Goodfood Market Corp. (“Goodfood” or “the

Company”) (TSX: FOOD), a leading Canadian online grocery company,

delivering fresh meal solutions and grocery items, today announced

financial results for the third quarter of Fiscal 2022, ended June

4, 2022.

“In our third quarter, we have demonstrated

continued progress across our three key value-creating drivers.

First, our focus to improve profitability is yielding substantial

results as our gross margin surpassed 26% for the first time in a

year, on its way to returning to our 30% historical average. This

improvement, despite extraordinary inflationary pressures across

all our input costs, along with strong cost discipline in our

SG&A cost structure, have improved our Adjusted EBITDA (1) by

$3 million this quarter compared to the second quarter, reaching an

Adjusted EBITDA (1) loss of $10.6m, a significant improvement from

our first post-COVID Adjusted EBITDA (1) loss of $17.7m in the

fourth quarter of Fiscal 2021,” said Jonathan Ferrari, Chief

Executive Officer of Goodfood.

“We also showed important growth in our other

two key value-creating drivers, with on-demand active customers (1)

reaching 38,000 and our micro-fulfilment centre footprint standing

at 9 facilities in operation. As we outlined in our second quarter

disclosure, our path to profitability is expected to be driven by a

return to back-to-school volumes in our weekly subscription

offering and by reaching a certain level of scale in on-demand

active customers (1) and micro-fulfilment centres. The progress

made this quarter on our on-demand strategy positions us very well

on our path to profitability. In addition to scale, additional

efficiencies in costs of goods sold and selling, general and

administrative expenses are expected to provide the required

leverage to achieve positive Adjusted EBITDA (1). Last quarter, we

launched Project Blue Ocean, a series of identified initiatives

which we have begun to put in place that are designed to yield cost

efficiencies to return the company to a positive Adjusted EBITDA

(1) position in the first half of Fiscal 2023,” added Mr.

Ferrari

“As of today, through pricing, operational

simplification and SG&A reductions, Project Blue Ocean, which

we launched during the third quarter, has contributed to gross

margin and SG&A improvements and we expect further savings

opportunities in the near-term. With the objective of simplifying

our operations, we are undertaking a review of our asset base,

seeking opportunities to optimize our facilities infrastructure

beginning with the consolidation in late June of our breakfast

facility in Montreal into our main production facility. In

addition, in recent months, we have begun to significantly simplify

our operations through key actions such as ingredient reduction in

our ready-to-eat meals and curtailing grocery availability in

weekly subscription to streamline our processes. Finally, earlier

this month, we passed through a high single-digit percentage price

increase, placing us at or slightly below our largest competitor’s

pricing.”

“As we continue to execute on our three key

value-creating drivers and Project Blue Ocean, we are building an

optimized cost structure that, combined with a return to growth,

will provide the Company with the financial flexibility required to

return to positive Adjusted EBITDA (1) and continue to execute on

our on-demand strategy,” concluded Mr. Ferrari.

FINANCIAL HIGHLIGHTS

RESULTS OF OPERATIONS – THIRD QUARTER OF FISCAL 2022 AND

2021

The following table sets forth the components of

the Company’s consolidated statement of loss and comprehensive

loss:

(In thousands of Canadian dollars, except per

share and percentage information)

|

For the 13-weeks periods ended |

June 4,2022 |

|

May 31,2021 |

|

($) |

|

(%) |

|

|

Net sales |

$ |

67,031 |

|

$ |

107,795 |

|

$ |

(40,764 |

) |

(38 |

)% |

| Cost of

goods sold |

|

49,475 |

|

|

70,063 |

|

|

(20,588 |

) |

(29 |

)% |

|

Gross profit |

$ |

17,556 |

|

$ |

37,732 |

|

$ |

(20,176 |

) |

(53 |

)% |

| Gross margin |

|

26.2 |

% |

|

35.0 |

% |

|

N/A |

|

(8.8)p.p. |

|

| Selling, general and

administrative expenses |

|

29,369 |

|

|

37,255 |

|

|

(7,886 |

) |

(21 |

)% |

| Reorganization and other

related costs |

|

2,477 |

|

|

- |

|

|

2,477 |

|

N/A |

|

| Depreciation and

amortization |

|

5,220 |

|

|

2,318 |

|

|

2,902 |

|

125 |

% |

| Net

finance costs |

|

1,596 |

|

|

431 |

|

|

1,165 |

|

270 |

% |

|

Net loss before income taxes |

$ |

(21,106 |

) |

$ |

(2,272 |

) |

$ |

(18,834 |

) |

N/A |

|

| Deferred income tax (recovery)

