Heineken N.V. reports on 2023 third-quarter trading

Amsterdam, 25 October 2023 – Heineken N.V. (HEIA;

HEINY) publishes its third quarter 2023 trading update.

- Revenue growth 2.0% for the quarter, 4.7% year to date

- Net revenue (beia)

organic growth 4.5% for the quarter, 5.8% year to date

- Net revenue (beia)

per hectolitre organic growth 9.7% for the quarter, 11.6% year to

date

- Beer volume organic

growth -4.2% for the quarter, -5.1% year to date

- Premium beer volume

organic growth -5.7% for the quarter, -6.1% year to date1

- Heineken® volume

growth 2.3% for the quarter, 1.9% year to date

- 2023 full year

expectations of stable to mid-single-digit operating profit (beia)

organic growth unchanged

Dolf van den Brink, Chairman of the Executive Board /

CEO, commented: "We continue to focus on our EverGreen

priorities and see gradual improvement in our business performance,

although somewhat slower than our ambition. In half of our markets,

volume trends are improving. Similarly in just over half of our

markets, we are gaining or holding market share.

We returned to volume growth in the Americas, with strong

performances in Brazil and Mexico. Asia Pacific improved

sequentially, despite ongoing challenges in Vietnam. The Africa,

Middle East & Eastern Europe region was impacted by volume

declines in Nigeria and South Africa. In Europe, following the

impact of adverse weather in July and August, trends improved in

September and we gained share in the majority of our markets in the

on-trade, with more to do to recover in the off-trade.

Heineken® grew 2.3%, with double-digit growth in 28 markets and

continued momentum of Heineken® 0.0 and Heineken® Silver. Our eB2B

platforms captured €8 billion in gross merchandise value by the end

of this quarter, 22% more than last year. Our productivity

programme remains fully on track.

Whilst inflation-led pricing is tapering, we observe a slowdown

of consumer demand in various markets facing challenging

macro-economic conditions. In this context, we will stay the course

on executing our strategy, remain vigilant on costs and focus on

rebalancing our growth. All in all, the operating profit (beia)

guidance range for 2023 remains unchanged."

Throughout this report figures refer to quarterly performance

unless otherwise indicated.

Revenue in the quarter was €9.6 billion (YTD:

€27.0 billion). Net revenue (beia) increased

organically by 4.5% (YTD: 5.8%). Total consolidated volume declined

by 4.8% (YTD: 5.2% decline) and net revenue (beia) per hectolitre

was up 9.7% (YTD: up 11.6%). Price mix on a constant geographic

basis was up 9.5% (YTD up 10.9%), driven by pricing to mitigate

inflationary pressures and premiumisation effects.

Currency translation impacted revenue by €397 million (YTD: €488

million), mainly from the devaluation of currencies in Africa and

partially offset by a stronger Mexican Peso. Consolidation effects

contributed €276 million (YTD: €507 million) mainly from the

integration of Distell and Namibian Breweries.

|

Revenue2 |

|

|

|

|

|

|

|

|

|

|

|

|

| (in €

million or %) |

|

3Q23 |

|

Total growth |

|

Organic growth |

|

YTD 3Q23 |

|

Total growth |

|

Organic growth |

|

Revenue (IFRS) |

|

9,604 |

|

2.0% |

|

|

|

27,040 |

|

4.7% |

|

|

| Net revenue (beia) |

|

8,015 |

|

|

|

4.5% |

|

22,529 |

|

|

|

5.8% |

Beer volume declined organically by 4.2% (YTD:

5.1% decline), given the challenging economic conditions in many of

our markets and lower consumer demand following inflation-led

pricing. Around half of our markets sequentially improved volume

into the third quarter and into September in the case of Europe. We

are gaining or holding volume market share in just over half of our

markets year to date.

