Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

27 January 2024 - 4:21AM

Edgar (US Regulatory)

Nuveen

California

Select

Tax-Free

Income

Portfolio

Portfolio

of

Investments

November

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

LONG-TERM

INVESTMENTS

-

98.9% (100.0%

of

Total

Investments)

X

86,480,854

MUNICIPAL

BONDS

-

98.9% (100.0%

of

Total

Investments)

X

86,480,854

Consumer

Staples

-

0.2%

(0.2%

of

Total

Investments)

$

20

California

County

Tobacco

Securitization

Agency,

Tobacco

Settlement

Asset-

Backed

Bonds,

Los

Angeles

County

Securitization

Corporation,

Series

2020A,

4.000%,

6/01/49

6/30

at

100.00

$

18,015

1,265

Golden

State

Tobacco

Securitization

Corporation,

California,

Tobacco

Settlement

Asset-Backed

Bonds,

Capital

Appreciation

Series

2021B-2,

0.000%,

6/01/66

12/31

at

27.75

132,003

Total

Consumer

Staples

150,018

Education

and

Civic

Organizations

-

0.5%

(0.5%

of

Total

Investments)

60

California

School

Finance

Authority,

School

Facility

Revenue

Bonds,

Alliance

for

College-Ready

Public

Schools

Project,

Series

2016A,

5.000%,

7/01/46,

144A

7/25

at

100.00

59,560

385

California

School

Finance

Authority,

School

Facility

Revenue

Bonds,

Alliance

for

College-Ready

Public

Schools

Project,

Series

2016C,

5.000%,

7/01/46,

144A

7/25

at

101.00

382,180

Total

Education

and

Civic

Organizations

441,740

Health

Care

-

11.3%

(11.4%

of

Total

Investments)

California

Health

Facilities

Financing

Authority,

California,

Revenue

Bonds,

Sutter

Health,

Refunding

Series

2016B:

2,590

5.000%,

11/15/46

11/26

at

100.00

2,638,698

1,000

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

Adventist

Health

System/West,

Refunding

Series

2016A,

4.000%,

3/01/39

3/26

at

100.00

961,006

1,240

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

City

of

Hope

National

Medical

Center,

Series

2019,

4.000%,

11/15/45

11/29

at

100.00

1,147,213

1,000

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

CommonSpirit

Health,

Series

2020A,

4.000%,

4/01/49

4/30

at

100.00

939,614

1,365

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

Kaiser

Permanente

System,

Series

2017A-2,

4.000%,

11/01/44

11/27

at

100.00

1,345,440

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

Providence

Health

&

Services,

Refunding

Series

2014A:

70

5.000%,

10/01/38

10/24

at

100.00

70,469

255

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

Providence

Health

&

Services,

Series

2014B,

5.000%,

10/01/44

10/24

at

100.00

256,171

450

California

Municipal

Finance

Authority,

Revenue

Bonds,

Community

Health

System,

Series

2021A,

4.000%,

2/01/51

-

AGM

Insured

2/32

at

100.00

418,228

35

California

Municipal

Finance

Authority,

Revenue

Bonds,

Eisenhower

Medical

Center,

Refunding

Series

2017A,

5.000%,

7/01/47

7/27

at

100.00

35,053

130

California

Municipal

Finance

Authority,

Revenue

Bonds,

NorthBay

Healthcare

Group,

Series

2017A,

5.250%,

11/01/41

11/26

at

100.00

129,084

150

California

Municipal

Financing

Authority,

Certificates

of

Participation,

Palomar

Health,

Series

2022A,

5.250%,

11/01/52

-

AGM

Insured

11/32

at

100.00

164,333

350

California

Statewide

Communities

Development

Authority,

California,

Revenue

Bonds,

Loma

Linda

University

Medical

Center,

Series

2014A,

5.250%,

12/01/34

12/24

at

100.00

352,419

1,365

California

Statewide

Communities

Development

Authority,

California,

Revenue

Bonds,

Loma

Linda

University

Medical

Center,

Series

2016A,

5.250%,

12/01/56,

144A

6/26

at

100.00

1,325,432

70

California

Statewide

Community

Development

Authority,

Health

Revenue

Bonds,

Enloe

Medical

Center,

Refunding

Series

2022A,

5.250%,

8/15/52

-

AGM

Insured

8/32

at

100.00

75,592

Total

Health

Care

9,858,752

Nuveen

California

Select

Tax-Free

Income

Portfolio

(continued)

