Submitted New Drug Application (NDA) for

taletrectinib to the U.S. Food and Drug Administration (FDA) in

October for the treatment of patients with advanced ROS1-positive

(ROS1+) non-small cell lung cancer (NSCLC), positioning Company to

commercialize taletrectinib, if approved, as early as mid-2025

Presented positive pooled data from the pivotal

Phase 2 TRUST-I and TRUST-II studies of taletrectinib in patients

with advanced ROS1+ NSCLC at the 2024 European Society of Medical

Oncology (ESMO) Congress

Appointed industry veteran Philippe Sauvage as

the company’s Chief Financial Officer (CFO) in October

Strong balance sheet with cash, cash

equivalents, and marketable securities of $549.1 million as of

September 30, 2024

Nuvation Bio Inc. (NYSE: NUVB), a late clinical-stage, global

biopharmaceutical company tackling some of the greatest unmet needs

in oncology, today reported financial results for the third quarter

ended September 30, 2024, and provided a business update.

David Hung, M.D., Founder, President, and Chief Executive

Officer of Nuvation Bio, reflected on the quarter and stated: “In

the third quarter, we continued to execute on our goal of bringing

taletrectinib to people living with ROS1-positive NSCLC as quickly

as possible, which has been our focus since we closed the

acquisition of AnHeart Therapeutics earlier this year. In October,

we completed the rolling submission of our NDA for line agnostic

full approval of taletrectinib in advanced ROS1-positive NSCLC,

which was supported by the pooled data from the pivotal Phase 2

TRUST-I and TRUST-II studies that we presented at ESMO. We believe

that these data – a confirmed objective response rate of 89% and

median duration of response approaching four years in the TKI-naïve

setting – are the strongest data seen to date in the ROS1 space and

increase taletrectinib’s potential to become a best-in-class

treatment option. Additionally, we are excited about the momentum

of our overall pipeline, including safusidenib, our mutant IDH1

inhibitor for both low- and high-grade diffuse IDH1-mutant glioma,

where we plan to make meaningful clinical progress next year, and

NUV-1511, our first drug-drug conjugate, which we continue to dose

escalate in the clinic.”

Recent Pipeline Updates:

Taletrectinib, ROS1 inhibitor: Advanced ROS1+ NSCLC

- Completed submission of an NDA for taletrectinib to the U.S.

FDA for the treatment of advanced ROS1+ NSCLC (line agnostic) in

October, in alignment with feedback from the U.S. FDA as part of a

pre-NDA meeting.

- Company expects the U.S. FDA to accept its NDA submission for

full approval as early as year-end 2024, which, if approved, will

allow Nuvation Bio to launch taletrectinib in the U.S. as early as

mid-2025.

- Taletrectinib is the only ROS1 tyrosine kinase inhibitor (TKI)

currently in development that has received Breakthrough Therapy

Designation from the U.S. FDA for the treatment of patients with

locally advanced or metastatic ROS1+ NSCLC who either have or have

not previously been treated with ROS1 TKIs (line agnostic).

- Pooled data from the pivotal Phase 2 TRUST-I and TRUST-II

studies were presented at the 2024 ESMO Congress in September. The

pooled analysis supported the Company’s NDA submission for

taletrectinib.

- Key highlights from the pooled analysis include:

- Confirmed objective responses in 89% of taletrectinib-treated

patients with advanced ROS1+ NSCLC who were tyrosine kinase

inhibitor (TKI)-naïve and 56% of those who were TKI-pretreated in

the study.

- Taletrectinib demonstrated durable responses and prolonged

disease control with long-term follow up; median duration of

response (DOR) and median progression-free survival (PFS) in

TKI-naïve patients were 44 months and 46 months, respectively.

- Taletrectinib’s safety and tolerability profile appeared

favorable, including a low treatment discontinuation rate of

7%.

- Data from the global, pivotal Phase 2 TRUST-II study were

presented at the 2024 World Conference on Lung Cancer in September

as part of the press program.

Safusidenib, mIDH1 inhibitor: Diffuse IDH1-mutant

glioma

- Safusidenib is a potentially best-in-class, novel, oral, brain

penetrant inhibitor of mutant IDH1.

- Phase 2 study of safusidenib in patients with diffuse

IDH1-mutant glioma remains ongoing.

NUV-1511, drug-drug conjugate (DDC): Advanced solid

tumors

- NUV-1511, the Company’s first clinical-stage DDC, fuses a

targeting agent to a widely used chemotherapy agent.

- Phase 1/2 dose escalation study of NUV-1511 in patients with

various advanced solid tumors remains ongoing.

NUV-868, BD2-selective BET inhibitor: Advanced solid

tumors

- As previously announced, the Company is evaluating next steps

for the NUV-868 program, including further development in

combination with approved products for indications in which

BD2-selective BET inhibitors may improve outcomes for

patients.

Corporate Updates:

- Appointed Philippe Sauvage as Chief Financial Officer in

October. Mr. Sauvage brings over 20 years of global leadership

experience in finance, operations, and commercialization within

healthcare and biopharmaceutical organizations.

