Gibson Energy Inc. (TSX:GEI) ("Gibson" or the "Company") announced

today its financial and operating results for the three and twelve

months ended December 31, 2024.

“We are pleased to announce record

Infrastructure results for 2024, driven by a full year of

contribution from Gateway," said Curtis Philippon, President &

Chief Executive Officer. "Exiting the year, the quality and

stability of our Infrastructure cash flows improved due to

successful re-contracting efforts and record throughput at both

Gateway and Edmonton. We also announced exciting growth capital

projects at Gateway. I am pleased with the progress we are making

on setting up the Gibson team, increasing our focus on the

business, strengthening our growth pipeline and building a

high-performance culture.”

Financial Highlights:

- Revenue of $11,780

million for the full year, including $2,358 million in the fourth

quarter, relatively consistent year over year primarily due to

higher sales volumes within the Marketing segment and the revenue

contribution from the Gateway Terminal

- Infrastructure

Adjusted EBITDA(1) of $601 million for the full year, including

$147 million in the fourth quarter, a $107 million or 22% increase

over full year 2023 primarily due to the full year contribution

from the Gateway Terminal and an Edmonton tank, which were only

partially offset by a reduction from the Hardisty Unit Train

Facility and the impact of certain one-time items

- Marketing Adjusted

EBITDA(1) of $63 million for the full year, including a $5 million

loss in the fourth quarter, an $82 million or 57% decrease over

full year 2023 principally due to significantly tighter crude oil

differentials and crack spreads, and increased demand for Canadian

heavy oil triggering steep backwardation and limited volatility,

impacting storage, quality and time-based opportunities

- Adjusted EBITDA(1)

on a consolidated basis of $610 million for the full year,

including $130 million in the fourth quarter, a $20 million or 3%

increase over full year 2023, due to the impact of unrealized gains

and losses on financial instruments recorded in both periods and

the factors noted above, partially offset by the add back of

certain one-time items, and an increase in general and

administrative expenses, net of executive transition and

restructuring costs

- Net income of $152

million for the full year 2024, including a $6 million loss in the

fourth quarter, a $62 million or 29% decrease over full year 2023

due to the impact of items noted above, higher general and

administrative costs primarily due to executive transition and

restructuring costs, the impact of the Gateway acquisition that

resulted in higher finance costs, depreciation and amortization

expenses, and an environmental remediation provision, partially

offset by acquisition and integration costs in the prior year and a

lower income tax expense

- Distributable Cash

Flow(1) of $375 million for the full year, including $71 million in

the fourth quarter, an $11 million or 3% decrease over full year

2023, primarily due to higher finance costs, partially offset by

higher Adjusted EBITDA and lower lease payments

- Dividend Payout

ratio(2) on a trailing twelve-month basis of 71%, which is at the

low end of the 70% – 80% target range

- Net debt to

Adjusted EBITDA ratio(2) of 3.5x for the twelve months ended

December 31, 2024, which is at the high end of the 3.0x – 3.5x

target range, compared to 3.7x for the twelve months ended December

31, 2023

Strategic Developments and

Highlights:

- Appointed Curtis

Philippon as the President and Chief Executive Officer, effective

August 29, 2024

- Announced the

extension of a long-term contract with an investment grade global

E&P company at the Gateway Terminal and the sanction of a

connection to the Cactus II Pipeline in July

- Refinanced $350

million 5.80% senior unsecured notes due 2026 with $350 million of

4.45% senior unsecured notes due in November 2031, resulting in

annual cost savings of approximately $5 million

- Announced the

extension of a long-term contract and the sanctioning of the

dredging project at the Gateway Terminal in December which, along

with the earlier announcements, will allow the Company to achieve

its Gateway targets

- Placed in-service

two new 435,000 barrel tanks under a long-term take-or-pay

agreement with an investment grade customer at the Edmonton

Terminal in December

- Achieved a new

milestone, recording 8.8 million hours without a lost time injury

for our employee and contract workforce

- Subsequent to the

quarter, appointed Riley Hicks as the Senior Vice President and

Chief Financial Officer, effective February 4, 2025

- Subsequent to the

quarter, Gibson’s Board of Directors also approved a quarterly

dividend of $0.43 per common share, an increase of $0.02 per common

share or 5%, beginning with the dividend payable in April

|

(1) |

Adjusted EBITDA and distributable cash flow are non-GAAP financial

measures. See the “Specified Financial Measures” section of this

release. |

| (2) |

Net debt to adjusted EBITDA ratio

and dividend payout ratio are non-GAAP financial ratios. See the

“Specified Financial Measures” section of this release. |

Management’s Discussion and Analysis and

Financial StatementsThe 2024 fourth quarter Management’s

Discussion and Analysis and audited Consolidated Financial

Statements provide a detailed explanation of Gibson’s financial and

operating results for the three months and year ended December 31,

2024, as compared to the three months and year ended December 31,

2023. These documents are available at

www.gibsonenergy.com and on SEDAR+ at

www.sedarplus.ca.

