Hut 8 Corp. (Nasdaq | TSX: HUT) (“Hut 8” or the “Company”), a

leading, vertically integrated operator of large-scale energy

infrastructure and one of North America’s largest Bitcoin miners,

today announced its financial results for the three and six months

ended June 30, 2024.

“Our results this quarter reflect the ambitious restructuring

program we set in motion six months ago,” said Asher Genoot, CEO of

Hut 8. “Despite the network halving, gross margins in our Digital

Assets Mining segment rose to 46% for the three months ended June

30, 2024 from 34% in the prior year period. Restructuring and

optimization initiatives, together with the energization of Salt

Creek, enabled a 21% reduction in our energy cost per kilowatt-hour

from $0.040 in Q1 2024 to $0.032 in Q2 2024. With our strengthened

operating foundation and recent advancements in ASIC efficiencies,

we believe that now is the right time to upgrade our fleet. We are

also on track to commercialize our GPU-as-a-service vertical in the

third quarter, further bolstering our compute-layer economics.”

“Scaling our power footprint remains central to our strategy. We

believe high-quality power assets will become increasingly valuable

as compute applications demand more energy. Our differentiated

energy strategy continues to unlock access to expansion capacity at

scale. Last month, we announced a new site in the Texas Panhandle

with 205 megawatts of immediately available, low-cost, long-term

power. We are in discussions for a large-scale commercial

partnership for the site, which can power up to 205 megawatts of

NVIDIA Blackwell GPUs or up to 16.5 exahash of next-generation

ASICs.”

“To build a next-generation energy infrastructure platform

spanning power infrastructure, data centers, and compute, we are

doubling down on our strengths in energy sourcing and portfolio

development. Our $150 million partnership with Coatue has enhanced

our ability to commercialize these advantages, driving incremental

deal flow and interest in our platform and capabilities. We are

aggressively advancing our pipeline to enable us to address

multi-hundred-megawatt infrastructure development opportunities and

look forward to sharing updates on committed projects as they

materialize.”

Second Quarter 2024 Financial and Operational

Highlights

U.S. Data Mining Group, Inc. dba US Bitcoin Corp (“USBTC”) and

Hut 8 Mining Corp. completed an all-stock merger of equals (the

“Business Combination”) on November 30, 2023. USBTC was deemed the

accounting acquirer in the transaction and, as a result, the

historical figures in the Company’s income statement for the three

and six months ended June 30, 2023 reflect USBTC’s standalone

performance. Results for the three and six months ended June 30,

2024 reflect the performance of the combined company. With respect

to the balance sheet, the ending balance for Q2 2024 is being

compared to year-end 2023 balance, both of which reflect the

combined company’s performance. All financial results are reported

in US dollars.

- As of June 30, 2024, Hut 8’s total energy capacity under

management was 1,075 megawatts (“MW”) across eighteen sites: 762 MW

across nine Bitcoin mining sites in North America, 310 MW across

four natural gas power generation facilities in Canada, and 3 MW

across five cloud and colocation data centers in Canada.

- Owned approximately 49,400 miners totaling approximately 4.8

exahash per second (EH/s), including the Company’s net share of the

King Mountain joint venture (“King Mountain JV”), as of June 30,

2024.

- Revenue increased by $14.7 million to $35.2 million from $20.5

million for the three months ended June 30, 2023.

- Net loss attributable to Hut 8 was $71.9 million, including

losses on digital assets fair value adjustment of $71.8 million,

compared to a loss of $1.7 million for the three months ended June

30, 2023.

- Adjusted EBITDA was ($57.5) million compared to $14.8 million

for the three months ended June 30, 2023.

- During the three months ended June 30, 2024, 279 Bitcoin were

mined, versus 740 Bitcoin mined in the three months ended June 30,

2023.

- As of June 30, 2024, total self-mined Bitcoin balance was

9,102, which represented a market value of approximately $570.5

million.

- Weighted average cost to mine a Bitcoin was $26,232 during the

three months ended June 30, 2024, versus $14,907 for the three

months ended June 30, 2023.

- Energy cost per MWh of $31.71 during the three months ended

June 30, 2024, versus $37.34 during the three months ended June 30,

2023.

