UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of July 2024

Commission File Number: 001-13464

Telecom Argentina S.A.

(Translation of registrant’s name into English)

General Hornos, No. 690, 1272

Buenos Aires, Argentina

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Telecom

Argentina S.A. Announces the Commencement of the Tender Offer for its 8.500% Notes due 2025.

July 8,

2024— Buenos Aires, Argentina

Telecom Argentina S.A.

Offer to Purchase for Cash Up to U.S.$100,000,000

Aggregate Principal Amount of the Outstanding

8.500% Notes due August 6, 2025

(CUSIP Nos. 879273 AT7 and P9028N AZ4; ISIN

Nos. US879273AT79 and USP9028NAZ44)

Telecom Argentina S.A. (“Telecom”

or “we”) hereby announces the commencement of its offer to purchase for cash (the “Offer”) from each registered

holder (each, a “Holder” and, collectively, the “Holders”), on the terms and subject to the conditions set forth

in the offer to purchase dated July 8, 2024 (as it may be amended or supplemented from time to time, the “Statement”),

up to U.S.$100,000,000 outstanding aggregate principal amount (reflecting, for the avoidance of doubt, any amortization) (the “Tender

Cap”) of its outstanding 8.500% Notes due August 6, 2025 (the “Notes”). Telecom reserves the right, in its sole

discretion, subject to applicable law, to increase or decrease the Tender Cap; however, there can be no assurance that it will do so.

Morrow Sodali

International LLC is acting as the information and tender agent (the “Information and Tender Agent”) for the Offer.

Deutsche Bank Securities Inc., J.P. Morgan Securities LLC, Santander US Capital Markets LLC, BBVA Securities Inc., BCP

Securities, Inc., Latin Securities, S.A., Agente de Valores and UBS Securities LLC are acting as dealer managers (the

“Dealer Managers”) for the Offer.

The

aggregate cash consideration for each U.S.$1,000 principal amount of Notes purchased pursuant to the Offer will be (i) U.S.$993

per U.S. $1,000 principal amount of Notes (the “Early Tender Offer Consideration”) payable only in respect of Notes validly

tendered and not validly withdrawn at or prior to 5:00 P.M. New York City time on July 19, 2024 (the “Early Tender

Deadline”) and accepted for purchase, or (ii) U.S.$963 per U.S.$1,000 principal amount of Notes (the “Tender Offer

Consideration”) payable in respect of Notes validly tendered after the Early Tender Deadline but at or before 5:00 P.M., New York

City time, on August 5, 2024 (the “Expiration Time”) and accepted for purchase. Only Notes validly tendered and not validly

withdrawn at or before the Early Tender Deadline will be eligible to receive the Early Tender Offer Consideration. Notes validly tendered

after the Early Tender Deadline but at or before the Expiration Time will be eligible to receive only the Tender Offer Consideration.

In addition, Telecom will pay accrued and unpaid interest and additional amounts, if any, in respect of any Notes purchased in the Offer

from the last interest payment date to the Payment Date.

If the purchase of all validly tendered Notes would

cause Telecom to purchase a principal amount greater than the Tender Cap, then the Offer will be oversubscribed and, if Telecom accept

Notes in the Offer, Telecom will accept for purchase tendered Notes on a prorated basis as described below. If at the Early Tender Deadline,

the aggregate principal amount of Notes validly tendered and not validly withdrawn by Holders exceeds the Tender Cap, we will not accept

any Notes validly tendered by Holders after the Early Tender Deadline, unless we decide to increase the Tender Cap, subject to applicable

law, in our sole discretion.

The

following table sets forth certain terms of the Offer:

Title of

Security | |

CUSIP / ISIN

Nos. | |

| Original

Principal

Amount of

Notes(1) | | |

| Principal

Amount

Reflecting Any

Amortization(2) | | |

| Tender Cap(3) | | |

| Tender Offer

Consideration(4) | | |

| Early Tender

Offer

Consideration (5) | |

| 8.500% Notes due August 6, 2025 | |

144A

Notes

CUSIP No.: 879273 AT7

ISIN No.: US879273AT79

Regulation

S Notes CUSIP No.: P9028N AZ4

ISIN No.: USP9028NAZ44 | |

| U.S.$388,871,000 | | |

| U.S.$260,543,570 | | |

| U.S.$100,000,000 | | |

| U.S.$963 | | |

| U.S.$993 | |

(1) As of July 8, 2024. This amount

does not reflect any amortizations or repurchases.

