Parsons to Acquire BlackSignal Technologies

31 July 2024 - 6:05AM

Parsons Corporation (NYSE:PSN) announced today that it has entered

into a definitive agreement to acquire BlackSignal Technologies,

LLC, a Razor’s Edge portfolio company, in an accretive deal valued

at $200 million. Parsons anticipates that the acquisition will

close in August 2024.

BlackSignal is a next-generation digital signal processing,

electronic warfare, and cybersecurity provider built to counter

near-peer threats. This acquisition will expand Parsons’ customer

base across the Department of Defense and Intelligence Community

and significantly strengthen Parsons’ positioning with

full-spectrum cyber and electronic warfare, while adding new

capabilities in the counterspace radio frequency domain: markets

anticipated to grow more than 10% annually with double digit margin

expectations. BlackSignal uses artificial intelligence and machine

learning to create innovative signal processing techniques that

detect and disrupt difficult-to-access command and control systems

and platforms.

The transaction is consistent with Parsons’ strategy of

acquiring high-growth companies with greater than 10% revenue

growth and adjusted EBITDA margins. BlackSignal will be integrated

into Parsons’ Defense & Intelligence business unit.

"Parsons' acquisition of BlackSignal will represent a strategic

enhancement to our cyber and intelligence and electronic warfare

capabilities, reinforcing our commitment to quickly delivering

mission-essential solutions that address our customer’s national

security requirements," said Carey Smith, Parsons' chair,

president, and chief executive officer. "Our purpose-built Federal

Solutions portfolio is addressing national security threats from

near-peer adversaries that are becoming increasingly aggressive

with rapidly evolving advanced technologies. I am excited that we

will welcome BlackSignal’s accomplished team into Parsons.”

Headquartered in Chantilly, Va., BlackSignal’s culture of

innovation and disruption delivers differentiated solutions to

address national security challenges related to near-peer threats

for the Defense Department and Intelligence Community. The

company’s space, cyber, electronic warfare, and digital signal

processing capabilities include full-spectrum cyber solutions and

tool development; space-based, artificial intelligence-enhanced

signal processing; and tactical communication and intelligence

systems.

“There is complete alignment with our culture and values, and we

share a common passion for supporting our nation’s most pressing

security challenges while promoting a people-first culture,” said

Ned Zimmer, chief executive officer of BlackSignal. “This

partnership will be a force multiplier for our warfighters,

accelerate our business growth, and expand our customer base, while

providing exciting new opportunities for our employees. I am

excited about our future together and to become part of the Parsons

team.”

The $200 million cash purchase price represents a 10.5x multiple

on the forecasted 2025 EBITDA before considering revenue or cost

synergies. Parsons expects that BlackSignal will generate

approximately $95m of revenue in 2025e and be accretive to Parsons’

revenue growth, adjusted EBITDA margins, and adjusted EPS. The

transaction is expected to close in August 2024, subject to

customary closing conditions. Parsons was advised by Raymond James

and BlackSignal was advised by Baird.

About Parsons

Parsons (NYSE: PSN) is a leading disruptive technology provider

in the national security and global infrastructure markets, with

capabilities across cyber and intelligence, space and missile

defense, transportation, environmental remediation, urban

development, and critical infrastructure protection. Please visit

parsons.com and follow us on LinkedIn and Facebook to learn how

we're making an impact.

Forward-Looking Statements

This document contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements are based on our current expectations,

beliefs and assumptions, and are not guarantees of future

performance. Forward-looking statements are inherently subject to

uncertainties, risks, changes in circumstances, trends, and factors

that are difficult to predict, many of which are outside of our

control. Accordingly, actual performance, results, and events may

vary materially from those indicated in the forward-looking

statements, and you should not rely on the forward-looking

statements as predictions of future performance, results, or

events. Numerous factors could cause actual future performance,

results and events to differ materially from those indicated in the

forward-looking statements, including, among others: any issue that

compromises our relationships with the U.S. federal government or

its agencies or other state, local, or foreign governments or

agencies; any issues that damage our professional reputation;

changes in governmental priorities that shift expenditures away

from agencies or programs that we support; our dependence on

long-term government contracts, which are subject to the

government’s budgetary approval process; the size of our

addressable markets and the amount of government spending on

private contractors; failure by us or our employees to obtain and

maintain necessary security clearances or certifications; failure

to comply with numerous laws and regulations; changes in government

procurement, contract or other practices or the adoption by

governments of new laws, rules, regulations, and programs in a

manner adverse to us; the termination or nonrenewal of our

government contracts, particularly our contracts with the U.S.

federal government; our ability to compete effectively in the

competitive bidding process and delays, contract terminations, or

cancellations caused by competitors’ protests of major contract

awards received by us; our ability to generate revenue under

certain of our contracts; any inability to attract, train, or

retain employees with the requisite skills, experience, and

security clearances; the loss of members of senior management or

failure to develop new leaders; misconduct or other improper

activities from our employees or subcontractors; our ability to

realize the full value of our backlog and the timing of our receipt

of revenue under contracts included in backlog; changes in the mix

of our contracts and our ability to accurately estimate or

otherwise recover expenses, time and resources for our contracts;

changes in estimates used in recognizing revenue; internal system

or service failures and security breaches; and inherent

uncertainties and potential adverse developments in legal

proceedings, including litigation, audits, reviews, and

investigations, which may result in materially adverse judgments,

settlements, or other unfavorable outcomes. These factors are not

exhaustive and additional factors could adversely affect our

business and financial performance. For a discussion of additional

factors that could materially adversely affect our business and

financial performance, see the factors included under the caption

“Risk Factors” in our Registration Statement on Form S-1 and our

other filings with the Securities and Exchange Commission. All

forward-looking statements are based on currently available

information and speak only as of the date on which they are made.

We assume no obligation to update any forward-looking statement

made in this presentation that becomes untrue because of subsequent

events, new information or otherwise, except to the extent we are

required to do so in connection with our ongoing requirements under

federal securities laws.

Media Contact:Bryce

McDevitt+1.703.851.4425Bryce.McDevitt@parsons.com

Investor Relations Contact:Dave Spille+

1.571.655.8264Dave.Spille@parsons.us

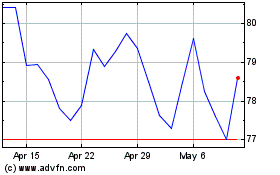

Parsons (NYSE:PSN)

Historical Stock Chart

From Oct 2024 to Nov 2024

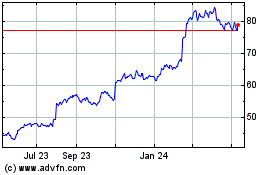

Parsons (NYSE:PSN)

Historical Stock Chart

From Nov 2023 to Nov 2024