Key Performance Indicators

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

| |

|

2024 |

|

2023 |

| Cost to mine a Bitcoin

(excluding hosted facilities)(1) |

|

$ |

26,232 |

|

|

$ |

11,321 |

|

| Cost to mine a Bitcoin(2) |

|

$ |

26,232 |

|

|

$ |

14,907 |

|

| Weighted average revenue per

Bitcoin mined(3) |

|

$ |

65,656 |

|

|

$ |

27,927 |

|

| Bitcoin mined(4) |

|

|

279 |

|

|

|

740 |

|

| Energy cost per MWh |

|

$ |

31.71 |

|

|

$ |

37.34 |

|

| Hosting cost per MWh |

|

$ |

— |

|

|

$ |

60.11 |

|

| Energy capacity under

management (mining)(5) |

|

|

762 MW |

|

|

|

730 MW |

|

| Total energy capacity under

management(6) |

|

|

1,075 MW |

|

|

|

730 MW |

|

- Cost to mine a Bitcoin (excluding hosted facilities) is

equivalent to the all-in electricity cost, net of credits from

participation in ancillary demand response programs, to mine a

Bitcoin at owned facilities and includes the Company’s net share of

the King Mountain JV.

- Cost to mine a Bitcoin (or weighted average cost to mine a

Bitcoin) is calculated as the sum of total all-in electricity

expense, net of credits from participation in ancillary demand

response programs, and hosting expense divided by Bitcoin mined

during the respective periods and includes the Company’s net share

of the King Mountain JV.

- Weighted average revenue per Bitcoin mined is calculated as the

sum of total self-mining revenue divided by Bitcoin mined during

the respective periods and includes the Company’s net share of the

King Mountain JV; it excludes discontinued operations at

Drumheller, Alberta.

- Bitcoin mined includes the Company’s net share of the King

Mountain JV and excludes discontinued operations at Drumheller,

Alberta. Bitcoin mined excluding the Company’s net share of the

King Mountain JV was 212 and 568 for the three months ended June

30, 2024 and 2023, respectively, and 803 and 894 for the six months

ended June 30, 2024 and 2023, respectively.

- Energy capacity under management (mining) includes 180 MW of

self-mining site capacity comprising Alpha, Medicine Hat, and Salt

Creek, as well as 280 MW of capacity under management at the King

Mountain JV. The remaining 302 MW is from the Company’s Managed

Services agreement with Ionic Digital Inc.

- Total energy capacity under management includes 762 MW of

energy capacity under management (mining), 310 MW of capacity from

the Company’s four natural gas power generation facilities, and 3

MW of capacity from the Company’s five cloud and colocation data

centers.

Select Second Quarter 2024 Financial

Results

Revenue for the three months ended June 30, 2024 increased by

72% to $35.2 million from $20.5 million in the prior year period,

and consisted of $13.9 million in Digital Assets Mining revenue,

$9.0 million in Managed Services revenue, $3.4 million in High

Performance Computing – Colocation and Cloud revenue, and $8.9

million in Other revenue. Other consists primarily of hosting

services revenue and equipment sales, if any.

Cost of revenue exclusive of depreciation and amortization for

the three months ended June 30, 2024 was $20.6 million versus $12.0

million in the prior year period, and consisted of $7.5 million in

cost of revenue for Digital Assets Mining, $3.1 million in cost of

revenue for Managed Services, $2.5 million in cost of revenue for

High Performance Computing – Colocation and Cloud, and $7.5 million

in cost of revenue for Other.

Depreciation and amortization expense for the three months ended

June 30, 2024 was $11.5 million compared to $4.1 million for the

prior year period. The increase was primarily driven by property

and equipment acquired as part of the Business Combination and the

Company’s Far North transaction. Additionally, during the quarter

ended March 31, 2024, management performed an operational

efficiency review of its mining fleet, which resulted in a change

in the expected useful life of some of its mining equipment. The

result was an increase in depreciation expense of $1.5 million for

the three months ended June 30, 2024.

General and administration expenses for the three months ended

June 30, 2024 were $17.9 million versus $5.2 million in the prior

year period. This increase was driven by a $6.7 million increase in

stock-based compensation, a $2.4 million increase in salary and

benefit costs due to added headcount as part of the Business

Combination and to support the Company’s growth, a $2.0 million

increase related primarily to the relocation of miners to Alpha and

Salt Creek, and $3.4 million in other expenses related to being a

publicly listed entity, restructuring costs, and professional fees.

