false

0001039684

0001039684

2025-01-31

2025-01-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

January 31, 2025

ONEOK, Inc.

(Exact name of registrant as specified in its charter)

| Oklahoma |

|

001-13643 |

|

73-1520922 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

100 West Fifth Street; Tulsa, OK

(Address of principal executive offices)

74103

(Zip Code)

(918) 588-7000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common stock, par value of $0.01 |

|

OKE |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

On January

31, 2025 (the “Closing Date”), (i) Elk Merger Sub I, L.L.C. (“Merger Sub I”), a Delaware limited liability company

and direct, wholly-owned subsidiary of ONEOK, Inc., an Oklahoma corporation (“ONEOK”), merged (the “First Merger”)

with and into EnLink Midstream, LLC, a Delaware limited liability company (“EnLink”), with EnLink surviving the First Merger,

and (ii) promptly following the First Merger, EnLink, as the surviving entity in the First Merger, merged (the “Second Merger”

and, together with the First Merger, the “Mergers”) with and into Elk Merger Sub II, L.L.C. (“Merger Sub II”),

a Delaware limited liability company and direct, wholly-owned subsidiary of ONEOK, with Merger Sub II surviving the Second Merger as a

direct, wholly-owned subsidiary of ONEOK. The Mergers were effected pursuant to the Agreement and Plan of Merger (the “Merger Agreement”),

dated as of November 24, 2024, by and among ONEOK, Merger Sub I, Merger Sub II, EnLink and EnLink Midstream Manager, LLC, the managing

member of EnLink (the “Manager”).

Item 2.01 Completion of Acquisition or Disposition of Assets.

The disclosure set forth in the Introductory Note

above is incorporated into this Item 2.01 by reference. As a result of the Mergers, each common unit representing limited liability company

interests in EnLink (the “EnLink Units”) issued and outstanding immediately prior to the time the First Merger became effective

(the “First Merger Effective Time”), other than those EnLink Units owned by ONEOK, was converted into the right to receive

0.1412 shares (the “Exchange Ratio”) of ONEOK common stock, par value $0.01 (the “ONEOK common stock”). No

fractional shares of ONEOK common stock will be issued in the Mergers, and holders of EnLink Units will, instead, receive cash in lieu

of fractional shares of ONEOK common stock, if any, as provided in the Merger Agreement.

In addition, at the First Merger Effective Time:

(i) each

award of restricted incentive units of EnLink (each, an “EnLink RIU” and such award, an “EnLink RIU Award”),

whether vested or unvested, that was outstanding immediately prior to the First Merger Effective Time, was assumed by ONEOK and converted

into a time-based restricted stock unit award with respect to ONEOK common stock relating to a number of shares of ONEOK common stock

equal to the number of EnLink Units subject to such EnLink RIU Award immediately prior to the First Merger Effective Time multiplied

by the Exchange Ratio, rounded up or down to the nearest whole share of ONEOK common stock and otherwise subject to the same terms and

conditions (including as to vesting and forfeiture) as were applicable to such EnLink RIU Award immediately prior to the First Merger

Effective Time; and

(ii) each

award of performance units of EnLink (each, an “EnLink PU” and such award, an “EnLink PU Award”), whether vested

or unvested, that was outstanding immediately prior to the First Merger Effective Time, was assumed by ONEOK and converted into a time-based

restricted stock unit award with respect to ONEOK common stock relating to a number of shares of ONEOK common stock with respect to each

tranche of the EnLink PU Award as identified in the applicable award agreement (an “EnLink PU Tranche”) equal to the number

of EnLink Units subject to such EnLink PU Tranche immediately prior to the First Merger Effective Time multiplied by the Exchange Ratio,

rounded up or down to the nearest whole share of ONEOK Common Stock and otherwise subject to the same terms and conditions (including

as to vesting and forfeiture, except any performance-based vesting condition will not apply) as were applicable to such EnLink PU Award

immediately prior to the First Merger Effective Time.

The issuance of shares of ONEOK common stock in

connection with the First Merger was registered under the Securities Act of 1933, as amended, pursuant to our registration statement on

Form S-4 (File No. 33-283681) (the “Registration Statement”), declared effective by the U.S. Securities and Exchange Commission

(the “SEC”) on December 30, 2024. The proxy statement/prospectus included in the Registration Statement contains additional

information about the Mergers. Prior to the consummation of the Mergers and without giving effect to the issuance of the EnLink Units

issued upon the exchange of all the outstanding Series B Cumulative Convertible Preferred Units of EnLink Midstream Partners, LP (“ENLK”),

ONEOK beneficially owned approximately 43.7% of the outstanding EnLink Units and all of the membership interests in the Manager.