Earnings Conference Call & Webcast

DetailsA conference call and webcast will be held to

discuss the 2024 fourth quarter and year-end financial and

operating results at 7:00am Mountain Time (9:00am Eastern Time) on

Wednesday, February 19, 2025.

To register for the call, view dial-in numbers,

and obtain a dial-in PIN, please access the following URL:

-

https://register.vevent.com/register/BI23dfba5e0f5d48ff9c597a04d3958c64

Registration at least five minutes prior to the

conference call is recommended.

This call will also be broadcast live on the

Internet and may be accessed directly at the following URL:

-

https://edge.media-server.com/mmc/p/ckn6qbx6

The webcast will remain accessible for a

12-month period at the above URL.

Supplementary InformationGibson

has also made available certain supplementary information regarding

the 2024 fourth quarter and full year financial and operating

results, available at www.gibsonenergy.com.

About Gibson Gibson is a

leading liquids infrastructure company with its principal

businesses consisting of the storage, optimization, processing, and

gathering of liquids and refined products, as well as waterborne

vessel loading. Headquartered in Calgary, Alberta, the Company's

operations are located across North America, with core terminal

assets in Hardisty and Edmonton, Alberta, Ingleside and Wink,

Texas, and a facility in Moose Jaw, Saskatchewan.

Gibson shares trade under the symbol GEI and are

listed on the Toronto Stock Exchange. For more information, visit

www.gibsonenergy.com.

Forward-Looking StatementsCertain statements

contained in this press release constitute forward-looking

information and statements (collectively, forward-looking

statements) including, but not limited to, the Company’s plans and

targets, including its focus on delivering shareholder returns and

progressing its cost focus campaign, and dividend payment dates and

amounts thereof. All statements other than statements of historical

fact are forward-looking statements. The use of any of the words

“will,” “anticipate”, “continue”, “expect”, “intend”, “may”,

“should”, “could”, “believe”, “further” and similar expressions are

intended to identify forward looking statements. These statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements. No assurance

can be given that these expectations will prove to be correct and

such forward-looking statements included in this press release

should not be unduly relied upon. These statements speak only as of

the date of this press release. The Company does not undertake any

obligations to publicly update or revise any forward-looking

statements except as required by securities law. Actual results

could differ materially from those anticipated in these

forward-looking statements as a result of numerous risks and

uncertainties including, but not limited to, the risks and

uncertainties described in “Forward-Looking Information” and “Risk

Factors” included in the Company's Annual Information Form and

Management's Discussion and Analysis, each dated February 18, 2025,

as filed on SEDAR+ and available on the Gibson website at

www.gibsonenergy.com.

For further information, please contact:

Investor Relations: (403)

776-3077investor.relations@gibsonenergy.com

Media Relations:(403) 476-6334

communications@gibsonenergy.com

Specified Financial

Measures

This press release refers to certain financial

measures that are not determined in accordance with GAAP, including

non-GAAP financial measures and non-GAAP financial ratios. Readers

are cautioned that non-GAAP financial measures and non-GAAP

financial ratios do not have standardized meanings prescribed by

GAAP and, therefore, may not be comparable to similar measures

presented by other entities. Management considers these to be

important supplemental measures of the Company’s performance and

believes these measures are frequently used by securities analysts,

investors and other interested parties in the evaluation of

companies in industries with similar capital structures.

For further details on these specified financial

measures, including relevant reconciliations, see the "Specified

Financial Measures" section of the Company’s MD&A for the years

ended December 31, 2024 and 2023, which is incorporated by

reference herein and is available on Gibson's SEDAR+ profile at

www.sedarplus.ca and Gibson's website at

www.gibsonenergy.com.

