Includes offers for securities issued by United

States Steel Corporation and co-issued by Big River Steel LLC and

BRS Finance Corp.

United States Steel Corporation (NYSE: X) (“U. S. Steel” or the

“Company”) and its subsidiaries, Big River Steel LLC, a Delaware

limited liability company, and BRS Finance Corp., a Delaware

corporation (together, “Big River Steel,” and collectively with U.

S. Steel, the “Offerors,” and each of U. S. Steel and Big River

Steel individually, an “Offeror”), announced today the commencement

of tender offers to purchase (each offer a “Tender Offer” and

collectively, the “Tender Offers”) for cash, subject to certain

terms and conditions, up to a total of $300,000,000 aggregate

principal amount (the “Tender Cap Amount”) of (i) the 6.875% Senior

Notes due 2029 (CUSIP No. 912909AU2) issued by U. S. Steel (the

“2029 Notes”), (ii) the 6.650% Senior Notes due 2037 (CUSIP No.

912909AD0) issued by U. S. Steel (the “2037 Notes”) and (iii) the

6.625% Senior Secured Notes due 2029 (CUSIP Nos. 08949LAB6 and

U0901LAB6) issued by Big River Steel (the “2029 Secured Notes” and,

together with the 2029 Notes and the 2037 Notes, the “Securities”),

subject to the Series Maximum Tender Amount (as defined below) and

subject to the Acceptance Priority Levels (as defined below) and

proration. U. S. Steel is the Offeror for the 2029 Notes and the

2037 Notes and Big River Steel is the Offeror for the 2029 Secured

Notes.

The Tender Offers are scheduled to expire at 11:59 p.m. New York

City time on September 14, 2022 (the “Expiration Date”), unless

extended or earlier terminated by the Offerors. The Tender Offers

are being made pursuant to an Offer to Purchase dated August 17,

2022 (the “Offer to Purchase”), which sets forth a more detailed

description of the Tender Offers. Holders of the Securities are

urged to carefully read the Offer to Purchase before making any

decision with respect to the Tender Offers.

The aggregate principal amount of the Securities that may be

purchased pursuant to the Tender Offers will not exceed the Tender

Cap Amount. The aggregate principal amount of each series of

Securities that may be purchased pursuant to the Tender Offers will

not exceed the applicable maximum tender amount set forth in the

table below (with respect to each series of Securities, the “Series

Maximum Tender Amount”). Subject to the Tender Cap Amount and the

Series Maximum Tender Amounts, the aggregate principal amount of

any series of Securities that is purchased in a Tender Offer will

be based on the acceptance priority level for such series, as set

forth in the table below (the “Acceptance Priority Level”). As

discussed in more detail in the Offer to Purchase, each of the

Offerors, respectively, reserves the right, but is under no

obligation, to increase or decrease any or all of the Series

Maximum Tender Amounts. The Offerors also reserve the right, but

are under no obligation, to increase or decrease the Tender Cap

Amount, at any time, subject to compliance with applicable law.

The following table sets forth certain terms of the Tender

Offers:

Dollars per $1,000 Principal

Amount of Securities

Title of Security

Issuer

CUSIP No. / ISIN

Principal Amount

Outstanding

Acceptance Priority

Level

Series Maximum Tender

Amount

Tender Offer

Consideration(1)

Early Tender Premium

Total

Consideration(1)(2)

6.875% Senior Notes due 2029

United States Steel

Corporation

912909AU2 /

US912909AU28

$700,000,000

1

$225,000,000

$945.00

$50.00

$995.00

6.650% Senior Notes due 2037

United States Steel

Corporation

912909AD0 /

US912909AD03

$350,000,000

2

$75,000,000

$870.00

$50.00

$920.00

6.625% Senior Secured Notes due

2029

Big River Steel LLC and BRS

Finance Corp.

08949LAB6 /

US08949LAB62

U0901LAB6/

USU0901LAB63

$720,000,000

3

$75,000,000

$975.00

$50.00

$1,025.00

(1)

Excludes accrued and unpaid interest up

to, but not including, the applicable Settlement Date, which will

be paid in addition to the Tender Offer Consideration or Total

Consideration, as applicable.

