0000097216false00000972162025-02-062025-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) February 6, 2025

TEREX CORPORATION

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Delaware | 1-10702 | 34-1531521 |

| (State or Other Jurisdiction | (Commission | (IRS Employer |

| of Incorporation) | File Number) | Identification No.) |

| | | | | | | | | | | |

| 301 Merritt 7, 4th Floor | Norwalk | Connecticut | 06851 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code (203) 222-7170

| | |

| NOT APPLICABLE |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock ($0.01 par value) | TEX | New York Stock Exchange |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02. Results of Operations and Financial Condition.

Attached as Exhibit 99.1 to this Form 8-K of Terex Corporation (“Terex”) are the prepared statements of Terex from its February 6, 2025, conference call providing certain fourth quarter and year-end 2024 financial results. In addition, a replay of the teleconference is available to the public at https://investors.terex.com.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 7, 2025

| | |

| TEREX CORPORATION |

|

By: /s/Julie A. Beck |

| Julie A. Beck |

| Senior Vice President |

| and Chief Financial Officer |

|

Fourth Quarter and Year-End 2024 Earnings Release Conference Call

February 6, 2025

Derek Everitt – Terex Corporation – Vice President, Investor Relations

Good morning and welcome to the Terex fourth quarter 2024 earnings conference call. A copy of the press release and presentation slides are posted on our Investor Relations website at investors.terex.com. In addition, the replay and slide presentation will be available on our website. We are joined today by Simon Meester, President and Chief Executive Officer, and Julie Beck, Senior Vice President and Chief Financial Officer, along with Jennifer Kong, who will succeed Julie as Senior Vice President and Chief Financial Officer shortly after Terex files its 2024 Annual Report on Form 10-K. Their remarks will be followed by question-and-answer.

Please turn to slide 2 of the presentation, which reflects our safe harbor statement. Today’s conference call contains forward-looking statements, which are subject to risks that could cause actual results to be materially different from those expressed or implied. These risks are described in greater detail in the earnings materials and in our reports filed with the Securities and Exchange Commission. On this call, we will be discussing non-GAAP financial information, including adjusted figures that we believe are useful in evaluating the Company’s operating performance. Reconciliations for these non-GAAP measures can be found in the conference call materials. Please turn to slide 3 and I’ll turn it over to Simon Meester.

Simon A. Meester – Terex Corporation – President and Chief Executive Officer

Thanks, Derek, and good morning. I would like to welcome everyone to our earnings call and appreciate your interest in Terex. As you know, this will be Julie Beck’s last earnings call as she will be leaving Terex in April. I want to thank Julie on behalf of our team, our board of directors and our shareholders for her commitment and contributions to Terex over these past three years. I also want to welcome our in-coming CFO, Jennifer Kong, who started on Monday. Jenn’s extensive finance experience, including leading significant integrations and transformations in large multi-nationals, makes her a great fit for Terex. Looking at the year’s performance, I’m very pleased by our improved safety performance, and as we enter 2025, our commitment to safety and the Terex values remains steadfast. As we continue to transform and grow our company, our values will continue to include keeping each other safe, treating each other with respect and dignity, and being stewards of our environment and our community.

Turning to slide 4. Our financial performance in the final quarter of 2024 was consistent with our Q3 outlook. For the full year, we delivered earnings per share of $6.11, on sales of $5.1 billion. This is the second highest full-year earnings per share performance in the Company’s history and a reflection of the strength of the Terex portfolio. As we discussed last quarter, Aerial Work Platforms (“AWP”) and Materials Processing (“MP”) scaled back production in the second half to align with industry-wide channel adjustments and will maintain a prudent operational posture for 2025. Environment Solutions Group (“ESG”) executed very well in their first quarter with Terex. In the period following the October 8 close, ESG earned $51 million or 22% EBITDA on revenue of $228 million, delivering on the commitment of being financially accretive from day one. I am excited to see this level of performance continue into 2025 and beyond.

Turning to slide 5. ESG has a strong leadership team, led by Pat Carroll, that chartered ESG’s impressive growth over the past 15 years. In Q1 of 2025, Pat took on additional responsibilities, becoming president of our new Environmental Solutions segment, which includes ESG and Terex Utilities. I know Pat and the team will do a great job capitalizing on the many opportunities ahead, and thanks to detailed advanced planning, the integration team hit the ground running with eight workstreams making progress. We fully expect to deliver at least $25 million in operational run-rate synergies by the end of 2026 and realize additional commercial opportunities as we integrate ESG into Terex.