|

Beer volume |

|

|

|

|

|

|

|

|

|

|

|

| (in mhl

or %) |

|

3Q23 |

|

Total growth |

|

Organic growth |

|

YTD 3Q23 |

|

Total growth |

Organic growth |

| Heineken N.V. |

|

63.2 |

|

-5.4% |

|

-4.2% |

|

183.3 |

|

-5.4% |

-5.1% |

|

Africa, Middle East & Eastern Europe |

|

8.3 |

|

-15.4% |

|

-10.1% |

|

26.9 |

|

-8.7% |

-7.7% |

|

Americas |

|

22.4 |

|

2.2% |

|

2.2% |

|

64.5 |

|

-0.2% |

-0.2% |

|

Asia Pacific |

|

10.7 |

|

-4.6% |

|

-4.6% |

|

32 |

|

-10.5% |

-10.5% |

|

Europe |

|

21.8 |

|

-8.6% |

|

-7.6% |

|

59.8 |

|

-6.1% |

-5.9% |

Driving premiumisation at scale, led by

Heineken®

Premium beer volume declined by 5.7% mainly

driven by Vietnam and our exit from Russia. Outside these markets,

premium beer volume was down 2.0% (YTD: up 0.4%). Our premium

portfolio outperformed the total portfolio in the majority of our

markets, showing that premiumisation trends continue.

Heineken® continued its

favourable momentum and grew volume 2.3% with double-digit growth

in 28 markets. Heineken®

0.0 grew 3.5%, driven by the Americas.

Heineken® Silver

grew close to forty percent, with continued strong growth in China,

Vietnam and the launch in the USA this year.

|

Heineken® volume |

|

|

|

|

|

|

|

|

| (in mhl

or %) |

|

3Q23 |

|

Organic growth |

|

YTD 3Q23 |

|

Organic growth |

| Heineken N.V. |

|

14.6 |

|

2.3% |

|

40.9 |

|

1.9% |

|

Africa, Middle East & Eastern Europe |

|

1.2 |

|

-16.2% |

|

3.9 |

|

-15.5% |

|

Americas |

|

5.9 |

|

6.3% |

|

16.9 |

|

6.3% |

|

Asia Pacific |

|

3.1 |

|

25.6% |

|

8.0 |

|

22.2% |

|

Europe |

|

4.3 |

|

-9.0% |

|

12.1 |

|

-7.4% |

Build a future-fit digital

route-to-consumer

We continued to focus on the expansion of our

business-to-business digital (eB2B) platforms. In

the first nine months of this year we captured €8 billion (€10.5

billion annualised) in gross merchandise value (GMV), an increase

of 22% versus last year. In Europe, we accelerated the digitisation

of our route-to-consumer, with the key markets of Italy, the

Netherlands, France and Spain doubling their GMV versus last year.

We continue to expand our customer base, achieving more than

600,000 active customers in fragmented, traditional channels, an

increase of 27% compared to last year.

Africa, Middle East & Eastern Europe

- Net revenue

(beia) grew 9.6% organically, with total consolidated

volume down 8.6% and net revenue (beia) per hectolitre up 19.5%.

Price mix on a constant geographic basis was up 17.9%, driven by

strong pricing across the region.

- Beer

volume decreased organically by 10.1% as double-digit

growth in Ethiopia, Tunisia and Algeria was more than offset by the

declines in Nigeria and South Africa. Premium beer volume,

excluding Russia, declined in line with total.

- In

Nigeria, net revenue (beia) grew organically by a

low-single-digit, driven by pricing to partially mitigate

significant inflation and currency devaluation. Total volume

declined in the twenties, behind the market. Consumers' purchasing

power continued to be under severe pressure due to inflation and

the impact of structural economic reforms, affecting our premium

portfolio disproportionately. In this challenging context, the

leading non-alcoholic malt proposition Maltina continued to

significantly outperform the market and broadly held volume.

- In South

Africa, revenue of Heineken Beverages declined by a

mid-single-digit.3 The decline was driven by the beer volume, down

in the twenties and below the category growth, given a challenging

competitive environment at the time of the integration of Distell.

The beyond beer portfolio grew revenue by a low-single-digit, with

a strong performance of Savanna, Bernini and 4th Street from our

cider, ready-to-drink and wine portfolios. We launched Heineken®

Silver with an encouraging early start.

- In

Ethiopia, net revenue (beia) grew organically

close to fifty percent, driven by pricing in a high inflation

environment and volume growth. Beer volume grew in the low-teens,

ahead of the market, led by Harar, Bedele and Walia.

- In the

Democratic Republic of Congo (DRC), net revenue

(beia) grew organically in the high-twenties, driven by total

volume growth in the mid-teens, ahead of the market, and pricing to

partially mitigate inflation.