A

copy of the Merger Agreement is attached hereto as Exhibit 2.1 and is incorporated by reference herein. The foregoing summary of the Merger

Agreement does not purport to be complete, has been included to provide investors and security holders with information regarding the

terms of the Merger Agreement and is qualified in its entirety by reference to the full text and the terms and conditions of the Merger

Agreement. It is not intended to provide any other factual information about ONEOK, Merger Sub I, Merger Sub II, EnLink or Manager or

their respective subsidiaries and affiliates.

Item 7.01 Regulation FD Disclosure.

On January 31, 2025, ONEOK

issued a press release announcing the completion of the Mergers. A copy of the press release is attached hereto as Exhibit 99.1

to this Current Report and is incorporated into this Item 7.01 by reference.

On January 31, 2025, following

the completion of the Mergers, ONEOK effected an internal reorganization of the entities acquired pursuant to the First Merger. In connection

with such internal reorganization, (i) ONEOK assumed the obligations of Merger Sub II, as successor in interest to EnLink, and ENLK under

each of their respective indentures and the outstanding senior notes issued thereunder (collectively, the “assumed notes”),

(ii) Merger Sub II and ENLK provided guarantees of the assumed notes, (iii) Merger Sub II and ENLK provided guarantees of the obligations

of ONEOK and ONEOK Partners, L.P. under their respective indentures and the outstanding senior notes issued thereunder, and (iv) Merger

Sub II and ENLK provided guarantees of the obligations of ONEOK under its amended and restated credit agreement.

The information set forth

in this Item 7.01 and the attached Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended.

Item 9.01. Financial Statements and Exhibits

EXHIBIT INDEX

Exhibit

Number |

|

Description |

| 2.1 |

|

Agreement and Plan of Merger, dated as of November 24, 2024, by and among ONEOK, Inc., Elk Merger Sub I, L.L.C., Elk Merger Sub II, L.L.C., EnLink Midstream, LLC and EnLink Midstream Manager, LLC (incorporated by reference to Exhibit 2.1 to our Current Report on Form 8-K dated November 25, 2024, filed with the SEC on November 25, 2024, file No. 001-13643). |

| 99.1 |

|

News release issued by ONEOK, Inc. dated January 31, 2025. |

| 104 |

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document (contained in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

ONEOK, INC. |

| |

|

|

| Date: January 31, 2025 |

By: |

/s/ Walter S. Hulse III |

| |

|

Walter S. Hulse III |

| |

|

Chief Financial Officer, Treasurer and |

| |

|

Executive Vice President, Investor Relations and Corporate Development |

Exhibit 99.1

|

News |

| Jan. 31, 2025 |

Analyst Contact: |

Megan Patterson |

| |

|

918-561-5325 |

| |

Media Contact: |

Alicia Buffer |

| |

|

918-861-3749 |

ONEOK

Announces Completion of

Strategic

EnLink Midstream Acquisition

Transaction Strengthens ONEOK’s Integrated

Value Chain and

Further Diversifies Platform

TULSA, Okla. – Jan. 31, 2025 – ONEOK,

Inc. (NYSE: OKE) (ONEOK) today announced that it has completed its acquisition of EnLink Midstream, LLC (EnLink).

EnLink unitholders approved the transaction at

a special meeting on Jan. 30, 2025.

“The completion of this acquisition further

enhances ONEOK’s integrated midstream business and provides exceptional value to all stakeholders, including EnLink unitholders

who we now welcome as ONEOK shareholders,” said Pierce H. Norton II, ONEOK president and chief executive officer.

“We welcome EnLink’s employees to the

ONEOK team,” added Norton. “We look forward to the many benefits this acquisition can provide.”

EnLink unitholders, other than ONEOK, received

0.1412 shares of ONEOK common stock for each outstanding EnLink common unit. EnLink common units will no longer be publicly traded on

the New York Stock Exchange.

