0001465128FALSE00014651282024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2024

Starwood Property Trust, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Maryland | | 001-34436 | | 27-0247747 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

| | |

591 West Putnam Avenue Greenwich, CT | | 06830 |

| (Address of principal | | (Zip Code) |

| executive offices) | | |

Registrant’s telephone number,

including area code:

(203) 422-7700

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.01 par value per share | STWD | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 6, 2024, Starwood Property Trust, Inc. issued a press release announcing its financial results for the quarter ended June 30, 2024. A copy of the press release is attached as Exhibit 99.1 hereto and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| |

Exhibit Number |

Description |

| |

| 99.1 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

EXHIBIT INDEX

| | | | | |

| |

Exhibit

Number | Description |

| |

| 99.1 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

Dated: August 6, 2024 | STARWOOD PROPERTY TRUST, INC. |

| |

| | By: | /s/ RINA PANIRY |

| | Name: | Rina Paniry |

| | Title: | Chief Financial Officer, Treasurer, Chief Accounting Officer and Principal Financial Officer |

For Immediate Release

Starwood Property Trust Reports Results for

Quarter Ended June 30, 2024

– Quarterly GAAP Earnings of $0.24 and Distributable Earnings (DE) of $0.48 per Diluted Share –

– Paid Dividend of $0.48 per Share and Declared $0.48 Dividend for each of the next Two Quarters –

– Received Repayments of $0.9 Billion in the Quarter –

– Repriced our $591.0 Million Term Loan B, Reducing Spread by 50 bps to S+275 –

– Received 8th Nareit Gold Investor CARE (Communications & Reporting Excellence) Award –

– LNR’s Commercial Special Servicer Rating of CSS1 (Highest Rating Possible) Reaffirmed by Fitch –

GREENWICH, Conn., August 6, 2024 /PRNewswire/ -- Starwood Property Trust, Inc. (NYSE: STWD) today announced operating results for the fiscal quarter ended June 30, 2024. The Company’s second quarter 2024 GAAP net income was $77.9 million, inclusive of a $42.7 million credit loss provision, and Distributable Earnings (a non-GAAP financial measure) was $157.8 million.

“We strategically diversified Starwood Property Trust into investment cylinders other than commercial lending as we saw risk and reward shift. Today, more than 40% of our assets are outside of our commercial lending book. This diversification, along with our low leverage ratios, have allowed us to outperform in what has been a tough correction for real estate. We think the roughest patch for the property sector globally is behind us, and the U.S. and Europe will be moving into an easing cycle.

We have delivered a consistent dividend and a greater than 10% annualized return since our inception 15 years ago. While some businesses slow, others have accelerated. Our special servicing team now has nearly $10 billion of assignments, up 40% from the beginning of the year. Our conduit had a superb first half of the year and our property book, concentrated in affordable housing, continues to exhibit meaningful and continued rental growth,” commented Barry Sternlicht, Chairman and CEO of Starwood Property Trust.

“In addition to the benefits of diversification, we remain well positioned with over $4.00 per share of embedded gains in our owned property portfolio, $1.2 billion of liquidity and $4.5 billion of unencumbered assets. Our liquidity and access to capital has uniquely allowed us to continue to invest across our businesses in every quarter since inception. This consistency and stability of our diversified portfolio provided our Board the confidence to declare our $0.48 per share quarterly dividend for the remainder of 2024,” added Jeffrey DiModica, President of Starwood Property Trust.

“In the quarter, we were awarded our 8th Nareit gold award in the last ten years. The award is granted to the mortgage REIT that exemplifies excellence in investor reporting and communications, further demonstrating our long-term commitment to our stakeholders,” added Zachary Tanenbaum, Head of Investor Relations.

Supplemental Schedules

The Company has published supplemental earnings schedules on its website in order to provide additional disclosure and financial information for the benefit of the Company’s stakeholders. Specifically, these materials can be found on the Company’s website in the Investor Relations section under “Quarterly Results” at www.starwoodpropertytrust.com.

Webcast and Conference Call Information

The Company will host a live webcast and conference call on Tuesday, August 6, 2024, at 10:00 a.m. Eastern Time. To listen to a live broadcast, access the site at least 15 minutes prior to the scheduled start time in order to register, download and install any necessary audio software. The webcast is available at www.starwoodpropertytrust.com in the Investor Relations section of the website. The Company encourages use of the webcast due to potential extended wait times to access the conference call via dial-in.