Portfolio

of

Investments

November

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

Housing/Multifamily

-

8.4%

(8.5%

of

Total

Investments)

$

615

California

Community

Housing

Agency,

California,

Essential

Housing

Revenue

Bonds,

Creekwood,

Series

2021A,

4.000%,

2/01/56,

144A

8/31

at

100.00

$

380,544

590

California

Community

Housing

Agency,

California,

Essential

Housing

Revenue

Bonds,

Glendale

Properties,

Junior

Series

2021A-2,

4.000%,

8/01/47,

144A

8/31

at

100.00

446,739

800

California

Community

Housing

Agency,

California,

Essential

Housing

Revenue

Bonds,

Serenity

at

Larkspur

Apartments,

Series

2020A,

5.000%,

2/01/50,

144A

2/30

at

100.00

625,800

200

California

Community

Housing

Agency,

California,

Essential

Housing

Revenue

Bonds,

Stoneridge

Apartments,

Series

2021A,

4.000%,

2/01/56,

144A

2/31

at

100.00

144,388

609

California

Housing

Finance

Agency,

Municipal

Certificate

Revenue

Bonds,

Class

A

Series

2019-2,

4.000%,

3/20/33

No

Opt.

Call

605,454

519

California

Housing

Finance

Agency,

Municipal

Certificate

Revenue

Bonds,

Class

A

Series

2021-1,

3.500%,

11/20/35

No

Opt.

Call

482,212

89

California

Housing

Finance

Agency,

Municipal

Certificate

Revenue

Bonds,

Class

A

Series2019-1,

4.250%,

1/15/35

No

Opt.

Call

87,449

513

California

Housing

Finance

Agency,

Municipal

Certificate

Revenue

Bonds,

Class

A

Social

Certificates

Series

2023-1,

4.375%,

9/20/36

No

Opt.

Call

496,683

California

Municipal

Finance

Authority,

Mobile

Home

Park

Revenue

Bonds,

Caritas

Affordable

Housing

Inc

Projects,

Senior

Series

2014A:

