FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16 of

the

Securities Exchange Act of 1934

For

November 2024

Commission

File Number: 001-10306

NatWest

Group plc

Gogarburn,

PO Box 1000

Edinburgh

EH12 1HQ

________________________________________________

(Address of

principal executive offices)

Indicate by check

mark whether the registrant files or will file annual reports under

cover of Form 20-F or Form 40-F.

Form

20-F __X__ Form

40-F _____

Indicate by check

mark whether the registrant by furnishing the information contained

in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange

Act of 1934.

Yes

_____ No __X__

If

“Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b): 82-

_____

This

report on Form 6-K, except for any information contained on any

websites linked in this report, shall be deemed incorporated by

reference into the company's Registration Statement on Form F-3

(File No. 333-261837) and to be a part thereof from the date which

it was filed, to the extent not superseded by documents or reports

subsequently filed or furnished.

|

Exhibit

No. 1

|

Off-Market Purchase

of Ordinary Shares from HMT dated 11 November 2024

|

|

Exhibit

No. 2

|

Q3 2024

Pillar 3 dated 12 November 2024

|

Exhibit

No. 1

NatWest Group plc

11 November 2024

Off-market purchase of 262,605,042 ordinary shares from His

Majesty's Treasury ("HM Treasury")

NatWest Group plc (the "Company") has agreed with HM Treasury to

make an off-market purchase (the "Off-Market Purchase") of

262,605,042 ordinary shares in the Company with a nominal value

of £1.0769* each ("Ordinary Shares") at a price of

380.8 pence per Ordinary Share, being the closing price of the

Ordinary Shares on the London Stock Exchange on 8 November 2024.

The total consideration for the Off-Market Purchase will be

£1 billion.

Paul Thwaite, CEO of NatWest Group commented:

"As a

result of NatWest Group's continued strong performance, we are

pleased to have today completed our second buy back of government

shares of 2024, further reducing HM Treasury's

shareholding.

This transaction represents another important

milestone on the path to full

privatisation. We believe it is a positive

use of capital for the bank and for our shareholders

and we are pleased with the

sustained momentum in reducing HM Treasury's stake

in NatWest

Group throughout this

year."

The purchased Ordinary Shares represent 3.16 per cent of the

Company's issued Ordinary Share capital (excluding treasury

shares). The Off-Market Purchase is expected to settle on 13

November 2024.

A contract (the "Directed Buyback Contract") between the Company

and HM Treasury was approved by the shareholders of the Company at

a General Meeting held on 6 February 2019 and signed on 7 February

2019. Amendments to the Directed Buyback Contract were approved by

the shareholders of the Company at a General Meeting held on 25

August 2022 and signed on 17 November 2022 and at the Annual

General Meeting held on 23 April 2024 (the "2024 AGM") and signed

on 7 May 2024. The authority from shareholders to make

off-market purchases of Ordinary Shares from HM Treasury (or its

nominee) under the terms of the Directed Buyback Contract was

renewed at the 2024 AGM.

The Company intends to cancel all of the purchased Ordinary

Shares.

HM Treasury is a related party to the Company and the

Off-Market Purchase, when aggregated with the other

transactions referred to in this announcement,

constitutes a related party transaction under UK Listing Rule

8.2.1R and this announcement is therefore being made

in accordance with that rule. Pursuant to the changes to the

Listing Rules which came into effect on 29 July 2024, the

Board of the Company (the "Board") confirms its view that the

Off-Market Purchase is fair and reasonable as far as the

shareholders of the Company are concerned and that the Board has

been so advised by Merrill Lynch International, a sponsor to

the Company.

The following transactions or arrangements between the Company and

HM Treasury have taken place in the last 12 months and were related

party transactions for the purposes of UK Listing Rule

8.2.1R.

|

Description

|

Value

|

|

Off-market purchase by the Company of shares from

HM Treasury, as announced on 31 May 2024 Off-Market Purchase of Ordinary Shares from HMT

(investis.com)

|

£1,240,921,312.75

|

|

Agreement

for the Company to cover costs incurred and to be incurred by HM

Treasury and UK Government Investments on behalf of HM Treasury in

connection with HM Treasury's holding of Ordinary Shares in the

Company and its disposal of such shares

|

Up

to £19,000,000

|

Upon settlement of the above transaction:

-

the Company will hold 287,667,803 of its Ordinary Shares

as treasury shares;

- the

Company will have in issue 8,043,477,072 Ordinary Shares (excluding

treasury shares) and 483,140 Cumulative Preference Shares of

£1; and

-

HM Treasury will hold approximately 12.03** per cent. of

the Company's voting rights.

The Company continues to target a CET1 ratio in the range of

13-14%.

*The nominal value of Ordinary Shares without rounding is

£1.076923076923077 per share

** This number is based on the Company's most recent TR-1

notification of major shareholdings on 31 October 2024 in respect

of HM Treasury's shareholding notification dated 30 October 2024

and does not take into account any sales executed by HM Treasury

since the notification date.