- In

Egypt, net revenue (beia) grew organically in the

mid-twenties, driven by pricing and volume growth. Beer volume grew

by a mid-single-digit, in line with the market.

- On 25 August, HEINEKEN announced it

completed its exit from Russia.

Americas

- Net revenue

(beia) grew 5.5% organically, with total consolidated

volume up 2.1% and net revenue (beia) per hectolitre up 3.5%. Price

mix on a constant geographic basis was up by 5.2%, driven by

pricing across the region and continued premiumisation of our

portfolio.

- Beer

volume returned to growth in the quarter, up 2.2%

organically, led by growth in Brazil and Mexico. Our premium

portfolio grew by a mid-single-digit, led by Heineken®.

- In

Mexico, net revenue (beia) grew organically by a

mid-single-digit, driven by pricing and modest volume growth, in

line with the market, led by Tecate and Dos Equis. Our

non-alcoholic portfolio grew by more than fifty percent, driven by

the launch of Tecate 0.0 and the continued momentum of Heineken®

0.0. On 14 September, we announced our plan to invest in a

ground-breaking new brewery in Yucatán to propel growth, expand

sustainable brewing practices and foster community

development.

- In

Brazil, net revenue (beia) grew organically in the

low-teens, driven by volume growth, pricing and premiumisation.

Beer volume grew by a high-single digit, outperforming the market.

Our premium and mainstream portfolio continued its strong momentum,

led by Heineken® and Amstel, up in the mid-teens and in the forties

respectively.

- In the

USA, net revenue (beia) declined organically by a

high-single-digit, as pricing and mix management were more than

offset by a decline in volume shipments as distributors reduced

inventory levels. Depletions were down by a mid-single-digit. We

outperformed in a soft market, both in the quarter and year to

date, boosted by the launch of Heineken® Silver, which continues to

show encouraging early results in distribution build-up and rate of

sale. Heineken® 0.0, the #1 alcohol-free beer brand in the market

by value, grew by a mid-single-digit in depletions.

- Other markets in the region observed a

strong performance, particularly Panama and

Ecuador.

Asia Pacific

- Net revenue

(beia) declined 0.9% organically, with total consolidated

volume down 4.7% and net revenue (beia) per hectolitre up 3.4%.

Price mix on a constant geographic basis was up 4.0%, mainly driven

by pricing.

- Beer

volume continues to be affected by the economic slowdown

in the region and was down organically by 4.6%. Volume trends

improved relative to the first half of the year, as India was back

to growth and stock levels in Vietnam normalised. The premium

portfolio volume declined by a high-single-digit, driven by

Vietnam.

- In

Vietnam, the beer market continues to be impacted

by the economic slowdown, disproportionately affecting our regional

strongholds and the premium segment. As a result, our net

revenue (beia) declined organically in the low-teens with

a beer volume decline in the mid-teens, an improvement relative to

the first half, albeit behind the category mainly due to the market

decline of the premium segment. Our mainstream portfolio

outperformed, with Bia Viet, Bivina and Larue gaining share in the

segment. Heineken® grew volume in the high-teens, driven by the

continued success of Heineken® Silver, up in the forties.

- In

India, net revenue (beia) grew organically in the

mid-teens driven by high-single-digit beer volume growth and

mid-single-digit pricing. Our volume performance was slightly

behind the market, mainly driven by changes in our route-to-market.

The premium portfolio outperformed, led by Kingfisher Ultra.

- In

China, Heineken® grew in the high-forties, with

continued momentum of Heineken® Original and Heineken® Silver.

- In

Cambodia, net revenue (beia) declined organically

by a mid-single-digit, driven by similar decline in beer volume,

outperforming the market. Consumer confidence and purchasing power

continued to be affected by high inflation and slower economic

growth.

- In

Malaysia, beer volume declined close to twenty

percent driven by a weak consumer environment.

- In Indonesia, net

revenue (beia) was broadly stable on an organic basis. A

high-single-digit total volume decline, outperforming the market,

was offset by pricing and revenue management initiatives.

Europe

- Net revenue

(beia) grew 3.9% organically, with total consolidated

volume down 8.4%. Net revenue (beia) per hectolitre grew 13.3% with

price mix on a constant geographic basis up 12.1%, driven by

pricing in line with inflation.

