Athabasca Oil Corporation (TSX: ATH) (“Athabasca” or the “Company”)

reported its operating and consolidated financial results for the

three months ended June 30, 2020.

The second quarter was defined by unprecedented

moves in commodity prices due to the COVID-19 pandemic and

resulting oil demand destruction. Athabasca responded swiftly to

mitigate the impact of these unexpected events. The Company entered

2020 with a strong liquidity position allowing it to withstand the

economic impact on its low decline, long reserve life assets.

Resiliency Measures Taken in Response to

COVID-19

- Reduction to Capital: 2020 budget of $85

million reflecting a $40 million reduction.

- Production Curtailments: Temporary

curtailments; assets returning to productive capacity in Q3.

- Contingent Bitumen Royalty: $70 million for an

upsized Royalty at a very attractive cost of capital.

- Reduced Future Financial Commitments:

Reassigned 15,000 bbl/d of Keystone XL transportation.

- Risk Management: ~$45 million in realized

hedging gains in H1 2020.

Operations Highlights

- Q2 Production: ~27,100 boe/d including ~17,600

bbl/d from Thermal Oil & ~9,500 boe/d from Light Oil. Volumes

were temporarily curtailed in response to unprecedented

pricing.

- Leismer: Production temporarily curtailed to

~15,000 bbl/d and now restored with July averaging ~18,500 bbl/d.

The asset has an estimated operating breakeven of US$23/bbl WCS

(using a $12.50 WCS differential). Non-condensable gas co-injection

across mature pads is proving successful with a field SOR of 3.4x

in July.

- Hangingstone: The asset was shut-in on April

2. A planned facility turnaround has now been completed. With

recent improvements in pricing, the asset will be brought back on

production in September 2020. Corporate hedges have been

implemented to protect downside volatility.

- Placid Montney: 10 new well start-ups were

deferred until early July and are now all on stream.

- Kaybob Duvernay: Well results continue to

screen as top liquids wells in the Basin with Kaybob East IP90s

averaging 840 boe/d (85% liquids). 16 wells have been brought on

stream in 2020.

Balance Sheet and Financial

Highlights

- Balance Sheet: $170 million in liquidity, of

which $167 million is unrestricted cash.

- Capital: $5.8 million during Q2; minimal

activity for the balance of 2020 (~$25 million in H2 2020).

- Financial Results: Q2 Operating Income of $6.2

million with financial results impacted by realized price declines

related to the onset of the COVID-19 pandemic.

- RBL renewal: The credit facility was

renewed at $41 million which reflects the outstanding letters of

credit for long term transportation contracts and is secured by the

Company’s cash balances.

Business Environment and the Impact of

COVID-19

In March 2020, the COVID-19 outbreak was

declared a pandemic by the World Health Organization. Global

commodity prices declined significantly as countries around the

world enacted emergency measures to combat the spread of the virus.

The decrease in oil demand has been unprecedented with an estimated

peak demand impact of 20 MMbbl/d in April 2020 (Goldman Sachs

Global Investment Research). Since April, global demand has

improved while OPEC and North American producers have cut

production. Global inventories have begun to moderate with

economies reopening and leading to a partial recovery and

stabilization in oil prices.

In Alberta, physical markets and regional

benchmark prices (e.g. Western Canadian Select “WCS” heavy oil)

have materially strengthened with WTI prices and tighter

differentials as a result of curtailed volumes. Athabasca expects

WCS differentials to widen from current spot levels (US$7.79/bbl

August WCS index differentials) through the fall as more industry

volumes are placed back on production.

The global heavy oil market continues to see

structural supply declines in Venezuela and Mexico, extended OPEC

production cuts and growing petrochemical demand. These shifting

dynamics are expected to support heavy oil pricing benchmarks with

US refineries in PADD II and III requiring a heavier

feedstock. Athabasca is well positioned for this changing

dynamic with its Thermal Oil assets.