a) Adjusted

EBITDA

Noted below is the reconciliation to the most

directly comparable GAAP measures of the Company's segmented and

consolidated adjusted EBITDA for the three months and years ended

December 31, 2024, and 2023:

|

Three months ended December 31, |

Infrastructure |

Marketing |

Corporate andAdjustments |

Total |

|

($ thousands) |

2024 |

2023 |

|

2024 |

|

2023 |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

Segment profit |

127,444 |

157,968 |

|

(16,435 |

) |

24,474 |

— |

|

— |

|

111,009 |

|

182,442 |

|

|

Unrealized loss (gain) on derivative financial instruments |

6,359 |

(5,377 |

) |

11,662 |

|

3,388 |

— |

|

— |

|

18,021 |

|

(1,989 |

) |

|

General and administrative |

— |

— |

|

— |

|

— |

(18,065 |

) |

(10,893 |

) |

(18,065 |

) |

(10,893 |

) |

|

Adjustments to share of profit from equity accounted investees |

1,169 |

155 |

|

— |

|

— |

— |

|

— |

|

1,169 |

|

155 |

|

|

Executive transition and restructuring costs |

— |

— |

|

— |

|

— |

6,304 |

|

— |

|

6,304 |

|

— |

|

|

Environmental remediation provision (1) |

9,287 |

— |

|

— |

|

— |

— |

|

— |

|

9,287 |

|

— |

|

|

Post-close purchase price adjustment (1) |

2,670 |

— |

|

— |

|

— |

— |

|

— |

|

2,670 |

|

— |

|

|

Renewable power purchase agreement |

— |

— |

|

— |

|

— |

(713 |

) |

— |

|

(713 |

) |

— |

|

|

Other |

— |

— |

|

— |

|

— |

— |

|

(34 |

) |

— |

|

(34 |

) |

|

Adjusted EBITDA |

146,929 |

152,746 |

|

(4,773 |

) |

27,862 |

(12,474 |

) |

(10,927 |

) |

129,682 |

|

169,681 |

|

| Years ended December

31, |

Infrastructure |

Marketing |

Corporate andAdjustments |

Total |

|

($ thousands) |

2024 |

2023 |

|

2024 |

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

| Segment profit |

574,010 |

494,451 |

|

52,956 |

148,436 |

|

— |

|

— |

|

626,966 |

|

642,887 |

|

| Unrealized loss (gain) on

derivative financial instruments |

10,105 |

(4,637 |

) |

9,778 |

(3,484 |

) |

— |

|

— |

|

19,883 |

|

(8,121 |

) |

| General and

administrative |

— |

— |

|

— |

— |

|

(69,985 |

) |

(49,570 |

) |

(69,985 |

) |

(49,570 |

) |

| Adjustments to share of profit

from equity accounted investees |

5,240 |

4,448 |

|

— |

— |

|

— |

|

— |

|

5,240 |

|

4,448 |

|

| Executive transition and

restructuring costs |

— |

— |

|

— |

— |

|

16,969 |

|

— |

|

16,969 |

|

— |

|

| Environmental remediation

provision (1) |

9,287 |

— |

|

— |

— |

|

— |

|

— |

|

9,287 |

|

— |

|

| Post-close purchase price

adjustment (1) |

2,670 |

— |

|

— |

— |

|

— |

|

— |

|

2,670 |

|

— |

|

| Renewable power purchase

agreement |

— |

— |

|

— |

— |

|

(888 |

) |

— |

|

(888 |

) |

— |

|

|

Other |

— |

— |

|

— |

— |

|

— |

|

184 |

|

— |

|

184 |

|

|

Adjusted EBITDA |

601,312 |

494,262 |

|

62,734 |

144,952 |

|

(53,904 |

) |

(49,386 |

) |

610,142 |

|

589,828 |

|

(1) added back in the calculation of adjusted EBITDA as these

charges are not reflective of the ongoing earning capacity of the

business, as described in the discussion of Infrastructure segment

results in the MD&A.

