Centamin PLC Announces Results for the Quarter Ended 31 March 2014

PERTH, AUSTRALIA--(Marketwired - May 15, 2014) - Centamin PLC

(LSE: CEY) (TSX: CEE)

Centamin plc Results for the Quarter Ended 31 March 2014

Centamin plc ("Centamin" or "the Company") (LSE: CEY; TSX: CEE)

is pleased to announce its results for the three months ended 31

March 2014.

These are not the full results - to access the full document

please CLICK HERE

http://www.rns-pdf.londonstockexchange.com/rns/1631H_1-2014-5-15.pdf

HIGHLIGHTS (1) (2) (3) (4)

Production

* Gold production 74,241 ounces, 19% lower quarter-on-quarter

and 15% lower on the prior year period.

* Production guidance for 2014 remains unchanged at 420,000

ounces at a cash cost of production of US$700 per ounce.

* Cash cost of production of US$744 per ounce.

* Commissioning of the Stage 4 plant expansion to 10 million

tonnes per annum (Mtpa) continues with first ore fed through the

new circuit.

Financials

* Basic earnings per share 1.87 cents, down 33% on Q4 2013 and

down 72% on the prior year period and EBITDA US$34.3 million; 25%

on Q4 2013 and 58% on the prior year period.

* Centamin remains debt-free and un-hedged with cash, bullion on

hand, gold sales receivables and available-for-sale financial

assets of US$137.8 million as at 31 March 2014.

Exploration

* Exploration drilling commenced in Burkina Faso and Cote

D'Ivoire following the takeover of ASX-listed Ampella Mining

Ltd.

* Exploration results at Sukari and in Ethiopia continue to

justify further drilling.

Legal developments in Egypt

* The Supreme Administrative Court appeal and Diesel Fuel Court

Case are both ongoing. Operations continue as normal and any

enforcement of the Administrative Court decision has been suspended

pending the appeal ruling.

* New investment law (32 of 2014) came into force in April 2014

restricting the capacity for third parties to challenge any

contractual agreement between the Egyptian government and an

investor. Centamin understands, based on legal advice, that it is

likely to benefit from this new law.

|

|

|

Q1 2014 |

|

Q4 2013(1) |

|

Q1 2013(1) |

| Total

Gold Production (oz) |

|

74,241 |

|

91,546 |

|

87,016 |

| Cash

Costs of Production(2) (US$/oz) |

|

744(3) |

|

711(3) |

|

556(4) |

|

Average Sales Price (US$/oz) |

|

1,298 |

|

1,249 |

|

1,604 |

|

Revenue (US$million) |

|

102.7 |

|

111.2 |

|

138.2 |

|

EBITDA(2) (US$million) |

|

34.3(3) |

|

45.7(3) |

|

81.7 |

| Basic

EPS (cents) |

|

1.87(3) |

|

2.813) |

|

6.60 |

(1) Results and highlights for the first quarter ended 31 March

2013 and fourth quarter ended 31 December 2013 (included within the

2013 Annual Report) are available at www.centamin.com

(2) Cash cost of Production, EBITDA and cash, bullion on hand,

gold sales receivables and available-for-sale financial assets are

non-GAAP measures defined on pages 21 - 23

(3) Basic EPS, EBITDA, Cash Costs of Production now includes an

exceptional provision against prepayments recorded in Q4 2012, Q1

2013, Q2 2013, Q3 2013, Q4 2013 and Q1 2014 to reflect the removal

of fuel subsidies which occurred in January 2012 (see Note 4 of the

Interim Condensed Consolidated Financial Statements for further

details)

(4) At full international fuel price (excluding fuel subsidy),

for comparative purposes to reflect the fuel price differential had

the prepayments been expensed during the period

Josef El-Raghy, Chairman of Centamin, said: "Consistently high

levels of productivity have again been achieved with the process

plant at Sukari, with minimal impact from the Stage 4 commissioning

activities. Although underground performance has impacted Q1 we are

pleased to confirm commissioning of Stage 4 is proceeding as

planned, with Sukari achieving a major milestone towards the end of

Q1 as first ore was fed through the new circuit. We expect plant

throughput, and hence quarterly production rates, to increase

through the rest of the year as commissioning continues. Our

forecast 2014 production and the continued ramp up towards Sukari's

long-term target of 450,000-500,000 ounces per annum remain on

track."

Centamin will host a conference call on Thursday, 15 May at

8.30am (London, UK time) to update investors and analysts on its

results. Participants may join the call by dialling one of the

following three numbers, approximately 10 minutes before the start

of the call.

From UK: (toll free) 0800 694 5707 From Canada: (toll free)

+1866 607 2172 From rest of world: +44 1452 541 003 Participant

pass code: 44582137

A recording of the call will be available four hours after the

completion of the call on:

Std International: +44 (0)1452 550 000 Participant pass code:

44582137

| For more information please contact: |

| |

|

Centamin plc |

|

|

| Josef

El-Raghy, Chairman |

|

|

| Andy

Davidson, Head of Business |

|

|

|

Development and Investor Relations |

|

+44 1534 828 708 |

|

|

|

|

|

Buchanan |

|

|

| Bobby

Morse |

|

+44 20 7466 5000 |

|

Gordon Poole |

|

|

|

Gabriella Clinkard |

|

|

About Centamin plc

Centamin is a mineral exploration, development and mining

company dual listed on the London and Toronto Stock Exchanges.

Centamin's principal asset, the Sukari Gold Mine, began

production in 2009 and is the first large scale modern gold mine in

Egypt, with an estimated 20 year mine life and ramping up

production towards a 450,000-500,000 ounce per annum target from

2015 onwards. Our development and operating experience gives us a

significant advantage in acquiring and developing other gold

projects.

In 2013 Centamin agreed a recommended all-share takeover offer

for ASX-listed Ampella Mining Ltd and also formed a joint venture

with AIM-listed Alecto Minerals plc, adding highly prospective

licence packages in Burkina Faso and Ethiopia respectively.

Centamin completed its acquisition of Ampella in early 2014.

This information is provided by RNS

The company news service from the London Stock Exchange

Contact: RNS Customer Services 0044-207797-4400

rns@londonstockexchange.com http://www.rns.com

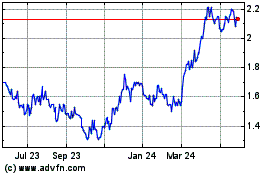

Centamin (TSX:CEE)

Historical Stock Chart

From Feb 2025 to Mar 2025

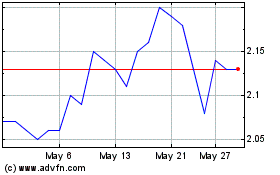

Centamin (TSX:CEE)

Historical Stock Chart

From Mar 2024 to Mar 2025