Kelso Technologies Inc. (“Kelso” or the “Company”), (TSX: KLS),

reports that it has released its unaudited consolidated interim

financial statements and Management Discussion and Analysis for the

three months ended March 31, 2024.

The unaudited consolidated interim financial

statements were prepared in accordance with International Financial

Reporting Standards (“IFRS”) as issued by the International

Accounting Standards Board (“IASB”). All amounts herein are

expressed in United States dollars (the Company’s functional

currency) unless otherwise indicated.

The Company’s unaudited consolidated financial

statements and MD&A for the three months ended March 31, 2024

were approved by the Board of Directors on May 13, 2024.

SUMMARY OF FINANCIAL

PERFORMANCE

|

|

Three months ended March 31 |

|

|

|

|

2024 |

|

|

2023 |

|

|

Revenues |

|

$ |

2,652,604 |

|

$ |

2,459,958 |

|

|

Gross profit |

|

$ |

1,109,826 |

|

$ |

1,086,568 |

|

|

Gross profit margin |

|

|

42 |

% |

|

44 |

% |

|

Non-cash expenses |

|

$ |

540,143 |

|

$ |

255,059 |

|

|

Termination settlement |

|

$ |

- |

|

$ |

(465,360 |

) |

|

Net income (loss) |

|

$ |

(698,759 |

) |

$ |

(786,677 |

) |

|

Basic earnings (loss) per share |

|

$ |

(0.01 |

) |

$ |

(0.01 |

) |

|

Adjusted EBITDA (loss) (1) |

|

$ |

(158,616 |

) |

$ |

(531,618 |

) |

|

(1) – Adjusted EBITDA for the three months ended March 31, 2024 and

2023 has been calculated as follows: |

|

|

Three months ended March 31 |

|

|

|

|

2024 |

|

|

2023 |

|

|

Net income (loss) |

|

$ |

(698,759 |

) |

$ |

(786,677 |

) |

|

Unrealized foreign exchange loss (gain) |

|

$ |

25,218 |

|

$ |

(21,584 |

) |

|

Amortization |

|

$ |

226,125 |

|

$ |

276,643 |

|

|

Income tax |

|

$ |

288,800 |

|

$ |

- |

|

|

Adjusted EBITDA (Loss) |

|

$ |

(158,616 |

) |

$ |

(531,618 |

) |

Adjusted EBITDA (loss) represents net earnings

or loss for the three months ended March 31, 2024 before interest,

taxes and tax recoveries, amortization, income tax and unrealized

foreign exchange losses. Adjusted EBITDA (loss) removes the effects

of items that do not reflect the Company’s underlying operating

performance and are not necessarily indicative of future operating

results. Adjusted EBITDA (loss) is not an earnings measure

recognized by IFRS and does not have a standardized meaning

prescribed by IFRS. Management believes that Adjusted EBITDA (loss)

is an alternative measure in evaluating the Company's operational

performance and its ability to generate cash to finance business

operations.

Readers are cautioned that Adjusted EBITDA

should not be construed as an alternative to net income as

determined under IFRS; nor as an indicator of financial performance

as determined by IFRS; nor a calculation of cash flow from

operating activities as determined under IFRS; nor as a measure of

liquidity and cash flow under IFRS. The Company's method of

calculating Adjusted EBITDA may differ from methods used by other

issuers and, accordingly, the Company's Adjusted EBITDA may not be

comparable to similar measures used by any other issuer.

LIQUIDITY AND CAPITAL

RESOURCES

As at March 31, 2024 the Company had cash on

deposit in the amount of $1,066,089, accounts receivable of

$939,641 prepaid expenses of $96,010 and inventory of $3,824,083

compared to cash on deposit in the amount of $1,433,838, accounts

receivable of $1,065,411 prepaid expenses of $134,349 and inventory

of $3,376,005 at December 31, 2023.

The Company had income tax payable of $298,824

at March 31, 2024 compared to $10,024 at December 31, 2023.

