Filed by Smurfit WestRock Limited

(Commission File No. 333-278185)

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed

Pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: WestRock Company

(Commission File No. 001-38736)

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION.

THIS IS AN ANNOUNCEMENT AND NOT A PROSPECTUS

OR CIRCULAR OR EQUIVALENT DOCUMENT. THIS ANNOUNCEMENT DOES NOT CONSTITUTE OR FORM PART OF, AND SHOULD NOT BE CONSTRUED AS,

ANY OFFER, INVITATION OR RECOMMENDATION TO PURCHASE, SELL OR SUBSCRIBE FOR ANY SECURITIES IN ANY JURISDICTION AND NEITHER THE ISSUE

OF THE INFORMATION NOR ANYTHING CONTAINED HEREIN SHALL FORM THE BASIS OF OR BE RELIED UPON IN CONNECTION WITH, OR ACT AS AN INDUCEMENT

TO ENTER INTO, ANY INVESTMENT ACTIVITY. INVESTORS AND PROSPECTIVE INVESTORS SHOULD NOT MAKE ANY INVESTMENT DECISION ON THE BASIS OF ITS

CONTENTS. A PROSPECTUS AND CIRCULAR IN RELATION TO THE COMBINATION REFERRED TO IN THIS ANNOUNCEMENT HAVE BEEN PUBLISHED TODAY.

14 May 2024

Smurfit WestRock Limited

(to be re-registered as an Irish public limited

company

and renamed Smurfit WestRock plc)

Publication of Prospectus

Smurfit WestRock Limited (to be re-registered

as an Irish public limited company and renamed Smurfit WestRock plc) (“Smurfit WestRock”) announces that the UK Financial

Conduct Authority (the “FCA”) has today approved its prospectus (the “Prospectus”) relating to

the proposed admission of its ordinary shares (the “Smurfit WestRock Shares”) to the standard listing segment of the

Official List of the FCA and to trading on the main market for listed securities of the London Stock Exchange plc (the “LSE”).

In addition, a shareholder circular relating

to the Combination (as defined below) (the “Circular”), which contains, among other things, the full terms and conditions

of the scheme of arrangement (the “Scheme”) and an explanatory statement, together with the actions to be taken by

the shareholders of Smurfit Kappa Group plc (“Smurfit Kappa”) (“Smurfit Kappa Shareholders”) in

relation to an Irish High Court convened shareholder meeting (the “Scheme Meeting”) and an Extraordinary General Meeting

of Smurfit Kappa (the “EGM”), has been published today.

Availability of the Prospectus

Copies

of the Prospectus and certain other documents in relation to the Combination are available for inspection on https://www.smurfitkappa.com/investors/smurfitwestrock.

The

Prospectus and certain other documents in relation to the Combination will also be available for inspection from 9:00 a.m. to

5:00 p.m. (Irish time), Monday to Friday (excluding public holidays in Ireland) at the registered office of Smurfit WestRock,

Beech Hill, Clonskeagh, Dublin 4, D04 N2R2, Ireland, for a period of 12 months from today.

A copy of the Prospectus will also be submitted

to the UK National Storage Mechanism, where it will shortly be available for inspection at https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

Availability of the Circular

Copies of the Circular and certain other documents

in relation to the Combination (including a copy of Smurfit Kappa’s Articles of Association showing the proposed changes in relation

to the Combination) are available on Smurfit Kappa’s corporate website at www.smurfitkappa.com/investors/meetings2024. Additionally,

Smurfit Kappa Shareholders will shortly receive a hard copy of the Circular and the Forms of Proxy for the Scheme Meeting and the EGM.

The Circular and certain other documents in

relation to the Combination will also be available for inspection from 9:00 a.m. to 5:00 p.m. (Irish time), Monday to

Friday (excluding public holidays in Ireland) at the registered office of Smurfit Kappa, Beech Hill, Clonskeagh, Dublin 4, D04

N2R2, Ireland and at the offices of Matheson LLP, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland.

