TransUnion Partners with Snowflake to Provide On-demand Access to Pseudonymized Credit Data

07 August 2024 - 10:00PM

TransUnion (NYSE: TRU) today announced its partnership with

Snowflake, the AI Data Cloud company, to launch TruIQTM Data

Enrichment on Snowflake Marketplace. TruIQ Data Enrichment’s

availability on Snowflake Marketplace will provide joint customers

with unlimited, on-demand access to pseudonymized TransUnion credit

data in the Snowflake AI Data Cloud.

The need for such a solution is clear. According to a recent

Forrester Research survey, more than 85% of organizational cloud

decision-makers say that cloud-native technology is essential to

accelerating architecture modernization, achieving workload

decentralization, or enabling platform-driven innovation. At the

same time, however, another recent Forrester survey shows that one

of the greatest challenges organizations face today involves ready,

quick, and efficient access and availability of data for analytics,

with one in five citing it as a main data management and security

challenge for their organization.

TruIQ Data Enrichment allows organizations to address these data

challenges. Through its proprietary linking capability, TruIQ Data

Enrichment enriches first and third-party data with TransUnion

credit data, in a pseudonymized manner within the Snowflake AI Data

Cloud, while eliminating setup time and data movement between

various platforms for customers.

“TransUnion developed TruIQ Data Enrichment specifically to meet

the critical need of our joint customers to quickly access and link

credit data,” said Patrick White, vice president of strategic

initiatives at TransUnion. “This app enables faster access to

pseudonymized TransUnion credit data, the ability to link it with

first and third party datasets, and ultimately make a bigger impact

throughout the analytic and marketing journeys.”

Benefits from TruIQ Data Enrichment include:

- Optimized identity resolution: TruIQ Data

Enrichment offers a more well-rounded view of data by integrating

their first and third-party data with pseudonymized TransUnion

credit data.

- Control over sensitive data: Limit the

exposure of sensitive data by allowing data to be kept in one

place.

- Minimum data movement: Bring all TransUnion

credit data into Snowflake in a pseudonymized manner while avoiding

inherent delays, risks and costs that come with moving data across

platforms or vendors.

“TransUnion and Snowflake share the common understanding that

control of data use and the best possible protection of that data

is a winning combination for our customers,” said Kieran Kennedy,

Global Head, Strategic Data Cloud Principal, Snowflake. “Snowflake

customers want more control over the movement of their data as well

as the ability to match with TransUnion credit data. With the

capabilities offered through TruIQ Data Enrichment, customers can

get insights and update strategies faster than ever, thanks to

having an even stronger view of the data than they have had before

– all while ensuring the safety and security of that data.”

TruIQ Data Enrichment is derived from OneTru TM, TransUnion’s

new solution enablement platform for managing, governing, analyzing

and delivering data and insights. The OneTru platform connects

separate data and analytic assets built for credit risk, marketing

and fraud prevention and concentrates them in a single, layered and

unified environment that sits at the core of TransUnion’s

business.

Snowflake Marketplace is powered by Snowflake’s ground-breaking

cross-cloud technology, Snowgrid, allowing companies direct access

to raw data products and the ability to leverage data, data

services, and applications quickly, securely, and cost-effectively.

Snowflake Marketplace simplifies discovery, access, and the

commercialization of data products, enabling companies to unlock

entirely new revenue streams and extended insights across the Data

Cloud. To learn more about Snowflake Marketplace and how to

discover, evaluate, and purchase the data, data services, and

applications needed to innovate for business, click here.

For more information about TruIQ Data Enrichment and to watch a

video to learn more, please click here.

About TransUnion (NYSE: TRU)

TransUnion is a global information and insights company with

over 13,000 associates operating in more than 30 countries. We make

trust possible by ensuring each person is reliably represented in

the marketplace. We do this with a Tru™ picture of each person: an

actionable view of consumers, stewarded with care. Through our

acquisitions and technology investments we have developed

innovative solutions that extend beyond our strong foundation in

core credit into areas such as marketing, fraud, risk and advanced

analytics. As a result, consumers and businesses can transact with

confidence and achieve great things. We call this Information for

Good® — and it leads to economic opportunity, great experiences and

personal empowerment for millions of people around the world.

http://www.transunion.com/business

|

Contact |

Dave

Blumberg |

| |

TransUnion |

| |

|

| E-mail |

dblumberg@transunion.com |

| |

|

| Telephone |

312-972-6646 |

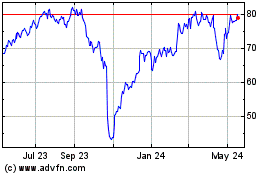

TransUnion (NYSE:TRU)

Historical Stock Chart

From Dec 2024 to Jan 2025

TransUnion (NYSE:TRU)

Historical Stock Chart

From Jan 2024 to Jan 2025