expense |

|

(2 |

) |

|

61 |

|

|

(63 |

) |

N/A |

|

|

Net loss, being comprehensive loss |

$ |

(21,104 |

) |

$ |

(2,333 |

) |

$ |

(18,771 |

) |

N/A |

|

|

Basic and diluted loss per share |

$ |

(0.28 |

) |

$ |

(0.03 |

) |

$ |

(0.25 |

) |

N/A |

|

VARIANCE ANALYSIS FOR THE THIRD QUARTER

OF 2022 COMPARED TO THIRD QUARTER OF 2021

- Net sales

decreased compared to the same period last year mainly due to the

change in customer behaviors driven by removal of lock-down

restrictions and the increased vaccine coverage as well as the

current economic conditions partially offset by the growth of our

on-demand active customer base. In addition, due to the

non-recurrence of the prior year’s COVID-19 restrictions coupled

with a lower sales base, there was a slight increase in incentives

and credits used as a percentage of sales.

- The decrease in

gross profit and gross margin primarily resulted from a decrease in

net sales leading to operating de-leverage as well as the current

extraordinary inflationary pressures, both impacting our input

costs mainly on food, labour, production, and shipping costs. The

increase in food costs was also driven by the expansion of our

private label grocery offering. Higher production costs primarily

resulted from an increase in production and fulfillment labour due

to inflationary increases in wages and operating de-leverage.

- The decrease in

selling, general and administrative expenses is primarily due to

lower marketing spend and wages and salaries driven primarily by

lower net sales and the Company’s reorganization initiatives,

including the launch of Project Blue Ocean, to align its workforce

and marketing spend towards its current net sales base and its

future catalyst for growth, on-demand groceries and meal solutions.

Selling, general and administrative expenses as a percentage of net

sales increased from 34.6% to 43.8%.

- Reorganization

and other related costs were incurred in the third quarter of

Fiscal 2022 mainly consisting of external costs related to ongoing

execution of Project Blue Ocean.

- The increase in

depreciation and amortization expense is mainly due to the

recognition of right-of-use assets from new facility lease

agreements and related additions of leasehold improvements as the

Company continues to grow and expand its product offering of

grocery products and the ramp-up of new facilities across

Canada.

- The increase in

net finance costs is mainly due to the Company’s $30 million

convertible debenture issued in February 2022 as well as its

on-demand strategy leading to a ramp-up of new facilities across

Canada from continuous expansion of its footprint and its network

of centralized manufacturing with localized micro fulfillment

resulting in an increase interest expense on lease

obligations.

- The increase in

net loss in the third quarter of 2022 compared to the same quarter

last year is mainly due to lower net sales and gross profit

partially offset by lower higher wages and salaries and marketing

spend.

RESULTS OF OPERATIONS – YEAR-TO-DATE FISCAL 2022 AND

2021

The following table sets forth the components of

the Company’s consolidated statement of loss and comprehensive

loss:

(In thousands of Canadian dollars, except per

share and percentage information)

|

For the 39-weeks periods ended |

June 4,2022 |

|

May 31,2021 |

|

($) |

|

(%) |

|

|

Net sales |

$ |

218,229 |

|

$ |

299,876 |

|

$ |

(81,647 |

) |

(27 |

)% |

| Cost of

goods sold |

|

164,430 |

|

|

201,935 |

|

|

(37,505 |

) |

(19 |

)% |

|

Gross profit |

$ |

53,799 |

|

$ |

97,941 |

|

$ |

(44,142 |

) |

(45 |

)% |

| Gross margin |

|

24.7 |

% |

|

32.7 |

% |

|

N/A |

|

(8.0) p.p. |

|

| Selling, general and

administrative expenses |

|

97,107 |

|

|

98,778 |

|

|

(1,671 |

) |

(2 |

)% |

| Reorganization and other

related costs |

|

5,582 |

|

|

139 |

|

|

5,443 |

|

3,916 |

% |

| Depreciation and

amortization |

|

12,442 |

|

|

6,643 |

|

|

5,799 |

|

87 |

% |

| Net

finance costs |

|

3,556 |

|

|

1,646 |

|

|

1,910 |

|

116 |

% |

|

Net loss before income taxes |

$ |

(64,888 |

) |

$ |

(9,265 |

) |

$ |

(55,623 |

) |

N/A |

|

| Deferred income tax (recovery)

expense |

|

(1,534 |

) |

|

403 |

|

|

(1,937 |

) |

N/A |

|

|

Net loss, being comprehensive loss |

$ |

(63,354 |

) |

$ |

(9,668 |

) |

$ |

(53,686 |

) |

N/A |

|

|

Basic and diluted loss per share |

$ |

(0.85 |

) |

$ |

(0.14 |

) |

$ |

(0.71 |

) |

N/A |

|

VARIANCE ANALYSIS FOR THE YEAR-TO-DATE

2022 COMPARED TO SAME PERIOD OF 2021

- Net sales

decreased year-over-year mainly due to the change in customer

behaviors driven by the removal of lock-down restrictions and the

increased vaccine coverage and the current economic conditions

partially offset by the growth of our on-demand active customer

base. In addition, due to the non-recurrence of the prior year’s

COVID-19 restrictions coupled with a lower sales base, there was an

increase in incentives and credits used as a percentage of

sales.

- The decrease in

gross profit and gross margin primarily resulted from a decrease in

net sales leading to operating de-leverage as well as the current

extraordinary inflationary pressures, both impacting our input

costs mainly on food, labour, production, and shipping costs. The

increase in food costs was also driven by the expansion of our

private label grocery offering. Higher production costs primarily

resulted from an increase in production and fulfillment labour due

to inflationary increases in wages and operating de-leverage.

- The decrease in

selling, general and administrative expenses is primarily due to

lower marketing spend driven by lower net sales and the Company’s

reorganization initiatives, including the launch of Project Blue

Ocean, to align its workforce and marketing spend towards its

current net sales base and its future catalyst for growth,

on-demand groceries and meal solutions partially offset by higher

wages and salaries resulting from the expansion of the management

team, including mainly our technology, operations management and

marketing groups, and related administrative functions needed to

build out the physical and digital on-demand fulfillment

infrastructure, including the growing product offering required to

support the Company’s growth plan. Selling, general and

administrative expenses as a percentage of net sales increased from

32.9% to 44.5%.

- Reorganization

and other related costs were incurred in Fiscal 2022 mainly

consisting of severance and other costs related to organizational

realignments being progressively implemented in light of the

completion and implementation of systems and improved processes

coupled with aligning our workforce towards our future catalyst for

growth on-demand groceries and meal solutions.

- The increase in

depreciation and amortization expense is mainly due to the

recognition of right-of-use assets from new facility lease

agreements and related additions of leasehold improvements as the

Company continues to grow and expand its product offering of

grocery products and the ramp-up of new facilities across

Canada.

- The increase in

net finance costs is mainly due to the Company’s on-demand strategy

leading to a ramp-up of new facilities across Canada from

continuous expansion of its footprint and its network of

centralized manufacturing with localized micro fulfillment

resulting in an increase interest expense on lease obligations as

well as interest expense related to the Company’s $30 million

convertible debenture issued in February 2022.

- A deferred

income tax recovery was recognized due to the issuance of $30

million convertible debentures in February 2022.

- The increase in

net loss year-over-year is mainly due to lower net sales and gross

profit as well as higher depreciation and amortization expense and

reorganization and other related costs.