Turning to slide 6. With the addition of ESG to our portfolio, approximately 25% of our revenue is from waste and recycling markets characterized by low cyclicality and steady growth. About 20% of our business is related to infrastructure where significant investment is being put in place in the United States and around the world. Utilities is about 10% and growing as the well documented need to expand and strengthen energy distribution is clear. General construction, which in the past had represented the majority of our end markets, is now less than a third. An important macro headwind is the elevated level of interest rates and uncertainty around the Fed’s outlook. We continue to see strong public sector spending on infrastructure and utilities, but rate-sensitive private projects continue to be impacted by the higher rates. Policies that stabilize inflation, enabling rate reductions, would unlock pent-up demand on the private investment side. We are encouraged by the improved sentiment that followed the U.S. election in November. The new administration’s focus on easing the regulatory environment for new projects and encouraging growth and investment in the United States are stimulants for many of our end markets. With over two-thirds of our revenue coming from North America, a strong U.S. economy is an important overall tailwind for us. We’re closely following the administration’s approach to international trade policy.

It is important to understand that the majority of the products we sell in the United States, we make in the United States which limits our exposure. Moreover, we initiated mitigation actions last year in anticipation of additional tariffs, leveraging our global capabilities to manage the impact. As a global company with a significant footprint in the United States and around the world, we have optionality and are ready to take additional actions if needed. Turning to Europe, we continue to see a generally weak economic environment. We do remain encouraged by increasing adoption of our products in emerging markets such as India, Southeast Asia, the Middle East, and Latin America.

Please turn to slide 7. While we see shorter term adjustments in some of our legacy markets, we continue to be highly confident in our longer-term growth outlook. Our portfolio of strong businesses will continue to benefit from mega-trends, onshoring, technology advancements and federal investments. We continue to see record levels of mega-projects in data centers, manufacturing, semiconductor plants, and others, with more projects expected to come online through 2027. We anticipate increased activity from infrastructure investments, from roads and bridges to airports, railways and the power grid. We are encouraged by the new administration’s support for artificial intelligence, power and other infrastructure investments, and while priorities may shift, we believe these high investment levels will continue.

Turning to slide 8. We started implementing our revised Execute, Innovate and Grow strategy, and will continue to drive progress in 2025 and beyond. As said, we are evaluating our global footprint, focusing on opportunities to reduce fixed costs while improving operational performance and efficiency. When it comes to innovation, we have a very exciting new product development pipeline focused on maximizing return on investment for our customers. We also continue to invest in robotics, automation, and digitizing workstreams to make our operations more efficient and more flexible. Turning to growth. Completing the ESG acquisition was a significant step forward. We fully expect organic growth in that business to continue, in line with its demonstrated performance over the past decade. On the Utilities front, we are unlocking growth potential by improving productivity and expanding capacity, as the long-term demand outlook continues to expand. Our MP and Aerials businesses will manage through the current portion of the cycle, before returning to growth as the need for more replacement equipment and mega-trends are expected to remain significant tailwinds. Overall, we have a $40 billion addressable market with significant upside for our businesses.

Turning to slide 9. Maintaining industrial market leadership requires a regular cadence of new innovative product introductions. Our businesses pride themselves on bringing ground-breaking products to market that improve return on investment (“ROI”) for our customers. A great example is the completely re-designed, next generation Genie slab scissor family, pictured on the left. The new Genie scissors provide our customers with industry-leading quality, performance, and significantly lower total cost of ownership. Included in the launch is the first ever Genie scissor that does not use any hydraulic oil, which is perfect for the rapidly growing data center and entertainment markets. The middle picture features the industry’s first all-electric refuse collection body, recently introduced by Heil. While on route the automated side loader is entirely electrically actuated with no hydraulics. It can plug directly into an electric chassis battery or run on its own battery to maximize the vehicle’s collection range. Customers love it because it has demonstrated fuel savings of up to 38% and supports sustainability and contamination reduction objectives while delivering excellent productivity. And finally, the image on the right shows our new Brush Chipper, the latest addition to our new Green-Tec product line. We launched Green-Tec last year to focus on the growing tree care and vegetation management markets. The team is doing a great job growing the new business line, entering 2025 with a healthy backlog. Each of these new product offerings are examples of the strength and the leverage of the Terex portfolio to maximize ROI for our customers in a diverse and continually expanding market. And with that I’ll turn it over to Julie.