Corporate Update and Response to

COVID-19

Safety is a key priority for Athabasca. The

Company has implemented business procedures that comply with

Alberta Health Guidelines. Athabasca has successfully transitioned

its office staff back to the office and the field sites continue to

take site specific pre-cautionary measures related to COVID-19. The

Company has not experienced any COVID-19 cases in the Calgary

office or at its field sites.

The Company has taken swift action in response

to the pandemic and economic crisis. Major initiatives to date

include a reduction to the 2020 capital program, significant

production curtailments, partnering with service companies to

reduce operating costs and reducing future financial commitments on

the Keystone XL pipeline. Finally, the Company bolstered its

liquidity by $70 million through an upsized Contingent Bitumen

Royalty.

The Company is well positioned to navigate the

current challenging environment with $170 million in liquidity, of

which $167 million is unrestricted cash. The Company’s RBL credit

facility was renewed at $41 million which reflects the current

outstanding letters of credit for long term transportation

commitments and is secured by the Company’s cash balances.

Athabasca is currently pursuing additional financial support under

the previously announced EDC RBL support program. Athabasca is

disappointed in the lack of urgency by the Federal Government to

administer the program in an effective manner.

Athabasca remains focused on maximizing

corporate funds flow and maintaining strong corporate liquidity.

Athabasca maintains long-term optionality across a deep inventory

of high-quality Thermal Oil projects and flexible Light Oil

development opportunities. This balanced portfolio provides

shareholders with differentiated exposure to liquids weighted

production and significant long reserve life assets. The low

decline nature of the Company’s assets allows for minimal capital

investment while maintaining its production base for a crude oil

demand recovery.

Financial and Operational Highlights

|

|

Three months

endedJune 30, |

|

Six months

endedJune 30, |

|

|

($ Thousands, unless otherwise noted) |

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

|

CONSOLIDATED |

|

|

|

|

|

|

|

|

|

|

|

|

|

Petroleum and natural gas production (boe/d) |

|

27,067 |

|

|

|

33,958 |

|

|

|

31,812 |

|

|

|

36,568 |

|

|

|

Operating Income (Loss)(1)(2) |

$ |

6,166 |

|

|

$ |

67,122 |

|

|

$ |

7,264 |

|

|

$ |

125,724 |

|

|

|

Operating Netback(1)(2) ($/boe) |

$ |

2.37 |

|

|

$ |

22.19 |

|

|

$ |

1.21 |

|

|

$ |

19.29 |

|

|

|

Capital expenditures |

$ |

5,811 |

|

|

$ |

33,717 |

|

|

$ |

82,057 |

|

|

$ |

86,681 |

|

|

|

Capital Expenditures Net of Capital-Carry(1) |

$ |

5,811 |

|

|

$ |

26,888 |

|

|

$ |

59,317 |

|

|

$ |

58,644 |

|

|

|

LIGHT OIL DIVISION |

|

|

|

|

|

|

|

|

|

|

|

|

|

Petroleum and natural gas production (boe/d) |

|

9,466 |

|

|

|

10,210 |

|

|

|

8,854 |

|

|

|

10,957 |

|

|

|

Percentage liquids (%) |

62 |

% |

|

51 |

% |

|

61 |

% |

|

52 |

% |

|

|

Operating Income (Loss)(1) |

$ |

6,350 |

|

|

$ |

25,637 |

|

|

$ |

19,133 |

|

|

$ |

56,917 |

|

|

|

Operating Netback(1) ($/boe) |

$ |

7.37 |

|

|

$ |

27.59 |

|

|

$ |

11.88 |

|

|

$ |

28.70 |

|

|

|

Capital expenditures |

$ |

1,089 |

|

|

$ |

11,858 |

|

|

$ |

59,617 |

|

|

$ |

41,713 |

|

|

|

Capital Expenditures Net of Capital-Carry(1) |

$ |

1,089 |

|

|

$ |

5,029 |

|

|

$ |

36,877 |

|

|

$ |

13,676 |

|

|

|

THERMAL OIL DIVISION |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bitumen production (bbl/d) |

