Nu Skin Enterprises Inc. (NYSE: NUS) today announced second

quarter results in line with top-line guidance.

Executive Summary

Q2 2024 vs. Prior-year Quarter

Revenue

$439.1 million; (12.2)%

- (4.2)% FX impact or $(21.0) million

- Rhyz revenue $67.8 million; 32.3%

Earnings Per Share

(EPS)

$(2.38) or $0.21 excluding restructuring

and impairment charges, compared to $0.54

Customers

893,514; (14)%

Paid Affiliates

155,486; (17)% or (9)% excluding an

adjustment to eligibility requirements

Sales Leaders

38,592; (16)%

“We are pleased with our progress as we perform to plan

on our transformational efforts, and we are on track as evidenced

by our second quarter results,” said Ryan Napierski, Nu Skin

president and CEO. “Our revenue was in-line with our expectations

despite a 4 percent FX headwind, while adjusted earnings per share

slightly exceeded our projections due to heightened operational

discipline, excluding our restructuring and impairment charges. As

our core Nu Skin business continues to navigate the macro-economic

environment, we were encouraged by sequential gains in several of

our markets including the U.S. and most of Southeast Asia/Pacific.

Additionally, our Rhyz business grew 32 percent versus the

prior-year quarter led by strong performances in our Mavely

affiliate platform and manufacturing companies.

“We are intensifying our transformation efforts to become a

leading integrated beauty, wellness and lifestyle ecosystem by

building synergistic value between our Nu Skin core and Rhyz. In

late July, we held our first Western market, in-person affiliate

event in over five years with a similar event for Eastern markets

coming in September. At the event, we were able to drive energy and

alignment among our leaders as we previewed our MYND360 cognitive

health division and promoted new activation efforts to grow our

salesforce. We also announced plans for a Nu Skin/Mavely app, with

Mavely’s more than 1,200 brands and 70,000 everyday influencers,

for our Nu Skin affiliates, anticipated for second-half

introduction in the U.S.

“We are enhancing our developing market strategy including a

revised business model, targeted product offering and streamlined

operating infrastructure beginning with Latin America and parts of

Southeast Asia in the second half. In addition, we are intensifying

our plans to enter India with a proprietary business model that

will be a catalyst for expansion into other emerging markets. We

are also exploring integrated brand building initiatives, including

digital marketing and third-party marketplaces, as we strive to be

wherever our customers seek to find us.”

Q2 2024 Year-over-year Operating

Results

Revenue

$439.1 million compared to $500.3

million

- (4.2)% FX impact or $(21.0) million

- Rhyz revenue $67.8 million; +32.3%

Gross Margin

70.0% compared to 72.9%

- Nu Skin business was 76.1% compared to 77.2%

Selling Expenses

37.7% compared to 37.0%

- Nu Skin business was 42.2% compared to 40.2%

G&A Expenses

26.9% compared to 27.4%

Operating Margin

(28.6)% or 5.4% excluding restructuring

and impairment charges compared to 8.5%

Interest Expense

$6.7 million compared to $5.8 million

Other Income/(Expense)

$0.6 million compared to $0.4 million

Income Tax Rate

10.2% or 41.4% excluding restructuring and

impairment charges compared to 27.5%

EPS

$(2.38) or $0.21 excluding restructuring

and impairment charges compared to $0.54

Stockholder Value

Dividend Payments

$3.0 million

Stock Repurchases

$0.0 million

- $162.4 million remaining in authorization

Q3 and Full-year 2024 Outlook

Q3 2024 Revenue

$430 to $465 million; (14)% to (7)%

- Approximately (4) to (3)% FX impact

Q3 2024 EPS

$0.08 to $0.18 or $0.15 to $0.25

non-GAAP

2024 Revenue

$1.73 to $1.81 billion; (12)% to (8)%

- Approximately (4) to (3)% FX impact

2024 EPS

$(2.01) to $(1.81) or $0.75 to $0.95

non-GAAP

“As we continue to refine our operating model during our

transformation, we remain diligent in pursuing cost saving

initiatives going forward, including additional product portfolio

optimization along with expense management,” said James D. Thomas,

chief financial officer. “We remain on track with our cost

efficiency program as reflected by our reductions in G&A

expense, helping to protect profitability despite revenue

pressures. During the quarter, we generated $51.2 million in cash

from operations, reduced inventory levels and paid down debt to

strengthen our balance sheet. We also performed an impairment

analysis and recorded a $141 million non-cash charge for impairment

of goodwill and other intangibles as a result of the decline in

stock price and current market conditions.

