Tilly’s, Inc. (NYSE: TLYS, the "Company") today announced

financial results for the second quarter of fiscal 2024 ended

August 3, 2024.

"While the macro environment remains challenging for our

customer demographic, we believe that our new pricing strategies

are gaining traction as evidenced by our second consecutive quarter

of improved product margins, and that we are beginning to drive

improved customer engagement through our refocused marketing

efforts," commented Hezy Shaked, Co-Founder and Interim President

and Chief Executive Officer. "We are encouraged to have started the

third quarter with a positive comp in fiscal August, representing

our first positive monthly comparable net sales result since

February 2022. However, we remain cautious in our third quarter

outlook as our business has begun to slow down following the peak

of the back-to-school season, consistent with the trend pattern in

recent years."

Operating Results Overview

Fiscal 2024 Second Quarter Operating

Results Overview

The following comparisons refer to the Company's operating

results for the second quarter of fiscal 2024 ended August 3, 2024

versus the second quarter of fiscal 2023 ended July 29, 2023.

- Total net sales were $162.9 million, an increase of $2.9

million or 1.8%, compared to $160.0 million last year, primarily

due to the calendar shift impact of last year's 53rd week in the

retail calendar, which caused a portion of the back-to-school

season's sales volume to shift into the latter stages of the second

quarter from the beginning of the third quarter last year. Total

comparable net sales, including both physical stores and e-commerce

("e-com"), decreased by 7.8% relative to the shifted 13-week period

ended August 5, 2023.

- Net sales from physical stores were $132.3 million, an increase

of $2.5 million or 2.0%, compared to $129.8 million last year, with

a comparable store net sales decrease of 7.9%. Net sales from

physical stores represented 81.3% of total net sales this year

compared to 81.1% of total net sales last year. The Company ended

the second quarter with 247 total stores compared to 246 total

stores at the end of the second quarter last year.

- Net sales from e-com were $30.5 million, an increase of $0.4

million or 1.3%, compared to $30.2 million last year. E-com net

sales represented 18.7% of total net sales this year compared to

18.9% of total net sales last year.

- Gross profit, including buying, distribution, and occupancy

costs, was $49.9 million, or 30.7% of net sales, compared to $44.3

million, or 27.7% of net sales, last year. Product margins improved

by 270 basis points primarily due to the combination of improved

initial markups and lower total markdowns. Buying, distribution,

and occupancy costs improved by 30 basis points collectively,

primarily due to carrying these costs against a higher level of net

sales this year.

- Selling, general and administrative ("SG&A") expenses were

$50.8 million, or 31.2% of net sales, compared to $47.0 million, or

29.4% of net sales, last year. The $3.8 million increase in

SG&A was primarily attributable to increases in store payroll

and related benefits of $1.5 million due primarily to average wage

rate increases, digital marketing expenses of $0.7 million,

software as a service expense of $0.6 million, and corporate

payroll and related benefits of $0.5 million.

- Operating loss was $0.9 million, or 0.5% of net sales, compared

to an operating loss of $2.7 million, or 1.7% of net sales, last

year, due to the combined impact of the factors noted above.

- Pre-tax loss was $0.1 million, or break-even as a percentage of

net sales, compared to a pre-tax loss of $1.5 million, or 0.9% of

net sales, last year.

- Income tax benefit was $4.5 thousand or 6.2% of pre-tax loss,

compared to an income tax benefit of $0.3 million, or 23.2% of

pre-tax loss, last year. The decrease in the effective income tax

rate was due to an immaterial state tax benefit arising in a

quarter with a nearly break-even pre-tax loss.

- Net loss was $0.1 million, or $0.00 net loss per share,

compared to a net loss of $1.1 million, or $0.04 net loss per

share, last year. Weighted average shares were 30.0 million this

year compared to 29.8 million shares last year.

Fiscal 2024 First Half Operating Results

Overview

The following comparisons refer to the Company's operating

results for the first half of fiscal 2024 ended August 3, 2024

versus the first half of fiscal 2023 ended July 29, 2023.

- Total net sales were $278.7 million, a decrease of $4.9 million

or 1.7%, compared to $283.6 million last year, primarily due to a

decline in comparable net sales partially offset by the calendar

shift impact of last year's 53rd week in the retail calendar, which

caused a portion of the back-to-school season's sales volume to

shift into the second quarter this year from the beginning of the

third quarter last year. Total comparable net sales, including both

physical stores and e-commerce ("e-com"), decreased by 8.4%

relative to the shifted 26-week period ended August 5, 2023.