|

17,601 |

|

|

|

23,748 |

|

|

|

22,958 |

|

|

|

25,611 |

|

|

|

Operating Income (Loss)(1) |

$ |

(24,619 |

) |

|

$ |

56,522 |

|

|

$ |

(57,730 |

) |

|

$ |

101,650 |

|

|

|

Operating Netback(1) ($/bbl) |

$ |

(14.21 |

) |

|

$ |

26.97 |

|

|

$ |

(13.17 |

) |

|

$ |

22.42 |

|

|

|

Capital expenditures |

$ |

4,722 |

|

|

$ |

21,859 |

|

|

$ |

22,418 |

|

|

$ |

44,968 |

|

|

|

CASH FLOW AND FUNDS FLOW |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow from operating activities |

$ |

(31,186 |

) |

|

$ |

61,488 |

|

|

$ |

(34,207 |

) |

|

$ |

42,916 |

|

|

|

per share - basic |

$ |

(0.06 |

) |

|

$ |

0.12 |

|

|

$ |

(0.06 |

) |

|

$ |

0.08 |

|

|

|

Adjusted Funds Flow(1) |

$ |

(16,214 |

) |

|

$ |

47,757 |

|

|

$ |

(44,097 |

) |

|

$ |

89,376 |

|

|

|

per share - basic |

$ |

(0.03 |

) |

|

$ |

0.09 |

|

|

$ |

(0.08 |

) |

|

$ |

0.17 |

|

|

|

NET INCOME (LOSS) & COMPREHENSIVE INCOME (LOSS) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) & comprehensive income (loss) |

$ |

(65,335 |

) |

|

$ |

57,091 |

|

|

$ |

(581,816 |

) |

|

$ |

263,887 |

|

|

|

per share - basic |

$ |

(0.12 |

) |

|

$ |

0.11 |

|

|

$ |

(1.10 |

) |

|

$ |

0.51 |

|

|

|

per share - diluted |

$ |

(0.12 |

) |

|

$ |

0.11 |

|

|

$ |

(1.10 |

) |

|

$ |

0.50 |

|

|

|

COMMON SHARES OUTSTANDING |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

530,363,434 |

|

|

|

522,459,443 |

|

|

|

526,979,706 |

|

|

|

519,253,275 |

|

|

|

Weighted average shares outstanding - diluted |

|

530,363,434 |

|

|

|

527,661,455 |

|

|

|

526,979,706 |

|

|

|

525,417,016 |

|

|

| |

|

|

June 30, |

|

December 31, |

|

|

As at ($ Thousands) |

|

|

2020 |

|

2019 |

|

|

LIQUIDITY AND BALANCE SHEET |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

$ |

167,442 |

|

$ |

254,389 |

|

|

Restricted cash (current and long-term) |

|

|

$ |

152,125 |

|

$ |

110,609 |

|

|

Available credit facilities(3) |

|

|

$ |

2,560 |

|

$ |

85,815 |

|

|

Capital-carry receivable (undiscounted) |

|

$ |

— |

|

$ |

22,740 |

|

|

Face value of long-term debt(4) |

|

|

$ |

613,260 |

|

$ |

583,425 |

|

(1) Refer to the Advisories in this News Release

and the “Advisories and Other Guidance” section within the

Company’s Q2 2020 MD&A for additional information on Non-GAAP

Financial Measures. (2) Includes realized commodity risk management

gains of $24.4 million and $45.9 million for the three and six

months ended June 30, 2020, respectively (three and six months

ended June 30, 2019 - $15.0 million loss and $32.8 million

loss).(3) Includes available credit under Athabasca's Credit

Facility and Unsecured Letter of Credit Facility.(4) The face value

of the 2022 Notes is US$450 million. The 2022 Notes were translated

into Canadian dollars at the June 30, 2020 exchange rate of US$1.00

= C$1.3628.