(2) The

original principal amount of Notes of U.S.$388,871,000 is subject to a variable amortization factor (the “Amortization Factor”)

which is calculted in accordance with amortization payments made and expected to be made in accordance with the terms and conditions

of the Notes. As of the date of the Statement, the Amortization Factor is 0.67 and the aggregate outstanding principal amount of the

Notes is U.S.$260,543,570. On or after August 6, 2024, the Amortization Factor is expected be 0.34 and the aggregate outstanding

principal amount of the Notes is expected to be U.S.$132,216,140.

(3) Tender Cap to be applied to the outstanding

aggregate principal amount of Notes (such aggregate principal amount of the Notes being subject to the Amortization Factor). For the

avoidance of doubt, determination as to whether or not the Tender Cap has been exceeded will be made based on the aggregate principal

amount of the Notes validly tendered and accepted for purchase after the application of the Amortization Factor that is expected to be

applicable on the Payment Date (0.34).

(4) Per U.S.$1,000 principal amount of Notes

that are validly tendered at or prior to the Expiration Time but after the Early Tender Deadline and that are accepted for purchase.

The Tender Offer Consideration will be paid following the application of the relevant Amortization Factor applicable on the Payment Date.

The Tender Offer Consideration excludes accrued interest. Holders whose Notes are validly tendered and accepted for purchase pursuant

to the Offer will receive accrued interest and will be paid in U.S. dollars.

(5) Per

U.S.$1,000 principal amount of Notes that are validly tendered at or prior to the Early Tender Deadline and that are accepted for purchase.

The Early Tender Offer Consideration will be paid following the application of the relevant Amortization Factor applicable on the Payment

Date. The Early Tender Offer Consideration excludes accrued interest. Holders whose Notes are validly tendered at or prior to the Early

Tender Deadline and that are accepted for purchase pursuant to the Offer will receive accrued interest and will be paid in U.S. dollars.

The purpose of the Offer is to acquire a portion

of the outstanding Notes as part of a plan to extend the maturity profile of our existing debt. Concurrently with the commencement of

the Offer, Telecom is announcing an offering (the “New Notes Offering”) of a new series of notes (the “New Securities”)

to be issued by Telecom in reliance on an exemption from the registration requirements of the U.S. Securities Act of 1933, as amended

(the “Securities Act”). The New Notes Offering will be made in compliance with all the requirements of, and will be subject

to the procedural requirements established in, the Argentine Negotiable Obligations Law No. 23,576, as amended and supplemented (the

“Negotiable Obligations Law”), Law No. 26,831, as amended and supplemented (the “Argentine Capital Markets Law”),

the General Resolution No. 622, as amended and supplemented, issued by the CNV, and any other applicable laws and regulations of

Argentina. Telecom expects to use the net proceeds from the New Notes Offering, (i) to pay all or a portion of the consideration

for the Offer and accrued and unpaid interest on the Notes validly tendered and accepted by Telecom on or before the Expiration Time,

(ii) to pay fees and expenses incurred in connection with the Offer, (iii) to pay or prepay in whole or in part one or more

credit facilities and (iv) the remainder, if any, for general corporate purposes. The Offer is conditioned upon, among other things,

the successful completion of the New Notes Offering (the “Financing Condition”). No assurance can be given that the New Notes

Offering will be completed successfully. In no event will this announcement or the information contained in this announcement regarding

the New Securities constitute an offer to sell or a solicitation of an offer to buy any New Securities. Any investment decision to purchase

any New Securities should be made solely on the basis of the information contained in the offering memorandum to be prepared in connection

with the New Notes Offering, which will include the final terms of the New Securities, and no reliance is to be placed on any information

other than that contained in the offering memorandum. Subject to compliance with all applicable securities laws and regulations, the offering

memorandum will be available from the Dealer Managers on request. Certain of the Dealer Managers are acting as initial purchasers in the

New Notes Offering.

Upon the pricing of the New Notes Offering, we

may launch an offer to exchange (the “Exchange Offer”) our outstanding 8.000% Notes due 2026 for new securities of the same

series offered in the New Notes Offering. The offering of the New Securities is not conditioned on the successful consummation of the

Exchange Offer. However, the Exchange Offer is expected to be contingent on the successful consummation of the New Notes Offering. The

Exchange Offer is not being made pursuant to this announcement. The Exchange Offer is to be made solely on the terms and subject to the

conditions set out in a separate offer document. The Dealer Managers are expected to act as dealer managers in the Exchange Offer. No

assurances can be made that we will launch the Exchange Offer.