ABOUT ONEOK:

At ONEOK (NYSE: OKE), we deliver energy products and services vital

to an advancing world. We are a leading midstream operator that provides gathering, processing, fractionation, transportation and storage

services. Through our approximately 60,000-mile pipeline network, we transport the natural gas, natural gas liquids (NGLs), refined products

and crude oil that help meet domestic and international energy demand, contribute to energy security and provide safe, reliable and responsible

energy solutions needed today and into the future. As one of the largest diversified energy infrastructure companies in North America,

ONEOK is delivering energy that makes a difference in the lives of people in the U.S. and around the world.

ONEOK is an S&P 500 company headquartered in Tulsa, Oklahoma.

For information about ONEOK, visit the website: www.oneok.com. For

the latest news about ONEOK, find us on LinkedIn, Facebook, X and Instagram.

-more-

ONEOK Announces Completion of Strategic EnLink Midstream Acquisition

Jan. 31, 2025

Page 2

ABOUT ENLINK MIDSTREAM:

Headquartered in Dallas, EnLink Midstream provides integrated midstream

infrastructure services for natural gas, crude oil, and NGLs, as well as CO2 transportation for carbon capture and sequestration

(CCS). Our large-scale, cash-flow-generating asset platforms are in premier production basins and core demand centers, including the Permian

Basin, Louisiana, Oklahoma, and North Texas. EnLink is focused on maintaining the financial flexibility and operational excellence that

enables us to strategically grow and create sustainable value. Visit http://www.EnLink.com to learn how EnLink connects energy to life.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS:

This communication contains “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements, other than statements of historical fact, included in this communication that address activities, events or developments

that ONEOK expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,”

“project,” “predict,” “believe,” “expect,” “anticipate,” “potential,”

“opportunity,” “create,” “intend,” “could,” “would,” “may,” “plan,”

“will,” “guidance,” “look,” “goal,” “target,” “future,” “build,”

“focus,” “continue,” “strive,” “allow” or the negative of such terms or other variations

thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking

statements. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements

include, but are not limited to, statements regarding the anticipated benefits of the acquisition. There are a number of risks and uncertainties

that could cause actual results to differ materially from the forward-looking statements included in this communication. These include

the risk that ONEOK will not be able to successfully integrate EnLink’s business; the risk that cost savings, synergies and growth

from the proposed transaction may not be fully realized or may take longer to realize than expected; the risk that the credit ratings

following the acquisition may be different from what ONEOK expects; the risk of potential adverse reactions or changes to business or

employee relationships, including those resulting from the completion of the acquisition the risk that changes in ONEOK’s capital

structure could have adverse effects on the market value of its securities; risks related to the ability of the parties to retain customers

and retain and hire key personnel and maintain relationships with their suppliers and customers and on each of the companies’ operating

results and business generally; the risk that the integration process could distract ONEOK’s management team from ongoing business

operations or cause either of the companies to incur substantial costs; risks related to the impact of any economic downturn and any substantial

decline in commodity prices; the risk of changes in governmental regulations or enforcement practices, especially with respect to environmental,

health and safety matters; and other important factors that could cause actual results to differ materially from those projected. All

such factors are difficult to predict and are beyond ONEOK’s control, including those detailed in ONEOK’s Annual Reports on

Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on ONEOK’s website at www.oneok.com

and on the website of the SEC at www.sec.gov, and those detailed in EnLink’s Annual Reports on Form 10-K, Quarterly Reports

on Form 10-Q and Current Reports on Form 8-K that are available on EnLink’s website at www.enlink.com and on the website

of the SEC at www.sec.gov. All forward-looking statements are based on assumptions that ONEOK believes to be reasonable but that

may not prove to be accurate. Any forward-looking statement speaks only as of the date on which such statement is made, ONEOK undertakes

no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise,

except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak

only as of the date hereof.

###

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

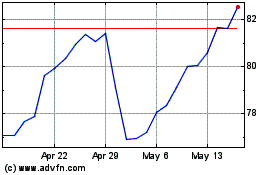

ONEOK (NYSE:OKE)

Historical Stock Chart

From Jan 2025 to Feb 2025

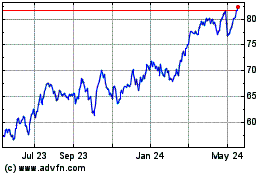

ONEOK (NYSE:OKE)

Historical Stock Chart

From Feb 2024 to Feb 2025