Operations Update

Thermal Oil

In Q2 2020, production averaged 17,600 bbl/d.

The Company took proactive steps to temporarily curtail Leismer

volumes and fully suspend Hangingstone operations in response to

unprecedented commodity prices. Activity in the field was minimal

during the quarter with $4.7 million of capital expenditures. The

Company has halted all major capital projects for the H2 2020 with

budgeted activity only including routine pump-changes on wells.

At Leismer, volumes were curtailed down to

15,000 bbl/d in late April. As the commodity outlook improved the

Company commenced ramping up volumes through the balance of the

quarter. July production is expected to average ~18,500 bbl/d.

Leismer operations are now benefiting from the water disposal

project which was completed in Q1 2020. The project is estimated to

reduce non-energy operating costs by approximately $10 million on

an annual basis. In addition, Leismer’s steam oil ratio (“SOR”) is

currently 3.4x supported by the ramp-up of sustaining Pad L7 and

NCG co-injection on the mature pads. These activities have reduced

field wide steam demand by 15% relative to the prior year and is

supporting lower energy operating costs and emissions.

At Hangingstone, operations were suspended in

April 2020. Through the summer planned turnaround activities were

completed. With the improved commodity price outlook, the Company

is planning to restart field operations in September. To protect

against future commodity price volatility the Company has hedged

the production profile through next winter and intends to secure

additional risk management activities for the balance of 2021. The

Company has utilized a collar hedge structure with a minimum WCS

floor price of ~US$25/bbl with upside potential to ~US$31/bbl WCS

(Q4 2020 – Q1 2021).

Light Oil

In Q2 2020, production averaged 9,466 boe/d (62%

liquids). In response to unprecedented commodity prices, the

Company elected to defer the start-up of its new Montney

development wells. Capital expenditures were $1.1 million during

the quarter as the Company completed its winter Montney and

Duvernay program. No additional Light Oil activity is planned for

the balance of the year.

At Greater Placid, production from the 10

Montney development wells from the winter program were deferred to

July and all wells are now on-stream. Placid is positioned for

flexible future development with an inventory of approximately 200

locations and no near-term land retention requirements.

In the Greater Kaybob Duvernay 16 wells have

been brought on-stream year-to-date. In the volatile oil window,

production results have been consistently strong. Recent multi-well

pads at Kaybob East have had IP30s averaging ~1,000 boe/d per well

(88% liquids) and IP90s ~840 boe/d (85% liquids). Drilling and

completion costs have been reduced to ~C$7.5 million (2-well pads)

with line of sight to further improvements with multi-well pad

development. These results compare favorably to the East Shale

Basin Duvernay due to low capital costs and higher sustained

liquids rates. Greater Kaybob is positioned for flexible future

development with an inventory of approximately 700 locations,

established infrastructure and no near-term land retention

requirements.

Outlook

Athabasca reiterates its $85 million 2020

capital budget, a $40 million reduction from the original budget,

with minimal activity planned for the balance of the year (H2 2020

~$25 million). The Company forecasts Q4 2020 production between

32,000 – 34,000 boe/d (~88% liquids) reflecting a ramp-up in

volumes following curtailments and the Hangingstone suspension.

Athabasca is well positioned to navigate the current challenging

environment with $170 million in liquidity, of which $167 million

is unrestricted cash.

About Athabasca Oil Corporation

Athabasca Oil Corporation is a Canadian energy

company with a focused strategy on the development of thermal and

light oil assets. Situated in Alberta’s Western Canadian

Sedimentary Basin, the Company has amassed a significant land base

of extensive, high quality resources. Athabasca’s common shares

trade on the TSX under the symbol “ATH”. For more information,

visit www.atha.com.