To Participate via Telephone Conference Call:

Dial in at least 15 minutes prior to start time.

Domestic: 1-877-407-9039

International: 1-201-689-8470

Conference Call Playback:

Domestic: 1-844-512-2921

International: 1-412-317-6671

Passcode: 13742860

The playback can be accessed through August 20, 2024.

About Starwood Property Trust, Inc.

Starwood Property Trust (NYSE: STWD), an affiliate of global private investment firm Starwood Capital Group, is a leading diversified finance company with a core focus on the real estate and infrastructure sectors. As of June 30, 2024, the Company has successfully deployed over $98 billion of capital since inception and manages a portfolio of $26 billion across debt and equity investments. Starwood Property Trust’s investment objective is to generate attractive and stable returns for shareholders, primarily through dividends, by leveraging a premiere global organization to identify and execute on the best risk adjusted returning investments across its target assets. Additional information can be found at www.starwoodpropertytrust.com.

Forward-Looking Statements

Statements in this press release which are not historical fact may be deemed forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are developed by combining currently available information with our beliefs and assumptions and are generally identified by the words “believe,” “expect,” “anticipate” and other similar expressions. Although Starwood Property Trust, Inc. believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, it can give no assurance that its expectations will be attained. Factors that could cause actual results to differ materially from the Company’s expectations include, but are not limited to, completion of pending investments and financings, continued ability to acquire additional investments, competition within the finance and real estate industries, availability of financing, and other risks detailed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as well as other risks and uncertainties set forth from time to time in the Company’s reports filed with the SEC, including its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024.

In light of these risks and uncertainties, there can be no assurances that the results referred to in the forward-looking statements contained herein will in fact occur. Except to the extent required by applicable law or regulation, we undertake no obligation to, and expressly disclaim any such obligation to, update or revise any forward-looking statements to reflect changed assumptions, the occurrence of anticipated or unanticipated events, changes to future results over time or otherwise.

Additional information can be found on the Company’s website at www.starwoodpropertytrust.com.

Contact:

Zachary Tanenbaum

Starwood Property Trust

Phone: 203-422-7788

Email: ztanenbaum@starwood.com

Starwood Property Trust, Inc. and Subsidiaries

Condensed Consolidated Statement of Operations by Segment

For the three months ended June 30, 2024

(Amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Commercial and

Residential

Lending

Segment | | Infrastructure

Lending

Segment | | Property

Segment | | Investing

and Servicing

Segment | | Corporate | | Subtotal | | Securitization

VIEs | | Total |

| Revenues: | | | | | | | | | | | | | | | |

| Interest income from loans | $ | 358,749 | | | $ | 64,218 | | | $ | — | | | $ | 4,465 | | | $ | — | | | $ | 427,432 | | | $ | — | | | $ | 427,432 | |

| Interest income from investment securities | 29,373 | | | 130 | | | — | | | 24,637 | | | — | | | 54,140 | | | (37,140) | | | 17,000 | |

| Servicing fees | 124 | | | — | | | — | | | 20,025 | | | — | | | 20,149 | | | (4,116) | | | 16,033 | |

| Rental income | 3,987 | | | — | | | 15,736 | | | 5,736 | | | — | | | 25,459 | | | — | | | 25,459 | |

| Other revenues | 1,323 | | | 888 | | | 235 | | | 750 | | | 706 | | | 3,902 | | | — | | | 3,902 | |

| Total revenues | 393,556 | | | 65,236 | | | 15,971 | | | 55,613 | | | 706 | | | 531,082 | | | (41,256) | | | 489,826 | |

| Costs and expenses: | | | | | | | | | | | | | | | |

| Management fees | 192 | | | — | | | — | | | — | | | 30,325 | | | 30,517 | | | — | | | 30,517 | |

| Interest expense | 216,511 | | | 37,875 | | | 11,652 | | | 8,475 | | | 70,084 | | | 344,597 | | | (208) | | | 344,389 | |

| General and administrative | 17,745 | | | 4,230 | | | 1,202 | | | 23,691 | | | 4,214 | | | 51,082 | | | — | | | 51,082 | |

