0000093676false00000936762023-09-152023-09-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 15, 2023

THE L.S. STARRETT COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| | | | | |

| Massachusetts | | 1-367 | | 04-1866480 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

121 CRESCENT STREET, ATHOL, MA 1331

(Address of principal executive offices) (Zip Code)

Registrant's telephone number:

978-249-3551

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | | | | |

| | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Trading Symbol(s) Name of each exchange on

which registered

Class A Common Stock, $1.00 par value per share SCX New York Stock Exchange

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2of the Securities Exchange Act of 1934 (§ 240 12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by a check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | | | | | | | | | | | | | |

| | | | | |

| ITEM 2.02 | Results of Operations and Financial Condition | |

On September 15, 2023, the L.S. Starrett Company (the “Company”) announced its financial results for the fiscal year-end period ended June 30, 2023. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. Furthermore, the information contained in this Item 2.02 shall not be deemed to be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such a filing. | |

| | |

| ITEM 9.01. | Financial Statements and Exhibits | |

| Exhibit Number | Description | |

| 99.1 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 15, 2023 THE L.S. STARRETT COMPANY

By: /s/ John C. Tripp

Name: John C. Tripp

Title: Chief Financial Officer and Treasurer

The L.S. Starrett Company Announces Fiscal 2023 Results

ATHOL, MA. – September 15, 2023 – The L.S. Starrett Company (NYSE: SCX) (“Starrett” or “the Company”) a global innovator, manufacturer and marketer of precision measuring tools, cutting tools and equipment, and high-end metrology solutions for industrial, professional, and consumer markets, today announced operating results for the fiscal year ended June 30, 2023.

Financial results include non-U.S. GAAP financial measures. These non-U.S. GAAP measures are more fully described and are reconciled from the respective measures determined under GAAP in the section titled “Use of Non-U.S. GAAP Financial Measures” and the attached tables.

Fiscal 2023 Financial Highlights

•Net sales for fiscal 2023 were $256.2 million, an increase of 1% compared to fiscal 2022, while currency-neutral net sales of $257.9 million increased 1.7%. North American industrial net sales increased 7% compared to fiscal 2022. Global test and measurement net sales, which increased 6% year on year were supported by high demand for precision granite products. International industrial net sales, which declined 7% compared to fiscal 2022, were impacted by macro recessionary pressures in Europe.

•Gross margin for fiscal 2023 was 32.2%, 100 basis points lower compared to 33.2% in the prior fiscal year. Gross margin was impacted by lower factory utilization resulting from lower demand and the Company’s focus on working capital reduction and cash generation. In addition, approximately one-third of this decline resulted from geographical sales mix, as higher margin international industrial net sales for fiscal 2023 comprised a smaller portion of consolidated net sales when comparing to fiscal 2022.

•Operating income for fiscal 2023 was $18.9 million or 7.4% of net sales, compared to $21.6 million, or 8.5% of net sales in fiscal 2022. This reduction was the result of the lower gross margin, and an increase in Selling, General and Administrative expenses of $1.1 million due to planned spend increase of $1.7 million to support the company’s growth initiatives, partially offset by a $0.6 million reduction in General and Administrative expenses.

•Operating cash flow in fiscal 2023 was $25.1 million, an improvement of $19.8 million compared to $5.3 million for fiscal 2022. The Company retired $21.3 million in debt during fiscal 2023 as the result of its initiatives to reduce working capital and improve treasury operations. On June 30, 2023, the Company’s debt totaled $10.6 million, its lowest level in more than ten years.

•Net income for fiscal 2023 was $23.1 million, or diluted earnings per share of $3.06, compared to net income of $14.9 million, or diluted earnings per share of $2.00, for fiscal 2022. The significant increase in fiscal 2023 was driven by a $10.5 million favorable adjustment to the Company’s net pension liability in the United States, and a $5 million tax credit related to a reduction of the Company’s valuation allowance against its deferred tax assets. The latter resulted from improved performance achieved and forecasted for the North American operating units, and an increase in foreign-sourced royalty income resulting from amendments to the Company’s transfer pricing policies. The favorable pension adjustment was a result of liability gains due to an increase in the discount rate and strong performance of the plan’s assets. Without these one-time adjustments and restructuring charges, adjusted net income for fiscal 2023 was $7.7 million, or adjusted diluted earnings per share of $1.03, compared to $15.3 million, or adjusted diluted earnings per share of $2.06 for fiscal 2022. (See Table 4 included herein).