(2)

Includes the Early Tender Premium.

The total consideration (the “Total Consideration”) payable for

each $1,000 principal amount of Securities validly tendered at or

prior to 5:00 p.m., New York City time, on August 30, 2022 (such

date and time, as it may be extended, the “Early Tender Date”) and

accepted for purchase pursuant to the Tender Offers will be the

applicable total consideration for such series of Securities set

forth in the table above. The Total Consideration includes the

early tender premium for such series of Securities also set forth

in the table above (the “Early Tender Premium”). Holders must

validly tender and not subsequently validly withdraw their

Securities at or prior to the Early Tender Date in order to be

eligible to receive the Total Consideration for such Securities

purchased in the Tender Offers.

Subject to the terms and conditions of the Tender Offers, each

Holder who validly tenders and does not subsequently validly

withdraw their Securities at or prior to the Early Tender Date will

be entitled to receive the Total Consideration, plus accrued and

unpaid interest up to, but not including, the applicable Settlement

Date (as defined below) if and when such Securities are accepted

for payment. Holders who validly tender their Securities after the

Early Tender Date but at or prior to the Expiration Date will be

entitled to receive the tender offer consideration equal to the

applicable Total Consideration less the applicable Early Tender

Premium (the “Tender Offer Consideration”), plus accrued and unpaid

interest up to, but not including, the applicable Settlement Date,

if and when such Securities are accepted for payment.

Each of the Offerors, respectively, reserves the right, but is

under no obligation, at any point following the Early Tender Date

and before the Expiration Date, to accept for purchase any

Securities validly tendered at or prior to the Early Tender Date

(the “Early Settlement Date”). The Early Settlement Date will be

determined at each Offeror's option and is currently expected to

occur on the second business day following the Early Tender Date,

subject to all conditions to the Tender Offers having been

satisfied or waived. The expected Early Settlement Date is

September 1, 2022, unless extended by the Offerors, as applicable,

assuming all conditions to the Tender Offers have been satisfied or

waived.

Irrespective of whether each Offeror, respectively, chooses to

exercise its option to have an Early Settlement Date, each Offeror,

respectively, will purchase any remaining Securities that have been

validly tendered by the Expiration Date and that each Offeror

chooses to accept for purchase, subject to the applicable Series

Maximum Tender Amounts, the Tender Cap Amount, the application of

the Acceptance Priority Levels and all conditions to the Tender

Offers having been satisfied or waived by the applicable Offeror,

on a date immediately following the Expiration Date (the “Final

Settlement Date” and each of the Early Settlement Date and Final

Settlement Date, a “Settlement Date”). The Final Settlement Date is

expected to occur on the second business day following the

Expiration Date, subject to all conditions to the Tender Offers

having been satisfied or waived by the respective Offeror. The

expected Final Settlement Date is September 16, 2022 unless

extended by the respective Offeror, assuming all conditions to the

Tender Offers have been satisfied or waived.

To receive either the Total Consideration or the Tender Offer

Consideration, holders of the Securities must validly tender and

not validly withdraw their Securities prior to the Early Tender

Date or the Expiration Date, respectively. Securities tendered may

be withdrawn from the Tender Offers at or prior to, but not after,

5:00 p.m., New York City time, on August 30, 2022, unless extended,

by following the procedures described in the Offer to Purchase.

Subject to each Series Maximum Tender Amount, the Tender Cap

Amount, the application of the Acceptance Priority Levels and the

other terms and conditions described in the Offer to Purchase, and

each of the Offerors’ right to increase or decrease any or all of

the Series Maximum Tender Amounts and the Tender Cap Amount, each

Offeror intends to accept for payment the respective Securities

validly tendered at or prior to the Expiration Date, and will only

prorate the Securities if the aggregate principal amount of

Securities validly tendered at or prior to the Early Tender Date or

the Expiration Date, as applicable, exceeds the applicable Series

Maximum Tender Amount, or if the aggregate principal amount of

Securities of all series validly tendered at or prior to the Early

Tender Date or the Expiration Date, as applicable, exceeds the

Tender Cap Amount.

