Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

22 July 2024 - 9:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of July 2024

Commission File Number: 001-13464

Telecom Argentina S.A.

(Translation of registrant’s name into English)

General Hornos, No. 690, 1272

Buenos Aires, Argentina

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Telecom Argentina S.A. Announces an Extension

of Early Tender Offer Consideration for Cash Tender Offer

July 22,

2024 — Buenos Aires, Argentina

Telecom Argentina S.A.

8.500% Notes due August 6, 2025

(CUSIP Nos. 879273 AT7 and P9028N AZ4; ISIN

Nos. US879273AT79 and USP9028NAZ44)

Telecom

Argentina S.A. (“Telecom”) hereby announces that it is extending the offer to pay the Early Tender Offer Consideration through

the Expiration Time in connection with its previously announced offer to purchase for cash (the “Offer”) up to U.S.$100,000,000

outstanding aggregate principal amount (reflecting, for the avoidance of doubt, any amortization) of its outstanding 8.500% Notes due

August 6, 2025 (the “Notes”) from each registered holder, on the terms and subject to the conditions set forth in the

offer to purchase dated July 8, 2024 (as it may be amended or supplemented from time to time, the “Statement”). As a

result, holders of Notes that are validly tendered (and not validly withdrawn) at or prior to the Expiration Time, including those who

have validly tendered (and not validly withdrawn) Notes at or prior to the Early Tender Deadline, and accepted for purchase (subject to

any required proration), will be entitled to receive the Early Tender Offer Consideration as set forth in the Statement. Capitalized terms

used but not defined herein have the meanings assigned to them in the Statement.

The complete terms and conditions

of the Offer are described in Telecom’s Statement. Except as described in this press release, the other terms of the Offer as set

forth in the Statement remain unchanged.

The Offer is scheduled to

expire at 5:00 p.m., New York City time, on August 5, 2024 unless extended or earlier terminated (such time and date, as the same

may be extended, the “Expiration Time”). The previously announced withdrawal deadline of 5:00 p.m., New York City time, on

July 19, 2024, has now passed. Notes that have been validly tendered may no longer be withdrawn, and any Notes validly tendered

on and after the date hereof and prior to the Expiration Time may not be withdrawn. The Payment Date is expected to be three business

days after the Expiration Time.

Morrow

Sodali International LLC is acting as the information and tender agent (the “Information and Tender Agent”) for the Offer.

Deutsche Bank Securities Inc., J.P. Morgan Securities LLC, Santander US Capital Markets LLC, BBVA Securities Inc., BCP Securities, Inc.,

Latin Securities, S.A., Agente de Valores, and UBS Securities LLC are acting as dealer managers (the “Dealer Managers”) for

the Offer.

This press release is neither

an offer to purchase nor a solicitation of an offer to sell the Notes. The Offer is not being made to holders in any jurisdiction in which

Telecom is aware that the making of the Offer would not be in compliance with the laws of such jurisdiction. In any jurisdiction in which

the securities laws or blue sky laws require the Offer to be made by a licensed broker or dealer, the Offer will be deemed to be made

on Telecom’s behalf by the Dealer Managers or one or more registered brokers or dealers that are licensed under the laws of such

jurisdiction. Any questions or requests for assistance regarding the Offer may be directed to the Dealer Managers. Requests for additional

copies of the Statement and related documents may be directed to the Information and Tender Agent.

Forward-Looking Statements

This press release contains forward-looking statements.

Forward-looking statements are information of a non-historical nature or which relate to future events and are subject to risks and uncertainties.

No assurance can be given that the transactions described herein will be consummated or as to the ultimate terms of any such transactions.

Telecom undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or

future events or for any other reason.

The

Information and Tender Agent for the Offer is:

| Morrow Sodali International LLC |

| |

|

E-mail:

telecomargentina@investor.morrowsodali.com

|

| Offer

Website: https://projects.morrowsodali.com/telecomargentina |

| |

In London

103 Wigmore Street

W1U 1QS

London

Telephone: +44 20 4513 6933 |

In Stamford

333 Ludlow Street,

South Tower, 5th Floor

Stamford, CT 06902

Telephone: +1 203 658 9457 |

Any question regarding the terms of the

Offer should be directed to the Dealer Managers.

The

Dealer Managers for the Offer are:

|

Deutsche Bank Securities Inc.

1 Columbus Circle

New York, New York, 10019

United States

Attention: Liability

Management

Call Collect: (212) 250-2955

Toll-Free: (866) 627-0391 |

J.P. Morgan

Securities LLC

383 Madison Avenue

New York, New York 10179

United States

Attention: Latin America Debt Capital Markets

Call Collect: (212) 834-7279

Toll-Free: (866) 846-2874 |

Santander US Capital Markets LLC

437 Madison Ave

New York, New York 10022

United States

Attention: Liability Management

Call Collect: (212) 350-0660

Toll-Free: (855) 404-3636 |

|

BBVA Securities Inc.

1345 Avenue of the Americas,

44th Floor

New York, New York 10105

United States of America

Attn: Liability Management

Collect: +1 (212) 728 2446

U.S. Toll Fee: +1 (800) 422 8692

Email: liabilitymanagement@bbva.com |

BCP Securities, Inc.

289 Greenwich Avenue

Greenwich, CT 06830

United States

Attention: James Harper

(203) 629-2186

Email: jharper@bcpsecurities.com |

Latin Securities S.A. Agente de Valores

Zonamérica

Ruta 8, Km 17,500

Edificio M2, Ofic. 002

Montevideo, CP 91600

Uruguay

Attention: m.sagaseta@latinsecurities.com.uy |

UBS Securities LLC

1285 Avenue of the Americas

New York, NY 10019

Attention: Liability Management Group

Call Collect: (212) 882-5723

Toll Free: (833) 690-0971

Email: Americas-lm@ubs.com |

Information

relating to the Offer shall be available online at https://projects.morrowsodali.com/telecomargentina until the consummation

or termination of the Offer

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Telecom Argentina S.A. |

| |

|

| Date: |

July 22, 2024 |

By: |

/s/ Luis Fernando Rial Ubago |

| |

|

|

Name: |

Luis Fernando Rial Ubago |

| |

|

|

Title: |

Responsible for Market Relations |

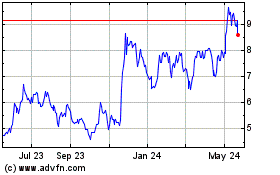

Telecom Argentina (NYSE:TEO)

Historical Stock Chart

From Dec 2024 to Jan 2025

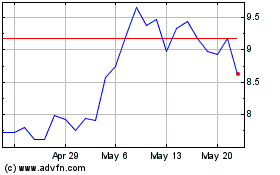

Telecom Argentina (NYSE:TEO)

Historical Stock Chart

From Jan 2024 to Jan 2025