- Beer

volume declined organically by 7.6%, significantly

impacted by adverse weather during the key summer months of July

and August, with trends improving into September. We outperformed

the category in the majority of our markets in the on-trade, with

more to do to recover in the off-trade. Our premium and

non-alcoholic beer and cider portfolios outperformed the wider

portfolio in the majority of markets.

- In the

UK, net revenue (beia) was stable on an organic

basis, as high-single-digit price mix was offset by the total

volume decline. The premium portfolio performed in line with the

broader portfolio. In April we launched Cruzcampo, our authentic

Spanish lager from Seville, now available in over 5,000 on-trade

outlets. In September we acquired a significant minority stake in

SERVED, the award-winning ready-to-drink brand, co-owned by Ellie

Goulding.

- In

France, net revenue (beia) grew by a

mid-single-digit, driven by pricing to mitigate inflationary

pressures and positive mix effects, partially offset by a

high-single-digit volume decline. Our next generation brand Gallia

grew close to sixty percent.

- In

Spain, net revenue (beia) grew organically by a

high-single-digit, driven by price mix in line with inflation and

stable beer volume. Our non-alcoholic portfolio grew in the

mid-teens, led by Amstel Radler 0.0. Our next generation brand El

Águila was up in the high-twenties.

- In

Italy, net revenue (beia) grew by a

low-single-digit, as pricing to cover the impact of inflation was

largely offset by a low-teens volume decline. Our premium portfolio

was also down in the low-teens.

- In

Poland, net revenue (beia) was stable, as pricing

was fully offset by a high-teens volume decline. Our premium

portfolio volume was broadly in line with the total.

- In the Netherlands,

net revenue (beia) declined by a mid-single-digit as inflation-led

pricing was more than offset by a high-teens beer volume decline.

Our premium portfolio outperformed the total, with growth in Birra

Moretti and Texels. On 29 September, HEINEKEN Nederland completed

the sale of soft-drink producer Vrumona.

The reported net profit for the first nine months of 2023 was

€1,924 million (2022: €2,199 million), including the effects from

exceptional items from our exit from Russia and the sale of Vrumona

among others. Following the sell-down by FEMSA of its shareholding

in the company earlier this year, HEINEKEN will align its

disclosure of financial information to the requirements of the

Transparency Directive of the EU and as of 2024 will only disclose

the reported net profit as part of its half-year and full-year

results.

|

|

|

Translational Currency Calculated Impact |

|

| |

|

|

|

Based on the impact to date, and applying spot rates of 23

October 2023 to the 2022 financial results as a baseline for the

remainder of the year, we calculate a negative currency

translational impact of approximately €790 million in net revenue

(beia), €110 million at operating profit (beia) and €30 million at

net profit (beia).

|

|

|

Reconciliation of non-GAAP measures |

|

|

Reconciliation net revenue (beia) |

|

|

|

|

|

|

|

|

| In

millions of € |

|

3Q23 |

|

3Q22 |

|

YTD 3Q23 |

|

YTD 3Q22 |

| Revenue

(IFRS) |

|

9,604 |

|

9,415 |

|

27,040 |

|

25,816 |

| Exceptional items |

|

-37 |

|

— |

|

-51 |

|

— |

| Excise

duties (beia) |

|

(1,552) |

|

(1,627) |

|

(4,461) |

|

(4,543) |

| Net revenue

(beia) |

|

8,015 |

|

7,788 |

|

22,529 |

|

21,273 |

| Media |

|

Investors |

| Joris

Evers |

|

José

Federico Castillo Martinez |

| Global

Communications Director |

|

Investor

Relations Director |

| Michael

Fuchs |

|

Mark

Matthews / Chris Steyn |

| Corporate &

Financial Communication Manager |

|

Investor Relations

Manager / Senior Analyst |

| E-mail:

pressoffice@heineken.com |

|

E-mail:

investors@heineken.com |

| Tel:

+31-20-5239355 |

|

Tel:

+31-20-5239590 |

HEINEKEN will host an analyst and investor conference call with

Harold van den Broek, Chief Financial Officer, in relation to its

Third Quarter 2023 Trading Update today at 14:00 CET/ 13:00 GMT.