| Costs of rental operations | 3,412 | | | — | | | 5,545 | | | 3,113 | | | — | | | 12,070 | | | — | | | 12,070 | |

| Depreciation and amortization | 2,136 | | | 15 | | | 5,926 | | | 1,795 | | | 252 | | | 10,124 | | | — | | | 10,124 | |

| Credit loss provision (reversal), net | 42,995 | | | (286) | | | — | | | — | | | — | | | 42,709 | | | — | | | 42,709 | |

| Other expense | 26 | | | — | | | 35 | | | 224 | | | — | | | 285 | | | — | | | 285 | |

| Total costs and expenses | 283,017 | | | 41,834 | | | 24,360 | | | 37,298 | | | 104,875 | | | 491,384 | | | (208) | | | 491,176 | |

| Other income (loss): | | | | | | | | | | | | | | | |

| Change in net assets related to consolidated VIEs | — | | | — | | | — | | | — | | | — | | | — | | | 17,180 | | | 17,180 | |

| Change in fair value of servicing rights | — | | | — | | | — | | | 885 | | | — | | | 885 | | | 10 | | | 895 | |

| Change in fair value of investment securities, net | (274) | | | — | | | — | | | (23,710) | | | — | | | (23,984) | | | 24,351 | | | 367 | |

| Change in fair value of mortgage loans, net | 47,711 | | | — | | | — | | | 16,710 | | | — | | | 64,421 | | | — | | | 64,421 | |

| Income from affordable housing fund investments | — | | | — | | | 6,446 | | | — | | | — | | | 6,446 | | | — | | | 6,446 | |

| Earnings (loss) from unconsolidated entities | 1,671 | | | (58) | | | — | | | 550 | | | — | | | 2,163 | | | (493) | | | 1,670 | |

| | | | | | | | | | | | | | | |

| Gain (loss) on derivative financial instruments, net | 9,120 | | | 41 | | | 267 | | | 709 | | | (9,151) | | | 986 | | | — | | | 986 | |

| Foreign currency gain, net | 6,858 | | | 17 | | | 10 | | | — | | | — | | | 6,885 | | | — | | | 6,885 | |

| Loss on extinguishment of debt | — | | | (60) | | | (1,045) | | | — | | | — | | | (1,105) | | | — | | | (1,105) | |

| Other loss, net | (2,515) | | | — | | | (277) | | | — | | | — | | | (2,792) | | | — | | | (2,792) | |

| Total other income (loss) | 62,571 | | | (60) | | | 5,401 | | | (4,856) | | | (9,151) | | | 53,905 | | | 41,048 | | | 94,953 | |

| Income (loss) before income taxes | 173,110 | | | 23,342 | | | (2,988) | | | 13,459 | | | (113,320) | | | 93,603 | | | — | | | 93,603 | |

| Income tax (provision) benefit | (10,787) | | | 130 | | | — | | | (5,221) | | | — | | | (15,878) | | | — | | | (15,878) | |

| Net income (loss) | 162,323 | | | 23,472 | | | (2,988) | | | 8,238 | | | (113,320) | | | 77,725 | | | — | | | 77,725 | |

| Net (income) loss attributable to non-controlling interests | (4) | | | — | | | (5,637) | | | 5,806 | | | — | | | 165 | | | — | | | 165 | |

| Net income (loss) attributable to Starwood Property Trust, Inc. | $ | 162,319 | | | $ | 23,472 | | | $ | (8,625) | | | $ | 14,044 | | | $ | (113,320) | | | $ | 77,890 | | | $ | — | | | $ | 77,890 | |

| | | | | | | | | | | | | | | |

Definition of Distributable Earnings

Distributable Earnings, a non-GAAP financial measure, is used to compute the Company’s incentive fees to its external manager and is an appropriate supplemental disclosure for a mortgage REIT. For the Company’s purposes, Distributable Earnings is defined as GAAP net income (loss) excluding non-cash equity compensation expense, the incentive fee due to the Company’s external manager, acquisition costs for successful acquisitions, depreciation and amortization of real estate and associated intangibles, any unrealized gains, losses or other non-cash items recorded in net income (loss) for the period and, to the extent deducted from net income (loss), distributions payable with respect to equity securities of subsidiaries issued in exchange for properties or interests therein. The amount is adjusted to exclude one-time events pursuant to changes in GAAP and certain other non-cash adjustments as determined by the Company’s external manager and approved by a majority of the Company’s independent directors. Refer to the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 for additional information regarding Distributable Earnings.