The amounts of each series of Securities that are purchased in

the Tender Offer will be determined in accordance with the

Acceptance Priority Levels set forth in the Offer to Purchase and

referenced in the table above, with 1 being the highest Acceptance

Priority Level and 3 being the lowest Acceptance Priority Level. At

the applicable Settlement Date, all Securities validly tendered and

not validly withdrawn in the Tender Offer having a higher (i.e.,

lower numerical) Acceptance Priority Level will be accepted before

any tendered Securities having a lower (i.e., higher numerical)

Acceptance Priority Level are accepted in the Tender Offer, subject

to the applicable Series Maximum Tender Amounts.

If the aggregate principal amount of any Securities tendered and

not validly withdrawn in the applicable Tender Offer exceeds the

amount of the applicable Series Maximum Tender Amount or the Tender

Cap Amount, as applicable, remaining available for application,

then, if any Securities of such series are purchased, the

applicable Offeror will accept such Securities on a pro rata

basis.

If the Tender Offers are not fully subscribed as of the Early

Tender Date and the Offerors elect to have an Early Settlement

Date, holders who validly tender Securities after the Early Tender

Date may be subject to proration, whereas holders who validly

tender Securities at or prior to the Early Tender Date will not be

subject to proration, subject to the applicable Series Maximum

Tender Amounts. In addition, if the aggregate principal amount of

Securities validly tendered in the applicable Tender Offer at or

prior to the Early Tender Date exceeds the applicable Series

Maximum Tender Amount, or if the aggregate principal amount of

Securities of all series validly tendered at or prior to the Early

Tender Date exceeds the Tender Cap Amount and the Offerors elect to

have an Early Settlement Date, Securities tendered after the Early

Tender Date will not be eligible for purchase, unless the

applicable Series Maximum Tender Amount or the Tender Cap Amount is

increased, as the case may be.

However, in the event the Offerors do not elect to have an Early

Settlement Date and the applicable Tender Offer is fully

subscribed, or the aggregate principal amount of Securities of all

series validly tendered at or prior to the Expiration Date exceeds

the Tender Cap Amount, as applicable, all holders who validly

tendered Securities in the applicable Tender Offer will be subject

to proration, subject to the application of the Acceptance Priority

Levels and the Series Maximum Tender Amounts. Securities which were

not accepted for purchase due to the applicable Series Maximum

Tender Amount, the Tender Cap Amount or the application of the

Acceptance Priority Levels may be accepted if the Offerors, as

applicable, increase the applicable Series Maximum Tender Amount or

the Tender Cap Amount, as applicable, which the Offerors are

entitled to do at their sole discretion, and such increase is not

fully used up by Securities validly tendered at or prior to the

Early Tender Date (in the event we elect to have an Early

Settlement Date) or by Securities purchased in a higher (i.e.,

lower numerical) Acceptance Priority Level. There can be no

assurance that the Offerors will increase any Series Maximum Tender

Amount or the Tender Cap Amount.

The obligation of each Offeror to accept for purchase and to pay

either the Total Consideration or Tender Offer Consideration and

the accrued and unpaid interest on the Securities pursuant to the

Tender Offers is not subject to any minimum tender condition or a

financing condition, but is subject to each Series Maximum Tender

Amount, the Tender Cap Amount, the application of the Acceptance

Priority Levels and certain other conditions described in the Offer

to Purchase.

The Offerors have retained Goldman, Sachs & Co. LLC, Credit

Suisse Securities (USA) LLC, J.P. Morgan Securities LLC and Wells

Fargo Securities, LLC to serve as Dealer Managers for the Tender

Offers. D.F. King & Co., Inc. has been retained to serve as the

Information Agent and Tender Agent for the Tender Offers. Questions

regarding the Tender Offers may be directed to Goldman, Sachs &

Co. LLC at (800) 828-3182 (toll free) or (212) 902-5962 (collect),

Credit Suisse Securities (USA) LLC at (800) 820-1653 (toll-free) or

(212) 325-6340 (collect), J.P. Morgan Securities LLC at (866)

834-4666 (toll free) or (212) 834-3822 (collect) and Wells Fargo

Securities, LLC at (866) 309-6316 (toll-free) or (704) 410-4759

(collect). Requests for the Offer to Purchase may be directed to

D.F. King & Co., Inc. at 48 Wall Street, New York, New York

10005, Attn: Michael Horthman, (212) 269-5550 (for banks and

brokers) or (800) 659-5550 (for all others) or email at

uss@dfking.com.

