- Revenue Growth of +9.8% at Actual Exchange Rates (AER);

+4.5% at Constant Exchange Rate (CER) Driven by Strong Momentum of

Growth & Launch Products (+14.6% at CER)

- Core Operating Profit Increase of +10.1% at CER; Core OP

Margin Climbs to 28.5%

- Reported Operating Profit +86.3% at AER Reflects Lower

Impairment of Intangible Assets Compared to FY2023

- Raises Adjusted Free Cash Flow Forecast Range by JPY 150.0

billion to JPY550.0 - JPY650.0 billion

- Announces Share Buyback of up to JPY 100.0 billion

Takeda (TOKYO:4502/NYSE:TAK) today announced earnings results

for the third quarter of fiscal year 2024 (nine months ended

December 31, 2024) showing continued advancement of its Growth

& Launch Products, which delivered double-digit growth of 14.6%

at CER. The company has upgraded its full year outlook for growth,

reflecting strong year-to-date product performance and OPEX

efficiencies, as well as revised foreign exchange assumptions.

Takeda continues to advance multiple late-stage programs and is

on track for three Phase 3 data readouts within the calendar year

2025. The company expects three regulatory filings in FY2025-FY2026

and five additional regulatory filings in FY2027-FY2029. Six of

these late-stage programs are estimated to have the potential to

generate peak revenues ranging from USD 10 billion to 20 billion in

total and contribute to long-term growth.

Takeda also announced today its decision to buy back shares up

to JPY 100.0 billion, underscoring confidence in its strong

business momentum and commitment to shareholder returns. For

details, see release: Takeda Announces Acquisition of Own

Shares

Takeda chief financial officer, Milano Furuta, commented:

“We are raising our Management Guidance and reported & Core

forecasts for the full year, pivoting to a growth outlook for

revenue and operating profit on the strength of product momentum

and OPEX efficiencies from our efficiency program. We are confident

that we will grow our Core Operating Profit margin this fiscal

year.

“As highlighted at our R&D Day in December 2024, we are on

track to three Phase 3 data readouts within calendar year 2025,

strengthening confidence in our long-term growth outlook.

“The announcement of our new share buyback program, approved by

Takeda’s Board of Directors, demonstrates our commitment to

shareholder returns.”

FINANCIAL HIGHLIGHTS for FY2024 Q3 YTD Ended December 31,

2024

(Billion yen, except percentages and per

share amounts)

FY2024 Q3 YTD

FY2023 Q3 YTD

vs. PRIOR YEAR

(Actual % change)

Revenue

3,528.2

3,212.9

+9.8%

Operating Profit

417.5

224.1

+86.3%

Net Profit

211.1

147.1

+43.5%

EPS (Yen)

134

94

+42.1%

Operating Cash Flow

835.0

437.8

+90.8%

Adjusted Free Cash Flow

(Non-IFRS)

568.3

36.3

+1,466%

Core (Non-IFRS)

(Billion yen, except percentages and per

share amounts)

FY2024 Q3 YTD

FY2023 Q3 YTD

vs. PRIOR YEAR

(Actual % change)

vs. PRIOR YEAR

(CER % change)

Revenue

3,528.2

3,212.9

+9.8%

+4.5%

Operating Profit

1,006.3

865.6

+16.3%

+10.1%

Margin

28.5%

26.9%

+1.6pp

―

Net Profit

698.9

643.6

+8.6%

+1.9%

EPS (Yen)

443

412

+7.5%

+0.9%

FY2024 Outlook Updating Full Year Management Guidance

and Reported and Core Forecasts

Takeda has upgraded its FY2024 Management Guidance, primarily

driven by product momentum and OPEX savings. In addition, and also

reflecting revised foreign exchange assumptions for the year,

Takeda has raised its FY2024 reported and Core forecasts from the

previous forecast. For more details, see release: Notice of the

Revised Forecast of Consolidated Financials for FY2024 (IFRS)

FY2024 Management Guidance Core Change at

CER (Non-IFRS)

FY2024 PREVIOUS MANAGEMENT

GUIDANCE (October 2024)

FY2024 REVISED MANAGEMENT

GUIDANCE (January 2025)

Core Revenue

Flat to slightly increasing

Low-single-digit % increase

Core Operating Profit

Mid-single-digit % decline

Low-single-digit % increase

Core EPS (Yen)

Approx 10% decline

Flat to slightly declining

FY2024 Reported and Core Forecasts

(Billion yen, except percentages and per

share amounts)

FY2024 PREVIOUS

FORECAST

(October 2024)

FY2024

REVISED FORECAST

(January 2025)

Revenue

4,480.0

4,590.0

Core Revenue (Non-IFRS)

4,480.0

4,590.0

Operating Profit

265.0

344.0

Core Operating Profit (Non-IFRS)

1,050.0

1,150.0

Net Profit

68.0

118.0

EPS (Yen)

43

75

Core EPS (Yen) (Non-IFRS)

456

507

Adjusted Free Cash Flow (Non-IFRS)

400.0-500.0

550.0-650.0

Annual Dividend per Share (Yen)

196

196

Positive Momentum in High-Value, Late-Stage Pipeline The

company is building strong momentum with its high-value, late-stage

programs. The transformative value these programs can deliver to

patients, as well as the significant revenue potential through 2030

and beyond, were presented at the R&D Day event held in

December 2024.