The working capital position of the Company as

at March 31, 2024 was $4,023,140 compared to $5,026,580 as at

December 31, 2023. Capital resources and operations are to be

expected to continue the Company’s ability to conduct ongoing

business as planned for the foreseeable future.

Total assets of the Company were $10,207,748 as

at March 31, 2024 compared to $9,703,271 as at December 31, 2023.

Net assets of the Company were $8,021,489 as at March 31, 2024

compared to $8,720,248 as at December 31, 2023. The Company had no

interest-bearing long-term liabilities or debt as at March 31, 2024

or December 31, 2023.

OUTLOOK

During the first quarter of 2024, Kelso

continued to strengthen the portfolio of its rail products by

closely monitoring those products near completion of the required

AAR service trial period. The strategic focus is to obtain full AAR

approvals in 2024 to complete our entire portfolio of rail pressure

car products. This has been the Company’s core branding ambition

over the past fourteen years and it is expected to close in

2024.

In 2024 OEM rail tank car deliveries and orders

are holding fairly stable and backlogs remain firm and consistent

with 2023 (8,257 units). There is a shift toward rail pressure

cars and the Company is completing the last stages of an AAR

regulatory approved rail pressure car kit in 2024 to drive new

sources of sales growth. The Company has fully developed production

systems including supply chain, inventory levels, reliable costs,

selling prices and predictable profitability that are expected to

remain stable in 2024.

The economic outlook for the rail tank car

industry is one of continued slow growth with current deliveries in

line with replacement demand levels. Tank car demand is

unpredictable, but deliveries are expected to remain stable through

the first half of 2024.

Freight moved by tank cars, the core business of

the Company took a severe hit at the start of the pandemic and has

yet to see any meaningful recovery. This is significant in that

there are already enough tank cars to move the amount of freight in

the system. This situation suggests that there is no apparent

catalyst to expand the tank car fleet in the foreseeable

future.

The level of activity for tank car orders and

deliveries puts the segment on track for the lower end of

replacement demand for 2024 and 2025. The current forecast has 2024

tank car deliveries in the range from 7,000 units to 10,000 units

and continues at this level throughout 2025. Longer-term

replacements could average between 10,000 and 12,000 units per

year. Despite current macroeconomic challenges the Company is in a

good position to service all product orders from the rail tank car

industry for the foreseeable future.

Despite the many ever-present challenges, the

Company has survived and still believes that it can exploit its

growing competitive advantages in the rail industry. Our goal is to

become the primary domestic supplier of high-quality products

featuring our 100% “Made in USA” product line fully servicing the

rail tank car market.

Key to the development of the Company’s rail

revenue growth ambitions in 2024 is the full AAR approval of our

pressure car package. This package sells at a much higher tank car

unit value. It is expected to grow rail car revenue from an average

of $1,500 per tank car to over $10,000 per tank car. Our

specialized angle valves for the pressure car package have

completed their service trial and are in the final stages of the

full AAR approval process. The AAR approvals are the key milestone

to establish new revenue growth from rail related products. Our

goal is to fully service the needs of the pressure car market fleet

that stands at approximately 86,000 tank cars. This provides a

significant financial growth opportunity to pursue while continuing

to obtain AAR approvals for the additional products in the R&D

pipeline.

Since mid 2021 the Company’s automotive

innovation development operations have been heavily engaged in

creating a unique fully automated “center-of-gravity” oriented

Advanced Driver-Assistance System (“ADAS”) designed specifically to

provide a safer “anti rollover” operating system for commercial

wilderness travel. In 2023 the Company confirmed that it had

created the first “field-tested” automated suspension-based ADAS

for emergency and commercial mission-critical wilderness

operations. Our ADAS technologies are specifically designed to

address the challenging issues of worker well-being and safety as

well as ecological protection while delivering effective and

efficient operational advantages to wilderness operating

stakeholders. The innovation design objectives are to create

products that diminish the potentially dangerous effects of human

and technology error through the use of the Company’s proprietary

engineered solutions.