The increase in expenses was partially offset by a $1.9 million

decrease in sales tax expense driven by a $2.2 million refund of

sales taxes in Canada for the years prior to the Business

Combination.

Net loss attributable to Hut 8 for the three months ended June

30, 2024 was $71.9 million, compared to a loss of $1.7 million in

the prior year period. Subsequent to June 30, 2023, the Company

adopted ASU 2023-08, the new FASB fair value accounting rules for

digital assets, which requires Hut 8 to recognize its digital

assets at fair value with changes recognized in net income during

the reporting period. The price of Bitcoin on March 31, 2024 was

$71,289 compared to the price of Bitcoin on June 30, 2024 of

$62,668, such that the decrease in Bitcoin price during the quarter

resulted in losses on digital assets of $71.8 million.

Adjusted EBITDA for the three months ended June 30, 2024 was

($57.5) million, compared to $14.8 million in the prior year

period. The decrease was primarily driven by the $71.8 million loss

on digital assets.

As of June 30, 2024, the Company’s Bitcoin holdings were marked

at fair value and totaled $570.5 million, based on 9,102 Bitcoin

held in reserve.

A reconciliation of Adjusted EBITDA to the most comparable GAAP

measure, net income (loss), and an explanation of this measure has

been provided in the table included below in this press

release.

CONFERENCE CALL

The Hut 8 Corp. Q2 2024 webcast will commence at 8:30 a.m. ET,

today.

To join the live webcast, please visit this link.

Analyst Coverage of Hut 8:

A full list of Hut 8 Corp. analyst coverage can be found here:

https://hut8.com/investors/.

About Hut 8

Hut 8 Corp. is an energy infrastructure operator and Bitcoin

miner with self-mining, hosting, managed services, and traditional

data center operations across North America. Headquartered in

Miami, Florida, Hut 8 Corp.’s portfolio comprises twenty sites: ten

Bitcoin mining, hosting, and Managed Services sites in Alberta, New

York, Nebraska, and Texas, five high performance computing data

centers in British Columbia and Ontario, and four power generation

assets in Ontario, and one newly announced site in the Texas

Panhandle. For more information, visit www.hut8.com and follow us

on X (formerly known as Twitter) at @Hut8Corp.

Cautionary Note Regarding Forward–Looking

Information

This press release includes “forward-looking information” and

“forward-looking statements” within the meaning of Canadian

securities laws and United States securities laws, respectively

(collectively, “forward-looking information”). All information,

other than statements of historical facts, included in this press

release that address activities, events, or developments that Hut 8

expects or anticipates will or may occur in the future, including

statements relating to the Company’s restructuring and optimization

initiatives, fleet upgrade, commercialization of its

GPU-as-a-service vertical, scaling of its power footprint, the

value of high-quality power assets, access to energy capacity,

commitment to disciplined capital allocation, execution of a

commercial partnership for the Texas Panhandle site, building of a

next-generation energy infrastructure platform, advancement of its

development pipeline to address opportunities, and future business

strategy, competitive strengths, expansion, and growth of the

business and operations more generally, and other such matters is

forward-looking information. Forward-looking information is often

identified by the words “may”, “would”, “could”, “should”, “will”,

“intend”, “plan”, “anticipate”, “allow”, “believe”, “estimate”,

“expect”, “predict”, “can”, “might”, “potential”, “predict”, “is

designed to”, “likely,” or similar expressions.