EBITDA (1), ADJUSTED

EBITDA (1) AND ADJUSTED EBITDA

MARGIN (1)

The reconciliation of net loss to EBITDA (1),

adjusted EBITDA (1) and adjusted EBITDA margin (1) is as

follows:

(In thousands of Canadian dollars, except

percentage information)

|

|

For the 13-weeks ended |

|

For the 39-weeks ended |

|

|

|

June 4,2022 |

|

May 31,2021 |

|

June 4,2022 |

|

May 31,2021 |

|

|

Net loss |

$ |

(21,104 |

) |

$ |

(2,333 |

) |

$ |

(63,354 |

) |

$ |

(9,668 |

) |

| Net finance costs |

|

1,596 |

|

|

431 |

|

|

3,556 |

|

|

1,646 |

|

| Depreciation and

amortization |

|

5,220 |

|

|

2,318 |

|

|

12,442 |

|

|

6,643 |

|

|

Deferred income tax (recovery) expense |

|

(2 |

) |

|

61 |

|

|

(1,534 |

) |

|

403 |

|

|

EBITDA(1) |

$ |

(14,290 |

) |

$ |

477 |

|

$ |

(48,890 |

) |

$ |

(976 |

) |

| Share-based payments

expense |

|

1,177 |

|

|

869 |

|

|

4,514 |

|

|

3,270 |

|

| Reorganization and other

related costs |

|

2,477 |

|

|

- |

|

|

5,582 |

|

|

139 |

|

|

Adjusted EBITDA(1) |

$ |

(10,636 |

) |

$ |

1,346 |

|

$ |

(38,794 |

) |

$ |

2,433 |

|

| Net

sales |

$ |

67,031 |

|

$ |

107,795 |

|

$ |

218,229 |

|

$ |

299,876 |

|

|

Adjusted EBITDA margin(1)(%) |

|

(15.9 |

)% |

|

1.2 |

% |

|

(17.8 |

)% |

|

0.8 |

% |

For the third quarter of 2022, adjusted EBITDA

margin (1) decreased by 17.1 percentage points compared to the

corresponding period in 2021 mainly due to a lower sales base

resulting from a shift in customer behaviors driven by post

COVID-19 effects and the current economic conditions partially

offset by the growth of our on-demand active customer (1) base. A

decrease in gross margin contributed to the lower adjusted EBITDA

margin (1) primarily due to a decrease in net sales leading to

operating de-leverage as well as the current extraordinary

inflationary pressures across all input costs. In addition, lower

adjusted EBITDA margin (1) can be explained mainly by higher wages

and salaries and marketing spend as a percentage of net sales

resulting from lower net sales.

For the 39-weeks ended June 4, 2022, adjusted

EBITDA margin (1) decreased by 18.6 percentage points compared to

the corresponding period in 2021 mainly due to a lower sales base

resulting from a shift in customer behaviors from post COVID-19

effects as well as the current economic conditions partially offset

by the growth of our on-demand active customer base. A decrease in

gross margin contributed to the lower adjusted EBITDA margin (1)

primarily due to a decrease in net sales leading to operating

de-leverage as well as the current extraordinary inflationary

pressures across all input costs. In addition, lower adjusted

EBITDA margin (1) can be explained mainly by higher wages and

salaries as a percentage of net sales resulting from the expansion

of the management team and related administrative functions needed

to build out the physical and digital on-demand fulfillment

infrastructure, including the growing product offering required to

support the Company’s growth plan as well as marketing spend as a

percentage of net sales.

FINANCIAL OUTLOOK

Online grocery is a growing segment of the

overall $140-billion-plus Canadian grocery industry, with digital

grocery delivery penetration currently estimated to be in the

single digits. We expect on-demand quick commerce delivery to act

as a further catalyst of growth, potentially resulting in online

grocery penetration reaching similar levels to other consumer goods

product categories. At 20% penetration, online grocery would result

in a market of approximately $30 billion.