- Net sales from physical stores were $225.2 million, a decrease

of $2.5 million or 1.1%, compared to $227.6 million last year, with

a comparable store net sales decrease of 8.2%. Net sales from

physical stores represented 80.8% of total net sales this year

compared to 80.3% of total net sales last year.

- Net sales from e-com were $53.6 million, a decrease of $2.4

million or 4.3%, compared to $56.0 million last year. E-com net

sales represented 19.2% of total net sales this year compared to

19.7% of total net sales last year.

- Gross profit, including buying, distribution, and occupancy

costs, was $74.2 million, or 26.6% of net sales, compared to $70.3

million, or 24.8% of net sales, last year. Product margins improved

by 210 basis points primarily due to the combination of improved

initial markups and lower total markdowns. Buying, distribution,

and occupancy costs deleveraged by 30 basis points collectively,

despite being $0.6 million lower than last year, primarily due to

carrying these costs against lower net sales this year.

- Selling, general and administrative ("SG&A") expenses were

$95.9 million, or 34.4% of net sales, compared to $90.2 million, or

31.8% of net sales, last year. The $5.7 million increase in

SG&A was primarily attributable to increases in store payroll

and related benefits of $2.5 million due primarily to average wage

rate increases, non-cash store asset impairment charges of $1.5

million, corporate payroll and related benefits of $1.0 million,

and software as a service expense of $0.9 million. These increases

were partially offset by a variety of smaller expense

decreases.

- Operating loss was $21.6 million, or 7.8% of net sales,

compared to an operating loss of $19.9 million, or 7.0% of net

sales, last year, due to the combined impact of the factors noted

above.

- Pre-tax loss was $19.7 million, or 7.1% of net sales, compared

to a pre-tax loss of $17.7 million, or 6.2% of net sales, last

year.

- Income tax benefit was $17.2 thousand or 0.1% of pre-tax loss,

compared to an income tax benefit of $4.6 million, or 25.9% of

pre-tax loss, last year. The decrease in the effective income tax

rate was primarily attributable to the continuing impact of the

valuation allowance.

- Net loss was $19.7 million, or $0.66 net loss per share,

compared to a net loss of $13.1 million, or $0.44 net loss per

share, last year. Weighted average shares were 30.0 million this

year compared to 29.8 million shares last year.

Balance Sheet and Liquidity

As of August 3, 2024, the Company had $76.7 million of cash,

cash equivalents and marketable securities and no debt outstanding,

compared to $104.3 million and no debt outstanding as of July 29,

2023. Total inventories increased 4.1% as of August 3, 2024

compared to July 29, 2023. Total year-to-date capital expenditures

at the end of the second quarter were $4.6 million this year

compared to $6.3 million last year.

Fiscal 2024 Third Quarter Outlook

Total comparable net sales for fiscal August ended August 31,

2024, increased by 1.0% relative to the comparable four-week period

last year. Due to the impact of the 53rd week in last year's retail

calendar, total net sales for this year's third quarter will start

with an $18.4 million deficit in net sales compared to last year's

third quarter as a result of a large back-to-school net sales week

shifting into the end of the second quarter this year from what was

in the beginning of the third quarter last year. Based on this

timing shift, current quarter-to-date comparable net sales results

and current and historical trends, the Company currently estimates

the following for the third quarter of fiscal 2024:

- Net sales to be in the range of approximately $140 million to

$146 million, translating to an estimated comparable net sales

decrease in the range of approximately (6)% to (2)%, respectively,

relative to the comparable 13-week period last year;

- SG&A expenses to be approximately $49 million before

factoring in any potential non-cash store asset impairment charges

which may arise;

- Pre-tax loss and net loss to be in the range of approximately

$(11.6) million to $(8.7) million, respectively, with a near-zero

effective income tax rate due to the continuing impact of a full,

non-cash valuation allowance on deferred tax assets; and

- Per share results to be in the range of a net loss of $(0.39)

to $(0.29), respectively, with estimated weighted average shares of

approximately 30 million.

The Company currently expects to have 246 total stores open at

the end of the third quarter of fiscal 2024 compared to 249 at the

end of last year's third quarter.

Conference Call Information

A conference call to discuss these financial results is

scheduled for today, September 5, 2024, at 4:30 p.m. ET (1:30 p.m.

PT). Investors and analysts interested in participating in the call

are invited to dial (877) 300-8521 (domestic) or (412) 317-6026

(international). The conference call will also be available to

interested parties through a live webcast at www.tillys.com. Please

visit the website and select the “Investor Relations” link at least

15 minutes prior to the start of the call to register and download

any necessary software. A telephone replay of the call will be

available until September 12, 2024, by dialing (844) 512-2921

(domestic) or (412) 317-6671 (international) and entering the

conference identification number: 10191499.