Reconciliation of Net Income to Distributable Earnings

For the three months ended June 30, 2024

(Amounts in thousands except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Commercial and

Residential

Lending

Segment | | Infrastructure

Lending

Segment | | Property

Segment | | Investing

and Servicing

Segment | | Corporate | | Total |

| Net income (loss) attributable to Starwood Property Trust, Inc. | $ | 162,319 | | | $ | 23,472 | | | $ | (8,625) | | | $ | 14,044 | | | $ | (113,320) | | | $ | 77,890 | |

| Add / (Deduct): | | | | | | | | | | | |

| Non-controlling interests attributable to Woodstar II Class A Units | — | | | — | | | 4,660 | | | — | | | — | | | 4,660 | |

| Non-controlling interests attributable to unrealized gains/losses | — | | | — | | | (2,285) | | | (9,470) | | | — | | | (11,755) | |

| Non-cash equity compensation expense | 2,538 | | | 508 | | | 99 | | | 1,576 | | | 5,947 | | | 10,668 | |

| Management incentive fee | — | | | — | | | — | | | — | | | 3,510 | | | 3,510 | |

| Depreciation and amortization | 2,285 | | | 5 | | | 6,012 | | | 1,888 | | | — | | | 10,190 | |

| Interest income adjustment for securities | 5,367 | | | — | | | — | | | 7,256 | | | — | | | 12,623 | |

| | | | | | | | | | | |

| Consolidated income tax provision (benefit) associated with fair value adjustments | 10,787 | | | (130) | | | — | | | 5,221 | | | — | | | 15,878 | |

| Other non-cash items | 4 | | | — | | | 278 | | | (390) | | | (9) | | | (117) | |

| Reversal of GAAP unrealized and realized (gains) / losses on: | | | | | | | | | | | |

| Loans | (47,711) | | | — | | | — | | | (16,710) | | | — | | | (64,421) | |

| Credit loss provision (reversal), net | 42,995 | | | (286) | | | — | | | — | | | — | | | 42,709 | |

| Securities | 274 | | | — | | | — | | | 23,710 | | | — | | | 23,984 | |

| Woodstar Fund investments | — | | | — | | | (6,446) | | | — | | | — | | | (6,446) | |

| Derivatives | (9,120) | | | (41) | | | (267) | | | (709) | | | 9,151 | | | (986) | |

| Foreign currency | (6,858) | | | (17) | | | (10) | | | — | | | — | | | (6,885) | |

| (Earnings) loss from unconsolidated entities | (1,671) | | | 58 | | | — | | | (550) | | | — | | | (2,163) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Recognition of Distributable realized gains / (losses) on: | | | | | | | | | | | |

| Loans | (1,003) | | | — | | | — | | | 15,778 | | | — | | | 14,775 | |

| | | | | | | | | | | |

| Securities | (298) | | | — | | | — | | | (5,913) | | | — | | | (6,211) | |

| Woodstar Fund investments | — | | | — | | | 17,593 | | | — | | | — | | | 17,593 | |

| | | | | | | | | | | |

| Derivatives | 30,351 | | | 89 | | | 3,006 | | | 1,020 | | | (11,176) | | | 23,290 | |

| Foreign currency | (3,074) | | | 3 | | | 10 | | | — | | | — | | | (3,061) | |

| Earnings (loss) from unconsolidated entities | 1,670 | | | (13) | | | — | | | 370 | | | — | | | 2,027 | |

| | | | | | | | | | | |

| Distributable Earnings (Loss) | $ | 188,855 | | | $ | 23,648 | | | $ | 14,025 | | | $ | 37,121 | | | $ | (105,897) | | | $ | 157,752 | |

| Distributable Earnings (Loss) per Weighted Average Diluted Share | $ | 0.58 | | | $ | 0.07 | | | $ | 0.04 | | | $ | 0.11 | | | $ | (0.32) | | | $ | 0.48 | |