Among the multiple late-stage programs presented, the company

expects three Phase 3 data readouts in the calendar year 2025 with

filings anticipated in FY2025-FY2026 for the following programs and

indications:

- oveporexton (TAK-861) for the treatment of narcolepsy type

1,

- zasocitinib for the treatment of psoriasis, and

- rusfertide for the treatment of polycythemia vera, a rare

chronic blood disorder

Moreover, five additional indication filings for late-stage

programs are on pace for FY2027-FY2029.

- zasocitinib for the treatment of psoriatic arthritis,

- mezagitamab for treatments of immune thrombocytopenia (ITP), a

rare immune-mediated bleeding disorder, and immunoglobulin A

nephropathy (IgAN), a chronic progressive autoimmune mediated

kidney disease,

- fazirsiran for the treatment of alpha-1 antitrypsin

deficiency-associated liver disease, and

- elritercept for the treatment of anemia associated with

myelodysplastic syndrome

Beyond its high-value, late-stage pipeline, Takeda will continue

advancing its early-stage pipeline and focusing on strategic

business development opportunities, to deliver treatments that have

the potential to change patients’ lives.

Additional Information About Takeda’s FY2024 Q3 YTD

Results For more details about Takeda’s FY2024 Q3 YTD results,

commercial progress, pipeline updates and other financial

information, including key assumptions in the FY2024 forecast and

management guidance as well as definitions of non-IFRS measures,

please refer to Takeda’s FY2024 Q3 investor presentation (available

at

https://www.takeda.com/investors/financial-results/quarterly-results/)

About Takeda Takeda is focused on creating better health

for people and a brighter future for the world. We aim to discover

and deliver life-transforming treatments in our core therapeutic

and business areas, including gastrointestinal and inflammation,

rare diseases, plasma-derived therapies, oncology, neuroscience and

vaccines. Together with our partners, we aim to improve the patient

experience and advance a new frontier of treatment options through

our dynamic and diverse pipeline. As a leading values-based,

R&D-driven biopharmaceutical company headquartered in Japan, we

are guided by our commitment to patients, our people and the

planet. Our employees in approximately 80 countries and regions are

driven by our purpose and are grounded in the values that have

defined us for more than two centuries. For more information, visit

www.takeda.com.

Important Notice For the purposes of this notice, “press

release” means this document, any oral presentation, any question

and answer session and any written or oral material discussed or

distributed by Takeda Pharmaceutical Company Limited (“Takeda”)

regarding this press release. This press release (including any

oral briefing and any question-and-answer in connection with it) is

not intended to, and does not constitute, represent or form part of

any offer, invitation or solicitation of any offer to purchase,

otherwise acquire, subscribe for, exchange, sell or otherwise

dispose of, any securities or the solicitation of any vote or

approval in any jurisdiction. No shares or other securities are

being offered to the public by means of this press release. No

offering of securities shall be made in the United States except

pursuant to registration under the U.S. Securities Act of 1933, as

amended, or an exemption therefrom. This press release is being

given (together with any further information which may be provided

to the recipient) on the condition that it is for use by the

recipient for information purposes only (and not for the evaluation

of any investment, acquisition, disposal or any other transaction).

Any failure to comply with these restrictions may constitute a

violation of applicable securities laws.

The companies in which Takeda directly and indirectly owns

investments are separate entities. In this press release, “Takeda”

is sometimes used for convenience where references are made to

Takeda and its subsidiaries in general. Likewise, the words “we”,

“us” and “our” are also used to refer to subsidiaries in general or

to those who work for them. These expressions are also used where

no useful purpose is served by identifying the particular company

or companies.

The product names appearing in this document are trademarks or

registered trademarks owned by Takeda, or their respective

owners.

Forward-Looking Statements This press release and any

materials distributed in connection with this press release may

contain forward-looking statements, beliefs or opinions regarding

Takeda’s future business, future position and results of

operations, including estimates, forecasts, targets and plans for

Takeda. Without limitation, forward-looking statements often

include words such as “targets”, “plans”, “believes”, “hopes”,

“continues”, “expects”, “aims”, “intends”, “ensures”, “will”,

“may”, “should”, “would”, “could”, “anticipates”, “estimates”,

“projects”, “forecasts”, “outlook” or similar expressions or the

negative thereof. These forward-looking statements are based on

assumptions about many important factors, including the following,

which could cause actual results to differ materially from those

expressed or implied by the forward-looking statements: the

economic circumstances surrounding Takeda’s global business,

including general economic conditions in Japan and the United

States; competitive pressures and developments; changes to

applicable laws and regulations; challenges inherent in new product

development, including uncertainty of clinical success and

decisions of regulatory authorities and the timing thereof;