On September 12, 2023 the Company’s KXI

Wildertec™ Software Division filed the first stage proprietary

patent application for its Automated Traction Optimization Method

for Vehicle Suspension Systems (“Method”). The Patent Application

forms the Company’s initial proprietary claims and intellectual

foundation for its future KXI Wildertec™ technologies. This patent

application filing begins the Company’s comprehensive proprietary

protection program for additional protectable full automation ADAS

developments and firmly positions the Company’s artificial

intelligence intentions. The grant of the Canadian Patent on our

Method technologies will be a key cornerstone event for the

Company’s business development ambitions.

In the automotive industry, ADAS refers to

specialized automated technical features that are designed to

increase the safety of operating motor vehicles on existing

roadways. Current automotive industry design ambitions are to use

human-machine interfaces that can assist a driver’s ability to

react to dangers on established roads. Upon extensively field

testing the unique Method, Kelso’s intelligence supports that the

Company is the first enterprise to demonstrate a functional

automated suspension-specific ADAS for commercial wilderness

applications. This is a major technological development advantage

for the Company to grow future revenues from specialized automotive

markets.

Very little emphasis, if any, by the automotive

world has addressed ADAS requirements in wilderness operations. Our

strategic business objectives are to lead the way on ADAS for

no-road environments for emergency responders,

commercial/industrial stakeholders and humanitarian aide and

defense customers. Our business ambition is to participate in the

emerging global ADAS software market which is estimated to reach

the $80 billion mark by 2030 as reported by industry experts,

McKinsey & Company.

In February 2024 the Company established an

initial Phase-One Pilot production facility with additional leased

space at its current R&D facility in West Kelowna, BC, Canada.

This production facility is being designed and tooled to convert

multiple classes of heavy duty “host” vehicles with the Company’s

patents pending proprietary Method technologies. These vehicles are

designed to be sold or leased to customers operating in extreme

terrain environments who have specified their custom user case

requirements utilizing our Method technologies.

The Method is now regulatory compliant for sales

to commercial wilderness operations including existing forestry

roads. The KXI equipped vehicle is compliant for operation on all

resource and private roads through an all-terrain vehicle insurance

policy. The ambition is to obtain the necessary federal and

regional compliance approvals to enable the technology to operate

on all roadways as early as 2025.

The low capital investment reflects the ease of

conversion of the “host” vehicle to the Method system in order to

minimize the costs of the final salable vehicle. Management is

currently developing longer-term scheduling logistics, supply chain

procurement systems, optimal inventory levels, labor and staffing

needs and product design enhancements, continuing R&D needs,

advancing engineering quality controls and general risk management

controls.

Once completed the Phase-One facility is

expected to have the potential to generate approximately $25

million of annual revenue currently expected to commence in early

2025. The facility houses R&D, Phase-One production and an

on-site test track.

The Company will concentrate its production

resources on delivering safety enhancing technology solutions for

customers in, but not limited to, disaster response, wilderness

fire fighting, mobile medical treatment, evacuation and emergency

response, mining and exploration, energy transmission, civil

engineering projects, telecommunications and

geographic/environmental data systems.

In 2024, the Company continues to make progress

in its research and development to create new innovative products.

Timing of required regulatory approvals on new rail and automotive

products and corresponding revenue streams remains unpredictable

and cannot be guaranteed to be successful.

The Company feels it is on course for new value

creation as we look forward to new business success in both rail

and automotive markets. Management has determined a clear path for

the commercialization of our new products in order to provide

longer-term profitable revenue growth. With no interest-bearing

long-term debt to service and improved sales prospects from larger

diverse markets, Kelso can focus on the growth of its equity value

from financial performance generated from a wider range of new

proprietary products.

About Kelso Technologies

Kelso is a diverse engineering company that

specializes in the creation, production, sales and distribution of

proprietary products used in rail and automotive transportation.

The Company’s rail engineering business has been developed as a

designer and reliable domestic supplier of unique high-quality rail

tank car valves that provide for the safe handling and containment

of hazardous and non-hazardous commodities during rail transport.