| | | | | | | | | | | |

Starwood Property Trust, Inc. and Subsidiaries

Condensed Consolidated Statement of Operations by Segment

For the six months ended June 30, 2024

(Amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Commercial and

Residential

Lending

Segment | | Infrastructure

Lending

Segment | | Property

Segment | | Investing

and Servicing

Segment | | Corporate | | Subtotal | | Securitization

VIEs | | Total |

| Revenues: | | | | | | | | | | | | | | | |

| Interest income from loans | $ | 753,221 | | | $ | 130,616 | | | $ | — | | | $ | 7,087 | | | $ | — | | | $ | 890,924 | | | $ | — | | | $ | 890,924 | |

| Interest income from investment securities | 60,778 | | | 268 | | | — | | | 45,781 | | | — | | | 106,827 | | | (71,621) | | | 35,206 | |

| Servicing fees | 252 | | | — | | | — | | | 33,064 | | | — | | | 33,316 | | | (7,594) | | | 25,722 | |

| Rental income | 7,552 | | | — | | | 36,511 | | | 10,243 | | | — | | | 54,306 | | | — | | | 54,306 | |

| Other revenues | 2,306 | | | 1,280 | | | 362 | | | 1,498 | | | 1,310 | | | 6,756 | | | — | | | 6,756 | |

| Total revenues | 824,109 | | | 132,164 | | | 36,873 | | | 97,673 | | | 1,310 | | | 1,092,129 | | | (79,215) | | | 1,012,914 | |

| Costs and expenses: | | | | | | | | | | | | | | | |

| Management fees | 384 | | | — | | | — | | | — | | | 76,147 | | | 76,531 | | | — | | | 76,531 | |

| Interest expense | 452,660 | | | 76,848 | | | 24,950 | | | 16,792 | | | 129,513 | | | 700,763 | | | (418) | | | 700,345 | |

| General and administrative | 34,573 | | | 10,185 | | | 2,465 | | | 47,158 | | | 7,364 | | | 101,745 | | | — | | | 101,745 | |

| Costs of rental operations | 5,437 | | | — | | | 11,252 | | | 5,725 | | | — | | | 22,414 | | | — | | | 22,414 | |

| Depreciation and amortization | 4,085 | | | 29 | | | 11,781 | | | 3,544 | | | 503 | | | 19,942 | | | — | | | 19,942 | |

| Credit loss provision, net | 77,972 | | | 576 | | | — | | | — | | | — | | | 78,548 | | | — | | | 78,548 | |

| Other expense | 756 | | | — | | | 35 | | | 168 | | | — | | | 959 | | | — | | | 959 | |

| Total costs and expenses | 575,867 | | | 87,638 | | | 50,483 | | | 73,387 | | | 213,527 | | | 1,000,902 | | | (418) | | | 1,000,484 | |

| Other income (loss): | | | | | | | | | | | | | | | |

| Change in net assets related to consolidated VIEs | — | | | — | | | — | | | — | | | — | | | — | | | 27,266 | | | 27,266 | |

| Change in fair value of servicing rights | — | | | — | | | — | | | (2,496) | | | — | | | (2,496) | | | 3,619 | | | 1,123 | |

| Change in fair value of investment securities, net | (7,265) | | | — | | | — | | | (40,168) | | | — | | | (47,433) | | | 48,715 | | | 1,282 | |

| Change in fair value of mortgage loans, net | 7,034 | | | — | | | — | | | 28,374 | | | — | | | 35,408 | | | — | | | 35,408 | |

| Income from affordable housing fund investments | — | | | — | | | 15,894 | | | — | | | — | | | 15,894 | | | — | | | 15,894 | |

| Earnings (loss) from unconsolidated entities | 9,016 | | | 269 | | | — | | | 863 | | | — | | | 10,148 | | | (803) | | | 9,345 | |

| (Loss) gain on sale of investments and other assets, net | (41) | | | — | | | 92,003 | | | — | | | — | | | 91,962 | | | — | | | 91,962 | |

| Gain (loss) on derivative financial instruments, net | 120,072 | | | 163 | | | 1,988 | | | 3,721 | | | (23,019) | | | 102,925 | | | — | | | 102,925 | |

| Foreign currency (loss) gain, net | (34,960) | | | (67) | | | 42 | | | — | | | — | | | (34,985) | | | — | | | (34,985) | |

| Gain (loss) on extinguishment of debt | 315 | | | (620) | | | (2,254) | | | — | | | — | | | (2,559) | | | — | | | (2,559) | |