25

5.250%,

8/15/39

8/24

at

100.00

25,178

65

5.250%,

8/15/49

8/24

at

100.00

65,267

660

CMFA

Special

Finance

Agency

I,

California,

Essential

Housing

Revenue

Bonds,

The

Mix

at

Center

City,

Series

2021A-2,

4.000%,

4/01/56,

144A

4/31

at

100.00

450,095

225

CMFA

Special

Finance

Agency,

California,

Essential

Housing

Revenue

Bonds,

Enclave

Apartments,

Senior

Series

2022A-1,

4.000%,

8/01/58,

144A

2/32

at

100.00

164,259

320

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

777

Place-Pomona,

Senior

Lien

Series

2021A-2,

3.250%,

5/01/57,

144A

5/32

at

100.00

216,653

425

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Acacia

on

Santa

Rosa

Creek,

Senior

Lien

Series

2021A,

4.000%,

10/01/56,

144A

10/31

at

100.00

343,380

560

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Altana

Glendale,

Series

2021A-2,

4.000%,

10/01/56,

144A

10/31

at

100.00

401,346

650

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Center

City

Anaheim,

Series

2020A,

5.000%,

1/01/54,

144A

1/31

at

100.00

502,969

540

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Moda

at

Monrovia

Station,

Social

Series

2021A-2,

4.000%,

10/01/56,

144A

10/31

at

100.00

373,038

265

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Monterrey

Station

Apartments,

Senior

Lien

Series

2021A-1,

3.125%,

7/01/56,

144A

7/32

at

100.00

166,404

115

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Oceanaire-Long

Beach,

Social

Series

2021A-2,

4.000%,

9/01/56,

144A

9/31

at

100.00

80,008

250

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Parallel-Anaheim

Series

2021A,

4.000%,

8/01/56,

144A

8/31

at

100.00

182,096

50

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Pasadena

Portfolio

Social

Bond,

Mezzanine

Senior

Series

2021B,

4.000%,

12/01/56,

144A

12/31

at

100.00

34,677

100

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Pasadena

Portfolio

Social

Bond,

Series

2021A-2,

3.000%,

12/01/56

12/31

at

100.00

65,240

185

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Union

South

Bay,

Series

2021A-2,

4.000%,

7/01/56,

144A

7/31

at

100.00

131,503

160

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Westgate

Phase

1-Pasadena

Apartments,

Senior

Lien

Series

2021A-1,

3.000%,

6/01/47,

144A

6/31

at

100.00

111,556

585

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Westgate

Phase

1-Pasadena

Apartments,

Senior

Lien

Series

2021A-2,

3.125%,

6/01/57,

144A

6/31

at

100.00

363,398

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

Housing/Multifamily

(continued)

$

600

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Wood

Creek

Apartments,

Senior

Lien

Series

2021A-1,

3.000%,

12/01/49

6/32

at

100.00

$

387,724

Total

Housing/Multifamily

7,334,060

Tax

Obligation/General

-

20

.3%

(20.6%

of

Total

Investments)

620

Butte-Glenn

Community

College

District,

Butte

and

Glenn

Counties,

California,

General

Obligation

Bonds,

Election

2016

Series

2017A,

5.250%,

8/01/46

8/27

at

100.00

652,402

1,000

California

State,

General

Obligation

Bonds,

Various

Purpose

Refunding

Series

2015,

5.000%,

8/01/34

8/25

at

100.00

1,026,135

1,000

Chaffey

Joint

Union

High

School

District,

San

Bernardino

County,

California,

General

Obligation

Bonds,

Election

2012

Series

2017C,

5.250%,

8/01/47

2/27

at

100.00

1,040,608

1,000

Marin

Healthcare

District,

Marin

County,

California,

General

Obligation

Bonds,

2013

Election,

Series

2015A,

4.000%,

8/01/45

8/25

at

100.00

971,545

2,790

Natomas

Unified

School

District,

Sacramento

County,

California,

General

Obligation

Bonds,

Election

of

2018,

Series

2020A,

4.000%,

8/01/49

-

AGM

Insured

8/26

at

100.00

2,756,544

7,575

Palomar

Pomerado

Health,

California,

General

Obligation

Bonds,

Convertible

Capital

Appreciation,

Election

2004

Series

2010A,

0.000%,

8/01/34

No

Opt.

Call

5,007,349

65

Puerto

Rico,

General

Obligation

Bonds,

Restructured

Series

2022A-1,

4.000%,

7/01/41

7/31

at

103.00

56,286

1,000

San

Benito

High

School

District,

San

Benito

and

Santa

Clara

Counties,

California,

General

Obligation

Bonds,

2016

Election

Series

2017,

5.250%,

8/01/46

8/27

at

100.00

1,051,563

8,075

San

Bernardino

Community

College

District,

California,

General

Obligation

Bonds,

Election

of

2008

Series

2009B,

0.000%,

8/01/44

No

Opt.

Call

3,120,816

2,000

(c)

West

Hills

Community

College

District,

California,

General

Obligation

Bonds,

School

Facilities

Improvement

District

3,

2008

Election

Series

2011,

0.000%,

8/01/38

-

AGM

Insured

8/31

at

100.00

2,129,245

Total

Tax

Obligation/General

17,812,493

Tax

Obligation/Limited

-

13.2%

(13.4%

of

Total

Investments)