- Appointed David Hung, M.D., Founder, President, and Chief

Executive Officer of Nuvation Bio, as Chairman of the Board of

Directors. Additionally, the Company appointed Robert Bazemore as

lead independent director.

Third Quarter 2024 Financial Results

As of September 30, 2024, Nuvation Bio had cash, cash

equivalents and marketable securities of $549.1 million.

For the three months ended September 30, 2024, research and

development expenses were $27.7 million, compared to $18.5 million

for the three months ended September 30, 2023. The increase was

primarily due to a $6.7 million increase in personnel-related costs

driven by the acquisition of AnHeart, stock-based compensation and

other benefits, $2.4 million increase in third-party costs related

to research services and drug manufacturing as a result of clinical

trial expense for taletrectinib and $0.1 million increase in

amortization of assembled workforce.

For the three months ended September 30, 2024, general and

administrative expenses were $19.6 million, compared to $7.8

million for the three months ended September 30, 2023. The increase

was due to a $5.3 million increase in personnel-related costs as a

result of the acquisition of AnHeart, $4.2 million increase in

sales and marketing expense, $1.8 million increase in professional

fees, $0.7 million increase in legal fees, and $0.4 million

increase in occupancy expense offset by $0.4 million increase in

foreign currency impact and $0.2 million decrease in insurance

expense.

For the three months ended September 30, 2024, Nuvation Bio

reported a net loss of $41.2 million, or $(0.15) per share. This

compares to a net loss of $19.6 million, or $(0.09) per share, for

the comparable period in 2023.

About Taletrectinib

Taletrectinib is an oral, potent, central nervous system-active,

selective, next-generation ROS1 inhibitor specifically designed for

the treatment of patients with advanced ROS1+ NSCLC. Taletrectinib

is being evaluated for the treatment of patients with advanced

ROS1+ NSCLC in two Phase 2 single-arm pivotal studies: TRUST-I

(NCT04395677) in China, and TRUST-II (NCT04919811), a global

study.

Taletrectinib has been granted Orphan Drug Designation by the

U.S. FDA for the treatment of patients with ROS1+ NSCLC and other

NSCLC indications, and Breakthrough Therapy Designations by both

the U.S. FDA and China’s National Medical Products Administration

(NMPA) for the treatment of patients with locally advanced or

metastatic ROS1+ NSCLC. Based on pooled results of the TRUST-I and

TRUST-II clinical studies, Nuvation Bio submitted an NDA for

taletrectinib to the U.S. FDA for the treatment of patients with

advanced ROS1+ NSCLC (line agnostic, full approval). Based on

results of the TRUST-I clinical study, China’s NMPA has accepted

and granted Priority Review Designations to New Drug Applications

for taletrectinib for the treatment of adult patients with locally

advanced or metastatic ROS1+ NSCLC who either have or have not

previously been treated with ROS1 TKIs.

About Nuvation Bio

Nuvation Bio is a late clinical-stage, global biopharmaceutical

company tackling some of the greatest unmet needs in oncology by

developing differentiated and novel product candidates. Nuvation

Bio’s portfolio of development candidates includes taletrectinib

(ROS1), safusidenib (mIDH1), NUV-1511 (DDC), and NUV-868 (BET).

Nuvation Bio was founded in 2018 by biopharma industry veteran

David Hung, M.D., who previously founded Medivation, Inc., which

brought to patients one of the world’s leading prostate cancer

medicines. Nuvation Bio has offices in New York, San Francisco,

Boston, and Shanghai. For more information, please visit

www.nuvationbio.com and follow us on LinkedIn.

Forward Looking Statements

Certain statements included in this press release that are not

historical facts are forward-looking statements for purposes of the

safe harbor provisions under the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements are

sometimes accompanied by words such as “believe,” “may,” “will,”

“estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,”

“would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,”

“outlook” and similar expressions that predict or indicate future

events or trends or that are not statements of historical matters.

These forward-looking statements include, but are not limited to,

our expectations regarding FDA acceptance, the length of the review

period, and full approval of a U.S. NDA for taletrectinib, the

timing of FDA approval and commercial launch, our expectations of

establishing a commercial organization, taletrectinib’s

best-in-class therapeutic potential in advanced ROS1+ NSCLC, the

potential therapeutic benefit of Nuvation Bio’s product candidates,

the advancement of our clinical programs, and the strength of

Nuvation Bio’s balance sheet. These statements are based on various

assumptions, whether or not identified in this press release, and

on the current expectations of the management team of Nuvation Bio

and are not predictions of actual performance. These

forward-looking statements are subject to a number of risks and

uncertainties that may cause actual results to differ from those

anticipated by the forward-looking statements, including but not

limited to the challenges associated with conducting drug discovery

and initiating or conducting clinical studies due to, among other

things, difficulties or delays in the regulatory process, enrolling

subjects or manufacturing or acquiring necessary products; the

emergence or worsening of adverse events or other undesirable side

effects; risks associated with preliminary and interim data, which

may not be representative of more mature data; and competitive

developments. Risks and uncertainties facing Nuvation Bio are

described more fully in its Form 10-Q filed with the SEC on

November 6, 2024, under the heading “Risk Factors,” and other

documents that Nuvation Bio has filed or will file with the SEC.