The automotive division of the Company has created the first proven

automated suspension-based Advanced Driver Assistance System for

commercial mission-critical wilderness operations. All Kelso

products are specifically designed to address the challenging

issues of public safety, worker well-being and potential

environmental harm while providing effective and efficient

operational advantages to customers. Kelso’s innovation objectives

are to create products that diminish the potentially dangerous

effects of human and technology error through the use of the

Company’s portfolio of proprietary products.

For a more complete business and financial

profile of the Company, please view the Company's website at

www.kelsotech.com and public documents posted under the Company’s

profile on www.sedar.com in Canada and on EDGAR at www.sec.gov in

the United States.

On behalf of the Board of

Directors,

James R. Bond, CEO and President

Legal Notice Regarding Forward-Looking

Statements: This news release contains “forward-looking

statements” within the meaning of applicable securities

legislation. Forward-looking statements are indicated expectations

or intentions. Forward-looking statements in this news release

include that our new rail products can sell for much higher unit

values and are expected to grow our rail car revenue from an

average of $1,500 per tank car to over $10,000 per tank car once

AAR approvals are secured; that our specialized angle valves for

the pressure car market have completed their service trial and are

in the final stages of the full AAR approval process; that although

the rail industry is fully depressed there is still a bona fide

opportunity for Kelso to grow its revenues by being able to fully

service the repair, retrofit and requalification activities by

hazmat shippers with a broader range of “100% Made in the USA”

technologies; that the Company is now concentrating its resources

on developing KXI Wildertec Application Development Agreements for

various industrial applications; and that current working capital

and anticipated sales activity at above average contribution

margins for 2024 are expected to protect the Company’s ability to

conduct ongoing business operations and R&D initiatives for the

foreseeable future. Although Kelso believes the Company’s

anticipated future results, performance or achievements expressed

or implied by the forward-looking statements and information are

based upon reasonable assumptions and expectations, they can give

no assurance that such expectations will prove to be correct. The

reader should not place undue reliance on forward-looking

statements and information as such statements and information

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

Kelso to differ materially from anticipated future results,

performance or achievement expressed or implied by such

forward-looking statements and information, including without

limitation that the risk that the longer-term effects on the rail

and automotive industries including high interest rates, inflation

and short supply chain issues may last much longer than expected

delaying R&D schedules and business orders from customers; that

the development of new products may proceed slower than expected,

cost more or may not result in a salable product; that tank car

producers may produce or retrofit fewer than cars than expected and

even if they meet expectations, they may not purchase the Company’s

products for their tank cars; capital resources may not be adequate

enough to fund future operations as intended; that regulatory

compliance including Canadian Motor Vehicle Safety Standards may be

delayed or cancelled; that the Company’s products may not provide

the intended economic or operational advantages to end users; that

KXI Application Development Agreements may not be successful and

deliver anticipated revenue streams; that the Company’s new rail

and automotive products may not receive regulatory certification;

that customer orders may not develop or be cancelled; that

competitors may enter the market with new product offerings which

could capture some of the Company’s market share; that a new

product idea under research and development may be dropped if

ongoing product testing and market research reveal engineering and

economic issues that render a new product concept infeasible; and

that the Company’s new equipment offerings may not capture market

share as well as expected. Except as required by law, the Company

does not intend to update the forward-looking information and

forward-looking statements contained in this news release.

For further information, please

contact:

| James R.

Bond, CEO and President |

Richard Lee,

Chief Financial Officer |

Corporate

Address: |

|

Email: bond@kelsotech.com |

Email: lee@kelsotech.com |

13966 -

18B Avenue South Surrey, BC V4A 8J1 www.kelsotech.com |

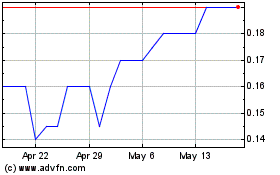

Kelso Technologies (TSX:KLS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Kelso Technologies (TSX:KLS)

Historical Stock Chart

From Nov 2023 to Nov 2024