1,000

Bell

Community

Redevelopment

Agency,

California,

Tax

Allocation

Bonds,

Bell

Project

Area,

Series

2003,

5.625%,

10/01/33

-

RAAI

Insured

1/24

at

100.00

1,003,155

20

Brentwood

Infrastructure

Financing

Authority,

California,

Infrastructure

Revenue

Bonds,

Refunding

Subordinated

Series

2014B,

5.000%,

9/02/36

9/24

at

100.00

20,112

2,000

California

State

Public

Works

Board,

Lease

Revenue

Bonds,

Department

of

Corrections

&

Rehabilitation,

Various

Correctional

Facilities

Series

2013F,

5.250%,

9/01/33

1/24

at

100.00

2,003,015

15

Golden

State

Tobacco

Securitization

Corporation,

California,

Tobacco

Settlement

Asset-Backed

Revenue

Bonds,

Series

2022A-1,

5.000%,

6/01/51

12/31

at

100.00

15,399

1,000

Los

Angeles

County

Metropolitan

Transportation

Authority,

California,

Measure

R

Sales

Tax

Revenue

Bonds,

Senior

Series

2016A,

5.000%,

6/01/39

6/26

at

100.00

1,036,091

3,000

Los

Angeles

County

Metropolitan

Transportation

Authority,

California,

Proposition

C

Sales

Tax

Revenue

Bonds,

Green

Senior

Lien

Series

2019A,

5.000%,

7/01/44

7/28

at

100.00

3,187,471

1,000

Norco

Redevelopment

Agency,

California,

Tax

Allocation

Bonds,

Project

Area

1,

Series

2009,

7.000%,

3/01/34

1/24

at

100.00

1,003,178

1,118

Puerto

Rico

Sales

Tax

Financing

Corporation,

Sales

Tax

Revenue

Bonds,

Restructured

2018A-1,

5.000%,

7/01/58

7/28

at

100.00

1,086,785

550

Puerto

Rico

Sales

Tax

Financing

Corporation,

Sales

Tax

Revenue

Bonds,

Taxable

Restructured

Cofina

Project

Series

2019A-2,

4.784%,

7/01/58

7/28

at

100.00

518,136

180

River

Islands

Public

Financing

Authority,

California,

Special

Tax

Bonds,

Community

Facilities

District

2003-1

Improvement

Area

1,

Refunding

Series

2022A-1,

5.250%,

9/01/52

-

AGM

Insured

9/29

at

103.00

194,739

60

San

Francisco

City

and

County

Redevelopment

Agency

Successor

Agency,

California,

Special

Tax

Bonds,

Community

Facilities

District

7,

Hunters

Point

Shipyard

Phase

One

Improvements,

Refunding

Series

2014,

5.000%,

8/01/39

8/24

at

100.00

60,268

20

Signal

Hill

Redevelopment

Agency,

California,

Project

1

Tax

Allocation

Bonds,

Series

2011,

7.000%,

10/01/26

1/24

at

100.00

20,052

1,285

Stockton

Public

Financing

Authority,

California,

Revenue

Bonds,

Arch

Road

East

Community

Facility

District

99-02,

Series

2018A,

5.000%,

9/01/28

9/25

at

103.00

1,354,091

Nuveen

California

Select

Tax-Free

Income

Portfolio

(continued)

Portfolio

of

Investments

November

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

Tax

Obligation/Limited

(continued)

$

60

Transbay

Joint

Powers

Authority,

California,

Tax

Allocation

Bonds,

Senior

Green

Series

2020A,

5.000%,

10/01/45

4/30

at

100.00

$

60,828

Total

Tax

Obligation/Limited

11,563,320

Transportation

-

14.0%

(14.1%

of

Total

Investments)

60

California

Municipal

Finance

Authority,

Special

Facility

Revenue

Bonds,

United

Airlines,

Inc.

Los

Angeles

International

Airport

Project,

Series

2019,

4.000%,

7/15/29,

(AMT)

No

Opt.

