ADR Report: Shares Higher On Positive Earnings Reports

10 August 2011 - 7:18AM

Dow Jones News

International companies trading in New York closed higher

Tuesday, as the broader market came off the worst three-day selloff

since the 2008 financial crisis.

The Bank of New York index of ADRs rose 5.6% to 124.35 as a

handful of corporate earnings reports were received warmly.

InterContinental Hotels Group PLC (IHG, IHG.LN), the world's

largest hotel operator by number of rooms, reported its first-half

earnings increased as demand from emerging markets boosted revenue.

Shares jumped 8.5% to $17.40. Giant Interactive Group Inc.'s (GA)

reported second-quarter financial results that topped expectations.

The Chinese online-game company also declared a special dividend.

Its shares climbed 4.1% to $7.88. ABB Ltd. (ABB, 500002.BY)

reported revenue that topped the average estimate of analysts

polled by Thomson Reuters. The Indian unit of Swiss engineering

conglomerate of the same name saw shares jump 12% to $21.88.

The European index climbed 5.8% to 113.87.

Deutsche Bank analysts raised their price target on British

insurer Prudential PLC (PUK, PRU.LN), citing the insurer's

better-than-expected interim results on most metrics. Shares rose

9% to $20.29.

The Asian index 5.3% higher at 124.85.

Xinyuan Real Estate Co. (XIN) reported its second-quarter

revenue more than doubled, topping analysts' estimates. Shares

jumped 17% to $1.96.

Simcere Pharmaceutical Group (SCR) reported second-quarter

profits that topped analysts' expectations. The Chinese

pharmaceutical company's shares rose 3.2% to $9.80.

The Latin American index advanced 5.2% to 340.73.

Brazilian oil giant Petroleo Brasileiro (PBR, PETR4.BR), or

Petrobras, registered a 24% jump in natural-gas production in the

first half of 2011, Gas and Energy Director Maria das Gracas Foster

said Tuesday. Separately, the company does not plan to revise its

recently announced investment plan in light of recent market

turmoil, the company's director of gas and energy said. Shares rose

3.3% to $27.02.

Investments in the Brazilian mine sector are unlikely to be

reduced as a result of the current economic turmoil and could even

increase as metals derivatives, including in gold, gain

attractiveness, a Brazilian-based independent mining consultant

said. Shares of miner Vale SA (VALE) ended up 6.1% at $26.51.

The emerging markets index rose 4.8% to 288.67.

Turmoil in world financial markets fired gold prices to record

heights, yet several large banks and brokers expect the yellow

metal will continue to soar. South African miner AngloGold Ashanti

Ltd.'s (AU, ANG.JO) shares rose 2% to $42.86 while Golf Fields Ltd.

(GFI, GFI.JO) shares climbed 6% to $15.53.

-By Matt Jarzemsky, Dow Jones Newswires; 212-416-2240;

matthew.jarzemsky@dowjones.com

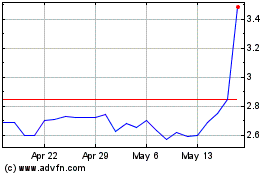

Xinyuan Real Estate (NYSE:XIN)

Historical Stock Chart

From Sep 2024 to Oct 2024

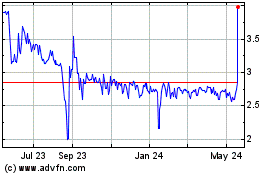

Xinyuan Real Estate (NYSE:XIN)

Historical Stock Chart

From Oct 2023 to Oct 2024