Niinimäki Raghav Sahgal

b. 1972 b. 1974 b. 1976 b. 1962

Chief People Officer (CPO). Group

Leadership Team member since 2022.

Joined Nokia in 2022.

Master of Human Resources and

Organizational Development, University

of San Francisco, the United States.

Bachelor of Arts in English, Tufts

University, Boston, the United States.

Chief People Officer, GlobalLogic, a

Hitachi Group Company 2019–2022. Vice

President, Human Resources, Synopsys,

Inc. 2017–2019. Executive Vice President,

People Success, Milestone Technologies

2016–2017. Director and Global HR Head,

Yahoo 2013–2016. Various positions such

as Senior HR Business Partner, Senior

Manager, Director, Global Talent

Development Operations, VMware 2004–

2013. Employee Relations Specialist,

Technology Credit Union 2003–2004.

Human Resources Manager, CAT

Technology 2000–2003. Manager,

Staffing Programs, Inktomi Corporation

1996–2000.

Member of the Board, Exceptional

Women Awardees Foundation. Advisory

Board member, Topia, Inc. Advisory Board

Member, BrightPlan.

President of Nokia Technologies. Group

Leadership Team member since 2019.

Joined Nokia in 2007.

Master of Laws, University of Helsinki,

Finland.

Senior Vice President, Head of Patent

Business, Nokia 2018–2019. Vice

President, Head of Patent Licensing,

Nokia 2018. Vice President, Head of

Litigation and Competition Law, Nokia

2016–2018. Director, Head of Regulatory

and Competition Law, Nokia 2015–2016.

Director, Head of Competition Law, Nokia

2011–2015. Senior Legal Counsel, Nokia

2007–2011. Visiting lawyer, Nokia 2001.

Lawyer, Roschier Ltd. 1999–2007.

Chief Legal Officer (CLO) and Board

Secretary. Group Leadership Team

member since 2023. Joined Nokia in 2007.

Master of Laws, Fordham University,

School of Law, New York, the United

States. Master of Laws, University of

Helsinki, Finland.

Interim Chief Legal Officer, Nokia 2022–

2023. Deputy Chief Legal Officer, Vice

President, Corporate Legal and Board

Secretary, Nokia 2018–2023. General

Counsel, Global Services, Nokia 2015–

2018. Head of Corporate Legal, Nokia

Solutions and Networks and Head of

Finance & Labor Legal, Nokia 2013–2015.

Senior Legal Counsel, Legal and IP, India,

Middle East and Africa, Nokia 2012–2013.

(Senior) Legal Counsel, Corporate Legal,

Nokia 2007–2011. Group Legal Counsel,

Metsä Group 2005–2007. Associate

Lawyer, White & Case LLP 2003–2005.

Chair of Legal Affairs Committee of the

Confederation of Finnish Industries.

Member of the Market Practice Board of

Securities Market Association and the

Policy Committee of the Directors’

Institute Finland.

President of Cloud and Network Services.

Group Leadership Team member since

2020. Joined Nokia in 2017.

Master of Science in Computer Systems

Management, University of Maryland, the

United States. Bachelor of Science in

Computer Engineering, Tulane University,

New Orleans, the United States.

Executive Business Certificate in General

Management, Harvard University,

the United States.

President of Nokia Enterprise 2020.

Senior Vice President, Nokia Software

2017–2020. President, NICE Ltd. Asia

Pacific and the Middle East 2010–2017.

Advisory Board Member, Orga Systems

2010–2014. Vice President,

Communications Business Unit, Asia

Pacific & Japan, Oracle 2008–2010. Chief

Business Officer, Comverse 2005–2006.

Executive Vice President, Asia Pacific,

CSG 2002–2005. Vice President,

Software Products Group Asia Pacific,

Lucent Technologies 2000–2002.

Business

overview

Corporate

governance

Board

review

Financial

statements

Other

information 51

Corporate governance statement continued

Nokia in 2023 |