If the purchase of all validly tendered Notes would

cause Telecom to purchase a principal amount greater than the Tender Cap, then the Offer will be oversubscribed and, if Telecom accepts

Notes in the Offer, Telecom will accept for purchase tendered Notes on a prorated basis, with the prorated aggregate principal amount

of each Holder’s validly tendered Notes accepted for purchase rounded down to the nearest U.S.$1,000. Depending on the amount tendered

and the proration factor applied, if the principal amount of Notes returned as a result of proration would result in less than the minimum

denomination of the Notes being tendered or returned, Telecom will accept or reject all of such Holder’s validly tendered Notes.

However, Notes validly tendered at or prior to the Early Tender Deadline will be accepted for purchase in priority to Notes tendered after

the Early Tender Deadline.

The Early Tender Offer Consideration or the Tender

Offer Consideration, as applicable, will not be due in respect of any Notes returned due to proration. Notes must be tendered on behalf

of each beneficial owner due to potential proration.

So long as the terms and conditions described herein

(including the Financing Condition) are satisfied, Telecom intends to accept for payment all Notes validly tendered and not validly withdrawn

at or prior to the Early Tender Deadline, and will only prorate such Notes if the aggregate amount of Notes validly tendered and not withdrawn

at or prior the Early Tender Deadline exceeds the Tender Cap. If the Offer is not fully subscribed as of the Early Tender Deadline, Notes

validly tendered after the Early Tender Deadline and at or before the Expiration Time may be subject to proration, whereas Notes validly

tendered at or prior to the Early Tender Deadline would not be subject to proration. Furthermore, if the Offer is fully subscribed as

of the Early Tender Deadline, Notes validly tendered after the Early Tender Deadline may not be accepted for payment, unless Telecom decides

to increase the Tender Cap, subject to applicable law, in its sole discretion. In any scenario, Notes validly tendered at or prior to

the Early Tender Deadline and not validly withdrawn will have priority in payment over Notes validly tendered after the Early Tender Deadline

and at or before the Expiration Time. Telecom will announce the results of proration, if any, by press release promptly after the Early

Acceptance Date (as defined below) or the Final Acceptance Date (as defined below), as the case may be.

Any Notes tendered may be validly withdrawn at

or before 5:00 P.M., New York City time, on July 19, 2024 (the “Withdrawal Deadline”), but not thereafter, by following

the procedures described herein. Tenders of Notes may not be withdrawn after the Withdrawal Deadline, unless mandated by applicable law.

If the Offer is terminated without Notes being purchased, any Notes tendered pursuant to the Offer will be returned promptly, and neither

the Early Tender Offer Consideration nor the Tender Offer Consideration, as the case may be, will be paid or become payable.

Subject to the terms and conditions of the Offer

(including the Financing Condition) being satisfied or waived, we reserve the right, at any time following the Early Tender Deadline but

prior to the Expiration Time (the “Early Acceptance Date”), to accept for purchase the Notes validly tendered at or before

the Early Tender Deadline and not validly withdrawn at or before the Withdrawal Deadline, subject any required proration.

Subject to the terms and conditions of the Offer

being satisfied or waived, and to our right to extend, amend, terminate or withdraw the Offer, we will, after the Expiration Time (the

“Final Acceptance Date”), accept for purchase all Notes validly tendered at or before the Expiration Time and not validly

withdrawn at or before the Withdrawal Deadline subject to proration, if applicable. We will pay the Early Tender Offer Consideration and

the Tender Offer Consideration for Notes accepted for purchase at the Final Acceptance Date on a date (the “Payment Date”)

promptly following the Final Acceptance Date. We will pay the Early Tender Offer Consideration and the Tender Offer Consideration following

the application of the relevant Amortization Factor applicable on the Payment Date. Also, on the Payment Date, we will pay accrued and

unpaid interest, and additional amounts, if any, to, but not including, the Payment Date, on Notes accepted for purchase at the Final

Acceptance Date.

For the avoidance of doubt, we expect to have a

single Payment Date for (i) Notes validly tendered before the Early Tender Deadline, and (ii) Notes validly tendered after the

Early Tender Deadline and at or before the Expiration Time that are, in each case, accepted for purchase.

Telecom’s obligation to accept for purchase,

and to pay for, Notes validly tendered and not validly withdrawn pursuant to the Offer, is subject to the satisfaction or waiver of a

number of conditions, including the Financing Condition and the General Conditions (as defined in the Statement). Telecom reserves the

right, subject to applicable law, in its sole discretion, to waive any of the conditions of the Offer, in whole or in part, at any time

and from time to time.