The Offerors are making the Tender Offers only by, and pursuant

to, the terms of the Offer to Purchase. None of the Offerors, the

Dealer Managers, the Information Agent and Tender Agent make any

recommendation as to whether holders should tender or refrain from

tendering their Securities. Holders of Securities must make their

own decision as to whether to tender their Securities and, if so,

the principal amount of such Securities to tender. The Tender

Offers are not being made to holders of Securities in any

jurisdiction in which the making or acceptance thereof would not be

in compliance with the securities, blue sky or other laws of such

jurisdiction. In any jurisdiction in which the securities laws or

blue sky laws require the Tender Offers to be made by a licensed

broker or dealer, the Tender Offers will be deemed to be made on

behalf of the Offerors by the Dealer Managers, or one or more

registered brokers or dealers that are licensed under the laws of

such jurisdiction.

This press release does not constitute an offer to purchase

securities or a solicitation of an offer to sell any securities or

an offer to sell or the solicitation of an offer to purchase any

new securities, nor does it constitute an offer or solicitation in

any jurisdiction in which such offer or solicitation is unlawful.

Capitalized terms used in this press release but not otherwise

defined herein have the meanings assigned to them in the Offer to

Purchase.

Cautionary Statement

All statements included in this press release, other than

historical information or statements of historical fact, are

forward-looking statements. Words such as, but not limited to,

“believes,” “expects,” “anticipates,” “estimates,” “intends,”

“plans,” “could,” “may,” “will,” “should,” and similar expressions

are intended to identify forward-looking statements. All

forward-looking statements rely on a number of assumptions,

estimates and data concerning future results and events and are

subject to a number of uncertainties and other factors, many of

which are outside the Company's control that could cause actual

results to differ materially from those reflected in such

statements. Accordingly, the Offerors caution that the

forward-looking statements contained herein are qualified by these

and other important factors and uncertainties that could cause

results to differ materially from those reflected by such

statements. For more information on the potential factors, please

review U. S. Steel's filings with the Securities and Exchange

Commission, including, but not limited to, U. S. Steel's Annual

Report on Form 10-K, its Quarterly Reports on Form 10-Q and its

Current Reports on Form 8-K.

Founded in 1901, United States Steel Corporation is a leading

steel producer. With an unwavering focus on safety, the Company’s

customer-centric Best for All® strategy is advancing a more secure,

sustainable future for U. S. Steel and its stakeholders. With a

renewed emphasis on innovation, U. S. Steel serves the automotive,

construction, appliance, energy, containers, and packaging

industries with high value-added steel products such as U. S.

Steel’s proprietary XG3™ advanced high-strength steel. The Company

also maintains competitively advantaged iron ore production and has

an annual raw steelmaking capability of 22.4 million net tons. U.

S. Steel is headquartered in Pittsburgh, Pennsylvania, with

world-class operations across the United States and in Central

Europe. For more information, please visit www.ussteel.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220817005770/en/

Arista Joyner Manager Financial Communications T – (412)

433-3994 E – aejoyner@uss.com

Kevin Lewis Vice President Investor Relations T – (412) 433-6935

E – klewis@uss.com

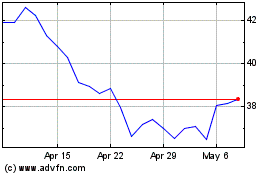

US Steel (NYSE:X)

Historical Stock Chart

From Apr 2024 to May 2024

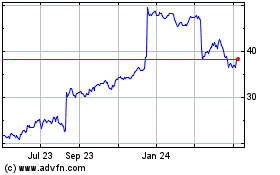

US Steel (NYSE:X)

Historical Stock Chart

From May 2023 to May 2024