“I am proud of what our global team achieved throughout the year to strengthen our balance sheet, improve cash flow and reduce debt, despite continued broader global economic challenges,” said Douglas A. Starrett, President and Chief Executive Officer. “Our diverse portfolio of North American products more than offset global headwinds

and our strategy to reduce working capital and improve cash generation leaves our balance sheet in its best shape for many years, positioning us well to grow the company over the long term.” he continued.

Use of Non-U.S. GAAP Financial Measures

The Company uses the following non-U.S. GAAP financial measures: “currency-neutral net sales,” which are net sales calculated using actual exchange rates in use during the comparative prior year period to enhance the visibility of the underlying business trends excluding the impact of translation arising from foreign currency exchange rate fluctuations; “adjusted net income” and “adjusted diluted earnings per share.”

The Company discusses these non-U.S. GAAP financial measures because management believes they assist investors in comparing the Company’s performance across reporting periods on a consistent basis by eliminating items that the Company does not believe are indicative of its core operating performance. Such non-U.S. GAAP financial measures assist investors in understanding the ongoing operating performance of the Company by presenting financial results between periods on a more comparable basis. Such measures should be considered in addition to, and not in lieu of, the financial measures calculated and presented in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

References to currency-neutral net sales adjusted net income, and adjusted diluted earnings per share should not be considered in isolation or as a substitute for other financial measures calculated and presented in accordance with U.S. GAAP, and may not be comparable to similarly titled non-U.S. GAAP financial measures used by other companies. In evaluating these non-U.S. GAAP financial measures, investors should be aware that in the future the Company may incur expenses or be involved in transactions that are the same as or similar to some of the adjustments in this press release. The Company’s discussion of non-U.S. GAAP financial measures should not be construed to imply that its future results will be unaffected by any such adjustments. Non-U.S. GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of our results as reported under U.S. GAAP.

About The L.S. Starrett Company:

Founded in 1880 by Laroy S. Starrett and incorporated in 1929, The L.S. Starrett Company is a leading manufacturer of high-end precision tools, cutting equipment, and metrology systems for industrial, professional and consumer markets and is engaged in the business of manufacturing over 5,000 different products for industrial, professional and consumer markets. The Company has a long history of global manufacturing experience and currently operates three major global manufacturing plants. All subsidiaries principally serve the global manufacturing industrial base with concentration in the metalworking, construction, machinery, equipment, aerospace and automotive markets. The Company offers its broad array of measuring and cutting products to the market through multiple channels of distribution throughout the world. Starrett is a brand recognized around the world for precision, quality and innovation. For more information, please visit: https://www.starrett.com.

Forward-Looking Statements:

This press release may contain forward-looking statements concerning the Company’s expectations, anticipations, intentions, beliefs or strategies regarding the future. These forward-looking statements are based on its current expectations and beliefs concerning future developments and their potential effects on the Company. There can be

no assurance that future developments affecting the Company will be those that it has anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond its control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, and other risks and uncertainties described in its Annual Report on Form 10-K, which was filed with the Securities and Exchange Commission on August 28, 2023 in the section entitled "Risk Factors," and in its other filings from time to time with the Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize, or should any of its assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements.

L.S. Starrett Company

Summary of Operations

Fiscal year Ended June 30, 2023

TABLE 1

L.S. Starrett Company

Consolidated, Condensed Balance Sheet

June 30, 2023

TABLE 2

L.S. Starrett Company

Currency-Neutral Net Sales

June 30, 2023

TABLE 3

L.S. Starrett Company

Reconciliation of Net Income and Diluted Earnings Per Share to

Adjusted Net Income and Adjusted Diluted Earnings Per Share

June 30, 2023

TABLE 4

Contact:

John C. Tripp

Chief Financial Officer

(978) 249-3551

jtripp@starrett.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

scx_CoverPageAbstract |

| Namespace Prefix: |

scx_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

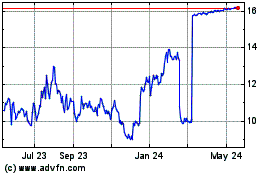

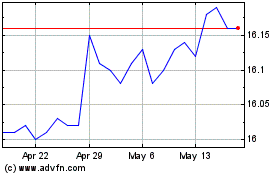

LS Starrett (NYSE:SCX)

Historical Stock Chart

From Apr 2024 to May 2024

LS Starrett (NYSE:SCX)

Historical Stock Chart

From May 2023 to May 2024