Semisubmersibles VALARIS DPS-3, DPS-5 and DPS-6

to be Retired from Global Drilling Supply Jackup VALARIS 75 Sold

for $24 Million Multi-Year Contract for Jackup VALARIS Stavanger in

the North Sea

Valaris Limited (NYSE: VAL) (“Valaris” or the “Company”) today

announced several fleet rationalization actions and issued a Fleet

Status Report.

Fleet Rationalization Actions

- The Company recently decided to retire three semisubmersibles

from its fleet: VALARIS DPS-5, which has been idle since last

working in third quarter 2024, as well as VALARIS DPS-3 and VALARIS

DPS-6, which have been stacked for several years. The Company

expects that these rigs will be removed from the global drilling

supply and repurposed for alternative uses or scrapped.

- Jackup VALARIS 75 has been sold for $24 million. VALARIS 75 is

a 25-year-old jackup that has been stacked in the U.S. Gulf for

five years. As part of the purchase and sale agreement, future

operations are restricted to the U.S. Gulf.

President and Chief Executive Officer Anton Dibowitz said, “We

are committed to prudently managing our fleet and will retire or

divest rigs when the expected future economic benefit for an asset

does not justify its costs. Consistent with this approach, we have

decided to high-grade our fleet by retiring three semisubmersibles:

VALARIS DPS-3, DPS-5 and DPS-6, for which we see limited

attractive, long-term contract opportunities, as well as selling

jackup VALARIS 75. These actions reduce costs for idle rigs,

benefit our cash flow and further focus our fleet on

high-specification assets.”

Fleet Status Report

The Company has also issued a Fleet Status Report, announcing

new contracts and contract extensions, with associated contract

backlog of approximately $120 million, awarded subsequent to

issuing the Company’s previous Fleet Status Report on October 30,

2024:

- 600-day priced contract extension with TotalEnergies in the UK

North Sea for jackup VALARIS Stavanger. The priced extension is

expected to commence in the third quarter 2025 in direct

continuation of the current program. The total contract value for

the priced extension is over $75 million.

- 100-day contract for jackup VALARIS 249 with BP offshore

Trinidad. The contract is expected to commence in the first quarter

2026 in direct continuation of the rig’s previous program with

another operator. The total contract value is approximately $16.8

million.

- One-well contract with Jadestone Energy offshore Australia for

jackup VALARIS 247. The contract is expected to commence in March

2025 in direct continuation of the rig’s current program with

another operator.

- Two-well priced option exercised by BP Indonesia for jackup

VALARIS 106. The option period has an estimated duration of 80 days

and is expected to commence in May 2025 in direct continuation of

the existing firm program. The operating day rate is $95,000.

- Short-term bareboat charter agreement extensions through

February 28, 2025, for jackups VALARIS 116, VALARIS 146 and VALARIS

250, which are leased to ARO Drilling (“ARO”). Valaris and ARO

remain in discussions with Saudi Aramco regarding longer-term

contract extensions for these rigs.

About Valaris Limited

Valaris Limited (NYSE: VAL) is the industry leader in offshore

drilling services across all water depths and geographies.

Operating a high-quality rig fleet of ultra-deepwater drillships,

versatile semisubmersibles and modern shallow-water jackups,

Valaris has experience operating in nearly every major offshore

basin. Valaris maintains an unwavering commitment to safety,

operational excellence, and customer satisfaction, with a focus on

technology and innovation. Valaris Limited is a Bermuda exempted

company (Bermuda No. 56245). To learn more, visit our website at

www.valaris.com.

Cautionary Statements

Statements contained in this press release that are not

historical facts are forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements include words or phrases such as

"anticipate," "believe," "estimate," "expect," "intend," "likely,"

"outlook," "plan," "project," "could," "may," "might," "should,"

