Linedata Powers Start-up Fund Administrator HBM With MFact, MShare and Linedata Reporting Suite

28 April 2009 - 1:35AM

Business Wire

Linedata Services (NYSE Euronext: LIN), announced today that it

has struck a deal to license MFact, MShare and Linedata Reporting

to HBM Fund Services (�HBM�), the newly launched fund

administration arm spun out of HBM Group. HBM Group is a leading

independent financial services provider with 18-years of

experience, headquartered in Cura�ao, Netherlands Antilles, and

also operating in the jurisdictions of Anguilla, Aruba, British

Virgin Islands, Cayman Islands, New York, Malta, Panama, St.

Maarten, The Netherlands and Uruguay.

HBM selected Linedata�s MFact, a fund administration platform,

MShare, a shareholder accounting solution, and Linedata Reporting,

which can provide customized reports online, so it could service

the entire spectrum of hedge funds in the market. HBM launched with

several hedge fund clients already in place, despite the difficult

operating environment faced by the whole industry, by capitalizing

on the reputation of its parent company, its impartiality, and its

comprehensive fund administration solutions powered by

Linedata.

�Although we�re a new entry in the market, we tap into a deep

wealth of experience from our corporate parent, and have senior

staff with more than 20 years of experience in the alternative

space,� said Robert Schaeffer, Managing Director, HBM Fund

Services. �This experience, combined with Linedata�s comprehensive,

state-of-the-art technology and web-based reporting capabilities,

gave us a compelling, differentiated service offering that has been

successful from day one.�

This deal marks the first time that Linedata Reporting has been

paired with Linedata Services� back-office suite. This gives HBM

the ability to offer web-based reporting, a significant investment

in technology and services by a �start-up� fund administrator.

�We�re a small fund administrator that made a big investment in

technology which provides full operational support to funds,

regardless of the size or strategy,� added HBM�s Schaeffer. �We can

provide our clients with comprehensive quarterly, monthly as well

as daily reporting if necessary. This allows fund managers to focus

on what they do best: generating returns, while demonstrating to

investors that fiduciary and statutory obligations are being

met.�

The deal also reflects how investor due-diligence and demands

for transparency and disclosure have worked their way across the

entire buy-side, from front-office (traders) to the back-office

(fund administrators). In the wake of recent industry scandals,

many hedge funds and fund-of-funds are retaining independent fund

administrators to help rebuild investor confidence and attract new

investment capital, emphasizing transparency and

responsiveness.

�Recent events have certainly elevated the independence of the

hedge fund administrator,� said Peter Muldoon, Executive Vice

President with Linedata Services North America. �Now more than

ever, administrators need software vendors that not only have the

solutions to meet their current requirements, but that are also

well-equipped to face their future challenges. Linedata Services

provides that complementary offering to HBM, and we are delighted

to have them as our client.�

Notes to Editors

About Linedata Services

Linedata Services (Bloomberg: LIN:FP) is the�global leader for

investment software, solutions, and support. Linedata combines

technological innovation, financial strength, and a deep

understanding of�the Asset Management, Leasing & Credit

Finance, and Insurance & Savings industries. Linedata Services�

asset management division provides comprehensive, scalable

solutions to the buy-side,�to manage the entire investment process

from pre-trade to post-settlement. Linedata is unique�in offering a

full front- to back-office solution via enterprise installation, or

as an Application Service Provider (�software as services� or

�service bureau� delivery), and has 20 years experience delivering

ASP solutions.

Headquartered in France, Linedata Services achieved revenues of

EUR 160.7 million in 2008, has offices worldwide and services more

than 700 clients across 50 countries. For more information, visit

Linedata Services corporate site at www.linedata.com.

About HBM Group

HBM Group, established in 1991, delivers comprehensive company

solutions in multiple jurisdictions globally. Our services

complement and support businesses operating cross-border; ranging

from investment back office solutions to asset protection needs to

in-and-out bound trading to e-commerce. HBM Group serves its

internationally focused clients with turn-key financial solutions

through its four brands; HBM Funds, HBM Trust, e-Management and New

Haven e-Zone.

We closely collaborate with professional intermediaries such as

specialized legal and tax advisors, lawyers, and auditors to create

tailor-made solutions for your business needs.

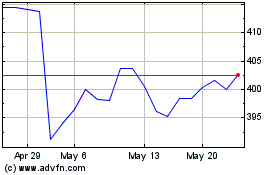

Linde (TG:LIN)

Historical Stock Chart

From Nov 2024 to Dec 2024

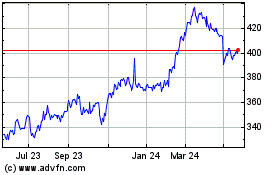

Linde (TG:LIN)

Historical Stock Chart

From Dec 2023 to Dec 2024