Hammond Power Solutions Inc. ("HPS") (TSX:HPS.A) -

(Dollar amounts are in thousands unless otherwise specified)

NOTE: ALL NUMBERS HAVE BEEN STATED UNDER IFRS

HIGHLIGHTS FROM THE QUARTER

-- Revenue growth of $13,000 or 28%

-- Earnings from operations increase of $1,400 or 33%

-- Order bookings increase of 28%

-- Order backlog increase of 46%

Hammond Power Solutions Inc. ("HPS"), a leading manufacturer of

dry type transformers and magnetics, today announced its financial

results for the fourth quarter of 2011.

"We ended the year with strong momentum of sales and margins, as

well as the biggest backlog we have ever had going into a new

year," commented Bill Hammond, Chairman & Chief Executive

Officer of Hammond Power Solutions Inc.

FOURTH QUARTER RESULTS

Sales for the quarter ended December 31, 2011, were $60,727 up

$13,119 or 27.6% from the comparative quarter last year, and were

higher by $30,719 or 16.1% year-to-date, finishing at $221,323

compared to $190,604 last year. Due to a solid quarter of order

booking activity, sales in the United States were $36,210 in

Quarter 4, 2011, an increase of $5,804 or 19.1% from Quarter 4,

2010. Year-to-date sales in the U.S. were $131,025, an increase of

$12,099 or 10.2%, when compared to $118,926 last year-to-date. The

sales increase can be attributed to higher shipments in both the

American and Canadian markets and additional European market sales

attributed to the Company's recent acquisition.

Canadian sales for Quarter 4, 2011 totaled $22,151 compared to

$17,203 in Quarter 4, 2010 an increase of $4,948 and on a

year-to-date basis were $81,238, an increase of $9,560 or 13.3% as

compared to sales of $71,678 in 2010. The Canadian electrical

industry market recovered slightly in 2011 after a soft 2010.

The Company derived $ 2,366 of sales in Quarter 4, 2011 and

$9,060 year-to-date from the Company's acquisition of Euroelettro

Hammond S.p.A, in Vicenza, Italy ("EH").

Bill Hammond stated, "Our sales growth continues to be fuelled

by our OEM markets and our industrial distributor network. Bookings

and backlog continue to be strong which bodes positively as we

enter into 2012."

Sales growth strategies combined with better market conditions

produced a 17.8% increase in Quarter 4, 2011 bookings as compared

to Quarter 4, 2010 and year to date were 27.7% higher. Due to the

increased level of bookings our order backlog increased 45.5% from

Quarter 4, 2010.

The Company's gross margin dollar contribution in Quarter 4,

2011 was positively impacted by market specific selling price

increases, higher manufacturing throughput and internal cost

reductions. Quarter ending December 31, 2011 margin dollars

increased by $3,460 or 28.3% compared to the same period as last

year. On a year-to-date basis, margin dollars increased by $5,814

or 12.1%. In Quarter 4, 2011 gross margin rates finished at 25.8%

versus 25.7% in Quarter 4, 2010 an increase of 0.1%. These factors

offset some of the eroding impact that a 4% year-over-year stronger

Canadian dollar compared to the U.S. dollar and of a 1% stronger

Canadian dollar compared to the U.S. dollar over the same quarter

last year, had on U.S. resale margins.

Total selling and distribution expenses amounted to $6,049 in

Quarter 4, 2011 versus $4,925 in Quarter 4, 2010, an increase of

$1,124 or 22.8%. The increased expense in the quarter resulted from

higher freight and commission expenses as a result of the increase

in sales and selling expenses attributable to our Italian

acquisition.

Total selling and distribution expenses were $22,609 for 2011

versus $19,319 in 2010, an increase of $3,290 or 17.0%. When

compared on a percentage of sales, total selling and distribution

costs remained virtually unchanged coming in at 10.2% for 2011

versus 10.1% for 2010. The selling and distribution expenses for

2011 include expenses pertaining to our Italian acquisition.

The general and administrative expenses for Quarter 4, 2011

totaled $3,908, an increase of $922 or 30.9% when compared to

Quarter 4, 2010 costs of $2,986. The increase in Quarter 4, 2011

compared to Quarter 4, 2010 is attributed to additional general and

administrative costs related to our Italian acquisition and

increased costs relating to acquisition activities.

General and administrative expenses in 2011 were higher by

$3,127 or 20.6%, totaling $18,343 when compared to $15,216 for

2010. On a percentage of sales this cost held relatively flat at

8.3 % in 2011 compared to 8.0% in 2010.The increase is a result of

the additional costs related to the Italian acquisition, stock

option expense and costs related to the company's ongoing

acquisition activities.

The interest expense for Quarter 4, 2011 finished at $121

compared to $23 in Quarter 4, 2010 an increase of $98. Year-to-date

interest cost was $305, an increase of $103 when compared to

year-to-date 2010 expense of $202.

The foreign exchange gain in Quarter 4, 2011 was $327 relating

primarily to the transactional exchange loss pertaining to the

Company's U.S. dollar trade accounts payable in Canada, compared to

a foreign exchange gain of $464 in Quarter 4, 2010. The exchange

loss was $382 year-to-date 2011 compared to a foreign exchange gain

of $1,122 for the same period of 2010.