Statements containing forward-looking information are not

historical facts, but instead represent management’s expectations,

estimates, and projections regarding future events based on certain

material factors and assumptions at the time the statement was

made. While considered reasonable by Hut 8 as of the date of this

press release, such statements are subject to known and unknown

risks, uncertainties, assumptions, and other factors that may cause

the actual results, level of activity, performance, or achievements

to be materially different from those expressed or implied by such

forward-looking information, including but not limited to, security

and cybersecurity threats and hacks, malicious actors or botnet

obtaining control of processing power on the Bitcoin network,

further development and acceptance of the Bitcoin network, changes

to Bitcoin mining difficulty, loss or destruction of private keys,

increases in fees for recording transactions in the Blockchain,

erroneous transactions, reliance on a limited number of key

employees, reliance on third party mining pool service providers,

regulatory changes, classification and tax changes, momentum

pricing risk, fraud and failure related to digital asset exchanges,

difficulty in obtaining banking services and financing, difficulty

in obtaining insurance, permits and licenses, internet and power

disruptions, geopolitical events, uncertainty in the development of

cryptographic and algorithmic protocols, uncertainty about the

acceptance or widespread use of digital assets, failure to

anticipate technology innovations, climate change, currency risk,

lending risk and recovery of potential losses, litigation risk,

business integration risk, changes in market demand, changes in

network and infrastructure, system interruption, changes in leasing

arrangements, failure to achieve intended benefits of power

purchase agreements, potential for interrupted delivery, or

suspension of the delivery, of energy to the Company’s mining

sites, and other risks related to the digital asset and data center

business. For a complete list of the factors that could affect the

Company, please see the “Risk Factors” section of the Company’s

Transition Report on Form 10-K for the transition period from July

1, 2023 to December 31, 2023, available under the Company’s EDGAR

profile at www.sec.gov, and Hut 8’s subsequent quarterly reports

and other continuous disclosure documents which are available under

the Company’s SEDAR+ profile at www.sedarplus.ca and under the

Company’s EDGAR profile at www.sec.gov.

Adjusted EBITDA

In addition to results determined in accordance with GAAP, Hut 8

relies on Adjusted EBITDA to evaluate its business, measure its

performance, and make strategic decisions. Adjusted EBITDA is a

non-GAAP financial measure. The Company defines Adjusted EBITDA as

net income (loss) before interest, taxes, depreciation and

amortization, further adjusted by the removal of unrealized gains

from the Company’s digital asset derivative transactions,

depreciation and amortization embedded in the equity in earnings

(losses) from an unconsolidated joint venture, foreign exchange

gains or losses, non-recurring transactions, losses from

discontinued operations, net income (loss) attributable to

noncontrolling interest, and stock-based compensation expense in

the period presented. You are encouraged to evaluate each of these

adjustments and the reasons the Company’s board of directors and

management team consider them appropriate for supplemental

analysis.

The Company’s board of directors and management team use

Adjusted EBITDA to assess its financial performance because it

allows them to compare operating performance on a consistent basis

across periods by removing the effects of capital structure (such

as varying levels of interest expense and income), asset base (such

as depreciation and amortization), and other items (such as

non-recurring transactions mentioned above) that impact the

comparability of financial results from period to period.

Net income (loss) is the GAAP measure most directly comparable

to Adjusted EBITDA. In evaluating Adjusted EBITDA, you should be

aware that in the future the Company may incur expenses that are

the same as or similar to some of the adjustments in such

presentation. The Company’s presentation of Adjusted EBITDA should

not be construed as an inference that its future results will be

unaffected by unusual or non-recurring items. There can be no

assurance that the Company will not modify the presentation of

Adjusted EBITDA in the future, and any such modification may be

material. Adjusted EBITDA has important limitations as an

analytical tool and you should not consider Adjusted EBITDA in

isolation or as a substitute for analysis of results as reported

under GAAP. Because Adjusted EBITDA may be defined differently by

other companies in the industry, the Company’s definition of this

non-GAAP financial measure may not be comparable to similarly

titled measures of other companies, thereby diminishing its

utility.

|

Hut 8 Corp. and SubsidiariesConsolidated

Statements of Operations and Comprehensive Income

(Loss)(Unaudited, in thousands, except share and per share

data) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 30, |

June 30, |

|

June 30, |

June 30, |

| |

|

|

2024 |

|

2023 |

|

|

|

2024 |

|

2023 |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Digital Assets Mining |

|

$ |

13,912 |

|

|

$ |

15,858 |

|

|

$ |

44,269 |

|

|

$ |

23,504 |

|

|

Managed Services |

|

|

9,017 |

|

|

|

4,672 |

|

|

|

18,252 |

|

|

|

10,199 |

|

|

High Performance Computing – Colocation and Cloud |

|

|

3,365 |

|

|

|

— |

|

|

|

6,691 |

|

|

|

— |

|

|

Other |

|

|

8,921 |

|

|

|

— |

|

|

|

17,744 |

|

|

|

2,474 |

|

| Total

revenue |

|

|

35,215 |

|

|

|

20,530 |

|

|

|

86,956 |

|

|

|

36,177 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue

(exclusive of depreciation and amortization shown

below): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue - Digital Assets Mining |

