Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

10 September 2024 - 6:29AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number: 001-15092

TURKCELL ILETISIM HIZMETLERI A.S.

(Translation of registrant’s name into English)

Aydınevler Mahallesi

İnönü Caddesi No:20

Küçükyalı

Ofispark

34854 Maltepe

Istanbul, Türkiye

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

x Form 20-F ¨

Form 40-F

Enclosure: A press release dated September 9, 2024, announcing

the closing of the registrant's share sale transaction of its subsidiaries operating in Ukraine.

Istanbul, September 9, 2024

Announcement Regarding the Closing of the Share Sale Transaction

of Subsidiaries Operating in Ukraine

As per our Company's

announcements on December 29, 2023 and other relevant dates; the transfer of shares, along with all rights and liabilities

in Lifecell LLC, LLC Global Bilgi, and LLC Ukrtower, our Company's subsidiaries, to DVL Telecom (one of NJJ Holding group companies) has

been completed. Our company is no longer a shareholder in these subsidiaries.

Today, at the closing date, USD 524,3 million

was received by our Company in accordance with the share purchase agreement. The final sales value will be determined based on closing

adjustments to be made, based on the level of net cash/debt on financial statements to be prepared as of the closing date. Further developments

will be fully and promptly disclosed to the public.

| Board Decision Date for Sale |

: |

20.12.2023 |

| |

|

|

| Were Majority of Independent Board Members' Approved the Board Decision for Sale? |

: |

Yes |

| Title of Non-current Financial Asset Sold |

: |

lifecell LLC ("lifecell"), LLC Global Bilgi ("Global Ukrayna"), LLC Ukrtower ("Kule Ukrayna") |

| |

|

|

| Field of Activity of Non-current Financial Asset sold |

: |

The relevant companies are engaged in telecommunications, customer relationship management, and telecommunications infrastructure management activities, respectively. |

| |

|

|

| Capital of Non-current Financial Asset sold |

: |

UAH 12,711,848,745, UAH 47,226,374, UAH 1,964,040,941, respectively |

| |

|

|

| Date on which the Transaction was/will be Completed |

: |

Closing procedures have been completed. |

| |

|

|

| Sales Conditions |

: |

Cash |

| |

|

|

| Nominal Value of Shares Sold |

: |

UAH 12,711,848,745, UAH 47,226,374, UAH 1,964,040,941, respectively |

| |

|

|

| Sales Price Per Share |

: |

The final sales value will be determined according to the closing financial statements. |

| |

|

|

| Total Sales Value |

: |

The final sales value will be determined according to the closing financial statements. |

| Ratio of Shares Sold to Capital of Non-current Financial Asset (%) |

: |

100%, 100%, 100%, respectively |

| |

|

|

| Total Ratio of Shares Owned in Capital of Non-current Financial Asset After Sales Transaction (%) |

: |

0%, 0%, 0%, respectively |

| |

|

|

| Total Voting Right Ratio Owned in Non-current Financial Asset After Sales Transaction (%) |

: |

0%, 0%, 0%, respectively |

| |

|

|

| Ratio of Non-current Financial Asset Sold to Total Assets in Latest Disclosed Financial Statements of Company (%) |

: |

- |

| |

|

|

| Ratio of Transaction Value to Sales in Latest Annual Financial Statements of Company (%) |

: |

- |

| |

|

|

| Effects on Company Operations |

: |

The subsidiary relationship is terminated. |

| |

|

|

| Profit / Loss Arose After Transaction |

: |

Will be clarified when the transaction is completed. |

| |

|

|

| How will Sales Profit be Used if Exists? |

: |

- |

| |

|

|

| Board Decision Date for Use of Sales Profit if Exists |

: |

- |

| |

|

|

| Title/ Name-Surname of Counter Party Bought |

: |

DVL Telecom (NJJ Holding group company) |

| |

|

|

| Is Counter Party a Related Party According to CMB Regulations? |

: |

No |

| |

|

|

| Relation with Counter Party if any |

: |

None |

| |

|

|

| Agreement Signing Date if Exists |

: |

29.12.2023 |

| |

|

|

| Value Determination Method of Non-current Financial Asset |

: |

Determined through negotiation. |

| |

|

|

| Did Valuation Report be Prepared? |

: |

Not Prepared |

| |

|

|

| Reason for not Preparing Valuation Report if it was not Prepared |

: |

Not required by the legislation. |

| |

|

|

| Date and Number of Valuation Report |

: |

- |

| |

|

|

| Title of Valuation Company Prepared the Report |

: |

- |

| Value Determined in Valuation Report if Exists |

: |

- |

| |

|

|

| Reasons if Transaction wasn't/will not be performed in Accordance with Valuation Report |

: |

- |

For more information:

Turkcell Investor Relations

investor.relations@turkcell.com.tr

Tel: + 90 212 313 1888

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, Turkcell Iletisim Hizmetleri A.S. has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| |

TURKCELL ILETISIM HIZMETLERI A.S. |

| |

|

|

| Date: September 9, 2024 |

By: |

/s/ Özlem Yardım |

| |

|

|

| |

|

Name: |

Özlem Yardım |

| |

|

Title: |

Investor Relations Corporate Finance Director |

| |

TURKCELL ILETISIM HIZMETLERI A.S. |

| |

|

|

| Date: September 9, 2024 |

By: |

/s/ Kamil Kalyon |

| |

|

|

| |

|

Name: |

Kamil Kalyon |

| |

|

Title: |

Chief Financial Officer |

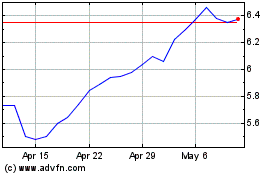

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Nov 2024 to Dec 2024

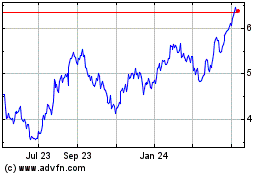

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Dec 2023 to Dec 2024