"will" and similar words and specifically include statements

regarding expected financial performance; expected utilization, day

rates, revenues, operating expenses, cash flows, contract status,

terms and duration, contract backlog, capital expenditures,

insurance, financing and funding; the offshore drilling market,

including supply and demand, customer drilling programs and the

attainment of requisite permits for such programs, stacking of

rigs, effects of new rigs on the market and effect of the

volatility of commodity prices; expected work commitments, awards,

contracts and letters of intent; scheduled delivery dates for rigs;

performance and expected benefits of our joint ventures, including

our joint venture with Saudi Aramco; timing of the delivery of the

Saudi Aramco Rowan Offshore Drilling Company ("ARO") newbuild rigs

and the timing of additional ARO newbuild orders; the availability,

delivery, mobilization, contract commencement, availability,

relocation or other movement of rigs and the timing thereof; rig

reactivations; suitability of rigs for future contracts;

divestitures of assets; general economic, market, business and

industry conditions, including inflation and recessions, trends and

outlook; general political conditions, including political

tensions, conflicts and war; cybersecurity attacks and threats;

uncertainty around the use and impacts of artificial intelligence

applications; impacts and effects of public health crises,

pandemics and epidemics; future operations; ability to renew

expiring contracts or obtain new contracts, including for VALARIS

DS-13 and VALARIS DS-14; increasing regulatory complexity; targets,

progress, plans and goals related to sustainability matters; the

outcome of tax disputes; assessments and settlements; and expense

management. The forward-looking statements contained in this press

release are subject to numerous risks, uncertainties and

assumptions that may cause actual results to vary materially from

those indicated, including cancellation, suspension, renegotiation

or termination of drilling contracts and programs; our ability to

obtain financing, service our debt, fund capital expenditures and

pursue other business opportunities; adequacy of sources of

liquidity for us and our customers; future share repurchases;

actions by regulatory authorities, or other third parties; actions

by our security holders; internal control risk; commodity price

fluctuations and volatility, customer demand, loss of a significant

customer or customer contract, downtime and other risks associated

with offshore rig operations; adverse weather, including

hurricanes; changes in worldwide rig supply, including as a result

of reactivations and newbuilds; and demand, competition and

technology; supply chain and logistics challenges; consumer

preferences for alternative fuels and forecasts or expectations

regarding the global energy transition; increased scrutiny of our

sustainability targets, initiatives and reporting and our ability

to achieve such targets or initiatives; changes in customer

strategy; future levels of offshore drilling activity; governmental

action, civil unrest and political and economic uncertainties,

including recessions, volatility affecting the banking system and

financial markets, inflation, tariffs and adverse changes in the

level of international trade activity; terrorism, piracy and

military action; risks inherent to shipyard rig reactivation,

upgrade, repair, maintenance or enhancement; our ability to enter

into, and the terms of, future drilling contracts; suitability of

rigs for future contracts; the cancellation of letters of intent or

letters of award or any failure to execute definitive contracts

following announcements of letters of intent, letters of award or

other expected work commitments; the outcome of litigation, legal

proceedings, investigations or other claims or contract disputes;

governmental regulatory, legislative and permitting requirements

affecting drilling operations; the use of artificial intelligence

by us, third-party service providers or our competitors; our

ability to attract and retain skilled personnel on commercially

reasonable terms; environmental or other liabilities, risks or

losses; compliance with our debt agreements and debt restrictions

that may limit our liquidity and flexibility, including in any

return of capital plans; cybersecurity risks and threats; and

changes in foreign currency exchange rates. In addition to the

numerous factors described above, you should also carefully read

and consider "Item 1A. Risk Factors" in Part I and "Item 7.

Management's Discussion and Analysis of Financial Condition and

Results of Operations" in Part II of our most recent annual report

on Form 10-K, which is available on the Securities and Exchange

Commission's website at www.sec.gov or on the Investor Relations

section of our website at www.valaris.com. Each forward-looking

statement speaks only as of the date of the particular statement,

and we undertake no obligation to update or revise any

forward-looking statements, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218408538/en/

Investor & Media Contacts: Nick Georgas Vice President –

Treasurer and Investor Relations +1-713-979-4632

Tim Richardson Director – Investor Relations +1-713-979-4619

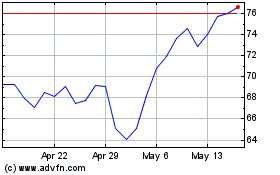

Valaris (NYSE:VAL)

Historical Stock Chart

From Jan 2025 to Feb 2025

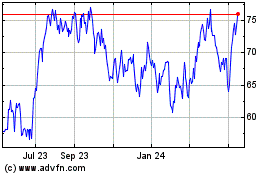

Valaris (NYSE:VAL)

Historical Stock Chart

From Feb 2024 to Feb 2025