The call will be audio cast live via the company’s website:

www.theheinekencompany.com. An audio replay service will also be

made available after the conference call at the above web address.

Analysts and investors can dial-in using the following telephone

numbers:

United Kingdom (Local): 020 3936 2999

Netherlands (Local): 085 888 7233

USA (Local): 646 664 1960

For the full list of dial in numbers, please refer to the

following link: Global Dial-In Numbers

Participation password for all countries: 499434

Editorial information:HEINEKEN is the world's most international

brewer. It is the leading developer and marketer of premium and

non-alcoholic beer and cider brands. Led by the Heineken® brand,

the Group has a portfolio of more than 300 international, regional,

local and specialty beers and ciders. With HEINEKEN’s over 90,000

employees, we brew the joy of true togetherness to inspire a better

world. Our dream is to shape the future of beer and beyond to win

the hearts of consumers. We are committed to innovation, long-term

brand investment, disciplined sales execution and focused cost

management. Through "Brew a Better World", sustainability is

embedded in the business. HEINEKEN has a well-balanced geographic

footprint with leadership positions in both developed and

developing markets. We operate breweries, malteries, cider plants

and other production facilities in more than 70 countries. Most

recent information is available on our Company's website and follow

us on LinkedIn, Twitter and Instagram.

Market Abuse RegulationThis press release may contain

price-sensitive information within the meaning of Article 7(1) of

the EU Market Abuse Regulation.

Disclaimer: This press release contains forward-looking

statements based on current expectations and assumptions with

regard to the financial position and results of HEINEKEN’s

activities, anticipated developments and other factors. All

statements other than statements of historical facts are, or may be

deemed to be, forward-looking statements. Forward-looking

statements also include, but are not limited to, statements and

information in HEINEKEN’s non-financial reporting, such as

HEINEKEN’s emissions reduction and other climate change related

matters (including actions, potential impacts and risks associated

therewith). These forward-looking statements are identified by

their use of terms and phrases such as “aim”, “ambition”,

“anticipate”, “believe”, “could”, “estimate”, “expect”, “goals”,

“intend”, “may”, “milestones”, “objectives”, “outlook”, “plan”,

“probably”, “project”, “risks”, “schedule”, “seek”, “should”,

“target”, “will” and similar terms and phrases. These

forward-looking statements, while based on management's current

expectations and assumptions, are not guarantees of future

performance since they are subject to numerous assumptions, known

and unknown risks and uncertainties, which may change over time,

that could cause actual results to differ materially from those

expressed or implied in the forward-looking statements. Many of

these risks and uncertainties relate to factors that are beyond

HEINEKEN’s ability to control or estimate precisely, such as but

not limited to future market and economic conditions, the behaviour

of other market participants, changes in consumer preferences, the

ability to successfully integrate acquired businesses and achieve

anticipated synergies, costs of raw materials and other goods and

services, interest-rate and exchange-rate fluctuations, changes in

tax rates, changes in law, environmental and physical risks, change

in pension costs, the actions of government regulators and weather

conditions. These and other risk factors are detailed in HEINEKEN’s

publicly filed annual reports. You are cautioned not to place undue

reliance on these forward-looking statements, which speak only of

the date of this press release. HEINEKEN assumes no duty to and

does not undertake any obligation to update these forward-looking

statements contained in this press release. Market share estimates

contained in this press release are based on outside sources, such

as specialised research institutes, in combination with management

estimates.

1 Excluding Russia -4.4% in the quarter and -4.3% year to date2

Refer to the Glossary for an explanation of organic growth and

other terms used throughout this report.3 Relative to the

historical baseline of the carved-out business of Distell and

HEINEKEN in South Africa, in local currency.

- To read the full press release, please click here to download

the PDF file.

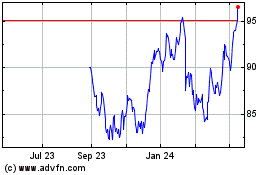

Heineken (TG:HNK1)

Historical Stock Chart

From Mar 2024 to Apr 2024

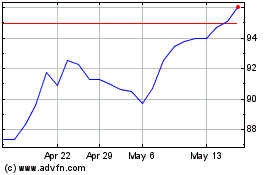

Heineken (TG:HNK1)

Historical Stock Chart

From Apr 2023 to Apr 2024