“Given that we have performed in-line with expectations for the

first half of the year while also considering the increasing FX

headwind, we believe it prudent to narrow our annual revenue

guidance range. We are now projecting 2024 revenue in the $1.73 to

$1.81 billion range, with earnings of $(2.01) to $(1.81) or $0.75

to $0.95 excluding restructuring and impairment charges. Our Q3

guidance assumes continued sequential improvement with projected

revenue of $430 to $465 million and earnings per share of $0.08 to

$0.18 or $0.15 to $0.25 excluding restructuring and impairment

charges.”

Conference Call

The Nu Skin Enterprises management team will host a conference

call with the investment community today at 5 p.m. (ET). Those

wishing to access the webcast, as well as the financial information

presented during the call, can visit the Investor Relations page on

the company's website at ir.nuskin.com. A replay of the webcast

will be available on the same page through Aug. 22, 2024.

About Nu Skin Enterprises Inc.

The Nu Skin Enterprises Inc. (NYSE: NUS) family of companies

includes Nu Skin and Rhyz Inc. Nu Skin is an integrated beauty and

wellness company, powered by a dynamic affiliate opportunity

platform, which operates in nearly 50 markets worldwide. Backed by

40 years of scientific research, the company’s products help people

look, feel and live their best with brands including Nu Skin®

personal care, Pharmanex® nutrition and ageLOC® anti-aging, which

includes an award-winning line of beauty device systems. Formed in

2018, Rhyz is a synergistic ecosystem of consumer, technology and

manufacturing companies focused on innovation within the beauty,

wellness and lifestyle categories.

Important Information Regarding Forward-Looking

Statements: This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, that represent the company’s current

expectations and beliefs. All statements other than statements of

historical fact are “forward-looking statements” for purposes of

federal and state securities laws and include, but are not limited

to, statements of management’s expectations regarding the macro

environment and the company’s performance, growth and growth

opportunities, strategies, sales force, shareholder value, product

previews and launches, product portfolio optimization,

transformation, evolution, operational and financial initiatives,

digital tools and initiatives, new market expansion, and plans for

developing and emerging markets; projections regarding revenue,

expenses, margins, tax rates, earnings per share, foreign currency

fluctuations, future dividends, uses of cash, financial position

and other financial items; statements of belief; and statements of

assumptions underlying any of the foregoing. In some cases, you can

identify these statements by forward-looking words such as

“believe,” “expect,” “anticipate,” “become,” “”plan,” accelerate,”

“project,” “continue,” “outlook,” “guidance,” “improve,” “will,”

“would,” “could,” “may,” “might,” the negative of these words and

other similar words.

The forward-looking statements and related assumptions involve

risks and uncertainties that could cause actual results and

outcomes to differ materially from any forward-looking statements

or views expressed herein. These risks and uncertainties include,

but are not limited to, the following:

- any failure of current or planned initiatives or products to

generate interest among the company’s sales force and customers and

generate sponsoring and selling activities on a sustained

basis;

- risk that direct selling laws and regulations in any of the

company’s markets, including the United States and Mainland China,

may be modified, interpreted or enforced in a manner that results

in negative changes to the company’s business model or negatively

impacts its revenue, sales force or business, including through the

interruption of sales activities, loss of licenses, increased

scrutiny of sales force actions, imposition of fines, or any other

adverse actions or events;

- economic conditions and events globally;

- competitive pressures in the company’s markets;

- risk that epidemics, including COVID-19 and related

disruptions, or other crises could negatively impact our

business;

- adverse publicity related to the company’s business, products,

industry or any legal actions or complaints by the company’s sales

force or others;

- political, legal, tax and regulatory uncertainties, including

trade policies, associated with operating in Mainland China and

other international markets;

- uncertainty regarding meeting restrictions and other government

scrutiny in Mainland China, as well as negative media and consumer

sentiment in Mainland China on our business operations and

results;

- risk of foreign-currency fluctuations and the currency

translation impact on the company’s business associated with these

fluctuations;

- uncertainties regarding the future financial performance of the

businesses the company has acquired;

- risks related to accurately predicting, delivering or

maintaining sufficient quantities of products to support planned

initiatives or launch strategies, and increased risk of inventory

write-offs if the company over-forecasts demand for a product or

changes its planned initiatives or launch strategies;

- regulatory risks associated with the company’s products, which

could require the company to modify its claims or inhibit its

ability to import or continue selling a product in a market if the

product is determined to be a medical device or if the company is

unable to register the product in a timely manner under applicable

regulatory requirements; and

- the company’s future tax-planning initiatives, any prospective

or retrospective increases in duties or tariffs on the company’s

products imported into the company’s markets outside of the United

States, and any adverse results of tax audits or unfavorable

changes to tax laws in the company’s various markets.