| |

Three months ended December 31, |

|

|

($ thousands) |

2024 |

|

2023 |

|

|

|

|

|

| Net

(Loss) Income |

(5,563 |

) |

53,301 |

|

| |

|

|

|

Income tax expense |

7,575 |

|

20,259 |

|

|

Depreciation, amortization, and impairment charges |

55,217 |

|

47,690 |

|

|

Finance costs, net |

34,033 |

|

35,919 |

|

|

Unrealized loss (gain) on derivative financial instruments |

18,021 |

|

(1,989 |

) |

|

Unrealized (gain) loss on renewable power purchase agreement |

(4,375 |

) |

866 |

|

|

Share-based compensation |

6,882 |

|

5,600 |

|

|

Acquisition and integration costs |

— |

|

2,083 |

|

|

Adjustments to share of profit from equity accounted investees |

1,169 |

|

155 |

|

|

Corporate foreign exchange (gain) loss and other |

(1,538 |

) |

5,797 |

|

|

Environmental remediation provision (1) |

9,287 |

|

— |

|

|

Post-close purchase price adjustment (1) |

2,670 |

|

— |

|

|

Executive transition and restructuring costs |

6,304 |

|

— |

|

|

Adjusted EBITDA |

129,682 |

|

169,681 |

|

| |

Years ended December

31, |

|

|

($ thousands) |

2024 |

|

2023 |

|

|

|

|

|

| Net

Income |

152,174 |

|

214,211 |

|

| |

|

|

|

Income tax expense |

53,780 |

|

71,123 |

|

|

Depreciation, amortization, and impairment charges |

186,669 |

|

142,478 |

|

|

Finance costs, net |

138,318 |

|

116,276 |

|

|

Unrealized loss (gain) on derivative financial instruments |

19,883 |

|

(8,121 |

) |

|

Corporate unrealized loss on derivative financial instruments |

2,332 |

|

1,296 |

|

|

Share-based compensation |

22,040 |

|

20,944 |

|

|

Acquisition and integration costs |

1,371 |

|

22,042 |

|

|

Adjustments to share of profit from equity accounted investees |

5,240 |

|

4,448 |

|

|

Corporate foreign exchange (gain) loss and other |

(591 |

) |

5,131 |

|

|

Environmental remediation provision (1) |

9,287 |

|

— |

|

|

Post-close purchase price adjustment (1) |

2,670 |

|

— |

|

|

Executive transition and restructuring costs |

16,969 |

|

— |

|

|

Adjusted EBITDA |

610,142 |

|

589,828 |

|

(1) added back in the calculation of adjusted EBITDA as these

charges are not reflective of the ongoing earning capacity of the

business, as described in the discussion of Infrastructure segment

results in the MD&A.

b) Distributable Cash

Flow

The following is a reconciliation of

distributable cash flow from operations to its most directly

comparable GAAP measure, cash flow from operating activities:

|

Three months ended December 31, |

|

Years ended December 31, |

|

|

($ thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

Cash flow from operating activities |

67,276 |

|

155,602 |

|

598,454 |

|

574,856 |

|

|

Adjustments: |

|

|

|

|

|

Changes in non-cash working capital and taxes paid |

53,978 |

|

7,487 |

|

(10,642 |

) |

(7,434 |

) |

|

Replacement capital |

(11,727 |

) |

(10,226 |

) |

(35,987 |

) |

(35,928 |

) |

|

Cash interest expense, including capitalized interest |

(31,931 |

) |

(34,456 |

) |

(134,336 |

) |

(100,133 |

) |

|

Acquisition and integration costs (1) |

— |

|

2,083 |

|

1,371 |

|

22,042 |

|

|

Executive transition and restructuring costs (1) |

6,304 |

|

— |

|

16,969 |

|

— |

|

|

Lease payments |

(6,063 |

) |

(9,628 |

) |

(30,241 |

) |

(35,896 |

) |

|

Current income tax |

(6,685 |

) |

(7,917 |

) |

(30,318 |

) |

(31,717 |

) |

|

Distributable cash flow |

71,152 |

|

102,945 |

|

375,270 |

|

385,790 |

|

(1) Costs adjusted on an incurred basis.

c) Dividend Payout

Ratio

|

|

Years ended December 31, |

|

|

|

2024 |

|

2023 |

|

|

Distributable cash flow |

375,270 |

|

385,790 |

|

| Dividends declared |

266,858 |

|

236,907 |

|

|

Dividend payout ratio |

71 |

% |

61 |

% |

d) Net

Debt To Adjusted EBITDA Ratio

| |

Years ended December

31, |

|

|

|

2024 |

|

2023 |

|

|

|

|

|

| Current and long-term

debt |

2,598,635 |

|

2,711,543 |

|

| Lease liabilities |

48,180 |

|

62,005 |

|

| Less: unsecured hybrid

debt |

(450,000 |

) |

(450,000 |

) |

| Less:

cash and cash equivalents |

(57,069 |

) |

(143,758 |

) |

|

|

|

|

| Net debt |

2,139,746 |

|

2,179,790 |

|

|

Adjusted EBITDA |

610,142 |

|

589,828 |

|

|

Net debt to adjusted EBITDA ratio |

3.5 |

|

3.7 |

|

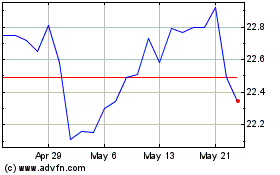

Gibson Energy (TSX:GEI)

Historical Stock Chart

From Jan 2025 to Mar 2025

Gibson Energy (TSX:GEI)

Historical Stock Chart

From Feb 2024 to Mar 2025