uncertainty of commercial success for new and existing products;

manufacturing difficulties or delays; fluctuations in interest and

currency exchange rates; claims or concerns regarding the safety or

efficacy of marketed products or product candidates; the impact of

health crises, like the novel coronavirus pandemic; the success of

our environmental sustainability efforts, in enabling us to reduce

our greenhouse gas emissions or meet our other environmental goals;

the extent to which our efforts to increase efficiency,

productivity or cost-savings, such as the integration of digital

technologies, including artificial intelligence, in our business or

other initiatives to restructure our operations will lead to the

expected benefits; and other factors identified in Takeda’s most

recent Annual Report on Form 20-F and Takeda’s other reports filed

with the U.S. Securities and Exchange Commission, available on

Takeda’s website at:

https://www.takeda.com/investors/sec-filings-and-security-reports/

or at www.sec.gov. Takeda does not undertake to update any of the

forward-looking statements contained in this press release or any

other forward-looking statements it may make, except as required by

law or stock exchange rule. Past performance is not an indicator of

future results and the results or statements of Takeda in this

press release may not be indicative of, and are not an estimate,

forecast, guarantee or projection of Takeda’s future results.

Financial information and Non-IFRS Measures Takeda’s

financial statements are prepared in accordance with International

Financial Reporting Standards (“IFRS”).

This press release and materials distributed in connection with

this press release include certain financial measures not presented

in accordance with IFRS, such as Core Revenue, Core Operating

Profit, Core Net Profit for the year attributable to owners of the

Company, Core EPS, Constant Exchange Rate (“CER”) change, Net Debt,

Adjusted Net Debt, EBITDA, Adjusted EBITDA, Free Cash Flow and

Adjusted Free Cash Flow. Takeda’s management evaluates results and

makes operating and investment decisions using both IFRS and

non-IFRS measures included in this press release. These non-IFRS

measures exclude certain income, cost and cash flow items which are

included in, or are calculated differently from, the most closely

comparable measures presented in accordance with IFRS. Takeda’s

non-IFRS measures are not prepared in accordance with IFRS and such

non-IFRS measures should be considered a supplement to, and not a

substitute for, measures prepared in accordance with IFRS (which we

sometimes refer to as “reported” measures). Investors are

encouraged to review the definitions and reconciliations of

non-IFRS measures to their most directly comparable IFRS measures,

which are in the Financial Appendix appearing at the end of our

FY2024 Q3 investor presentation (available at

www.takeda.com/investors). Beginning in the quarter ended June 30,

2024, Takeda (i) changed its methodology for CER adjustments to

results of subsidiaries in hyperinflation countries to present

those results in a manner consistent with IAS 29, Financial

Reporting in Hyperinflation Economies, (ii) re-named Free Cash Flow

as previously calculated as “Adjusted Free Cash Flow” (with “Free

Cash Flow” to be reported as Operating Cash Flow less Property,

Plant and Equipment), and (iii) re-named Net Debt as previously

calculated as “Adjusted Net Debt” (with “Net Debt” to be reported

as the book value of bonds and loans less cash and cash

equivalents).

Peak Sales and PTRS Estimates References in this press

release to peak revenue potential ranges are estimates that have

not been adjusted for probability of technical and regulatory

success (PTRS) and should not be considered a forecast or target.

These peak revenue potential ranges represent Takeda’s assessments

of various possible future commercial scenarios that may or may not

occur.

References in this press release to PTRS are to internal

estimates of Takeda regarding the likelihood of obtaining

regulatory approval for a particular product in a particular

indication. These estimates reflect the subjective judgment of

responsible Takeda personnel and have been approved by Takeda’s

Portfolio Review Committee for use in internal planning.

Medical information This press release contains

information about products that may not be available in all

countries, or may be available under different trademarks, for

different indications, in different dosages, or in different

strengths. Nothing contained herein should be considered a

solicitation, promotion or advertisement for any prescription drugs

including the ones under development.

Please refer to slide 5 of Takeda’s FY2024 Q3 investor

presentation (available at

https://www.takeda.com/investors/financial-results/quarterly-results/)

for the definition of Growth & Launch Products.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250127274764/en/

Investor Relations Christopher O’Reilly

Christopher.oreilly@takeda.com +81 (0) 90-6481-3412

Media Relations Brendan Jennings

Brendan.jennings@takeda.com +81 (0) 80-2705-8259 (Outside Japan

business hours) Media_relations@takeda.com

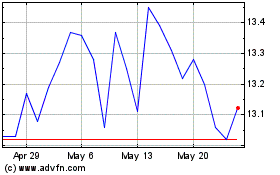

Takeda Pharmaceutical (NYSE:TAK)

Historical Stock Chart

From Jan 2025 to Feb 2025

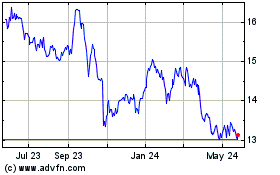

Takeda Pharmaceutical (NYSE:TAK)

Historical Stock Chart

From Feb 2024 to Feb 2025