The company’s financial performance and the forward-looking

statements contained herein are further qualified by a detailed

discussion of associated risks set forth in the documents filed by

the company with the Securities and Exchange Commission. The

forward-looking statements set forth the company’s beliefs as of

the date that such information was first provided, and the company

assumes no duty to update the forward-looking statements contained

in this release to reflect any change except as required by

law.

Non-GAAP Financial Measures: Constant-currency revenue

change is a non-GAAP financial measure that removes the impact of

fluctuations in foreign-currency exchange rates, thereby

facilitating period-to-period comparisons of the company’s

performance. It is calculated by translating the current period’s

revenue at the same average exchange rates in effect during the

applicable prior-year period and then comparing that amount to the

prior-year period’s revenue. The company believes that

constant-currency revenue change is useful to investors, lenders

and analysts because such information enables them to gauge the

impact of foreign-currency fluctuations on the company’s revenue

from period to period.

Earnings per share, operating margin and income tax rate, each

excluding restructuring and impairment charges, also are non-GAAP

financial measures. Restructuring and impairment charges are not

part of the ongoing operations of our underlying business. The

company believes that these non-GAAP financial measures are useful

to investors, lenders and analysts because removing the impact of

these charges facilitates period-to-period comparisons of the

company’s performance. Please see the reconciliations of these

items to our earnings per share, operating margin and income tax

rate calculated under GAAP, below.

The following table sets forth revenue for the three-month

periods ended June 30, 2024, and 2023 for each of our reportable

segments (U.S. dollars in thousands):

Three Months Ended June

30,

Constant-Currency

2024

2023

Change

Change

Nu Skin

Americas

$

84,935

$

107,641

(21.1

)%

(15.1

)%

Mainland China

64,710

88,362

(26.8

)%

(24.5

)%

Southeast Asia/Pacific

60,341

63,764

(5.4

)%

(0.5

)%

Japan

42,587

50,862

(16.3

)%

(4.9

)%

South Korea

44,119

53,686

(17.8

)%

(14.3

)%

Europe & Africa

40,714

46,968

(13.3

)%

(12.3

)%

Hong Kong/Taiwan

33,846

37,108

(8.8

)%

(5.5

)%

Nu Skin other

(4

)

597

(100.7

)%

(100.8

)%

Total Nu Skin

371,248

448,988

(17.3

)%

(12.6

)%

Rhyz Investments

Manufacturing

51,473

45,551

13.0

%

13.0

%

Rhyz other

16,360

5,718

186.1

%

186.1

%

Total Rhyz Investments

67,833

51,269

32.3

%

32.3

%

Total

$

439,081

$

500,257

(12.2

)%

(8.0

)%

The following table sets forth revenue for the six-month periods

ended June 30, 2024, and 2023 for each of our reportable segments

(U.S. dollars in thousands):

Six Months Ended June

30,

Constant-Currency

2024

2023

Change

Change

Nu Skin

Americas

$

159,966

$

208,798

(23.4

)%

(17.5

)%

Mainland China

125,777

156,338

(19.5

)%

(16.5

)%

Southeast Asia/Pacific

120,406

131,574

(8.5

)%

(4.4

)%

Japan

86,823

103,468

(16.1

)%

(5.3

)%

South Korea

85,082

124,010

(31.4

)%

(28.5

)%

Europe & Africa

82,987

94,412

(12.1

)%

(12.1

)%

Hong Kong/Taiwan

64,312

71,656

(10.2

)%

(7.6

)%

Nu Skin other

668

482

38.6

%

38.6

%

Total Nu Skin

726,021

890,738

(18.5

)%

(14.1

)%

Rhyz Investments

Manufacturing

101,775

81,318

25.2

%

25.2

%

Rhyz other

28,591

9,663

195.9

%

195.9

%

Total Rhyz Investments

130,366

90,981

43.3

%

43.3

%

Total

$

856,387

$

981,719

(12.8

)%

(8.8

)%

The following table provides information concerning the number

of Customers, Paid Affiliates and Sales Leaders in our core Nu Skin

business for the three-month periods ended June 30, 2024, and

2023:

Three Months Ended

June 30,

2024

2023

Change

Customers

Americas

226,626

263,138

(14)%

Mainland China

179,021

214,907

(17)%

Southeast Asia/Pacific

88,662

106,283

(17)%

Japan

109,357

112,484

(3)%

South Korea

99,358

112,019

(11)%

Europe & Africa

143,336

177,472

(19)%

Hong Kong/Taiwan

47,154

54,815

(14)%

Total Customers

893,514

1,041,118

(14)%

Paid Affiliates

Americas

29,531

36,048

(18)%

Mainland China

24,404

28,825

(15)%

Southeast Asia/Pacific(1)

29,701

32,769

(9)%

Japan(1)

21,575

36,765

(41)%

South Korea

22,116

23,012

(4)%

Europe & Africa

17,402

19,906

(13)%

Hong Kong/Taiwan

10,757

10,327

4%

Total Paid Affiliates

155,486

187,652

(17)%

Sales Leaders

Americas

6,070

7,872

(23)%

Mainland China

10,266

13,777

(25)%

Southeast Asia/Pacific

5,601

5,814

(4)%

Japan

6,116

5,853

4%

South Korea

4,689

5,784

(19)%

Europe & Africa

3,432

4,105

(16)%

Hong Kong/Taiwan

2,418

2,602

(7)%

Total Sales Leaders

38,592

45,807

(16)%

(1) The June 30, 2024, number is affected

by a change in eligibility requirements for receiving certain

rewards within our compensation structure. We plan to implement

these changes in additional segments over the next several

quarters.

- “Customers” are persons who have purchased directly from the

Company during the three months ended as of the date indicated. Our

Customer numbers include members of our sales force who made such a

purchase, including Paid Affiliates and those who qualify as Sales

Leaders, but they do not include consumers who purchase directly

from members of our sales force.

- “Paid Affiliates” are any Brand Affiliates, as well as members

of our sales force in Mainland China, who earned sales compensation

during the three-month period. In all of our markets besides

Mainland China, we refer to members of our independent sales force

as “Brand Affiliates” because their primary role is to promote our

brand and products through their personal social networks.

- “Sales Leaders” are the three-month average of our monthly

Brand Affiliates, as well as sales employees and independent

marketers in Mainland China, who achieved certain qualification

requirements as of the end of each month of the quarter.

NU SKIN ENTERPRISES,

INC.

Consolidated Statements of

Income (Unaudited)

(U.S. dollars in thousands,

except per share amounts)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

Revenue

$

439,081

$

500,257

$

856,387

$

981,719

Cost of sales

131,904

135,542

255,146

269,130

Gross profit

307,177

364,715

601,241

712,589

Operating expenses:

Selling expenses

165,463

185,165

319,005

373,289

General and administrative expenses

117,921

137,044

242,487

270,943

Restructuring and impairment expenses

149,350

—

156,484

9,787

Total operating expenses

432,734

322,209

717,976

654,019

Operating income (loss)

(125,557

)

42,506

(116,735

)

58,570

Interest expense

6,720

5,769

14,045

10,657

Other expense, net

629

376

233

3,788

Income (loss) before provision for income

taxes

(131,648

)

37,113

(130,547

)

51,701

Provision (benefit) for income taxes

(13,390

)

10,221

(11,756

)

13,433

Net income (loss)

$

(118,258

)

$

26,892

$

(118,791

)

$

38,268

Net income (loss) per share:

Basic

$

(2.38

)

$

0.54

$

(2.39

)

$

0.77

Diluted

$

(2.38

)

$

0.54

$

(2.39

)

$

0.76

Weighted-average common shares outstanding

(000s):

Basic

49,688

49,931

49,613

49,789

Diluted

49,688

50,161

49,613

50,098

NU SKIN ENTERPRISES,

INC.

Consolidated Balance Sheets

(Unaudited)

(U.S. dollars in thousands)

June 30,

2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

224,250

$

256,057

Current investments

8,671

11,759

Accounts receivable, net

71,554

72,879

Inventories, net

243,994

279,978

Prepaid expenses and other

105,937

81,198

Total current assets

654,406

701,871

Property and equipment, net

411,918

432,965

Operating lease right-of-use assets

88,071

90,107

Goodwill

99,885

230,768

Other intangible assets, net

88,464

105,309

Other assets

243,228

245,443

Total assets

$

1,585,972

$

1,806,463

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

36,305

$

43,505

Accrued expenses

242,288

260,366

Current portion of long-term debt

30,000

25,000

Total current liabilities

308,593

328,871

Operating lease liabilities

70,318

70,943

Long-term debt

428,327

478,040

Other liabilities

92,570

106,641

Total liabilities

899,808

984,495

Commitments and contingencies

Stockholders’ equity:

Class A common stock – 500 million shares

authorized, $0.001 par value, 90.6 million shares issued

91

91

Additional paid-in capital

621,440

621,853

Treasury stock, at cost – 40.9 million and

41.1 million shares

(1,564,090

)

(1,570,440

)

Accumulated other comprehensive loss

(116,995

)

(100,006

)

Retained earnings

1,745,718

1,870,470

Total stockholders' equity

686,164

821,968

Total liabilities and stockholders’

equity

$

1,585,972

$

1,806,463

NU SKIN ENTERPRISES, INC.