|

|

7,467 |

|

|

|

10,473 |

|

|

|

24,089 |

|

|

|

16,552 |

|

|

Cost of revenue - Managed Services |

|

|

3,120 |

|

|

|

1,514 |

|

|

|

5,881 |

|

|

|

3,897 |

|

|

Cost of revenue - High Performance Computing – Colocation and

Cloud |

|

|

2,500 |

|

|

|

— |

|

|

|

5,089 |

|

|

|

— |

|

|

Cost of revenue - Other |

|

|

7,549 |

|

|

|

— |

|

|

|

13,724 |

|

|

|

45 |

|

|

Total cost of revenue |

|

|

20,636 |

|

|

|

11,987 |

|

|

|

48,783 |

|

|

|

20,494 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses

(income): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

11,531 |

|

|

|

4,064 |

|

|

|

23,003 |

|

|

|

6,968 |

|

|

General and administrative expenses |

|

|

17,899 |

|

|

|

5,211 |

|

|

|

37,898 |

|

|

|

11,586 |

|

|

Losses (gains) on digital assets |

|

|

71,842 |

|

|

|

— |

|

|

|

(202,732 |

) |

|

|

— |

|

|

(Gain) loss on sale of property and equipment |

|

|

— |

|

|

|

— |

|

|

|

(190 |

) |

|

|

445 |

|

|

Realized gain on sale of digital assets |

|

|

— |

|

|

|

(1,004 |

) |

|

|

— |

|

|

|

(2,376 |

) |

|

Impairment of digital assets |

|

|

— |

|

|

|

868 |

|

|

|

— |

|

|

|

1,431 |

|

|

Legal settlement |

|

|

— |

|

|

|

(1,531 |

) |

|

|

— |

|

|

|

(1,531 |

) |

|

Total operating expenses (income) |

|

|

101,272 |

|

|

|

7,608 |

|

|

|

(142,021 |

) |

|

|

16,523 |

|

| Operating (loss)

income |

|

|

(86,693 |

) |

|

|

935 |

|

|

|

180,194 |

|

|

|

(840 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange gain (loss) |

|

|

720 |

|

|

|

— |

|

|

|

(1,679 |

) |

|

|

— |

|

|

Interest expense |

|

|

(6,012 |

) |

|

|

(5,657 |

) |

|

|

(12,293 |

) |

|

|

(13,232 |

) |

|

Gain on debt extinguishment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

23,683 |

|

|

Unrealized gain on derivatives |

|

|

17,219 |

|

|

|

— |

|

|

|

17,219 |

|

|

|

— |

|

|

Equity in earnings of unconsolidated joint venture |

|

|

2,440 |

|

|

|

3,358 |

|

|

|

6,962 |

|

|

|

6,642 |

|

| Total other income

(expense) |

|

|

14,367 |

|

|

|

(2,299 |

) |

|

|

10,209 |

|

|

|

17,093 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income from

continuing operations before taxes |

|

|

(72,326 |

) |

|

|

(1,364 |

) |

|

|

190,403 |

|

|

|

16,253 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax provision |

|

|

1,874 |

|

|

|

(322 |

) |

|

|

(2,522 |

) |

|

|

(611 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income from

continuing operations |

|

$ |

(70,452 |

) |

|

$ |

(1,686 |

) |

|

$ |

187,881 |

|

|

$ |

15,642 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from discontinued

operations (net of income taxes of $nil, $nil, $nil, $nil,

respectively) |

|

|

(1,738 |

) |

|

|

— |

|

|

|

(9,364 |

) |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss)

income |

|

|

(72,190 |

) |

|

|

(1,686 |

) |

|

|

178,517 |

|

|

|

15,642 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Less: Net loss

attributable to non-controlling interests |

|

|

324 |

|

|

|

— |

|

|

|

493 |

|

|

|

— |

|

| Net (loss) income

attributable to Hut 8 Corp. |

|

$ |

(71,866 |

) |

|

$ |

(1,686 |

) |

|

$ |

179,010 |

|

|

$ |

15,642 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per share

of common stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic from continuing operations attributable to Hut 8 Corp. |

|

$ |

(0.78 |

) |

|

$ |

(0.04 |

) |

|

$ |

2.10 |

|

|

$ |

0.37 |

|

|

Diluted from continuing operations attributable to Hut 8 Corp. |

|

$ |

(0.78 |

) |

|

$ |

(0.04 |

) |

|

$ |

2.00 |

|

|

$ |

0.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of shares of common stock outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic from continuing operations attributable to Hut 8 Corp. |