To gain share in this market, over the past two

and a half years, Goodfood has increased its offering from

approximately 50 products to over 1,000 products today, which have

built a cult-like following among customers. In addition, the

Company has increased its delivery speed moving from a four-day

delivery cycle to a same-day/next-day offering, and now to

extremely fast on-demand delivery in Toronto, Montreal and Ottawa.

As we build our selection and expand our coverage, we aim to gain

share in the online grocery market by focusing on complementing

Canadians’ weekly shop with our rapid delivery of our

differentiated grocery products and delicious meal solutions.

Building on this, Goodfood intends to continue

to create long-term shareholder value by focusing and executing on

three key value drivers:

- Growing its

orders and Active Customer (1) base supported by rapid on-demand

delivery and an expanding grocery and meal solutions product

portfolio

- Expanding the

reach and density of its on-demand grocery and meal solutions

fulfillment network

- Improving

progressively its Net Loss and Adjusted EBITDA (1) as a percentage

of Net Sales through Project Blue Ocean: building an optimized cost

structure, benefiting from the operating leverage Net Sales growth

provides as well as through improved efficiencies and processes, to

set up Goodfood for its next phase of growth

Each quarter, Goodfood’s Active Customer (1)

base places weekly-subscription and on-demand orders, serviced

through a hub and spoke national network of distribution centres

and manufacturing facilities feeding micro-fulfillment centres

(“MFC”) that are strategically located close to our customers’

homes. The Company intends to grow its Active Customer (1) base and

weekly orders by increasing the reach of its on-demand delivery to

go along with an expanding product portfolio that now includes

national brands, hyper-local brands, alcohol and health and beauty

products, and a digital store with continuously improving

user-interface and capabilities.

Since Goodfood launched its ground-breaking

on-demand grocery and meal solution service in Toronto, Montreal

and Ottawa, the Company sustained rapidly growing new on-demand

customers generating nearly $7 million sales before incentives in

the third quarter of Fiscal 2022. Supported by an attractive Net

Promoter Score, an indication of customer satisfaction that is

approximately 2x higher than traditional brick and mortar grocery,

industry leading average order values and monthly order frequency,

strong retention rates, and the attractive at scale unit-economics

these MFCs can provide, Goodfood now has 9 operational MFCs. As the

Company focuses on scaling up existing facilities and bringing

their economics towards its target, it could open additional

facilities to expand both the coverage and density within Toronto

and Montreal, as well as Canada’s other leading cities, while

focusing on returning to profitability for the overall Company.

To return to profitability, the Company has

embarked on a review of its cost structure efficiency called

Project Blue Ocean. As part of Project Blue Ocean, Goodfood will

increase its focus on near-and-medium-term profitability. The

project has helped Goodfood identify a series of initiatives to

simplify the business’ operational complexity and asset base, and

set up the structure to facilitate a return to top line growth and

to improve gross margin, and review its organizational structure

and marketing processes to gain further efficiency. A significant

portion of the initiatives identified have been or are currently in

process of execution and this strategic focus on optimizing asset

use and returning to profitability may result in fewer than the

previously anticipated 20 MFCs by the end of calendar 2022. The

goal of Project Blue Ocean aims to return Goodfood to positive

Adjusted EBITDA (1) in the first half of Fiscal Year 2023. In

recent months and in the near future, Goodfood’s key focus is to

attract and retain high-value customers and continue to implement

cost discipline across its assets and operations.

Goodfood's strategy involves investing capital

in operating expenses related to building out its on-demand

fulfillment capability, its grocery and meal-solutions offering as

well as the technology and marketing required to support these

initiatives. While Goodfood expects these investments to continue,

we expect, through the on-going implementation of cost saving

initiatives, a continued progressive improvement in our cost

structure on a sequential quarter-over-quarter basis, as we

generate efficiencies through the implementation of technology

systems and improved processes, improved purchasing power,

fulfillment, and delivery costs, and realized operating leverage

across our network.

Looking further out, as the Company grows its

market share and scale, it is confident that it will achieve

economies of scale and additional efficiencies which will lead to

attractive profitability levels and returns on invested

capital.

