Smithfield to Explore Packaged Meat - Analyst Blog

28 June 2011 - 6:45PM

Zacks

Following the pull out from the

acquisition deal of Spain’s Campofrio Food Group SA in June,

Smithfield Foods Inc. (SFD) is now looking for

potential opportunities in packaged-meats such as in smoked ham,

bacon and frozen meatballs in an effort to enhance its brand value

in the emerging markets.

Currently, Smithfield is eyeing on

Sara Lee Corp. (SLE), which is spinning off its

beverage business to focus on meat. As an alternative, the company

might get interested in China's People’s Food Holdings Ltd., the

world’s biggest consumer of pork and who has considerable amount of

net cash and gets all its sales in China.

Sara Lee

Smithfield was always interested in

the retail meats division of Sara Lee. In August 2006, Smithfield

bagged Sara Lee’s European meats arm for $614 million, including

net debt. At present, Sara Lee, postsplit of its beverage division,

can become one of the options for Smithfield.

Sara Lee’s North American retail

meats business generated $2.9 billion in sales in the past one year

and had an operating margin of 9.7%, according to reliable sources;

wherein Smithfield could generate only 7.6 cents in operating

income per dollar of sales.

If the deal consummates, Sara Lee’s

meats unit would increase sales at Smithfield’s packaged meats

business by about 50%, according to sources. Further, this will

reinforce higher margin activities.

People’s Food

One more option with Smithfield is

the acquisition of Linyi-based People’s Food, a meat processor in

China, which is valued at $721 million.

Over the past three years, People’s

Food has increased sales by 54% and has generated $246 million in

net cash, according to reliable sources. Further, it has generated

about 41% of its sales from processed meats, and the remaining from

fresh and frozen pork and poultry.

According to the U.S. Department of

Agriculture, pork accounts for half the world’s consumption of the

meat. The demand for pork surpasses the supply and thus the price

of pork in China has remained at their highest level since April

2008 due to the shortage.

This might excite Smithfield to

acquire People’s Food as the Chinese consume more pork per capita

than anyone in the world.

Other

Alternative

Tyson Foods Inc.

(TSN) might become one alternative for Smithfield based on its

operations, but the former is the biggest U.S. meat processor and

its size would make it difficult for Smithfield to pull off without

penalizing its own shareholders.

Smithfield has limited cash of

$374.7 million and debt of $2.1 million as against the Tyson’s

market value of $3.6 billion, which indicated that the acquisition

of Tyson would have to be financed through equity or debt.

Smithfield posted positive earnings

of $521 million at the end of April, 2011, after facing two years

of losses. However, Smithfield projects rising expenses going ahead

, such as those to raise, feed and slaughter hogs, as well as those

to produce meat products. Therefore, the company expects its

earnings to fall by 19% for fiscal 2011.

Additionally, Smithfield’s

debt-to-equity ratio, which measures the debt of the company

relative to its common shareholder equity, is very high in

comparison to its peers. Smithfield’s debt-to-equity ratio is 60%,

surpassing the ratio of 44% of Tyson.

Smithfield is thus keen on looking

at companies under $1 billion in value as it believes that small

acquisitions in faster growing economies would help the company to

boost the returns and the debt-equity ratio. In addition,

Smithfield might also consider buying smaller companies with

related product lines that have a larger proportion of sales

outside U.S.

SMITHFIELD FOOD (SFD): Free Stock Analysis Report

SARA LEE (SLE): Free Stock Analysis Report

TYSON FOODS A (TSN): Free Stock Analysis Report

Zacks Investment Research

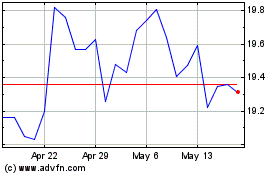

Prudential Financial (NYSE:PFH)

Historical Stock Chart

From Dec 2024 to Jan 2025

Prudential Financial (NYSE:PFH)

Historical Stock Chart

From Jan 2024 to Jan 2025