Call

58,098

Foothill/Eastern

Transportation

Corridor

Agency,

California,

Toll

Road

Revenue

Bonds,

Refunding

Series

2013A:

1,000

5.000%,

1/15/42

-

AGM

Insured

1/24

at

100.00

1,001,021

800

Long

Beach,

California,

Harbor

Revenue

Bonds,

Series

2015D,

5.000%,

5/15/42

5/25

at

100.00

815,033

1,860

Los

Angeles

Department

of

Airports,

California,

Revenue

Bonds,

Los

Angeles

International

Airport,

Refunding

&

Subordinate

Series

2022C,

4.000%,

5/15/40,

(AMT)

5/32

at

100.00

1,825,899

1,525

Los

Angeles

Department

of

Airports,

California,

Revenue

Bonds,

Los

Angeles

International

Airport,

Subordinate

Lien

Series

2022A,

5.000%,

5/15/45,

(AMT)

5/32

at

100.00

1,600,622

3,250

Riverside

County

Transportation

Commission,

California,

Toll

Revenue

Senior

Lien

Bonds,

RCTC

91

Express

Lanes,

Refunding

Series

2021B-1,

4.000%,

6/01/39

6/31

at

100.00

3,170,645

305

San

Diego

County

Regional

Airport

Authority,

California,

Airport

Revenue

Bonds,

International

Senior

Series

2023B,

5.000%,

7/01/53,

(AMT)

7/33

at

100.00

315,588

1,000

San

Diego

County

Regional

Airport

Authority,

California,

Airport

Revenue

Bonds,

Subordinate

Series

2021B,

5.000%,

7/01/46,

(AMT)

7/31

at

100.00

1,032,766

1,400

San

Francisco

Airport

Commission,

California,

Revenue

Bonds,

San

Francisco

International

Airport,

Refunding

Second

Series

2023C,

5.500%,

5/01/40,

(AMT)

5/33

at

100.00

1,568,525

90

San

Joaquin

Hills

Transportation

Corridor

Agency,

Orange

County,

California,

Refunding

Senior

Lien

Toll

Road

Revenue

Bonds,

Series

2021A,

4.000%,

1/15/50

1/32

at

100.00

88,026

750

San

Joaquin

Hills

Transportation

Corridor

Agency,

Orange

County,

California,

Toll

Road

Revenue

Bonds,

Refunding

Junior

Lien

Series

2014B,

5.250%,

1/15/44

1/25

at

100.00

756,771

Total

Transportation

12,232,994

U.S.

Guaranteed

-

10.4%

(10.5

%

of

Total

Investments)

(d)

California

Health

Facilities

Financing

Authority,

California,

Revenue

Bonds,

Sutter

Health,

Refunding

Series

2016B:

410

5.000%,

11/15/46,

(Pre-refunded

11/15/26)

11/26

at

100.00

437,619

2,500

California

Health

Facilities

Financing

Authority,

California,

Revenue

Bonds,

Sutter

Health,

Series

2016A,

5.000%,

11/15/41,

(Pre-refunded

11/15/25)

11/25

at

100.00

2,607,942

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

Providence

Health

&

Services,

Refunding

Series

2014A:

55

5.000%,

10/01/38,

(Pre-refunded

10/01/24)

10/24

at

100.00

55,923

530

Foothill/Eastern

Transportation

Corridor

Agency,

California,

Toll

Road

Revenue

Bonds,

Refunding

Junior

Lien

Series

2013C,

6.500%,

1/15/43,

(Pre-

refunded

1/15/24)

1/24

at

100.00

531,989

Foothill/Eastern

Transportation

Corridor

Agency,

California,

Toll

Road

Revenue

Bonds,

Refunding

Series

2013A:

1,170

5.750%,

1/15/46,

(Pre-refunded

1/15/24)

1/24

at

100.00

1,173,447

1,175

6.000%,

1/15/53,

(Pre-refunded

1/15/24)

1/24

at

100.00

1,178,751

Golden

State

Tobacco

Securitization

Corporation,

California,

Enhanced

Tobacco

Settlement

Asset-Backed

Revenue

Bonds,

Refunding

Series

2015A:

1,350

5.000%,

6/01/40,

(Pre-refunded

6/01/25)

6/25

at

100.00

1,391,506

1,650

5.000%,

6/01/40,

(Pre-refunded

6/01/25)

6/25

at

100.00

1,700,730

Total

U.S.

