Additional Proxy Soliciting Materials (definitive) (defa14a)

11 May 2023 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under § 240.14a-12 |

EXXON MOBIL CORPORATION

(Name of Registrant as Specified In Its Charter)

NOT APPLICABLE

(Name of

Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11. |

To our shareholders:

This

year, Legal and General Investment Management America Inc. filed a proposal requesting detailed quantitative disclosures of asset retirement obligations (AROs) using the IEA Net Zero Emissions by 2050 (IEA NZE) scenario. They did this even though

virtually all observers, including the IEA itself, agree that the world is not on the IEA NZE pathway.

Carbon Tracker Initiative (CTI) and the proponent

have muddied the waters with publications related to the proposal that contain inaccuracies, inconsistencies, and misstatements. These publications:

| |

• |

|

Conflate this year’s proposal requesting a specific quantitative metric with a broader proposal from last

year, merging them in a single assessment of our recent disclosures to suggest that our responsiveness was insufficient. |

| |

• |

|

Mix old/new, regional/global data to create a flawed narrative about our company. |

| |

• |

|

Draw false equivalency between us and energy companies in different parts of the world with different energy

transition plans, accounting standards, and market dynamics. |

| |

• |

|

Confuse key concepts, such as forecast assumptions vs. back-cast scenarios,1 individual asset impairment vs. portfolio resiliency, and more. 2 |

Last year, shareholders voted to pass a separate proposal related to the IEA NZE, requesting an audited report on how the scenario’s assumptions affect

our financial statements. We listened, and as outlined below, we have been responsive.

Following months of engagement with investors, including the

proponent, we published details of our resiliency analysis under the IEA NZE in our 2023 Advancing Climate Solutions (ACS) Progress Report. We included information about potential nominal dollar impacts on our operating cash flow and potential

changes to our capex through 2050, and we further addressed shareholder feedback in the following ways:

| |

• |

|

We laid out the IEA NZE assumptions that we used in our modeling, including additional detail

regarding pricing, demand, and production volumes used in our analysis.3 Our competitors and peers have different portfolios, strategies, markets, and regulatory realities that lend themselves to

different approaches and may lead to different results, especially for those who presume an exit from the oil and natural gas business. |

1

| |

• |

|

We provided more information about the effect the remote IEA NZE scenario’s assumptions could have on our

financial statements.4 We modeled our portfolio through 2050 and described our approach to repurposing downstream assets in support of a lower-emission future, including evolving the

product slate toward biofuels, chemicals, and basestocks, and converting some of our refineries to terminals. |

| |

• |

|

We solicited a Wood Mackenzie audit and published the audit statement in its entirety. Their audit

concluded that our modeling accurately reflected the IEA NZE scenario assumptions and yielded a reasonable representation of our portfolio mix. The proponent disregards this diligent analysis and instead relies on a Carbon Tracker Initiative report

that misrepresents the rigor of our analysis and thoroughness of our disclosures.5 |

| |

• |

|

We published information about the internal prices we use for planning, and how those compare to historical

trends and the IEA NZE scenario assumptions. Our ACS provides the ranges of our greenhouse gas pricing, as well as references to our mid- and longer-term oil and natural gas pricing, which are within the

range of third-party projections published by reputable organizations.6 The pricing is also well within historical bands,7 yet the proponent

claims that our ranges are too broad. This ignores the cyclic nature of our industry, and it would be misleading to investors to imply that any company could project these prices more precisely. |

| |

• |

|

We offered greater detail on the potential impact of the IEA NZE scenario on remaining asset lives, AROs, and asset-use optionality.8 We test our portfolio against a range of scenarios and projections, confirming that our flexible strategy enables us to adapt to the

energy transition at the pace society demands. The notion that we are concealing AROs by treating them as “off-balance sheet liabilities” is objectively wrong and demonstrates a basic lack of

understanding about our business and the accounting rules that apply. |

Regarding this year’s proposal asking for quantitative

impacts of the IEA NZE scenario on AROs, as mentioned above, our ACS progress report already includes detailed disclosure of our modeling through 2050 under the IEA NZE scenario and the optionality we have to manage and repurpose our downstream

assets.

Furthermore, others in the industry that provide information on AROs under the IEA NZE state that this information is not reflective of their

strategies and is therefore not useful in understanding how assets will be managed through the energy transition. We think this is further evidence that this type of report does not provide useful information for investors.

To be clear, pursuing this sort of disclosure doubles down on a misunderstanding of our business and energy transition plans, and it could mislead investors

and other stakeholders if we attempted to predict AROs beyond the estimates already provided on our balance sheet. We invite shareholders to look at our current disclosures and to engage with us in order to better understand our energy transition

strategy.

2

Ultimately, the proponent’s request is driven by a view of the energy transition that is fixated on a

scenario that is disconnected from how the transition is unfolding today, as well as the strategies needed to support society’s evolving needs.

As

such, our Board strongly recommends a vote AGAINST “Item 12 – Report on Asset Retirement Obligations Under IEA NZE Scenario.”

Regards,

Investor Relations Team

Exxon Mobil Corporation

This year’s Annual Meeting will be held virtually on May 31 at 9:30 a.m. Central Time. We’ll share how our

competitive advantages make us an essential partner as we work to reduce our own greenhouse gas emissions and the emissions of others. Make sure you share your thoughts in return by voting your shares.