|

|

90,192,842 |

|

|

|

43,193,201 |

|

|

|

89,671,344 |

|

|

|

42,830,760 |

|

|

Diluted from continuing operations attributable to Hut 8 Corp. |

|

|

90,192,842 |

|

|

|

43,193,201 |

|

|

|

94,152,139 |

|

|

|

42,868,871 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss)

income |

|

$ |

(72,190 |

) |

|

$ |

(1,686 |

) |

|

$ |

178,517 |

|

|

$ |

15,642 |

|

|

Other comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

(7,362 |

) |

|

|

— |

|

|

|

(18,436 |

) |

|

|

— |

|

| Total comprehensive

(loss) income |

|

|

(79,552 |

) |

|

|

(1,686 |

) |

|

|

160,081 |

|

|

|

15,642 |

|

|

Less: Comprehensive loss attributable to non-controlling

interest |

|

|

423 |

|

|

|

— |

|

|

|

557 |

|

|

|

— |

|

| Comprehensive (loss)

income attributable to Hut 8 Corp. |

|

$ |

(79,129 |

) |

|

$ |

(1,686 |

) |

|

$ |

160,638 |

|

|

$ |

15,642 |

|

| |

Adjusted EBITDA reconciliation:

| |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

|

| |

|

June 30, |

|

June 30, |

Increase |

| (in USD thousands) |

|

2024 |

|

|

2023 |

|

(Decrease) |

|

Net loss |

|

$ |

(72,190 |

) |

|

$ |

(1,686 |

) |

|

$ |

(70,504 |

) |

|

Interest expense |

|

|

6,012 |

|

|

|

5,657 |

|

|

|

355 |

|

|

Income tax provision |

|

|

(1,874 |

) |

|

|

322 |

|

|

|

(2,196 |

) |

|

Depreciation and amortization |

|

|

11,531 |

|

|

|

4,064 |

|

|

|

7,467 |

|

|

Unrealized gain on derivatives |

|

|

(17,219 |

) |

|

|

— |

|

|

|

(17,219 |

) |

|

Share of unconsolidated joint venture depreciation and amortization

(1) |

|

|

7,837 |

|

|

|

7,627 |

|

|

|

210 |

|

|

Foreign exchange loss (gain) |

|

|

(720 |

) |

|

|

— |

|

|

|

(720 |

) |

|

Non-recurring transactions (2) |

|

|

21 |

|

|

|

(1,531 |

) |

|

|

1,552 |

|

|

Loss from discontinued operations |

|

|

1,738 |

|

|

|

— |

|

|

|

1,738 |

|

|

Net loss attributable to non-controlling interests |

|

|

324 |

|

|

|

— |

|

|

|

324 |

|

|

Stock-based compensation expense |

|

|

7,010 |

|

|

|

314 |

|

|

|

6,696 |

|

|

Adjusted EBITDA |

|

$ |

(57,530 |

) |

|

$ |

14,767 |

|

|

$ |

(72,297 |

) |

- Net of the accretion of fair value differences of depreciable

and amortizable assets included in equity in earnings of

unconsolidated joint venture in the Consolidated Statements of

Operations and Comprehensive Income (Loss) in accordance with ASC

323. See Note 8. Investments in unconsolidated joint venture of the

Company’s Unaudited Condensed Consolidated Financial Statements for

further detail.

- Non-recurring transactions for the three months ended June 30,

2024 represent approximately $1.5 million of miner relocation

costs, $0.7 million of restructuring costs, and a $2.2 million tax

refund. Non-recurring transactions for the three months ended June

30, 2023 represent a gain from a legal settlement of $1.5

million.

Contacts

Hut 8 Investor RelationsSue

Ennisir@hut8.com

Hut 8 Media Relationsmedia@hut8.com

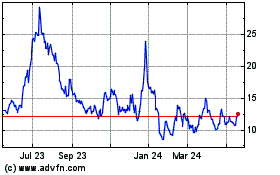

Hut 8 (TSX:HUT)

Historical Stock Chart

From Nov 2024 to Dec 2024

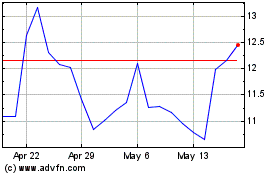

Hut 8 (TSX:HUT)

Historical Stock Chart

From Dec 2023 to Dec 2024