Enquiries

For further information, please contact:

Ciarán Potts

Smurfit Kappa

T: +353 1 202 7000

E:

ir@smurfitkappa.com |

Gillian Carson-Callan

Smurfit Kappa

T : +353 1 202 7000

E :

egm@smurfitkappa.com |

Background to the Combination

On 12 September 2023, Smurfit Kappa announced

that it had signed a definitive transaction agreement (the “Transaction Agreement”) with WestRock Company (“WestRock”)

to create the combined group of Smurfit WestRock (the “Combined Group”) (the “Combination”). The

Combination will be implemented by means of: (i) an acquisition by Smurfit WestRock of the entire issued share capital of Smurfit

Kappa by means of a Scheme under Section 450 of the Companies Act 2014 of Ireland (as amended) (the “Irish Companies Act”)

(the “Smurfit Kappa Share Exchange”); and (ii) a merger between Sun Merger Sub, LLC, a wholly-owned subsidiary

of Smurfit WestRock, with and into WestRock, with WestRock surviving the merger as a wholly-owned subsidiary of Smurfit WestRock (the

“Merger”). Upon completion of the Combination (“Completion”), Smurfit Kappa and WestRock will each

become wholly-owned subsidiaries of Smurfit WestRock and Smurfit WestRock will continue as the new holding company of the Combined Group.

Smurfit

Kappa’s ordinary shares (the “Smurfit Kappa Shares”) are currently (i) listed on the premium listing segment

of the Official List of the FCA and admitted to trading on the LSE’s main market for listed securities, and (ii) listed on

the Official List of Euronext Dublin and admitted to trading on the Euronext Dublin Market. WestRock’s shares of common

stock (the “WestRock Shares”) are currently listed and traded on the New York Stock Exchange (the “NYSE”).

Subject to Completion, it is expected that:

| · | the

Smurfit Kappa Shares (i) will be delisted from the premium listing segment of the Official

List of the FCA and will cease trading on the LSE’s main market for listed securities,

and (ii) will be delisted from the Official List of Euronext Dublin and will cease trading

on the Euronext Dublin Market; |

| · | the

WestRock Shares will be delisted from the NYSE; and |

| · | the

Smurfit WestRock Shares will be (i) approved for listing on the NYSE, and (ii) admitted

to the standard listing segment of the Official List of the FCA and to trading on the LSE’s

main market for listed securities. |

Additional Information about the Combination

and Where to Find It

In connection with the Combination, Smurfit WestRock

has filed with the US Securities and Exchange Commission (the “US SEC”) a registration statement on Form S-4

(Reg. No. 333-278185) (as amended and as may be further amended or supplemented from time to time, the “US Registration

Statement”), which was declared effective by the US SEC on 26 April 2024, that includes a prospectus (the “US

Prospectus”) relating to the offer and sale of the Smurfit WestRock Shares to WestRock stockholders (the “WestRock

Shareholders”) pursuant to the Merger. In addition, on 26 April 2024, WestRock filed a separate definitive proxy statement

with the US SEC with respect to the special meeting of WestRock Shareholders in connection with the Merger (as it may be amended or supplemented

from time to time, the “US Proxy Statement”). WestRock commenced mailing of the US Proxy Statement to WestRock Shareholders

on or about 1 May 2024. This announcement is not a substitute for any registration statement, prospectus, proxy statement or other

document that Smurfit Kappa, WestRock and/or Smurfit WestRock have filed or may file with the US SEC or the FCA in connection with the

Combination.

Before making any voting or investment decisions,

investors, stockholders and shareholders of Smurfit Kappa and WestRock are urged to read carefully and in their entirety the Circular,

the Prospectus, the US Registration Statement, the US Prospectus and the US Proxy Statement, as applicable, and any other relevant documents

that are filed or will be filed with the FCA or the US SEC, as well as any amendments or supplements to these documents, in connection

with the Combination when they become available, because they contain or will contain important information about the Combination, the

parties to the Combination, the risks associated with the Combination and related matters, including information about certain of the

parties’ respective directors, executive officers and other employees who may be deemed to be participants in the solicitation

of proxies in connection with the Combination and about their interests in the solicitation.

