Maxim Power Corp. Announces 2014 First Quarter Financial and Operating Results

07 May 2014 - 8:36AM

Marketwired Canada

Maxim Power Corp. ("MAXIM" or the "Corporation") (TSX:MXG) announced today the

release of financial and operating results for the first quarter ended March 31,

2014. The unaudited condensed consolidated interim financial statements,

accompanying notes and Management Discussion and Analysis will be available on

SEDAR and on MAXIM's website on May 6, 2014. All figures reported herein are

Canadian dollars unless otherwise stated.

FINANCIAL HIGHLIGHTS

Three Months Ended

March 31

($ in thousands except per share amounts) 2014 2013

Revenue $ 69,132 $ 55,504

Adjusted EBITDA (1) 16,573 14,067

Adjusted net income (1) 3,815 4,990

Per share - basic and diluted $ 0.07 $ 0.09

Net income attributable to shareholders 3,487 4,586

Per share - basic and diluted $ 0.06 $ 0.08

Funds from operations (2) 15,001 14,114

Per share - basic and diluted $ 0.28 $ 0.26

Electricity Deliveries (MWh) 338,221 302,202

Net Generation Capacity (MW) (3) 785 804

Average Alberta power price - market ($ per MWh) $ 60.59 $ 65.30

Average Alberta power price - Milner realized ($ per

MWh) $ 78.93 $ 95.43

Average US power price - Northeast U.S. realized (US$

per MWh) $ 282.28 $ 240.38

(1) Select financial information was derived from the audited consolidated

financial statements and is prepared in accordance with IFRS, except

adjusted EBITDA and adjusted net income. Adjusted EBITDA is provided to

assist management and investors in determining the Corporation's

approximate operating cash flows before interest, income taxes, and

depreciation and amortization and certain other income and expenses.

Adjusted net income is used to compare MAXIM's results among reporting

periods without consideration of unrealized gains and losses and to

evaluate MAXIM's performance. Adjusted EBITDA and adjusted net income do

not have any standardized meaning prescribed by IFRS and may not be

comparable to similar measures presented by other companies.

(2) Funds from operating activities before changes in working capital

("FFO") is an Additional GAAP measure provided to assist management and

investors in determining the Corporation's cash flows generated by

operations before the cash impact of working capital fluctuations.

(3) Generation capacity is manufacturer's nameplate capacity net of minority

ownership interests of third parties.

OPERATING RESULTS

Revenue, adjusted EBITDA and funds from operations increased in the first

quarter of 2014 when compared to the first quarter of 2013. The increase in

these financial measures is primarily due to an increase in generation in the

Northeast U.S. at Pittsfield and CDECCA in conjunction with higher average

realized prices at those two facilities.

Adjusted net income and net income attributable to shareholders decreased in the

first quarter of 2014 when compared to the first quarter of 2013 on foreign

exchange losses of certain foreign currency denominated loans, which is fully

offset by an increase in Other Comprehensive Income.

ALBERTA UTILITIES COMMISSION ("AUC") LOSS FACTOR DECISION

On April 16, 2014, the AUC rendered its decision with respect to applications

made to review and vary its previous decision on a complaint made by the

Corporation on transmission loss factor rules and loss factor methodologies

adopted by the Alberta Electric System Operator ("AESO") and applied in the

Alberta wholesale electricity market for the period from 2006 to 2008. The AUC

has upheld the complaint made by the Corporation that the current ISO Line Loss

Rules contravene the Transmission Regulation and are unjust, unreasonable,

unduly preferential, arbitrarily or unjustly discriminatory and inconsistent

with or in contravention of the 2003 Electric Utilities Act. The AUC will

proceed with the second phase of its consideration of Milner's complaint to

determine the relief or remedy to be given. MAXIM anticipates that these

proceedings will establish compensation to MAXIM. As at the date of this Press

Release, an estimate of this amount and its timing cannot be made.

FEDERAL ENERGY REGULATORY COMMISSION ("FERC") INQUIRY

FERC has continued its non-public confidential inquiry related to MAXIM's supply

of electricity to the ISO New England market. FERC's Office of Enforcement

("OE") communicated to MAXIM its preliminary findings on this matter. OE is

asserting that MAXIM received unjust gains of approximately $23 million for

which it should be required to repay amounts not already repaid (MAXIM repaid

approximately $3 million in 2010 through the ISO-NE mitigation program), and pay

a civil penalty calculated based on the amount of unjust gains. The preliminary

findings of the OE do not constitute a finding or order of FERC. MAXIM and its

external legal counsel strongly disagree with the preliminary findings of OE and

have made a submission to OE and FERC refuting these allegations. No provision

has been recorded in the first quarter financial statements related to this

matter as in the opinion of management after seeking external legal advice, as

of the date of this Press Release, it is not probable that a liability exists.

GROWTH INITIATIVES

Summit Coal Limited Partnership ("SUMMIT")

SUMMIT is MAXIM's development initiative located north of Grande Cache, Alberta

that owns metallurgical coal leases for Mine 14 ("M14") and Mine 16S ("M16S").

This initiative is construction ready and is the most advanced metallurgical

coal mine development project in North America.

Current estimates for M14 are 18.9 million tonnes of low-mid volatile

metallurgical coal reserves with a mine life of 17 years based on the NI 43-101

Technical Report filed on SEDAR on March 21, 2013. M16S is located 30 kilometers

northwest of M14 and represents 1,792 hectares or 29% of SUMMIT's total area of

coal leases. A NI 43-101 Technical Report has not been prepared for the Mine 16S

property. The coal quality of M14 has been tested by numerous potential buyers

and independent labs and is a very coveted mid to low volume coking coal with

other attributes which are best in class.