An area that has significant negative impact on the Company's

net earnings was caused by the cyclical effects and unprecedented

market cost fluctuations of copper commodity pricing in the global

market. Due to this unpredictability, HPS utilizes a hedging

strategy. The Company entered copper forwards for approximately 40%

of its normal annual requirements in order to reduce the Company's

exposure to changes in the price of copper. In Quarter 4, 2011 the

company experienced a gain on copper forward contracts as the

commodity future valuations rebounded from previous lower market

valuations of Quarter 3, 2011. The gains on future copper contracts

for Quarter 4, 2011 was $365, which was significantly lower than

the $1,225 gain posted in Quarter 4, 2010. Year-to-date 2011, the

hedging loss was $1,943 which was caused by a significant decrease

in market copper future valuations.

The net earnings for Quarter 4, 2011, finished at $3,569

compared to net earnings of $4,256 in Quarter 4, 2010, a decrease

of $687 or 16.1%. On a year-to-date basis net earnings finished at

$5,993 a decrease of $4,659 when compared to year-to-date 2010 net

earnings of $10,652.

Net cash provided by operating activities for Quarter 4, 2011

was $10,741 versus cash provided of $3,389 in Quarter 4, 2010 an

increase of $7,352 as a result of a decrease in usage of working

capital. Year-to-date cash provided by operations during 2011 was

$6,592 versus $14,109 in 2010, a decrease in cash generated from

operations of $7,517. This decrease is mostly due to lower net

earnings and higher working capital usage as a result of the

increase in business.

The Company's overall cash balances net of bank operating lines

of credit resulted in a net cash position of $6,218 as at December

31, 2011 versus a net cash position of $18,089 as at December 31,

2010. This change is primarily as a result of the purchase of

Euroelettro S.p.A. for $7,784 plus the related assumed debt of

$5,476 and increased investment working capital.

Mr. Hammond concluded, "We are very optimistic about our

potential for further growth in sales and profits going forward,

however we believe it's wise to remain cautious and conservative

given the uncertainty that seems to be so pervasive around the

globe at the current time."

THREE MONTHS ENDED:

(dollars in thousands)

----------------------------------------------------------------------------

December 31, December 31,

2011 2010 Change

----------------------------------------------------------------------------

Sales $ 60,727 $ 47,608 $ 13,119

----------------------------------------------------------------------------

Earnings from Operations $ 5,729 $ 4,315 $ 1,414

----------------------------------------------------------------------------

Exchange Loss/(Gain) $ (327) $ (464) $ 137

----------------------------------------------------------------------------

Copper forward unrealized/realized

loss/(gain) $ (365) $ (1,225) $ (860)

----------------------------------------------------------------------------

Net Earnings $ 3,569 $ 4,256 $ (687)

----------------------------------------------------------------------------

Earnings/(Loss) per share

Basic .31 .37 (0.06)

Diluted .31 .37 (0.06)

----------------------------------------------------------------------------

Cash (Used) Provided by Operations $ 10,741 $ 3,389 $ (7,352)

----------------------------------------------------------------------------

TWELVE MONTHS ENDED:

(dollars in thousands)

----------------------------------------------------------------------------

December 31, December 31,

2011 2010 Change

----------------------------------------------------------------------------

Sales $ 221,323 $ 190,604 $ 30,719

----------------------------------------------------------------------------

Earnings from Operations $ 13,039 $ 13,642 $ (603)

----------------------------------------------------------------------------

Exchange Loss/(Gain) $ 382 $ (1,122) $ (1,504)

----------------------------------------------------------------------------

Copper forward unrealized/realized

loss/(Gain) $ 1,943 $ (1,141) $ (3,084)

----------------------------------------------------------------------------

Net Earnings $ 5,993 $ 10,652 $ (4,659)

----------------------------------------------------------------------------

Earnings per share

Basic 0.52 0.92 (0.40)

Diluted 0.51 0.91 (0.40)

----------------------------------------------------------------------------

Cash Provided by Operations $ 6,592 $ 14,109 $ (7.517)

----------------------------------------------------------------------------

TELECONFERENCE

Hammond Power Solutions Inc. will hold a conference call on

Tuesday, March 13, 2012 at 10:00 a.m. EST, to discuss the Company's

financial results for the fourth quarter 2011.

Listeners may attend the conference by dialing:

1-416-340-2216 or 1-866-226-1792

About Hammond Power Solutions Inc.

Hammond Power Solutions Inc., ("HPS" or the "Company") is the

North American leader for the design of custom electrical

engineered magnetic as well as the leading manufacturer of standard

electrical dry type transformers. Advanced engineering

capabilities, high quality products and fast responsive service to

customers' needs has established the Company as a technical and

innovative leader in the electrical and electronic industries. The

Company has manufacturing facilities in Canada, the United States,

Mexico and Italy.

Contacts: Hammond Power Solutions Inc. Dawn Henderson Manager

Investor Relations (519) 822-2441

x414ir@hammondpowersolutions.com

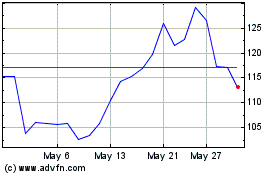

Hammond Power Solutions (TSX:HPS.A)

Historical Stock Chart

From May 2024 to Jun 2024

Hammond Power Solutions (TSX:HPS.A)

Historical Stock Chart

From Jun 2023 to Jun 2024