Texas Oil Company Asks Federal Court to Stop Insurance Companies’ $250 Million Demand for Additional Collateral

12 December 2024 - 10:41AM

Business Wire

Amended lawsuit alleges price-fixing,

collusion, antitrust violations

An independent Texas oil and gas producer is striking back

against a group of insurance companies, which collectively are

seeking $250 million in collateral beyond what the oil company has

already contracted for bonds backing its production activities.

The energy company, Houston-based W&T Offshore, Inc. (NYSE:

WTI), is asking a federal judge to declare insurers have colluded

to damage the company by jointly demanding additional collateral

and premiums.

At the heart of the dispute are rules from the federal Bureau of

Ocean Energy Management – BOEM – which require energy producers in

the Outer Continental Shelf to provide a bond to pay for well,

platform, pipeline and facilities cleanup if the operating company

fails to do so.

Several years ago, BOEM imposed the idea of requiring small to

mid-sized companies such as W&T to provide additional bonds. In

over 70 years of producer operations in the Gulf of Mexico, the

federal government has never been forced to pay for any abandonment

cleanup operations associated with well, platform facility, or

pipeline operations.

W&T’s legal filing says that armed with that proposal, its

insurers (also known as surety providers), including Endurance

Assurance Corp., which is owned by Japanese insurance holding

company Sompo and others, began demanding additional collateral for

surety and indemnity agreements W&T already utilizes and for

which it has already paid premiums.

In July, one of the surety companies demanded W&T fully and

immediately collateralize their bond by paying an additional $89

million as collateral, then filed suit in November demanding $93.5

million, despite W&T never having missed a previous payment.

Other W&T surety companies followed suit, demanding full and

immediate collateralization of their bonds.

“These insurance companies and their unreasonable demands for

increased collateral pose an existential threat to independent

operators like W&T,” CEO Tracy W. Krohn said. “We cannot afford

to keep paying for insurance we’ve already paid for in the course

of our operations.

“This is no different than your auto insurance carrier all of a

sudden demanding you put up 100 percent of your car’s cash value in

addition to doubling or tripling your existing premium. It is just

not possible or practical—nor fair. These unfair practices beg the

question: if insurance companies are requiring full cash

collateralization of the bonds they issue, then what is the purpose

of independent operators paying them millions of dollars to issue

the bonds? These unfair insurance practices deprive independent

operators of the very consideration for which they contracted,

thereby making the insurance companies’ contractual obligations

illusory or non-existent,” said Mr. Krohn.

“We hope the court will recognize these crippling demands are

improper and malicious and stop these insurance companies from

trying to arbitrarily extort massive amounts of additional premium

and collateral from customers like W&T.”

Among other things, W&T’s lawsuit, filed in August and

amended today, accuses five insurance companies of conspiracy,

saying the insurers met one or more times in 2024 and conspired to

raise premiums and collateral. The complaint also includes

allegations of price-fixing, antitrust violations and tortious

interference with existing contracts, as well as violations of the

Texas Insurance Code and violations of the Texas Free Enterprise

and Antitrust Act.

It asks a federal judge in Houston to block the companies’

unconscionable and unreasonable demands for collateral and to award

damages to W&T.

W&T says it has valid bonds to cover the potential eventual

cost of cleaning up its offshore operations if or when the time

comes.

Several states, including Texas, are challenging the BOEM rule

and in one case they specifically cite W&T as an example of how

the rule could be misused to irreparably harm energy producers.

The case is W&T Offshore, Inc. et al. v. Endurance Assurance

Corporation, et al., Civil Action No. 4:24-CV-3047, in the U.S.

District Court for the Southern District of Texas.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241211846138/en/

Mark Annick 800-559-4534 mark@androvett.com

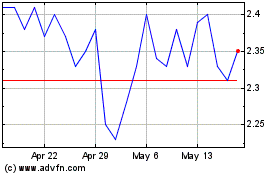

W and T Offshore (NYSE:WTI)

Historical Stock Chart

From Nov 2024 to Dec 2024

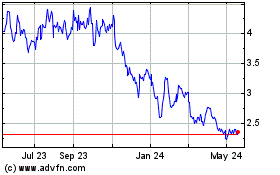

W and T Offshore (NYSE:WTI)

Historical Stock Chart

From Dec 2023 to Dec 2024