The US Registration Statement, the US Prospectus,

the US Proxy Statement and other documents filed by Smurfit WestRock, Smurfit Kappa and WestRock with the US SEC are available free of

charge at the US SEC’s website at www.sec.gov. In addition, investors and shareholders or stockholders are able to obtain free

copies of the US Registration Statement, the US Proxy Statement and other documents filed with the US SEC by WestRock online at ir.westrock.com/ir-home/,

upon written request delivered to 1000 Abernathy Road, Atlanta, Georgia 30328, United States, or by calling +1 (770) 448-2193, and are

able to obtain free copies of the US Registration Statement, the US Prospectus, the US Proxy Statement and other documents filed with

the US SEC by Smurfit WestRock or Smurfit Kappa online at www.smurfitkappa.com/investors, upon written request delivered to Beech Hill,

Clonskeagh, Dublin 4, D04 N2R2, Ireland or by calling +353 1 202 7000. The information included on, or accessible through, Smurfit

WestRock’s, Smurfit Kappa’s or WestRock’s websites is not incorporated by reference into this announcement.

Important Information regarding Financial

Advisers

Citigroup Global Markets Limited (“Citi”),

which is authorised by the Prudential Regulation Authority (the “PRA”) and regulated by the FCA and the PRA in the

United Kingdom, is acting as lead financial adviser to Smurfit Kappa and as listing adviser to Smurfit WestRock and no one else in connection

with the Combination. Citi and its affiliates and their respective directors, officers, employees and agents will not regard any other

person as a client in relation to the matters set out in this announcement and the Prospectus and will not be responsible to anyone other

than Smurfit Kappa and Smurfit WestRock for providing the protections afforded to their clients nor for providing advice in relation

to the contents of this announcement and the Prospectus or any other matter referred to therein. Neither Citi, nor any of its affiliates,

directors, officers or employees owes or accepts any duty, responsibility or liability whatsoever (directly or indirectly, whether in

contract, tort, statute or otherwise), and disclaims any liability, to any person who is not its client in connection with the Combination,

the contents of this announcement or any transaction arrangement or other matter referred to herein.

PJT Partners (UK) Limited (“PJT Partners”),

which is authorised and regulated by the FCA in the United Kingdom, is acting as financial adviser to Smurfit Kappa and Smurfit WestRock

and no one else in connection with the contents of this announcement and the Combination. PJT Partners and its affiliates and their respective

directors, officers, employees and agents will not regard any other person as a client in relation to the matters set out in this announcement

and the Prospectus and will not be responsible to anyone other than Smurfit Kappa and Smurfit WestRock for providing the protections

afforded to clients of PJT Partners nor for providing advice in relation to the contents of this announcement and the Prospectus or any

other matter referred to therein. Neither PJT Partners nor any of its or their subsidiaries, branches, affiliates, directors or employees

owes or accepts any duty, liability, or responsibility whatsoever (directly or indirectly, whether in contract, in tort, under statute

or otherwise) to any person who is not a client of PJT Partners in connection with the Prospectus, any statement contained therein, the

Combination, the contents of this announcement, or otherwise and its affiliates disclaim any and all such liability.

Evercore Group L.L.C. (“Evercore”)

is acting as financial adviser to the board of directors of WestRock and no one else in connection with this announcement and the Combination

and will not be responsible to anyone other than WestRock for providing the protections afforded to its clients or for providing advice

in relation to the Combination, the contents of this announcement and the Prospectus or any other matter referred to therein. Neither

Evercore nor any of its affiliates or their respective directors, officers or employees owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, whether in contract, in tort, under statute or otherwise) to any person who is not a client of

Evercore in connection with the Prospectus, any statement contained therein, the contents of this announcement, or otherwise and Evercore

and its affiliates disclaim any and all such liability.

Lazard Frères & Co. LLC (“Lazard”)

is acting as financial adviser to WestRock and no one else in connection with the contents of this announcement and the Combination and

will not be responsible to anyone other than WestRock for providing the protections afforded to its clients or for providing advice in

relation to the Combination, the contents of this announcement and the Prospectus or any other matter referred to therein. Neither Lazard

nor any of its affiliates or their respective directors, officers or employees owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, whether in contract, in tort, under statute or otherwise) to any person who is not a client of

Lazard in connection with the Prospectus, any statement contained therein, the contents of this announcement, or otherwise and Lazard

and its affiliates disclaim any and all such liability.