Further information:

Investor Relations

+ 44 (0)207 672 1758

Media Relations

+44 (0)131 523 4205

Legal Entity

Identifier: 2138005O9XJIJN4JPN90

Forward-looking statements

This document may include forward-looking statements within the

meaning of the United States Private Securities Litigation Reform

Act of 1995, such as statements that include, without limitation,

the words 'deliver', 'ambition', 'expect', 'estimate', 'project',

'anticipate', 'commit', 'believe', 'should', 'intend', 'will',

'plan', 'could', 'probability', 'risk', 'target', 'goal',

'objective', 'may', 'endeavour', 'outlook', 'optimistic',

'prospects' and similar expressions or variations on these

expressions. These statements concern or may affect future matters,

such as NatWest Group's future economic results, business plans and

strategies. In particular, this document may include

forward-looking statements relating to NatWest Group plc in respect

of, but not limited to: its outlook, guidance and targets

(including in relation to RoTE, income, operating costs, loan

impairment rate, CET1 ratio, RWA levels, payment of dividends and

participation in directed buybacks), its expectations in relation

to the Off-Market Purchase settlement date and its intentions in

respect of the Ordinary Shares (including the number of

outstanding Ordinary Shares, and their reissuance or cancellation),

its economic and political risks, its financial position,

profitability and financial performance, the implementation of its

strategy, and HMT's voting rights percentage. Forward-looking

statements are subject to a number of risks and uncertainties that

might cause actual results and performance to differ materially

from any expected future results or performance expressed or

implied by the forward-looking statements. Factors that could cause

or contribute to differences in current expectations include, but

are not limited to, future growth initiatives (including

acquisitions, joint ventures and strategic partnerships), the

outcome of legal, regulatory and governmental actions and

investigations, the level and extent of future impairments and

write-downs, legislative, political, fiscal and regulatory

developments, accounting standards, competitive conditions,

technological developments, interest and exchange rate

fluctuations, general economic and political conditions and

uncertainties (such as the direct and indirect impacts of

escalating armed conflicts) and the impact of climate-related risks

and the transitioning to a net zero economy. These and other

factors, risks and uncertainties that may impact any

forward-looking statement or NatWest Group plc's actual results are

discussed in NatWest Group plc's 2023 Annual Report on Form 20-F,

NatWest Group plc's Interim Management Statement for Q1, Q3 and H1

2024 on Form 6-K, and its other public filings. The forward-looking

statements contained in this document speak only as of the date of

this document and NatWest Group plc does not assume or undertake

any obligation or responsibility to update any of the

forward-looking statements contained in this document, whether as a

result of new information, future events or otherwise, except to

the extent legally required.

Exhibit

No. 2

NatWest Group plc

12 November 2024

Q3 2024 Pillar 3

NatWest Group plc today announces the publication of the Q3 2024

Pillar 3 documents for the following large subsidiaries

-

NatWest Holdings Limited

NatWest Markets Plc

National Westminster Bank Plc

The Royal Bank of Scotland plc

The Royal Bank of Scotland International Limited

Coutts & Company

The Q3 2024 Pillar 3 documents are available on the NatWest Group

plc website at

https://investors.natwestgroup.com/reports-archive

For further information, please contact

NatWest Group Investor Relations

Investor.relations@natwest.com

+44 207 672 1758

NatWest Group Press Office

+44 131 523 4205

LEI:

2138005O9XJIJN4JPN90 - NatWest Group plc

213800GDQMMREYFLQ454 - NatWest Holdings Limited

RR3QWICWWIPCS8A4S074 - NatWest Markets Plc

213800IBT39XQ9C4CP71 - National Westminster Bank Plc

549300WHU4EIHRP28H10 - The Royal Bank of

Scotland plc

21380078CCZSEEIIKA41 - The Royal Bank of Scotland International

Limited

549300OLXJ4Y010LOT34 - Coutts & Company

Signatures

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

|

|

NATWEST

GROUP plc (Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

29

November 2024

|

|

By:

|

|

|

|

|

|

|

|

Name:

|

Mark

Stevens

|

|

|

|

|

|

Title:

|

Assistant

Secretary

|

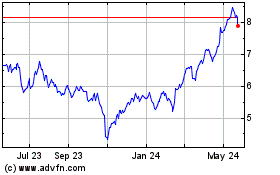

NatWest (NYSE:NWG)

Historical Stock Chart

From Nov 2024 to Dec 2024

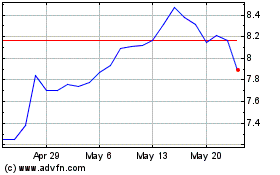

NatWest (NYSE:NWG)

Historical Stock Chart

From Dec 2023 to Dec 2024