Julie Beck – Terex Corporation – Senior Vice President and Chief Financial Officer

Thank you, Simon, and good morning everyone. Look at our fourth quarter financial results on slide 10. Total net sales of $1.2 billion were up slightly versus the prior year due to the addition of ESG. Sales in the legacy segments were down 17%, largely in line with our expectations due to industry-wide channel adjustments. Gross margin of 19% reflects lower year over year margins in the legacy segments partially offset by accretive margins from ESG. Volume, unfavorable manufacturing variances and mix in the legacy segments were partially offset by cost reduction actions. We reduced legacy selling, general, and administrative (“SG&A”) expenses by $14 million or 10.4% year-over-year as we executed cost reduction actions and lowered incentive compensation. Operating profit was $97 million or 7.8%. Interest and other expense was $39 million, $24 million higher than last year, due to interest on acquisition-related financing. The fourth quarter effective tax rate was 10.9%, compared to 18.7% in the fourth quarter of 2023, due to favorable jurisdictional mix and discrete one-time items. Earnings per share for the quarter was $0.77 and EBITDA was $114 million. Free cash flow for the quarter was $129 million, compared to $135 million in the fourth quarter of 2023.

Turning to slide 11 for the full year results. Total net sales of $5.1 billion were generally in line with 2023 as the fourth quarter addition of ESG offset a 4.9% decline in legacy revenue. Gross margin of 21.7% was 120 basis points lower year-over-year as volume and unfavorable mix in the legacy segments were only partially offset by cost reduction actions and the fourth quarter accretion from ESG. We reduced legacy SG&A expenses by $18 million or 3.4% for the full year, through cost reduction actions and

lower incentive compensation. Operating profit was $582 million or 11.3%. Interest and other expense was $83 million, $20 million higher than last year, due to interest on acquisition-related financing. The full year effective tax rate was 17.2%, 100 basis points better than the prior year due to favorable geographic mix. Earnings per share for the year was $6.11, as Simon mentioned that is the second highest in Terex history, and EBITDA was $642 million or 12.5%. Free cash flow of $190 million was down from last year due to lower net income, including higher interest expense, increased net working capital and a one-time benefit in the prior year associated with the sale of the Oklahoma City facility.

Please turn to slide 12 to review our segment results, starting with AWP. AWP sales of $3 billion for the year, represents 3% growth compared to 2023, with similar growth rates in Aerials and Terex Utilities. The year was characterized by a return to seasonal delivery patterns, which we expect to be the norm going forward. During this market transition, we were encouraged to see market share gains resulting from new products and other customer-focused improvements made by the team. Full year AWP operating margin was 11.6%. Consistent with our third quarter outlook, fourth quarter margins were impacted by aggressive production cuts, product moves, and unfavorable mix in Aerials. The Genie team continues to optimize manufacturing footprint, drive operational efficiency, and introduce a host of new products that maximize return on investment for its customers.

Please turn to slide 13 to review MP performance. Full year sales of $1.9 billion were 14.6% lower than the prior year due to industry-wide channel adjustments, combining with challenging macroeconomic factors in Europe, especially in the second half. On the aggregates side, we saw machines on rent longer than usual, impacting dealers’ replenishment of new units. The European market was weak all year which initially impacted Material Handling, Cranes and eventually aggregates. Our U.S. concrete and India aggregates businesses were bright spots, both growing in the fourth quarter. MP’s solid 13.6% full year operating margin was impacted by lower volume and unfavorable product and geographic mix, partially offset by cost reduction actions.

Please turn to slide 14 to review ESG. We were very pleased with the ESG’s performance following the October 8th close. The business achieved 21.9% operating margin on net sales of $228 million, representing meaningful growth and profitability improvement over the prior year period. Operational initiatives on both collection vehicle and compactor production contributed to the margin expansion. EBITDA in the period was $51 million or 22% of sales. We are very excited about ESG’s 2025 and future contributions to Terex.

Please turn to slide 15. In the fourth quarter we funded the ESG acquisition at favorable rates and terms and maintained our corporate rating. We continue to maintain a solid balance sheet and flexible capital structure with the right mix of secured and unsecured debt and variable versus fixed rates. We can pre-pay or re-price a significant portion of the debt and we do not have any maturities until 2029. We continue to have ample liquidity, with a year-end leverage ratio of 2.6 times based on the calculation in our credit agreement. We plan to de-leverage in future periods as we generate increased cash flow from operations and take advantage of cash tax benefits associated with the acquisition. We will also continue to invest in our businesses, fueling organic growth and profitability improvement. We reported a return on invested capital of 19.4%, well above our cost of capital. Returning capital to shareholders remains a priority. In 2024, Terex returned $92 million to shareholders through share repurchases and dividends, more than offsetting equity compensation dilution. We have $86 million remaining under our share repurchase authorization, and we will continue to buy back shares. Terex is in a strong financial position to continue investing in our business and executing our strategic initiatives, while returning capital to shareholders.