Our overall strategy as well as the metrics

discussed in this section of the Press Release can be found in our

latest investor presentation. The investor presentation can be

found under the “Investor Presentation” section of our investor

relations website here:

https://www.makegoodfood.ca/en/investisseurs/evenements.

Lastly, the COVID-19 pandemic has had an impact

on Goodfood’s overall business and operations. The Company

experienced an acceleration of growth in demand as well as on-going

pressure on its cost structure. During the summer of 2021 and in

the Winter and Spring of 2022, we observed relaxation of COVID-19

restrictions versus the prior year and a change in consumer

behaviors as it relates to the pandemic, which negatively impacted

weekly subscriber order volume. As we navigate the return to

normalcy, we expect to see inconsistent demand patterns, and supply

chain and operational conditions. Combined with recent inflationary

pressures, these challenges are expected to impact Goodfood until

stable consumer and behavioral patterns are established.

The foregoing discussion is based on assumptions

that we are able to launch on-demand facilities in accordance with

our strategic plan, that such facilities would be open and

operational in accordance with planned timing and that they would

have the impact on our operations, Net Sales and financial results

expected by management based on current circumstances and that we

are able to implement Project Blue Ocean and its components as

currently expected. Actual results could differ materially, and

risks related to the launch of such facilities and their impact

include availability of locations, our ability to source locations

for the facilities, the cost of leasing space and costs of

materials and labour to build out the facilities as well as

availability and ability to source capital to fund the build-out

and launch of planned facilities. The impact of new facilities and

their contribution to our operational and financial results, as

well as other administrative and operational matters, including

project Blue Ocean, also subject to the risk factors related to our

business in general identified or referred to in the

‘‘Forward-Looking Information’’ and ‘‘Business Risk” sections of

the MD&A.

TRENDS AND SEASONALITY

The Company’s net sales and expenses are

impacted by seasonality. During the holiday season and the summer

season, the Company anticipates net sales to be lower as a higher

proportion of customers elect to skip their delivery. The Company

generally anticipates the growth rate of the number of Active

Customers (1) to be lower during these periods. While this is

typically the case, the COVID-19 effects may continue to have, an

impact on this trend. Seasonality was muted during the pandemic. In

light of the COVID-19 vaccine rollout as well as relaxation of

lock-down restrictions in the summer, seasonality trends returned

in the fourth quarter of Fiscal 2021 and lasted well into the first

quarter of 2022 due to the unseasonably warm weather throughout

most of the quarter. During periods with warmer weather, the

Company anticipates packaging costs to be higher due to the

additional packaging required to maintain food freshness and

quality. The Company also anticipates food costs to be positively

affected due to improved availability during periods with warmer

weather.

CONFERENCE CALL

Goodfood will hold a conference call to discuss

these results on July 13, 2022, at 8:00AM Eastern Time. Interested

parties can join the call by dialing 1-416-764-8646 (Toronto or

overseas) or 1-888-396-8049 (elsewhere in North America). To access

the webcast and view the presentation, click on this link:

https://www.makegoodfood.ca/en/investisseurs/evenements

Parties unable to call in at this time may

access a recording by calling 1-877-674-7070 and entering the

playback passcode 136007#. This recording will be available on July

13, 2022, as of 11:00 AM Eastern Time until 11:59 PM Eastern Time

on July 20, 2022.

A full version of the Company’s Management’s

Discussion and Analysis (MD&A) and Consolidated Financial

Statements for the third quarters ended June 4, 2022, and May 31,

2021, will be posted on http://www.sedar.com later today.

NON-IFRS FINANCIAL MEASURES

Certain financial and non-financial measures

included in this news release do not have a standardized meaning

under IFRS and therefore may not be comparable to similar measures

presented by other companies. The Company includes these measures

because it believes they provide to certain investors a meaningful

way of assessing financial performance. For a more complete

description of these measures and a reconciliation of Goodfood's

non-IFRS financial measures to financial results, please see

Goodfood's Management's Discussion and Analysis for the third

quarter ended June 4, 2022.

