Melcor Real Estate Investment Trust Prices $83 Million Initial Public Offering

20 April 2013 - 8:07AM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED

STATES

Melcor Developments Ltd. (TSX:MRD) and Melcor Real Estate Investment Trust (the

"REIT") announced today that the REIT has filed, and obtained a receipt for, a

final prospectus for its initial public offering of 8,300,000 trust units with

the securities commissions of all provinces and territories in Canada. The trust

units will be issued at a price of $10.00 per trust unit and are expected to

provide holders of trust units with an annual yield of 6.75%. Gross proceeds of

the offering are expected to be $83,000,000.

The offering is being underwritten by a syndicate of underwriters co-led by RBC

Capital Markets and CIBC, and including BMO Nesbitt Burns, TD Securities Inc.,

Desjardins Securities Inc., National Bank Financial Inc., Scotia Capital Inc.,

Canaccord Genuity Corp. and Laurentian Bank Securities Inc. Melcor Developments

Ltd. and the REIT have granted to the underwriters an over-allotment option to

purchase up to an additional 830,000 trust units at a price of $10.00 per unit

for a period of 30 days after closing of the offering and, if exercised in full,

will increase the total gross proceeds of the offering to Melcor and the REIT to

$91,300,000.

The Toronto Stock Exchange (the "TSX") has conditionally approved the listing of

the trust units under the symbol "MR.UN", subject to fulfilling all of the

requirements of the TSX.

The REIT initially intends to make monthly cash distributions to its unitholders

at a rate of $0.05625 per trust unit, which are initially expected to provide an

annual yield of 6.75%. The first cash distribution, which will be for the period

from the date of closing of the offering to May 31, 2013, is expected to be paid

on or about June 14, 2013 to unitholders of record on May 31, 2013, in an amount

estimated to be $0.05625 per unit (assuming the closing occurs on May 1, 2013).

The offering is expected to close on May 1, 2013.

On closing of the initial public offering, it is expected that Melcor

Developments Ltd. (collectively, with its affiliates, "Melcor") will directly or

indirectly hold a 55.5% interest in the REIT (51.1% if the over-allotment option

is exercised in full). Melcor's experienced real estate team will externally

administer and operate the REIT's properties.

Copies of the final prospectus are available under the REIT's profile on SEDAR

at www.sedar.com.

The trust units have not been, nor will they be, registered under the United

States Securities Act of 1993, as amended, and may not be offered, sold or

delivered, directly or indirectly, in the United States or to, or for the

account or benefit of, "U.S. persons" (as defined in Regulation S under the

United States Securities Act of 1933, as amended). This press release does not

constitute an offer to sell or a solicitation of an offer to buy any of the

trust units in the United States or to, or for the account or benefit of, U.S.

Persons.

About Melcor Developments Ltd.

Melcor is a diversified real estate development and management company with a

rich heritage of integrity and innovation in real estate since 1923.

Through four integrated operating divisions, Melcor manages the full life cycle

of real estate development: from acquiring raw land, to community planning, to

construction and development, to owning and managing leasable office, retail and

residential sites. Melcor develops and manages mixed-use residential

communities, business and industrial parks, office buildings, retail commercial

centres and golf courses.

Melcor's headquarters are located in Edmonton, Alberta, with regional offices

throughout Alberta and British Columbia. Company developments span Western

Canada and the US. Melcor has been a public company since 1968 and trades on the

Toronto Stock Exchange (TSX:MRD).

Forward-Looking Statements

This press release may contain forward-looking information within the meaning of

applicable securities legislation, which reflects Melcor's and the REIT's

current expectations regarding future events. Forward-looking information is

based on a number of assumptions and is subject to a number of risks and

uncertainties, many of which are beyond Melcor's or the REIT's control, that

could cause actual results and events to differ materially from those that are

disclosed in or implied by such forward-looking information. Such risks and

uncertainties include, but are not limited to, failure to complete the initial

public offering of trust units and related transactions, and the factors

discussed under "Risk Factors" in the final prospectus of the REIT dated April

19th, 2013. Neither Melcor nor the REIT undertake any obligation to update such

forward-looking information, whether as a result of new information, future

events or otherwise, except as expressly required by applicable law.

For more information, visit the REIT's website at www.melcorREIT.ca and the

REIT's and Melcor's respective issuer profiles at www.sedar.com

FOR FURTHER INFORMATION PLEASE CONTACT:

Brian Baker - Business Contact

President & COO, Melcor Developments Ltd.

Trustee, Melcor Real Estate Investment Trust

780-423-6931

Darin Rayburn - Business Contact

Executive Vice-President, Melcor Developments Ltd.

CEO, Melcor Real Estate Investment Trust

780-423-6931

Investor Relations

Jonathan Chia, CA

CFO, Melcor Developments Ltd.

CFO, Melcor Real Estate Investment Trust

780-423-6931

www.melcorREIT.ca

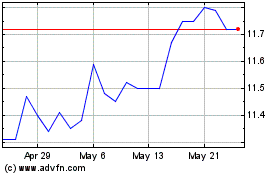

Melcor Developments (TSX:MRD)

Historical Stock Chart

From May 2024 to Jun 2024

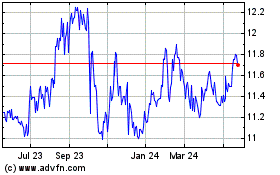

Melcor Developments (TSX:MRD)

Historical Stock Chart

From Jun 2023 to Jun 2024