About Tillys

Tillys is a leading, destination specialty retailer of casual

apparel, footwear, accessories and hardgoods for young men, young

women, boys and girls with an extensive selection of iconic global,

emerging, and proprietary brands rooted in an active, outdoor and

social lifestyle. Tillys is headquartered in Irvine, California and

currently operates 247 total stores across 33 states, as well as

its website, www.tillys.com.

Forward-Looking Statements

Certain statements in this press release are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. In particular, statements regarding our current

operating expectations in light of historical results, the impacts

of inflation and potential recession on us and our customers,

including on our future financial condition or operating results,

expectations regarding changes in the macro-economic environment,

customer traffic, our supply chain, our ability to properly manage

our inventory levels, and any other statements about our future

cash position, financial flexibility, expectations, plans,

intentions, beliefs or prospects expressed by management are

forward-looking statements. These forward-looking statements are

based on management’s current expectations and beliefs, but they

involve a number of risks and uncertainties that could cause actual

results or events to differ materially from those indicated by such

forward-looking statements, including, but not limited to the

impact of inflation on consumer behavior and our business and

operations, supply chain difficulties, and our ability to respond

thereto, our ability to respond to changing customer preferences

and trends, attract customer traffic at our stores and online,

execute our growth and long-term strategies, expand into new

markets, grow our e-commerce business, effectively manage our

inventory and costs, effectively compete with other retailers,

attract talented employees, or enhance awareness of our brand and

brand image, general consumer spending patterns and levels,

including changes in historical spending patterns, the markets

generally, our ability to satisfy our financial obligations,

including under our credit facility and our leases, and other

factors that are detailed in our Annual Report on Form 10-K, filed

with the Securities and Exchange Commission (“SEC”), including

those detailed in the section titled “Risk Factors” and in our

other filings with the SEC, which are available on the SEC’s

website at www.sec.gov and on our website at www.tillys.com under

the heading “Investor Relations”. Readers are urged not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this press release. We do not undertake any

obligation to update or alter any forward-looking statements,

whether as a result of new information, future events or otherwise.

This release should be read in conjunction with our financial

statements and notes thereto contained in our Form 10-K.

Tilly’s, Inc.

Consolidated Balance

Sheets

(In thousands, except par

value)

(unaudited)

August 3, 2024

February 3,

2024

July 29, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

36,749

$

47,027

$

54,578

Marketable securities

39,947

48,021

49,700

Receivables

13,176

5,947

10,922

Merchandise inventories

95,011

63,159

91,251

Prepaid expenses and other current

assets

9,539

11,905

9,209

Total current assets

194,422

176,059

215,660

Operating lease assets

188,711

203,825

224,537

Property and equipment, net

44,612

48,063

48,353

Deferred tax assets, net

—

—

12,973

Other assets

1,452

1,598

1,764

TOTAL ASSETS

$

429,197

$

429,545

$

503,287

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

42,961

$

14,506

$

44,763

Accrued expenses

20,011

13,063

18,972

Deferred revenue

13,615

14,957

14,012

Accrued compensation and benefits

11,488

9,902

8,358

Current portion of operating lease

liabilities

51,414

48,672

51,243

Current portion of operating lease

liabilities, related party

3,269

3,121

2,977

Other liabilities

270

336

425

Total current liabilities

143,028

104,557

140,750

Long-term liabilities:

Noncurrent portion of operating lease

liabilities

141,565

160,531

176,310

Noncurrent portion of operating lease

liabilities, related party

17,596

19,267

20,865

Other liabilities

235

321

447

Total long-term liabilities

159,396

180,119

197,622

Total liabilities

302,424

284,676

338,372

Stockholders’ equity:

Common stock (Class A)

23

23

23

Common stock (Class B)

7

7

7

Preferred stock

—

—

—

Additional paid-in capital

173,939

172,478

171,195

Accumulated deficit

(47,652

)

(27,962

)

(6,563

)

Accumulated other comprehensive income

456

323

253

Total stockholders’ equity

126,773

144,869

164,915

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

429,197

$

429,545

$

503,287

Tilly’s, Inc.

