Provident Bank’s First-Time Home Buyer Survey Reveals That While Homeownership Continues to Be Challenging, Many Americans Are Finding Their Home in Less Than a Year

15 October 2024 - 11:00PM

Provident Bank, a leading New Jersey-based

financial institution, has released the results of its First-Time

Home Buyer Survey, taking stock of the generational differences in

how Americans are navigating a complicated housing market. This

year’s survey revealed that, not surprisingly, searching for a

first home is extremely challenging. The top two factors impacting

budgets are high mortgage rates and the lack of homes within an

original budget. However, across generations, Americans appear to

be buying their first home after only looking less than a year,

signaling growing optimism in the market.

Potential homeowners are prolonging the buying process

and waiting to make a final purchase:

Searching for a new home is challenging for first-time home

buyers across generations. There are frequent bidding wars, which

can lead to many making sacrifices for their dream home.

- Over 40% of Gen Xers have been involved in a significant number

(5+) of bidding wars during the home-buying process. Comparatively,

only 30% of Millennial respondents have had the same

experience.

- Over 50% of Gen X respondents have had to significantly adjust

their search criteria to stay within budget. Nearly 50% of both

Millennials and Gen X respondents noted that they’ve settled for an

older home that needs renovations to complete the buying process,

compared to only 39% of Gen Z respondents.

Amidst all of these challenges, Americans still look

toward traditional financial avenues to complete the home-buying

process:

Overall, potential homeowners are still looking to traditional

financial institutions to help them through the home-buying

process. However, there are clear differences between how

generations think about their financing options and the experts

available to them.

- Over half of respondents noted that their savings account is

their main source of capital for their down payment. The second

highest source of capital stems from access to first-time home

buyer program grant(s).

- 15% of Gen X respondents will look to a fintech company for

financing for buying a first home compared to only 6% of Gen Z

respondents. Nearly 56% of Gen X respondents will be speaking to a

traditional bank as a source for the financing process in buying

their first home.

- Just under 50% of all Millennial respondents noted they would

look to a traditional bank for financing to buy their first

home.

“The findings from this year’s survey support what we’ve been

hearing directly from customers - in order to navigate a highly

competitive home buying market, understanding all of the financing

resources and capital requirements at your disposal is the key to

success,” said Margaret Volk, Senior Vice President, and Director

of Mortgage and Consumer Lending, at Provident Bank. “Especially as

we enter a new phase of the mortgage rate cycle, we believe it is

our responsibility to ensure our customers are equipped with the

resources and information needed to navigate the financing process

to achieve such an important life goal like buying a home.”

The survey was conducted by Survey Monkey, a market research

provider, on behalf of Provident Bank. The findings are based on

1,000 responses.

About Provident Bank

Founded in Jersey City in 1839, Provident Bank is the oldest

community-focused financial institution based in New Jersey and is

the wholly owned subsidiary of Provident Financial Services, Inc.

(NYSE:PFS). With assets of $24.07 billion as of June 30, 2024,

Provident Bank offers a wide range of customized financial

solutions for businesses and consumers with an exceptional customer

experience delivered through its convenient network of 140 branches

across New Jersey and parts of New York and Pennsylvania, via

mobile and online banking, and from its customer contact center.

The bank also provides fiduciary and wealth management services

through its wholly owned subsidiary, Beacon Trust Company, and

insurance services through its wholly owned subsidiary, Provident

Protection Plus, Inc. To learn more about Provident Bank, go to

www.provident.bank or call our customer contact center at

800.448.7768.

Media Contact:Provident BankKeith Buscio –

keith.buscio@provident.bank

Vestedprovidentbank@fullyvested.com

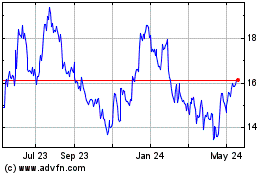

Provident Financial Serv... (NYSE:PFS)

Historical Stock Chart

From Dec 2024 to Jan 2025

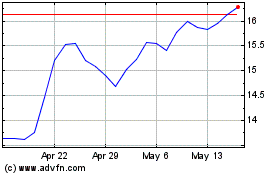

Provident Financial Serv... (NYSE:PFS)

Historical Stock Chart

From Jan 2024 to Jan 2025