Guaranteed

9,077,907

Utilities

-

20.6%

(20.8%

of

Total

Investments)

California

Pollution

Control

Financing

Authority,

Water

Furnishing

Revenue

Bonds,

Poseidon

Resources

Channelside

LP

Desalination

Project,

Series

2012:

375

5.000%,

7/01/37,

(AMT),

144A

7/24

at

100.00

375,076

1,160

5.000%,

11/21/45,

(AMT),

144A

7/24

at

100.00

1,152,331

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

Utilities

(continued)

$

2,000

Irvine

Ranch

Water

District,

California,

Certificates

of

Participation,

Irvine

Ranch

Water

District

Series

2016,

5.000%,

3/01/41

9/26

at

100.00

$

2,078,256

645

Long

Beach

Bond

Finance

Authority,

California,

Natural

Gas

Purchase

Revenue

Bonds,

Series

2007A,

5.500%,

11/15/37

No

Opt.

Call

716,361

1,970

Los

Angeles

Department

of

Water

and

Power,

California,

Power

System

Revenue

Bonds,

Series

2015E,

5.000%,

7/01/44

7/24

at

100.00

1,979,615

2,000

Los

Angeles

Department

of

Water

and

Power,

California,

Power

System

Revenue

Bonds,

Series

2020B,

5.000%,

7/01/40

7/30

at

100.00

2,195,124

Los

Angeles

Department

of

Water

and

Power,

California,

Waterworks

Revenue

Bonds,

Series

2017A:

3,000

5.000%,

7/01/44

1/27

at

100.00

3,114,428

2,900

4.000%,

7/01/47

1/27

at

100.00

2,875,126

1,000

Los

Angeles

Department

of

Water

and

Power,

California,

Waterworks

Revenue

Bonds,

Series

2018B,

5.000%,

7/01/38

7/28

at

100.00

1,075,403

250

Puerto

Rico

Aqueduct

and

Sewerage

Authority,

Revenue

Bonds,

Refunding

Senior

Lien

Series

2020A,

5.000%,

7/01/47,

144A

7/30

at

100.00

242,580

2,050

Sacramento

County

Sanitation

Districts

Financing

Authority,

California,

Revenue

Bonds,

Sacramento

Regional

County

Sanitation

District,

Series

2020A,

5.000%,

12/01/50

12/30

at

100.00

2,205,270

Total

Utilities

18,009,570

Total

Municipal

Bonds

(cost

$85,539,728)

86,480,854

Total

Long-Term

Investments

(cost

$85,539,728)

86,480,854

Other

Assets

&

Liabilities,

Net

-

1.1%

992,955

Net

Assets

Applicable

to

Common

Shares

-

100%

$

87,473,809

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Municipal

Bonds

$

–

$

86,480,854

$

–

$

86,480,854

Total

$

–

$

86,480,854

$

–

$

86,480,854

Nuveen

California

Select

Tax-Free

Income

Portfolio

(continued)

Portfolio

of

Investments

November

30,

2023

(Unaudited)

(a)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(b)

Optional

Call

Provisions:

Dates

(month

and

year)

and

prices

of

the

earliest

optional

call

or

redemption.

There

may

be

other

call

provisions

at

varying

prices

at

later

dates.

Certain

mortgage-backed

securities

may

be

subject

to

periodic

principal

paydowns.

(c)

Step-up

coupon

bond,

a

bond

with

a

coupon

that

increases

("steps

up"),

usually

at

regular

intervals,

while

the

bond

is

outstanding.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(d)

Backed

by

an

escrow

or

trust

containing

sufficient

U.S.

Government

or

U.S.

Government

agency

securities,

which

ensure

the

timely

payment

of

principal

and

interest.

144A

Investment

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

investments

may

only

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

AMT

Alternative

Minimum

Tax

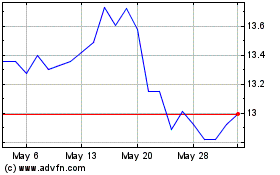

Nuveen California Select... (NYSE:NXC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Nuveen California Select... (NYSE:NXC)

Historical Stock Chart

From Mar 2024 to Mar 2025