Forward-Looking Statements

This announcement and the Prospectus, as well

as oral statements made or to be made by Smurfit WestRock, Smurfit Kappa and WestRock, include certain “forward-looking statements”

(including within the meaning of US federal securities laws) regarding the Combination and the listing of Smurfit WestRock, the rationale

and expected benefits of the Combination (including, but not limited to, synergies), and any other statements regarding Smurfit WestRock’s,

Smurfit Kappa’s and WestRock’s future expectations, beliefs, plans, objectives, results of operations, financial condition

and cash flows, or future events or performance. Statements included in this announcement and the Prospectus that are not historical

facts, including statements about the beliefs and expectations of the management of each of Smurfit WestRock, Smurfit Kappa and WestRock,

are forward-looking statements. Words such as “may”, “will”, “could”, “should”, “would”,

“anticipate”, “intend”, “estimate”, “project”, “plan”, “believe”,

“expect”, “target”, “prospects”, “potential”, “commit”, “forecasts”,

“aims”, “considered”, “likely”, “estimate” and variations of these words and similar

future or conditional expressions are intended to identify forward-looking statements but are not the exclusive means of identifying

such statements. While Smurfit WestRock, Smurfit Kappa and WestRock believe these expectations, assumptions, estimates and projections

are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which

are beyond the control of Smurfit WestRock, Smurfit Kappa and WestRock. By their nature, forward-looking statements involve risk and

uncertainty because they relate to events and depend upon future circumstances that may or may not occur. Actual results may differ materially

from the current expectations of Smurfit WestRock, Smurfit Kappa and WestRock depending upon a number of factors affecting their businesses

and risks associated with the successful execution of the Combination and the integration and performance of their businesses following

the Combination. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include:

developments related to pricing cycles and volumes; economic, competitive and market conditions generally, including macroeconomic uncertainty,

customer inventory rebalancing, the impact of inflation and increases in energy, raw materials, shipping, labour and capital equipment

costs; reduced supply of raw materials, energy and transportation, including from supply chain disruptions and labour shortages; intense

competition; risks related to international sales and operations; failure to respond to changing customer preferences and to protect

intellectual property; results and impacts of acquisitions by Smurfit Kappa, WestRock or, following Completion, the Combined Group; the

amount and timing of Smurfit Kappa’s, WestRock’s and, following Completion, the Combined Group’s capital expenditures;

evolving legal, regulatory and tax regimes; changes in economic, financial, political and regulatory conditions in Ireland, the United

Kingdom, the United States and elsewhere, and other factors that contribute to uncertainty and volatility, natural and man-made disasters,

civil unrest, pandemics (such as the COVID-19 pandemic), geopolitical uncertainty, and conditions that may result from legislative, regulatory,

trade and policy changes associated with the current or subsequent Irish, US or UK administrations; the ability of Smurfit Kappa, WestRock

or, following Completion the Combined Group, to successfully recover from a disaster or other business continuity problem due to a hurricane,

flood, earthquake, terrorist attack, war, pandemic, security breach, cyber-attack, power loss, telecommunications failure or other natural

or man-made event, including the ability to function remotely during long-term disruptions such as the COVID-19 pandemic; the impact

of public health crises, such as pandemics (including the COVID-19 pandemic) and epidemics and any related company or governmental policies

and actions to protect the health and safety of individuals or governmental policies or actions to maintain the functioning of national

or global economies and markets; the potential impairment of assets and goodwill; the scope, costs, timing and impact of any restructuring

of operations and corporate and tax structure; actions by third parties, including government agencies; a regulatory approval that may

be required for the Combination is delayed, is not obtained in a timely manner or at all or is obtained subject to conditions that are

not anticipated; Smurfit WestRock may be unable to achieve the synergies and value creation contemplated by the Combination; Smurfit

WestRock’s availability of sufficient cash to distribute to Smurfit WestRock shareholders in line with current expectations; Smurfit

WestRock may be unable to promptly and effectively integrate Smurfit Kappa’s and WestRock’s businesses; failure to successfully

implement strategic transformation initiatives; each of Smurfit Kappa’s, WestRock’s and, following Completion, the Combined

Group’s management’s time and attention is diverted on issues related to the Combination; disruption from the Combination

makes it more difficult to maintain business, contractual and operational relationships; significant levels of indebtedness; credit ratings

may decline following the Combination; legal proceedings may be instituted against Smurfit WestRock, Smurfit Kappa or WestRock; Smurfit

Kappa, WestRock and, following Completion the Combined Group, may be unable to retain or hire key personnel; the consummation of the