Consolidated Statements of

Operations

(In thousands, except per share

data)

(unaudited)

Thirteen Weeks Ended

Twenty-Six Weeks Ended

August 3, 2024

July 29, 2023

August 3, 2024

July 29, 2023

Net sales

$

162,867

$

159,951

$

278,723

$

283,588

Cost of goods sold (includes buying,

distribution, and occupancy costs)

112,013

114,704

202,625

211,472

Rent expense, related party

934

931

1,865

1,862

Total cost of goods sold (includes

buying, distribution, and occupancy costs)

112,947

115,635

204,490

213,334

Gross profit

49,920

44,316

74,233

70,254

Selling, general and administrative

expenses

50,648

46,868

95,616

89,934

Rent expense, related party

131

133

264

266

Total selling, general and

administrative expenses

50,779

47,001

95,880

90,200

Operating loss

(859

)

(2,685

)

(21,647

)

(19,946

)

Other income, net

786

1,220

1,940

2,284

Loss before income taxes

(73

)

(1,465

)

(19,707

)

(17,662

)

Income tax benefit

(4

)

(340

)

(17

)

(4,569

)

Net loss

$

(69

)

$

(1,125

)

$

(19,690

)

$

(13,093

)

Basic net loss per share of Class A and

Class B common stock

$

(0.00

)

$

(0.04

)

$

(0.66

)

$

(0.44

)

Diluted net loss per share of Class A and

Class B common stock

$

(0.00

)

$

(0.04

)

$

(0.66

)

$

(0.44

)

Weighted average basic shares

outstanding

30,029

29,831

29,995

29,815

Weighted average diluted shares

outstanding

30,029

29,831

29,995

29,815

Tilly’s, Inc.

Consolidated Statements of

Cash Flows

(In thousands)

(unaudited)

Twenty-Six Weeks Ended

August 3, 2024

July 29, 2023

Cash flows from operating

activities

Net loss

$

(19,690

)

$

(13,093

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

6,305

6,457

Insurance proceeds from casualty loss

131

—

Stock-based compensation expense

1,167

1,078

Impairment of assets

2,499

955

(Gain) loss on disposal of assets

(35

)

28

Gain on maturities of marketable

securities

(1,121

)

(961

)

Deferred income taxes

—

(4,476

)

Changes in operating assets and

liabilities:

Receivables

(6,863

)

(801

)

Merchandise inventories

(31,983

)

(29,134

)

Prepaid expenses and other assets

3,003

8,230

Accounts payable

28,436

28,768

Accrued expenses

7,048

4,274

Accrued compensation and benefits

1,586

175

Operating lease liabilities

(4,112

)

(2,994

)

Deferred revenue

(1,342

)

(2,091

)

Other liabilities

(232

)

(314

)

Net cash used in operating

activities

(15,203

)

(3,899

)

Cash flows from investing

activities

Purchases of marketable securities

(39,290

)

(53,904

)

Purchases of property and equipment

(4,625

)

(6,310

)

Proceeds from maturities of marketable

securities

48,500

45,081

Insurance proceeds from casualty loss

23

—

Proceeds from sale of property and

equipment

23

—

Net cash provided by (used in)

investing activities

4,631

(15,133

)

Cash flows from financing

activities

Proceeds from exercise of stock

options

294

84

Net cash provided by financing

activities

294

84

Change in cash and cash

equivalents

(10,278

)

(18,948

)

Cash and cash equivalents, beginning of

period

47,027

73,526

Cash and cash equivalents, end of

period

$

36,749

$

54,578

Tilly's, Inc.

Store Count and Square

Footage

Store

Count at

Beginning of

Quarter

New Stores

Opened

During Quarter

Stores

Permanently

Closed

During Quarter

Store Count at

End of Quarter

Total Gross

Square Footage

End of Quarter

(in thousands)

2023 Q1

249

1

2

248

1,809

2023 Q2

248

—

2

246

1,792

2023 Q3

246

3

—

249

1,810

2023 Q4

249

3

4

248

1,801

2024 Q1

248

2

4

246

1,784

2024 Q2

246

1

—

247

1,791

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240905293019/en/

Investor Relations Contact: Michael

Henry, Executive Vice President, Chief Financial Officer (949)

609-5599, ext. 17000 irelations@tillys.com

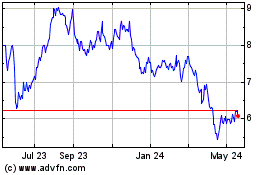

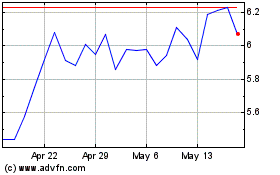

Tillys (NYSE:TLYS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Tillys (NYSE:TLYS)

Historical Stock Chart

From Nov 2023 to Nov 2024