The Corporation considers the advancement of the M14 and M16S development

projects strategic for MAXIM primarily because of the value of metallurgical

coal and partially due to Milner's ability to utilize tailings and lower quality

fuels, which are by-products of the beneficiation of coal, to produce

electricity. All monetization options including: i) construction, own and

operate, ii) joint venture or iii) outright sale, have been preserved for SUMMIT

and the evaluation of these options is ongoing.

Deerland Peaking Station ("D1")

MAXIM is actively pursuing commercial arrangements that will allow for the

full-scale construction of the 190 MW D1 Station to commence during 2014. In

2012, MAXIM entered into an agreement to secure firm natural gas transportation

services for D1. MAXIM had previously received regulatory approvals to construct

and operate D1. The D1 site is located near Bruderheim in Alberta's Industrial

Heartland, and it is in close proximity to the entry point of the proposed

Gateway pipeline and adjacent to the existing Deerland high voltage substation.

This area is expected to experience significant growth in electrical demand.

D1 is the only permitted peaking development project in the province of Alberta

as at the date of this press release. This project is attractive due to an

anticipated contraction of reliable base load supply in the Alberta power

market. The Corporation incurred costs in 2014 related to engineering and

design, determining the natural gas pipeline selection route, and consultations

with landowners. Additional costs will be incurred in 2014 to secure the right

of way for the gas pipeline and to advance the electrical interconnection and

engineering work.

Milner Expansion ("M2")

The AUC has granted MAXIM approval to develop a 500 MW generating facility

adjacent to the existing 150 MW generating facility ("M1"). A lengthy public

consultation and regulatory process culminated in the project's final approval

by the AUC on August 10, 2011. On September 12, 2012 the Government of Canada

enacted new greenhouse gas legislation that limits the amount of carbon dioxide

emitted by coal-fired generation facilities. As a result of the new greenhouse

gas legislation, on November 15, 2013, MAXIM submitted amendments for the

existing M2 permit that would convert the M2 fuel source from coal to natural

gas. MAXIM expects approval of these submissions by the third quarter of 2014.

The corporation incurred costs in 2014 related to engineering and consulting

work for permit amendments and will incur further costs in 2014 on engineering

consultation.

Buffalo Atlee ("B1")

MAXIM acquired the B1 Power Project, situated near Brooks, Alberta, through an

amalgamation with EarthFirst Canada Inc. This project has the potential for

development of over 200 MW of wind generation capacity. Wind data has been

collected on the site for approximately six years and supports project

development based on expected new provincial greenhouse gas legislation and/or

higher power prices than currently forecasted. MAXIM holds an exploratory Crown

land permit with a term of five years, expiring on January 1, 2016. The addition

of wind generation to MAXIM's existing portfolio of assets will diversify

MAXIM's generation fuel types and provide the potential to offset the impact of

expected new provincial greenhouse gas legislation.

CONFERENCE CALL FOR Q1 2014 RESULTS

MAXIM will host a conference call for analysts and investors on Wednesday, May

7, 2014 at 11:00 am MDT. The call will be hosted by John Bobenic, MAXIM's

President and Chief Executive Officer, and by Mike Mayder, Vice President,

Finance and Chief Financial Officer. To participate in this conference call

please dial (877) 223-4471 or (647) 788-4922 in the Toronto area. It is

recommended that participants call at least ten minutes prior to start time.

A recording of the conference call will be available from May 8, 2014 to May 15,

2014. To access the replay, dial (800) 585-8367 or (416) 621-4642 followed by

the passcode 34595173. In addition, the recording will be available commencing

May 8, 2014 in the Investor Relations section of MAXIM's website at

www.maximpowercorp.com.

About MAXIM

Based in Calgary, Alberta, MAXIM is an independent power producer, which

acquires or develops, owns and operates innovative and environmentally

responsible power and power related projects. MAXIM currently owns and operates

40 power plants in western Canada, the United States and France, having 785 MW

of electric generating capacity. MAXIM trades on the TSX under the symbol "MXG".

For more information about MAXIM, visit our website at www.maximpowercorp.com.

Statements in this release which describe MAXIM's intentions, expectations or

predictions, or which relate to matters that are not historical facts are

forward-looking statements. These forward-looking statements involve known and

unknown risks and uncertainties which may cause the actual results, performances

or achievements of MAXIM to be materially different from any future results,

performances or achievements expressed in or implied by such forward-looking

statements. MAXIM may update or revise any forward-looking statements, whether

as a result of new information, future events or changing market and business

conditions and will update such forward-looking statements as required pursuant

to applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Maxim Power Corp.

John R. Bobenic

President and CEO

(403) 750-9300

Maxim Power Corp.

Michael R. Mayder

Vice President, Finance and CFO

(403) 750-9311

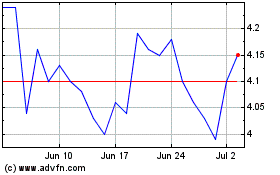

Maxim Power (TSX:MXG)

Historical Stock Chart

From Nov 2024 to Dec 2024

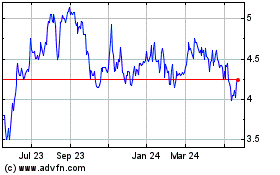

Maxim Power (TSX:MXG)

Historical Stock Chart

From Dec 2023 to Dec 2024