Goodfood's definition of the non-IFRS measures

are as follows:

- EBITDA is defined as net income or

loss before net finance costs, depreciation and amortization and

income taxes. Adjusted EBITDA is defined as EBITDA excluding

share-based payments expense and reorganization and other related

costs. Adjusted EBITDA margin is defined as the percentage of

adjusted EBITDA to net sales. EBITDA, adjusted EBITDA, and adjusted

EBITDA margin are non-IFRS financial measures. We believe that

EBITDA, adjusted EBITDA, and adjusted EBITDA margin are useful

measures of financial performance to assess the Company’s ability

to seize growth opportunities in a cost-effective manner, to

finance its ongoing operations and to service its long-term debt.

They also allow comparisons between companies with different

capital structures.

- Total cash, net of debt is a

non-IFRS measure that measures how much total cash the Company has

after taking into account its total debt. Total cash include cash

and cash equivalent. Total debt includes the current and long-term

portions of the debt as well as the liability component of the

convertible debentures. We believe that total cash, net of debt

measure is a useful measure to assess the Company’s overall

financial position.

- Total cash, net of debt to total

capitalization is a non-IFRS measure that is calculated as total

cash, net of debt over total capitalization. Total capitalization

is measured as total debt plus shareholder’s equity. We believe

this non-IFRS financial ratio to be a useful measure to assess the

Company’s financial leverage.

ACTIVE CUSTOMERS

(1)

An active customer is a customer that has placed

an order within the last three months. Active customers include

customers who have placed an order (1) received as part of our

weekly meal subscription plan, a subscription active customer; and

(2) received on a next-day, same-day or less basis, an on-demand

active customer. For greater certainty, an active customer is only

accounted for once, although different products and multiple orders

might have been purchased within a quarter. While the active

customers metric is not an IFRS or non-IFRS financial measure, and,

therefore, does not appear in, and cannot be reconciled to a

specific line item in the Company’s consolidated financial

statements, we believe that the active customers metric is a useful

metric for investors because it is indicative of potential future

net sales. The Company reports the number of active customers at

the beginning and end of the period, rounded to the nearest

thousand.

A subscription active customer and an on-demand

active customer should be evaluated independently, as a customer of

the Company’s platform can be counted as both a subscription active

customer and an on-demand active customer. For example, this could

occur if the customer has made an on-demand order in the three

months prior to the relevant measurement date and holds a

subscription account which has not been cancelled on or before the

relevant measurement date.

ABOUT GOODFOOD

Goodfood (TSX: FOOD) is a leading online grocery

company in Canada, delivering fresh meal solutions and grocery

items that make it easy for customers from across Canada to enjoy

delicious meals at home every day. Goodfood’s vision is to be in

every kitchen every day by enabling customers to complete their

grocery shopping and meal planning in minutes and to receive their

order in as little as 30 minutes. Goodfood customers have access to

a unique selection of online products as well as exclusive pricing

made possible by its direct-to-consumer infrastructures and

technology that eliminate food waste and costly retail overhead.

The Company’s main production facility and administrative offices

are based in Montreal, Québec, with additional production

facilities located in the provinces of Québec, Ontario, Alberta,

and British Columbia.

Except where otherwise indicated, all amounts in

this press release are expressed in Canadian dollars.

|

For further information: Investors and Media |

|

| Jonathan RoiterChief Financial

Officer(855) 515-5191IR@makegoodfood.ca |

Roslane Aouameur Vice

President, Corporate Development(855)

515-5191IR@makegoodfood.ca |

FORWARD-LOOKING INFORMATION

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Such forward-looking information includes, but is not

limited to, information with respect to our objectives and the

strategies to achieve these objectives, as well as information with

respect to our beliefs, plans, expectations, anticipations,

assumptions, estimates and intentions, including, without

limitation, statements in the “Financial Outlook” section of the

MD&A related to the build-out and launch of on demand

fulfillment centres or infrastructure and the impact of on-demand

grocery and meal solution offerings supported by an optimized

digital platform and the realization and impact of the foregoing.