3

How to Vote at the Annual Meeting

Please keep an eye out for your proxy materials, which are being mailed to all shareholders as recorded in our stock register on April 5, 2023. You may

vote at the Annual Meeting or by proxy, but we recommend you vote by proxy even if you plan to participate in the virtual meeting. You can vote by proxy one of the following ways:

|

|

|

|

Online

If your control number has 15 digits:

Follow the instructions at

investorvote.com/exxonmobil

If your control number has 16 digits:

Follow the instructions at proxyvote.com

If your control number has any other number of digits:

Follow the instructions you received from your bank, brokerage firm, or other intermediary

Your control number can be found on your

proxy card, Notice or the email you’ve received

with this material. |

|

Mail

Complete, sign, date, and return your

proxy card in the enclosed

envelope received with your proxy materials.

If you receive a Notice and would

like to vote by mail, please follow the instructions in the Notice

to obtain paper proxy materials. |

Learn more about our Annual Shareholder Meeting.

| 1 |

Unlike our Outlook for Energy, which is a projection, the IEA NZE scenario works backward from a hypothetical

outcome to identify the factors that would need to occur to achieve that outcome. 2023 ACS, p. 26. |

| |

• |

|

CTI mischaracterizes our announced ~$17 billion investment as directed toward “reducing others’

emissions,” ignoring the 60% allocation toward reducing our own emissions (Scopes 1 and 2). https://carbontracker.org/wp-content/uploads/2023/04/Exxon-FY22_Final_Acctg_Assessment.pdf, p. 5.

|

4

| |

• |

|

CTI references the ExxonMobil 2021 Outlook for Energy, not relying on the updated ExxonMobil 2022 Outlook for

Energy published in October 2022 (“ExxonMobil—The Existential Crisis,” https://carbontracker.org/reports/exxonmobil-the-existential-crisis/, p. 13).

|

| |

• |

|

In “ExxonMobil—The Existential Crisis,” CTI acknowledges that our refineries, particularly in the

U.S., position us “favourably in an energy transition,” adding that “Exxon’s complex refineries can be more readily repurposed to produce biofuels and other lower carbon products.” (p. 33) On the other hand, CTI’s

“CA100+ Climate Accounting and Alignment Assessment” calls for “quantitative impacts on existing assets and liabilities – on the business model as it stands today so investors can determine the company’s resilience to a net

zero scenario,” (p. 13) presuming that our manufacturing assets are not resilient, in conflict with their own assessment. |

| |

• |

|

CTI has taken statements of ExxonMobil Chairman and CEO Darren Woods out of context to suggest that he

“implicitly acknowledged” that electric vehicle sales mean “oil’s reign as the predominant transportation fuel is coming to end.” (“ExxonMobil – The Existential Crisis,” p. 8.) On the contrary, as Darren

explained in the interview, he was describing a sensitivity analysis indicating that if all vehicles were EVs by 2040, global oil demand would be the roughly same as in the 2013-2014 timeframe – a good time for our business.

|

| |

• |

|

CTI states that “Exxon did not appear to consider the impact of other significant climate-related matters

that it had identified in the front-end of its 10-K,” suggesting that quantitative assessment of climate-related risk factors within the financial statements, no

matter the remoteness, is needed to avoid “inconsistencies.” (https://carbontracker.org/wp-content/uploads/2023/04/Exxon-FY22_Final_Acctg_Assessment.pdf, p. 8) Climate change risks range from

immediate and probable (e.g., additional carbon taxes) to remote (e.g., a future with no oil and natural gas). Treating the risks outlined in a remote scenario like IEA NZE in the same way as enterprise risks reportable under SEC rules violates good

disclosure principles. |

| |

• |

|

CTI states that “Exxon’s scenario expectations, like the IEA NZE, are hypothetical, and Exxon’s

numbers are baked into the accounts.” (https://carbontracker.org/wp-content/uploads/2023/04/Exxon-FY22_Final_Acctg_Assessment.pdf, p.15.) As described in our 2023 ACS, our Outlook for Energy is based on

an analysis of current trends and does not work backwards from a presumed future state, and so is not a hypothetical scenario like the IEA NZE. The Outlook for Energy published on our website gives insight into our key assumptions and conclusions,

and the data and analysis behind them. Elements of this are also disclosed in the Summary of Accounting Policies section in the financial statements on p. 85 of our 2022 10-K. |

| |

• |

|

CTI states “Exxon did not supply the information sought, namely the financial statement impact of the IEA

NZE.” (https://carbontracker.org/wp-content/uploads/2023/04/Exxon-FY22_Final_Acctg_Assessment.pdf, p.15.) This claim would seem to be driven by CTI’s view that “Exxon shareholders filed a

resolution (‘2022 Resolution‘) requesting that, by February 2023, Exxon seek an audited report that provides the quantitative (dollar) impacts of achieving the drive to net zero by 2050.” (Ibid, p. 10) The actual proposal, however,

requested no such quantitative data, and the 2023 ACS contains extensive disclosures of how the assumptions of the IEA NZE could impact our financial statements, as described in the ACS and in our 2022 Proxy Statement on p. 29-31. |

| 7 |

For example, from 2010 to 2022, annual Brent crude prices ranged from $112 a barrel to $42 a barrel. For the

same period, annual Henry Hub natural gas price ranged between $6.45/mmbtu and $2.03/mmbtu. Source: U.S. EIA Brent and Henry Hub Annual Spot Price; May 3, 2023 (nominal dollars). U.S. EIA Brent and Henry Hub Annual Spot Price; May 3, 2023

(nominal dollars). |

5

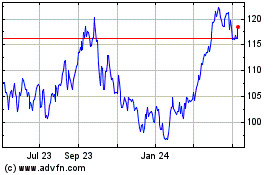

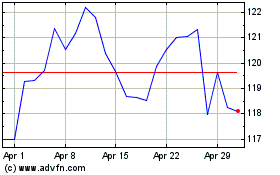

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2024 to May 2024

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From May 2023 to May 2024