Telecom reserves the right, subject to applicable

law, in its sole discretion, to (1) extend, terminate or withdraw the Offer at any time, (2) increase or decrease the Tender

Cap, or (3) otherwise amend the Offer in any respect, without extending the Withdrawal Deadline. The foregoing rights are in addition

to the right to delay acceptance for purchase of Notes tendered pursuant to the Offer or the payment of Notes accepted for purchase pursuant

to the Offer in order to comply with any applicable law, subject to Rule 14e-1(c) under the U.S. Securities Exchange Act of

1934, as amended (the “Exchange Act”), which requires that Telecom pay the consideration offered or return the deposited Notes

promptly after the termination or withdrawal of the Offer.

Notes tendered by or on behalf

of persons that are (i) Argentine Entities (as defined in the Statement) or (ii) Foreign Beneficiaries (as defined in the Statement)

that are residents in a “non-cooperative jurisdiction” for Argentine income tax purposes, or that acquired the Notes with

funds originating in a non-cooperative jurisdiction must be accompanied in each case with such documentation as Telecom may require to

make the withholdings mandated by Argentine income tax regulations.

The

Information and Tender Agent for the Offer is:

| Morrow Sodali International LLC |

| |

|

E-mail:

telecomargentina@investor.morrowsodali.com

|

| Offer

Website: https://projects.morrowsodali.com/telecomargentina |

| |

In London

103 Wigmore Street

W1U 1QS

London

Telephone: +44 20 4513 6933 |

In Stamford

333 Ludlow Street,

South Tower, 5th Floor

Stamford, CT 06902

Telephone: +1 203 658 9457 |

Any question regarding the terms of the Offer should

be directed to the Dealer Managers.

The

Dealer Managers for the Offer are:

|

Deutsche Bank Securities Inc.

1 Columbus Circle

New York, New York, 10019

United States

Attention: Liability

Management

Call Collect: (212) 250-2955

Toll-Free: (866) 627-0391

|

J.P. Morgan

Securities LLC

383 Madison Avenue

New York, New York 10179

United States

Attention: Latin America Debt Capital Markets

Call Collect: (212) 834-7279

Toll-Free: (866) 846-2874 |

Santander US Capital Markets LLC

437 Madison Ave

New York, New York 10022

United States

Attention: Liability Management

Call Collect: (212) 350-0660

Toll-Free: (855) 404-3636 |

|

BBVA Securities Inc.

1345 Avenue of the Americas,

44th Floor

New York, New York 10105

United States of America

Attn: Liability Management

Collect: +1 (212) 728 2446

U.S. Toll Fee: +1 (800) 422 8692

Email: liabilitymanagement@bbva.com |

BCP Securities, Inc.

289 Greenwich Avenue

Greenwich, CT 06830

United States

Attention: James Harper

(203) 629-2186

Email: jharper@bcpsecurities.com |

Latin Securities S.A. Agente de Valores

Zonamérica

Ruta 8, Km 17,500

Edificio M2, Ofic. 002

Montevideo, CP 91600

Uruguay

Attention: m.sagaseta@latinsecurities.com.uy |

UBS Securities LLC

1285 Avenue of the Americas

New York, NY 10019

Attention: Liability Management

Group

Call Collect: (212) 882-5723

Toll Free: (833) 690-0971

Email: Americas-lm@ubs.com |

The

Offer shall be available online at https://projects.morrowsodali.com/telecomargentina until the consummation or termination

of the Offer

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Telecom Argentina S.A. |

| |

|

| Date: |

July 8, 2024 |

By: |

/s/ Luis Fernando Rial Ubago |

| |

|

|

Name: |

Luis Fernando Rial Ubago |

| |

|

|

Title: |

Responsible for Market Relations |

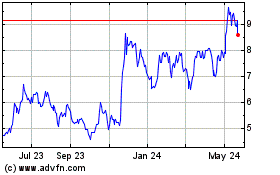

Telecom Argentina (NYSE:TEO)

Historical Stock Chart

From Dec 2024 to Jan 2025

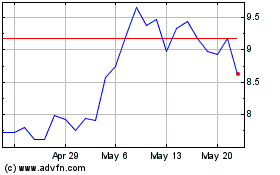

Telecom Argentina (NYSE:TEO)

Historical Stock Chart

From Jan 2024 to Jan 2025