Reconciliation of Operating Margin Excluding Impact of

Restructuring and Impairment to GAAP Operating Margin (in

thousands, except for per share amounts)

Three months ended June

30,

Six months ended June

30,

2024

2023

2024

2023

Operating Income

$

(125,557

)

$

42,506

$

(116,735

)

$

58,570

Impact of restructuring and

impairment:

Restructuring and impairment

149,350

-

156,484

9,787

Adjusted operating income

$

23,793

$

42,506

$

39,749

$

68,357

Operating margin

(28.6

)%

8.5

%

(13.6

)%

6.0

%

Operating margin, excluding restructuring

impact

5.4

%

8.5

%

4.6

%

7.0

%

Revenue

$

439,081

$

500,257

$

856,387

$

981,719

NU SKIN ENTERPRISES, INC.

Reconciliation of Effective Tax Rate Excluding Impact of

Restructuring and Impairment to GAAP Effective Tax Rate (in

thousands, except for per share amounts)

Three months ended June

30,

Six months ended June

30,

2024

2023

2024

2023

Provision (benefit) for income taxes

$

(13,390

)

$

10,221

$

(11,756

)

$

13,433

Impact of restructuring and impairment on

provision for income taxes

20,715

-

23,071

2,593

Provision for income taxes, excluding

impact of restructuring and impairment

$

7,325

$

10,221

$

11,315

$

16,026

Income before provision for income

taxes

(131,648

)

37,113

(130,547

)

51,701

Impact of restructuring and impairment

expense:

Restructuring and impairment

149,350

-

156,484

9,787

Income before provision for income taxes,

excluding impact of restructuring and impairment

$

17,702

$

37,113

$

25,937

$

61,488

Effective tax rate

10.2

%

27.5

%

9.0

%

26.0

%

Effective tax rate, excluding

restructuring and impairment impact

41.4

%

27.5

%

43.6

%

26.1

%

NU SKIN ENTERPRISES, INC.

Reconciliation of Earnings Per Share Excluding Impact of

Restructuring and Impairment to GAAP Earnings Per Share (in

thousands, except for per share amounts)

Three months ended June

30,

Six months ended June

30,

2024

2023

2024

2023

Net income

$

(118,258

)

$

26,892

$

(118,791

)

$

38,268

Impact of restructuring and impairment

expense:

Restructuring and impairment

149,350

-

156,484

9,787

Tax impact

(20,715

)

-

(23,071

)

(2,593

)

Adjusted net income

$

10,377

$

26,892

$

14,622

$

45,462

Diluted earnings per share

$

(2.38

)

$

0.54

$

(2.39

)

$

0.76

Diluted earnings per share, excluding

restructuring impact

$

0.21

$

0.54

$

0.29

$

0.91

Weighted-average common shares outstanding

(000)

49,688

50,161

49,613

50,098

NU SKIN ENTERPRISES, INC.

Reconciliation of Earnings Per Share Excluding Impact of

Restructuring and Impairment to GAAP Earnings Per Share

Three months ended

September 30, 2024

Year ended December 31,

2024

Low end

High end

Low end

High end

Earnings Per Share

$

0.08

$

0.18

$

(2.01

)

$

(1.81

)

Impact of restructuring and impairment

expense:

Restructuring and impairment

0.10

0.10

3.25

3.25

Tax impact

(0.03

)

(0.03

)

(0.50

)

(0.50

)

Adjusted EPS

$

0.15

$

0.25

$

0.75

$

0.95

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808830471/en/

Media: media@nuskin.com, (801) 345-6397 Investors:

investorrelations@nuskin.com, (801) 345-3577

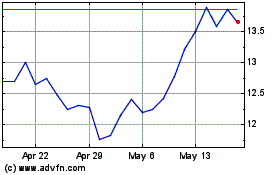

Nu Skin Enterprises (NYSE:NUS)

Historical Stock Chart

From Sep 2024 to Oct 2024

Nu Skin Enterprises (NYSE:NUS)

Historical Stock Chart

From Oct 2023 to Oct 2024