Turning to bookings and backlog on slide 16. Our current backlog of $2.3 billion includes a very healthy $520 million for ESG and $1.8 billion for our legacy businesses, which is in-line with historical, pre-covid norms. As expected, we saw booking trends return to a historical pattern, with the fourth quarter traditionally being a seasonally strong bookings period. Book to bill for the legacy business was 116%, led by the Aerials component of AWP at 153% as rental customers ramped up orders for 2025. Moreover, the Genie team has secured sizable additional 2025 commitments from large customers in January. We expect book to bill of greater than 100% again in the first quarter, providing further support for our Aerials 2025 outlook. MP has returned to its traditional book-to-bill cadence supported by reliable lead times with backlog coverage of approximately three months. ESG backlog of $520 million heading into 2025 is up 16% from the prior year. Its strong fourth quarter bookings of $255 million represent a 112% book to bill, supporting our growth outlook for ESG.

Now turn to slide 17 for our 2025 outlook. We are operating in a complex environment with many macroeconomic variables and geo-political uncertainties and results could change negatively or positively. With that said, this outlook represents our best estimate as of today and does not include the impact of any new tariffs or trade policy changes that are not currently in effect. We expect overall growth in 2025 with the full-year contribution of ESG, anticipating net sales of approximately $5.4 billion with a segment operating margin of about 12% and EBITDA of roughly $660 million. Interest and other expenses will increase compared to 2024 due to acquisition related financing to an expected full year total of about $175 million. We expect 2025 earnings per share of between $4.70 and $5.10 on lower legacy volume, partially offset by accretive ESG growth. From a quarterly perspective, we anticipate a slower start to the year, delivering about 10% of our full year earnings per share in the first quarter as we continue to execute the corrective

actions we deployed in the fourth quarter to set us up for the longer term. We expect about two-thirds of the full year earnings per share over the middle two quarters. We expect a significant increase in free cash flow compared to 2024, anticipating between $300 and $350 million in 2025 driven by working capital reductions and a full year of ESG cash generation, while continuing to invest in our businesses with expected capex of approximately $120 million.

Looking at our segments. During the first quarter, ESG was combined with Terex Utilities to create Environmental Solutions, or “ES”. MP is unchanged and Aerials, which is our Genie business, will be reported stand-alone. We will provide historical comparative information when we release our first quarter 2025 results. Let’s start with Aerials. We expect sales to be down low double digits compared to $2.4 billion in 2024. Excluding first quarter one-timers, we expect full year 2025 margins to be consistent with our 25% decremental target. As a result, and consistent with historical seasonal patterns, we expect the second and third quarters to be the highest margin quarters. We expect MP sales to be down high single digits compared to the prior year, Europe to remain generally weak with North America starting slowly then picking up steam as the year unfolds. We anticipate MP to achieve decremental margins well within our 25% target. ESG had a strong fourth quarter and we expect that momentum to carry into 2025 combining with Utilities to generate mid-single-digit sales growth for the ES segment. Heil refuse collection vehicle demand remains strong, and the Marathon team has implemented several commercial excellence programs that continue to drive growth in compactors. Utilities demand remains strong with backlog stretching into 2026. The 2024 comparable baseline for ES is revenue of $1.5 billion, with an operating profit of 17%. We anticipate continued strong margin performance for ES in 2025 through new product introduction, operational improvements, and synergy capture. With that, I will turn it back to Simon.

Simon A. Meester – Terex Corporation – President and Chief Executive Officer

Thanks, Julie. I will now turn to slide 18. Terex is very well positioned to deliver long-term value to our shareholders. We have a strong portfolio of industry-leading businesses across a diverse landscape of industrial segments with attractive end markets. We will continue to demonstrate improved through cycle financial performance as we integrate ESG and realize synergies across the Company. As always, I want to close by thanking our team members around the world. We have made great strides together, and we will continue to grow our company together. I am very excited about the road ahead for Terex. And with that, I would like to open it up for questions. Operator?

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

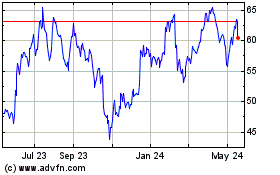

Terex (NYSE:TEX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Terex (NYSE:TEX)

Historical Stock Chart

From Feb 2024 to Feb 2025