| Other (loss) income, net | (5,191) | | | 40 | | | (277) | | | 6 | | | — | | | (5,422) | | | — | | | (5,422) | |

| Total other income (loss) | 88,980 | | | (215) | | | 107,396 | | | (9,700) | | | (23,019) | | | 163,442 | | | 78,797 | | | 242,239 | |

| Income (loss) before income taxes | 337,222 | | | 44,311 | | | 93,786 | | | 14,586 | | | (235,236) | | | 254,669 | | | — | | | 254,669 | |

| Income tax (provision) benefit | (11,508) | | | 258 | | | — | | | (5,834) | | | — | | | (17,084) | | | — | | | (17,084) | |

| Net income (loss) | 325,714 | | | 44,569 | | | 93,786 | | | 8,752 | | | (235,236) | | | 237,585 | | | — | | | 237,585 | |

| Net (income) loss attributable to non-controlling interests | (7) | | | — | | | (11,862) | | | 6,506 | | | — | | | (5,363) | | | — | | | (5,363) | |

| Net income (loss) attributable to Starwood Property Trust, Inc. | $ | 325,707 | | | $ | 44,569 | | | $ | 81,924 | | | $ | 15,258 | | | $ | (235,236) | | | $ | 232,222 | | | $ | — | | | $ | 232,222 | |

| | | | | | | | | | | | | | | |

Reconciliation of Net Income to Distributable Earnings

For the six months ended June 30, 2024

(Amounts in thousands except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Commercial and

Residential

Lending

Segment | | Infrastructure

Lending

Segment | | Property

Segment | | Investing

and Servicing

Segment | | Corporate | | Total |

| Net income (loss) attributable to Starwood Property Trust, Inc. | $ | 325,707 | | | $ | 44,569 | | | $ | 81,924 | | | $ | 15,258 | | | $ | (235,236) | | | $ | 232,222 | |

| Add / (Deduct): | | | | | | | | | | | |

| Non-controlling interests attributable to Woodstar II Class A Units | — | | | — | | | 9,319 | | | — | | | — | | | 9,319 | |

| Non-controlling interests attributable to unrealized gains/losses | — | | | — | | | (3,963) | | | (11,523) | | | — | | | (15,486) | |

| Non-cash equity compensation expense | 4,738 | | | 964 | | | 185 | | | 3,173 | | | 11,654 | | | 20,714 | |

| Management incentive fee | — | | | — | | | — | | | — | | | 22,593 | | | 22,593 | |

| Depreciation and amortization | 4,384 | | | 10 | | | 11,951 | | | 3,731 | | | — | | | 20,076 | |

| Interest income adjustment for securities | 10,948 | | | — | | | — | | | 17,261 | | | — | | | 28,209 | |

| | | | | | | | | | | |

Consolidated income tax provision (benefit} associated with fair value adjustments | 11,508 | | | (258) | | | — | | | 5,834 | | | — | | | 17,084 | |

| Other non-cash items | 7 | | | — | | | 552 | | | (352) | | | — | | | 207 | |

| Reversal of GAAP unrealized and realized (gains) / losses on: | | | | | | | | | | | |

| Loans | (7,034) | | | — | | | — | | | (28,374) | | | — | | | (35,408) | |

| Credit loss provision, net | 77,972 | | | 576 | | | — | | | — | | | — | | | 78,548 | |

| Securities | 7,265 | | | — | | | — | | | 40,168 | | | — | | | 47,433 | |

| Woodstar Fund investments | — | | | — | | | (15,894) | | | — | | | — | | | (15,894) | |

| Derivatives | (120,072) | | | (163) | | | (1,988) | | | (3,721) | | | 23,019 | | | (102,925) | |

| Foreign currency | 34,960 | | | 67 | | | (42) | | | — | | | — | | | 34,985 | |

| Earnings from unconsolidated entities | (9,016) | | | (269) | | | — | | | (863) | | | — | | | (10,148) | |

| Sales of properties | — | | | — | | | (92,003) | | | — | | | — | | | (92,003) | |

| | | | | | | | | | | |

| Recognition of Distributable realized gains / (losses) on: | | | | | | | | | | | |