Combination may have a negative effect on Smurfit Kappa’s or WestRock’s share prices, or on their operating results; the

risk that disruptions from the Combination will harm Smurfit Kappa’s or WestRock’s business, including current plans and

operations; certain restrictions during the pendency of the Combination that may impact Smurfit Kappa’s or WestRock’s ability

to pursue certain business opportunities or strategic transactions; Smurfit WestRock’s ability to meet expectations regarding the

accounting and tax treatments of the Combination, including the risk that the Internal Revenue Service may assert that Smurfit WestRock

should be treated as a US corporation or be subject to certain unfavourable US federal income tax rules under Section 7874

of the Internal Revenue Code of 1986, as amended, as a result of the Combination; and other factors such as future market conditions,

currency fluctuations, the behaviour of other market participants, the actions of regulators and other factors such as changes in the

political, social and regulatory framework in which the Combined Group will operate or in economic or technological trends or conditions.

None

of Smurfit WestRock, Smurfit Kappa, WestRock or any of their respective associates or directors, officers or advisers provides

any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements in

this announcement or the Prospectus will actually occur. You are cautioned not to place undue reliance on these forward-looking statements.

Other than in accordance with its legal or regulatory obligations (including under the UK Prospectus Regulation, the UK Listing Rules,

the Disclosure Guidance and Transparency Rules, the Prospectus Regulation Rules, the UK Market Abuse Regulation and other applicable

regulations), Smurfit WestRock is under no obligation, and Smurfit WestRock expressly disclaims any intention or obligation, to update

or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

No Offer of Securities

This

announcement does not constitute or form part of any offer or invitation to purchase, acquire, subscribe for, sell, dispose of

or issue, or any solicitation of any offer to sell, dispose of, purchase, acquire or subscribe for, any security, including any Smurfit

WestRock Shares to be issued to Smurfit Kappa Shareholders and WestRock Shareholders in connection with the Combination. In particular,

the issuance of the Smurfit WestRock Shares in connection with the Combination to Smurfit Kappa Shareholders has not been, and is not

expected to be, registered under the US Securities Act of 1933, as amended (the “US Securities Act”) or the securities

laws of any other jurisdiction. The Smurfit WestRock Shares to be issued in connection with the Combination to Smurfit Kappa Shareholders

will be issued pursuant to an exemption from the registration requirements provided by Section 3(a)(10) of the US Securities

Act based on the approval of the proposed Scheme to effect the Smurfit Kappa Share Exchange under the terms of the Transaction Agreement

by the Irish High Court. Section 3(a)(10) of the US Securities Act exempts securities issued in exchange for one or more bona

fide outstanding securities from the general requirement of registration where the fairness of the terms and conditions of the issuance

and exchange of the securities have been approved by any court or authorised governmental entity, after a hearing upon the fairness of

the terms and conditions of the exchange at which all persons to whom securities will be issued have the right to appear and to whom

adequate notice of the hearing has been given. In determining whether it is appropriate to authorise the Scheme, the Irish High Court

will consider at the hearing of the motion to sanction the Scheme under Section 453 of the Irish Companies Act (the “Irish

Court Hearing”) whether the terms and conditions of the Scheme are fair to Scheme shareholders. The Irish High Court will fix

the date and time for the Irish Court Hearing. If the Irish High Court approves the Scheme, its approval will constitute the basis for

the Smurfit WestRock Shares to be issued without registration under the US Securities Act in reliance on the exemption from the registration

requirements of the US Securities Act provided by Section 3(a)(10) of the US Securities Act.

Participants in the Solicitation of Proxies

This announcement is not a solicitation of proxies

in connection with the Combination. However, under US SEC rules, Smurfit WestRock, Smurfit Kappa, WestRock, and certain of their respective

directors, executive officers and other members of the management and employees may be deemed to be participants in the solicitation

of proxies in connection with the Combination.

Information

about (i) WestRock’s directors is set forth in the section entitled “Board Composition” on page 8 of WestRock’s

proxy statement on Schedule 14A filed with the US SEC on 13 December 2023 and (ii) WestRock’s executive officers is set

forth in the section entitled “Executive Officers” on page 141 of WestRock’s Annual Report on Form 10-K (the

“WestRock 2023 Annual Report”) filed with the US SEC on 17 November 2023. Information about the compensation

of WestRock’s directors for the financial year ended 30 September 2023 is set forth in the section entitled “Director

Compensation” starting on page 19 of WestRock’s proxy statement on Schedule 14A filed with the US SEC on 13 December 2023.

