South Africa Clears Anheuser-Busch InBev's Purchase of SABMiller

30 June 2016 - 7:50PM

Dow Jones News

Anheuser-Busch InBev NV's roughly $108 billion deal to buy

SABMiller PLC has been cleared by regulators in South Africa, with

the world's largest brewer on Thursday saying it is "well on track"

to close the acquisition in the second half of this year.

South Africa's Competition Tribunal's approval of the

combination of Belgian-based AB InBev with SABMiller leaves the

brewer now needing a formal nod from regulators in the U.S. and

China before the deal can close.

AB InBev in recent weeks had taken a series of steps to push the

deal through in South Africa—where regulators typically evaluate

how mergers affect employment—pledging to create a $69 million

investment fund in South Africa and promising that no employees in

the country would lose their jobs as a result of the merger. In

April, AB InBev said the investment fund would support farmers,

local manufacturing, jobs and the reduction of harmful alcohol use

in South Africa.

Those moves helped it get approval from the South Africa

Competition Commission last month, leaving it needing just the

Tribunal's nod, which it has now secured. The deal, if approved by

the U.S. and China, will create the world's largest brewer, with a

nearly 30% market share.

AB InBev in May got approval from the European Union after

agreeing to shed nearly all of SABMiller's European assets.

To appease U.S. regulators AB InBev has agreed to sell

SABMiller's interest in MillerCoors LLC to joint-venture partner

Molson Coors Brewing Co. In China, it has said it would sell

SABMiller's interest in the joint venture known as CR Snow to China

Resources Beer Holdings Co.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

June 30, 2016 05:35 ET (09:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

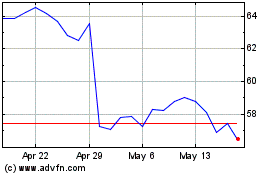

Molson Coors Beverage (NYSE:TAP)

Historical Stock Chart

From Apr 2024 to May 2024

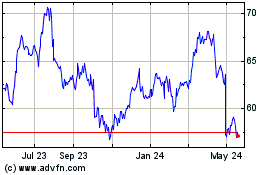

Molson Coors Beverage (NYSE:TAP)

Historical Stock Chart

From May 2023 to May 2024