| Loans | (3,398) | | | — | | | — | | | 27,420 | | | — | | | 24,022 | |

| Realized credit loss | — | | | (1,546) | | | — | | | — | | | — | | | (1,546) | |

| Securities | (9,292) | | | — | | | — | | | (37,895) | | | — | | | (47,187) | |

| Woodstar Fund investments | — | | | — | | | 35,203 | | | — | | | — | | | 35,203 | |

| | | | | | | | | | | |

| Derivatives | 71,085 | | | 184 | | | 8,823 | | | 5,373 | | | (20,325) | | | 65,140 | |

| Foreign currency | (8,675) | | | (12) | | | 42 | | | — | | | — | | | (8,645) | |

| Earnings (loss) from unconsolidated entities | 2,994 | | | (29) | | | — | | | 683 | | | — | | | 3,648 | |

| Sales of properties | — | | | — | | | 39,150 | | | — | | | — | | | 39,150 | |

| Distributable Earnings (Loss) | $ | 394,081 | | | $ | 44,093 | | | $ | 73,259 | | | $ | 36,173 | | | $ | (198,295) | | | $ | 349,311 | |

| Distributable Earnings (Loss) per Weighted Average Diluted Share | $ | 1.21 | | | $ | 0.14 | | | $ | 0.22 | | | $ | 0.11 | | | $ | (0.61) | | | $ | 1.07 | |

| | | | | | | | | | | |

Starwood Property Trust, Inc. and Subsidiaries

Condensed Consolidated Balance Sheet by Segment

As of June 30, 2024

(Amounts in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Commercial and

Residential

Lending

Segment | | Infrastructure

Lending

Segment | | Property

Segment | | Investing

and Servicing

Segment | | Corporate | | Subtotal | | Securitization

VIEs | | Total |

| Assets: | | | | | | | | | | | | | | | |

| Cash and cash equivalents | $ | 8,935 | | | $ | 134,806 | | | $ | 28,757 | | | $ | 8,919 | | | $ | 77,850 | | | $ | 259,267 | | | $ | — | | | $ | 259,267 | |

| Restricted cash | 51,957 | | | 51,855 | | | 1,049 | | | 4,634 | | | 66,940 | | | 176,435 | | | — | | | 176,435 | |

| Loans held-for-investment, net | 13,923,013 | | | 2,371,596 | | | — | | | — | | | — | | | 16,294,609 | | | — | | | 16,294,609 | |

| Loans held-for-sale | 2,503,967 | | | — | | | — | | | 316,059 | | | — | | | 2,820,026 | | | — | | | 2,820,026 | |

| Investment securities | 1,046,972 | | | 17,886 | | | — | | | 1,104,981 | | | — | | | 2,169,839 | | | (1,504,125) | | | 665,714 | |

| Properties, net | 476,004 | | | — | | | 662,726 | | | 67,941 | | | — | | | 1,206,671 | | | — | | | 1,206,671 | |

| | | | | | | | | | | | | | | |

| Investments of consolidated affordable housing fund | — | | | — | | | 2,004,983 | | | — | | | — | | | 2,004,983 | | | — | | | 2,004,983 | |

| Investments in unconsolidated entities | 25,917 | | | 52,960 | | | — | | | 33,360 | | | — | | | 112,237 | | | (14,813) | | | 97,424 | |

| Goodwill | — | | | 119,409 | | | — | | | 140,437 | | | — | | | 259,846 | | | — | | | 259,846 | |

| Intangible assets | 12,043 | | | — | | | 23,589 | | | 60,878 | | | — | | | 96,510 | | | (34,246) | | | 62,264 | |

| Derivative assets | 65,522 | | | — | | | 2,677 | | | 2,331 | | | — | | | 70,530 | | | — | | | 70,530 | |

| Accrued interest receivable | 174,982 | | | 14,834 | | | 286 | | | 1,644 | | | 5,368 | | | 197,114 | | | — | | | 197,114 | |

| Other assets | 156,597 | | | 16,571 | | | 51,189 | | | 16,160 | | | 68,610 | | | 309,127 | | | — | | | 309,127 | |

| VIE assets, at fair value | — | | | — | | | — | | | — | | | — | | | — | | | 39,665,392 | | | 39,665,392 | |