For more information, please contact:Matthew Taylor

Chief Financial Officer

1-403-817-9104

mtaylor@atha.com

Reader Advisory:

This News Release contains forward-looking

information that involves various risks, uncertainties and other

factors. All information other than statements of historical fact

is forward-looking information. The use of any of the words

“anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”,

“will”, “project”, “believe”, “view”, ”contemplate”,

“target”, “potential” and similar expressions are intended to

identify forward-looking information. The forward-looking

information is not historical fact, but rather is based on the

Company’s current plans, objectives, goals, strategies, estimates,

assumptions and projections about the Company’s industry, business

and future operating and financial results. This information

involves known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking information. No assurance

can be given that these expectations will prove to be correct and

such forward-looking information included in this News Release

should not be unduly relied upon. This information speaks only as

of the date of this News Release. In particular, this News Release

contains forward-looking information pertaining to, but not limited

to, the following: our strategic plans and growth strategies;

restoring production following curtailments and the Hangingstone

suspension; the Company’s 2020 capital budget; expectations on

global oil fundamentals; and other matters.

With respect to forward-looking information

contained in this News Release, assumptions have been made

regarding, among other things: commodity outlook; the regulatory

framework in the jurisdictions in which the Company conducts

business; the Company’s financial and operational flexibility; the

Company’s capital expenditure outlook, financial sustainability and

ability to access sources of funding; geological and engineering

estimates in respect of Athabasca’s reserves and resources; and

other matters.

Actual results could differ materially from

those anticipated in this forward-looking information as a result

of the risk factors set forth in the Company’s Annual Information

Form (“AIF”) dated March 4, 2020 available on SEDAR at

www.sedar.com, including, but not limited to: fluctuations in

commodity prices, foreign exchange and interest rates; political

and general economic, market and business conditions in Alberta,

Canada, the United States and globally; changes to royalty regimes,

environmental risks and hazards; the potential for management

estimates and assumptions to be inaccurate; the dependence on

Murphy as the operator of the Company’s Duvernay assets; the

capital requirements of Athabasca’s projects and the ability to

obtain financing; operational and business interruption risks,

including those that may be related to the COVID-19 pandemic;

failure by counterparties to make payments or perform their

operational or other obligations to Athabasca in compliance with

the terms of contractual arrangements; aboriginal claims; failure

to obtain regulatory approvals or maintain compliance with

regulatory requirements; uncertainties inherent in estimating

quantities of reserves and resources; litigation risk;

environmental risks and hazards; reliance on third party

infrastructure; hedging risks; insurance risks; claims made in

respect of Athabasca’s operations, properties or assets; risks

related to Athabasca’s amended credit facilities and senior secured

notes; and risks related to Athabasca’s common shares.

The risks and uncertainties referred to above

are described in more detail in Athabasca’s most recent AIF, which

is available on the Company’s SEDAR profile at www.sedar.com.

Readers are cautioned that the foregoing list of risk factors

should not be construed as exhaustive. The forward-looking

information included in this News Release is expressly qualified by

this cautionary statement and is made as of the date of this News

Release. The Company does not undertake any obligation to publicly

update or revise any forward-looking information except as required

by applicable securities laws.

Oil and Gas Information“BOEs"

may be misleading, particularly if used in isolation. A BOE

conversion ratio of six thousand cubic feet of natural gas to one

barrel of oil equivalent (6 Mcf: 1 bbl) is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the wellhead. As

the value ratio between natural gas and crude oil based on the

current prices of natural gas and crude oil is significantly

different from the energy equivalency of 6:1, utilizing a

conversion on a 6:1 basis may be misleading as an indication of

value.

Operating break‐even reflects the estimated WCS

oil price per barrel required to generate an asset level operating

income of Cdn $0. Break‐even is used to assess the impact of

changes in WCS oil prices on operating income of an asset and could

impact future investment decisions. Break‐even does not have any

standardized meaning and therefore should not be used to make

comparisons to similar measures presented by other issuers.The

initial production rates provided in this News Release should be

considered to be preliminary. Initial production rates disclosed

herein may not necessarily be indicative of long-term performance

or of ultimate recovery.