This forward-looking information is identified by the use of terms

and phrases such as “may”, “would”, “should”, “could”, “expect”,

“intend”, “estimate”, “anticipate”, “plan”, “foresee”, “believe”,

and “continue”, as well as the negative of these terms and similar

terminology, including references to assumptions, although not all

forward-looking information contains these terms and phrases.

Forward-looking information is provided for the purposes of

assisting the reader in understanding the Company and its business,

operations, prospects, and risks at a point in time in the context

of historical trends, current condition, and possible future

developments and therefore the reader is cautioned that such

information may not be appropriate for other purposes.

Forward-looking information is based upon a

number of assumptions and is subject to a number of risks and

uncertainties, many of which are beyond our control, which could

cause actual results to differ materially from those that are

disclosed in, or implied by, such forward-looking information.

These risks and uncertainties include, but are not limited to, the

following risk factors which are discussed in greater detail under

“Risk Factors” in the Company’s Annual Information Form for the

year ended August 31, 2021 available on SEDAR at www.sedar.com:

limited operating history, negative operating cash flow and net

losses, food industry including current industry inflation levels,

COVID-19 pandemic impacts and the appearance of COVID variants,

quality control and health concerns, regulatory compliance,

regulation of the industry, public safety issues, product recalls,

damage to Goodfood’s reputation, transportation disruptions,

storage and delivery of perishable foods, product liability,

unionization activities, consolidation trends, ownership and

protection of intellectual property, evolving industry, reliance on

management, failure to attract or retain key employees which may

impact the Company’s ability to effectively operate and meet its

financial goals, factors which may prevent realization of growth

targets, inability to effectively react to changing consumer

trends, competition, availability and quality of raw materials,

environmental and employee health and safety regulations, the

inability of the Company’s IT infrastructure to support the

requirements of the Company’s business, online security breaches,

disruptions and denial of service attacks, reliance on data

centers, open source license compliance, future capital

requirements, operating risk and insurance coverage, management of

growth, limited number of products, conflicts of interest,

litigation, catastrophic events, risks associated with payments

from customers and third parties, being accused of infringing

intellectual property rights of others and, climate change and

environmental risks. This is not an exhaustive list of risks that

may affect the Company’s forward-looking statements. Other risks

not presently known to the Company or that the Company believes are

not significant could also cause actual results to differ

materially from those expressed in its forward-looking statements.

Although the forward-looking information contained herein is based

upon what we believe are reasonable assumptions, readers are

cautioned against placing undue reliance on this information since

actual results may vary from the forward-looking information.

Certain assumptions were made in preparing the forward-looking

information concerning the availability of capital resources,

business performance, market conditions, and customer demand. In

addition, information and expectations set forth herein are subject

to and could change materially in relation to developments

regarding the duration and severity of the COVID-19 pandemic and

the appearance of COVID variants and its impact on product demand,

labour mobility, supply chain continuity and other elements beyond

our control. Consequently, all of the forward-looking information

contained herein is qualified by the foregoing cautionary

statements, and there can be no guarantee that the results or

developments that we anticipate will be realized or, even if

substantially realized, that they will have the expected

consequences or effects on our business, financial condition, or

results of operation. Unless otherwise noted or the context

otherwise indicates, the forward-looking information contained

herein is provided as of the date hereof, and we do not undertake

to update or amend such forward-looking information whether as a

result of new information, future events or otherwise, except as

may be required by applicable law.

(1) See the non-IFRS financial measures and

Active Customer sections at the end of this press release.

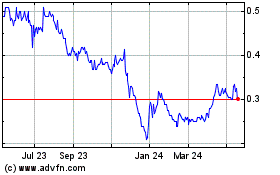

Goodfood Market (TSX:FOOD)

Historical Stock Chart

From Dec 2024 to Jan 2025

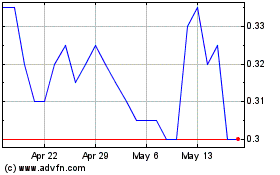

Goodfood Market (TSX:FOOD)

Historical Stock Chart

From Jan 2024 to Jan 2025