You are cautioned not to place undue reliance on the

forward-looking statements, which speak only as of the date of this

press release. Nuvation Bio disclaims any obligation or undertaking

to update, supplement or revise any forward-looking statements

contained in this press release.

NUVATION BIO INC. and Subsidiaries Consolidated Balance

Sheets Unaudited (In thousands, except share and per share

data)

September 30,

December 31,

2024

2023

Assets Current assets: Cash and cash equivalents

$

30,036

$

42,649

Accounts receivable, net of allowance for credit loss of $nil

112

-

Prepaid expenses and other current assets

11,598

1,519

Marketable securities

519,099

568,564

Interest receivable on marketable securities

4,140

3,702

Total current assets

564,985

616,434

Property and equipment, net of accumulated depreciation of $839 and

$666, respectively

719

717

Intangible assets, net of accumulated amortization of $291

2,779

-

Operating lease right-of-use assets

2,472

3,605

Lease security deposit

144

141

Other non-current assets

480

587

Total assets

$

571,579

$

621,484

Liabilities and stockholders' equity Current

liabilities: Accounts payable

$

12,380

$

2,209

Current operating lease liabilities

1,781

1,972

Contract liabilities, current portion

12,942

-

Short-term borrowings

8,426

-

Accrued expenses

23,506

9,793

Total current liabilities

59,035

13,974

Warrant liability

908

353

Contract liabilities, net of current portion

7,937

-

Non-current operating lease liabilities

985

2,035

Total liabilities

68,865

16,362

Stockholders' equity Class A and Class B common stock and

additional paid in capital, $0.0001 par value per share;

1,060,000,000 (Class A 1,000,000,000, Class B 60,000,000) shares

authorized as of September 30, 2024 and December 31, 2023,

336,248,642 (Class A 335,248,642, Class B 1,000,000) and

219,046,219 (Class A 218,046,219, Class B 1,000,000) shares issued

and outstanding as of September 30, 2024 and December 31, 2023,

respectively

1,362,631

947,745

Accumulated deficit

(861,298

)

(342,804

)

Accumulated other comprehensive income

1,381

181

Total stockholders' equity

502,714

605,122

Total liabilities and stockholders' equity

$

571,579

$

621,484

NUVATION BIO INC. and Subsidiaries Consolidated

Statements of Operations and Comprehensive Loss (In thousands,

except per share data)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenue

$

727

$

-

$

2,162

$

-

Cost of revenue

1,515

-

2,862

-

Gross deficit

(788

)

-

(700

)

-

Operating expenses: Research and development

27,731

18,561

69,820

55,938

Acquired in-process research and development

-

-

425,070

-

General and administrative

19,582

7,778

43,095

23,053

Total operating expenses

47,313

26,339

537,985

78,991

Loss from operations

(48,101

)

(26,339

)

(538,685

)

(78,991

)

Other income (expense): Interest income

6,726

6,523

21,000

17,588

Interest expense

(120

)

-

(252

)

-

Investment advisory fees

(237

)

(228

)

(749

)

(689

)

Change in fair value of warrant liability

533

383

209

260

Realized (loss) gain on marketable securities

(11

)

12

(17

)

(183

)

Total other income (expense), net

6,891

6,690

20,191

16,976

Loss before income taxes

(41,210

)

(19,649

)

(518,494

)

(62,015

)

Provision for income taxes

-

-

-

-

Net loss

$

(41,210

)

$

(19,649

)

$

(518,494

)

$

(62,015

)

Net loss attributable to common stockholders Net loss per

share attributable to common stockholders, basic and diluted

$

(0.15

)

$

(0.09

)

$

(2.11

)

$

(0.28

)

Weighted average common shares outstanding, basic and diluted

273,565

218,935

245,885

218,842

Comprehensive loss: Net loss

$

(41,210

)

$

(19,649

)

$

(518,494

)

$

(62,015

)

Other comprehensive loss, net of taxes: Currency translation

adjustment

(742

)

-

(594

)

-

Unrealized gain on available-for-sale securities

3,389

1,097

1,794

2,228

Comprehensive loss

$

(38,563

)

$

(18,552

)

$

(517,294

)

$

(59,787

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106502244/en/

Nuvation Bio Investor Contact: ir@nuvationbio.com

Nuvation Bio Media Contact: media@nuvationbio.com

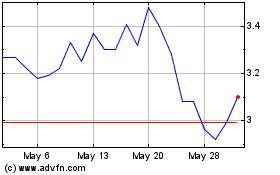

Panacea Acquisition (NYSE:NUVB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Panacea Acquisition (NYSE:NUVB)

Historical Stock Chart

From Feb 2024 to Feb 2025