Information about the compensation of WestRock’s executive officers for the financial year ended 30 September 2023 is set

forth in the section entitled “Executive Compensation Tables” starting on page 38 of WestRock’s proxy statement

on Schedule 14A filed with the US SEC on 13 December 2023. Transactions with related persons (as defined in Item 404 of Regulation

S-K promulgated under the US Securities Act) are disclosed in the section entitled “Certain Relationships and Related Person Transactions”

on page 20 of WestRock’s proxy statement on Schedule 14A filed with the US SEC on 13 December 2023. Information about

the beneficial ownership of WestRock’s securities by WestRock’s directors and named executive officers as of 22 April 2024

is set forth in the section entitled “Security Ownership of Certain Beneficial Holders, Directors and Management of WestRock”

starting on page 277 of each of the US Proxy Statement and the US Prospectus. As of 22 April 2024, none of the participants

(within the meaning of Rule 13d-3 under the Securities Exchange Act of 1934, as amended) owned more than 1% of WestRock Shares.

Other information regarding certain participants in the proxy solicitation and a description of their direct and indirect interests,

by security holdings or otherwise are contained in the section entitled “Interests of WestRock’s Directors and Executive

Officers in the Combination” beginning on page 139 of each of the US Prospectus and the US Proxy Statement.

Information about

Smurfit Kappa’s directors and executive officers is set forth in the section entitled “Board of Directors,”

starting on page 112 of Smurfit Kappa’s 2023 Annual Report (the “Smurfit Kappa 2023 Annual Report”)

published on Smurfit Kappa’s website on 15 March 2024 which was filed with the FCA on 15 March 2024 and Euronext

Dublin in Ireland on 15 March 2024. Information about the compensation of Smurfit Kappa executive officers and directors

is set forth in the remuneration report starting on page 129 of the Smurfit Kappa 2023 Annual Report. Transactions with

related persons (as defined under Paragraph 24 of the International Accounting Standards) are disclosed in the subsection entitled

“Related Party Transactions” to the section entitled “Notes to the Consolidated Financial Statements,” on

page 223 of the Smurfit Kappa 2023 Annual Report. Information about the beneficial ownership of Smurfit Kappa’s

securities by Smurfit Kappa’s directors and executive officers is set forth in the sections entitled “Executive

Directors’ Interests in Share Capital at 31 December 2023” on page 147 and "Non-Executive Directors' Interests

in Share Capital at 31 December 2023" on page 150 of the Smurfit Kappa 2023 Annual Report.

Information

about the expected beneficial ownership of Smurfit WestRock securities by the individuals who are expected to be executive officers and

directors of Smurfit WestRock at Completion is set forth in the section entitled “Security Ownership of Certain Beneficial Holders,

Directors and Management of Smurfit WestRock” beginning on page 279 of each of the US Prospectus and the US Proxy Statement.

Information required by Item 402 of the SEC’s Regulation S-K with respect to the executive officers of Smurfit WestRock

who served as executives of Smurfit Kappa during Smurfit Kappa’s fiscal year 2023, as well as a description of certain post-Completion

compensation arrangements that are expected to apply to the executive officers of Smurfit WestRock, is set forth in the section entitled

“Executive Compensation” beginning on page 327 of each of the US Prospectus and the US Proxy Statement.

Other

The contents of this announcement are not to

be construed as legal, business or tax advice. Each investor, stockholder or shareholder should consult its own legal adviser, financial

adviser or tax adviser for legal, financial or tax advice, respectively.

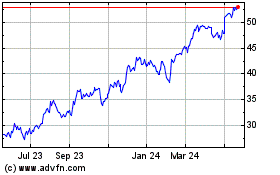

WestRock (NYSE:WRK)

Historical Stock Chart

From Nov 2024 to Dec 2024

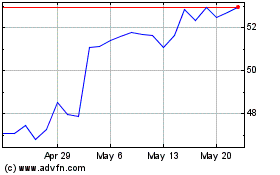

WestRock (NYSE:WRK)

Historical Stock Chart

From Dec 2023 to Dec 2024