| Total Assets | $ | 18,445,909 | | | $ | 2,779,917 | | | $ | 2,775,256 | | | $ | 1,757,344 | | | $ | 218,768 | | | $ | 25,977,194 | | | $ | 38,112,208 | | | $ | 64,089,402 | |

| Liabilities and Equity | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | |

| Accounts payable, accrued expenses and other liabilities | $ | 160,221 | | | $ | 39,912 | | | $ | 10,643 | | | $ | 35,395 | | | $ | 98,411 | | | $ | 344,582 | | | $ | — | | | $ | 344,582 | |

| Related-party payable | — | | | — | | | — | | | — | | | 27,849 | | | 27,849 | | | — | | | 27,849 | |

| Dividends payable | — | | | — | | | — | | | — | | | 153,422 | | | 153,422 | | | — | | | 153,422 | |

| Derivative liabilities | 29,358 | | | — | | | — | | | — | | | 46,773 | | | 76,131 | | | — | | | 76,131 | |

| Secured financing agreements, net | 8,861,573 | | | 809,128 | | | 478,548 | | | 640,878 | | | 1,333,278 | | | 12,123,405 | | | (20,546) | | | 12,102,859 | |

| Collateralized loan obligations and single asset securitization, net | 2,379,206 | | | 1,144,515 | | | — | | | — | | | — | | | 3,523,721 | | | — | | | 3,523,721 | |

| Unsecured senior notes, net | — | | | — | | | — | | | — | | | 2,754,370 | | | 2,754,370 | | | — | | | 2,754,370 | |

| | | | | | | | | | | | | | | |

| VIE liabilities, at fair value | — | | | — | | | — | | | — | | | — | | | — | | | 38,132,695 | | | 38,132,695 | |

| Total Liabilities | 11,430,358 | | | 1,993,555 | | | 489,191 | | | 676,273 | | | 4,414,103 | | | 19,003,480 | | | 38,112,149 | | | 57,115,629 | |

Temporary Equity: Redeemable non-controlling interests | — | | | — | | | 414,095 | | | — | | | — | | | 414,095 | | | — | | | 414,095 | |

| Permanent Equity: | | | | | | | | | | | | | | | |

| Starwood Property Trust, Inc. Stockholders’ Equity: | | | | | | | | | | | | | | | |

| Common stock | — | | | — | | | — | | | — | | | 3,241 | | | 3,241 | | | — | | | 3,241 | |

| Additional paid-in capital | 1,160,903 | | | 569,115 | | | (391,738) | | | (624,371) | | | 5,192,744 | | | 5,906,653 | | | — | | | 5,906,653 | |

| Treasury stock | — | | | — | | | — | | | — | | | (138,022) | | | (138,022) | | | — | | | (138,022) | |

| Retained earnings (accumulated deficit) | 5,840,613 | | | 217,247 | | | 2,056,463 | | | 1,571,657 | | | (9,253,298) | | | 432,682 | | | — | | | 432,682 | |

| Accumulated other comprehensive income | 13,920 | | | — | | | — | | | — | | | — | | | 13,920 | | | — | | | 13,920 | |

| Total Starwood Property Trust, Inc. Stockholders’ Equity | 7,015,436 | | | 786,362 | | | 1,664,725 | | | 947,286 | | | (4,195,335) | | | 6,218,474 | | | — | | | 6,218,474 | |

| Non-controlling interests in consolidated subsidiaries | 115 | | | — | | | 207,245 | | | 133,785 | | | — | | | 341,145 | | | 59 | | | 341,204 | |

| Total Permanent Equity | 7,015,551 | | | 786,362 | | | 1,871,970 | | | 1,081,071 | | | (4,195,335) | | | 6,559,619 | | | 59 | | | 6,559,678 | |

| Total Liabilities and Equity | $ | 18,445,909 | | | $ | 2,779,917 | | | $ | 2,775,256 | | | $ | 1,757,344 | | | $ | 218,768 | | | $ | 25,977,194 | | | $ | 38,112,208 | | | $ | 64,089,402 | |

| | | | | | | | | | | | | | | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

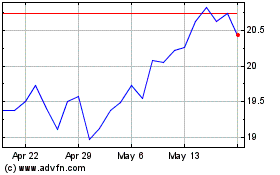

Starwood Property (NYSE:STWD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Starwood Property (NYSE:STWD)

Historical Stock Chart

From Nov 2023 to Nov 2024