Non-GAAP Financial MeasuresThe

"Adjusted Funds Flow”, "Light Oil Operating Income", “Light Oil

Operating Netback”, “Light Oil Capital Expenditures Net of

Capital‐Carry”, "Thermal Oil Operating Income (Loss)", "Thermal Oil

Operating Netback", “Consolidated Operating Income”, “Consolidated

Operating Netback”, and “Consolidated Capital Expenditures Net of

Capital‐Carry” financial measures contained in this News Release do

not have standardized meanings which are prescribed by IFRS and

they are considered to be non‐GAAP measures. These measures may not

be comparable to similar measures presented by other issuers and

should not be considered in isolation with measures that are

prepared in accordance with IFRS.

Adjusted Funds Flow is not intended to represent

cash flow from operating activities, net earnings or other measures

of financial performance calculated in accordance with IFRS.

Adjusted Funds Flow is calculated by adding certain non-cash

changes to working capital and settlement of provisions to cash

flow from operating activities. The Adjusted Funds Flow measure

allows management and others to evaluate the Company’s ability to

fund its capital programs and meet its ongoing financial

obligations using cash flow internally generated from ongoing

operating related activities. Adjusted Funds Flow per share is

calculated as Adjusted Funds Flow divided by the applicable number

of weighted average shares outstanding.

The Light Oil Operating Income measure in this

News Release is calculated by subtracting royalties, operating

expenses and transportation & marketing expenses from petroleum

and natural gas sales. The Light Oil Operating Netback measure is

calculated by dividing the Light Oil Operating Income (Loss) by the

Light Oil production and is presented on a per boe basis. The Light

Oil Operating Income and the Light Oil Operating Netback measures

allow management and others to evaluate the production results from

the Company’s Light Oil assets.

The Thermal Oil Operating Income (Loss) measure

in this News Release with respect to the Leismer Project and

Hangingstone Project is calculated by subtracting the cost of

diluent blending, royalties, operating expenses and transportation

& marketing expenses from blended bitumen sales and adjusting

for the impacts of inventory write-downs. The Thermal Oil Operating

Netback measure is calculated by dividing the respective projects

Operating Income (Loss) by its respective bitumen sales volumes and

is presented on a per barrel basis. The Thermal Oil Operating

Income (Loss) and the Thermal Oil Operating Netback measures allow

management and others to evaluate the production results from the

Company’s Thermal Oil assets.

The Consolidated Operating Income measure in

this News Release is calculated by adding or subtracting realized

gains (losses) on commodity risk management contracts, royalties,

the cost of diluent blending, operating expenses and transportation

& marketing expenses from petroleum and natural gas sales and

adjusting for the impacts of inventory write-downs. The

Consolidated Operating Netback measure is calculated by dividing

Consolidated Operating Income (Loss) by the total sales volumes and

is presented on a per boe basis. The Consolidated Operating Income

and the Consolidated Operating Netback measures allow management

and others to evaluate the production results from the Company’s

Light Oil and Thermal Oil assets combined together including the

impact of realized commodity risk management gains or losses.

The Consolidated Capital Expenditures Net of

Capital-Carry and Light Oil Capital Expenditures Net of

Capital-Carry measures in this News Release are outlined in the

Company’s Q2 2020 MD&A. These measures allow management and

others to evaluate the true net cash outflow related to Athabasca's

capital expenditures.

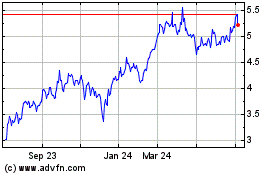

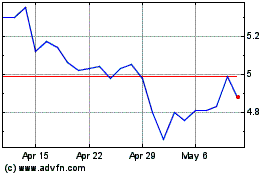

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Oct 2024 to Nov 2024

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Nov 2023 to Nov 2024