(TSX: NWC): The North West

Company Inc. (the "Company" or "North West") today reported its

unaudited financial results for the first quarter ended

April 30, 2021. It also announced that the Board of Directors

have declared a dividend of $0.36 per share to shareholders of

record on June 30, 2021, to be paid on July 15, 2021.

"Growth continued in our first quarter with some

banners up strongly, even compared to their exceptional results in

the first quarter of 2020. Our cost structure is leaner and our

retail businesses are more profitable and less volatile as a whole,

after the divestiture of most of our Giant Tiger stores last year.

In addition, our air cargo business achieved another quarter of

high utilization, offsetting the ongoing weakness in

Pandemic-related passenger volumes," commented President & CEO,

Edward Kennedy. "Our team is pulling together like we always have,

but even more so since the Pandemic started as we actively work on

post-Pandemic opportunities. Looking ahead to my retirement on

August 1st, I am immensely grateful for the opportunity I've had to

be CEO of North West for so long. I have worked closely with Dan

McConnell for the past 19 years and combined with our robust

transition process, I have full confidence in his ability to bring

great energy and leadership to the role."

"North West is a company with never-ending

potential," commented incoming CEO Dan McConnell. "I am excited

about every facet of this opportunity to step-up and engage all

Nor'Westers in shaping our future as a leading, trusted company in

the communities we serve."

Financial Highlights

First quarter sales decreased 7.0% to $551.0

million compared to the first quarter last year as same store sales

gains were more than offset by the sale and closure of most of the

Company's Giant Tiger stores last year (the "Giant Tiger

Transaction") and the negative impact of foreign exchange on the

translation of International Operations sales. Excluding the

foreign exchange impact, sales decreased 4.1%, with food sales

decreasing 5.0% and general merchandise sales decreasing 10.6% due

to the Giant Tiger Transaction. On a same store basis, sales

increased 3.8%1 on top of a 15.5% increase in the first quarter

last year driven by COVID-19-related factors including continuing

in-community spending and government income support for

individuals, combined with superior in-stock conditions. Food same

store sales increased 0.5% building on a 16.3% increase last year

and general merchandise same store sales were up 23.9% on top of a

12.0% increase last year.

Gross profit decreased 0.9% due to the impact of

lower sales partially offset by a 206 basis point increase in gross

profit rate compared to last year. The increase in gross profit

rate was primarily due to favourable changes in product sales blend

and higher inventory turns contributing to lower markdowns and

inventory shrinkage. These factors were partially offset by the

impact of lower margin wholesale food sales to the 36 Giant Tiger

stores that were acquired by Giant Tiger Stores Limited as part of

the Giant Tiger Transaction.

Selling, operating and administrative expenses

("Expenses") decreased $38.4 million compared to last year and are

down 487 basis points as a percentage to sales largely due to the

Non-Comparable Factors which included an $8.6 million

insurance-related gain this year, changes in share-based

compensation costs, a $9.4 million Giant Tiger store closure

provision related to the Giant Tiger Transaction and $5.0 million

in support office employee severance costs in Canadian Operations

last year. Share-based compensation costs increased $3.6 million

primarily due to mark-to-market adjustments resulting from changes

in the Company's share price. Excluding the Non-Comparable Factors,

Expenses decreased $19.1 million and were down 157 basis points as

a percentage to sales primarily due to lower store expenses related

to the Giant Tiger Transaction, a decrease in Canadian

administration costs and lower COVID-19-related expenses.

Earnings from operations increased $36.8 million

to $56.3 million compared to $19.5 million last year and earnings

before interest, income taxes, depreciation and amortization

(EBITDA2) increased $35.3 million to $78.7 million partially due to

the impact of the Non-Comparable Factors. Adjusted EBITDA2, which

excludes the Non-Comparable Factors, increased $15.9 million

compared to last year and as a percentage to sales was 13.7%

compared to 10.1% due to the sales, gross profit and Expense

factors previously noted.

Net earnings increased $28.0 million to $40.3

million. Net earnings attributable to shareholders were $39.7

million and diluted earnings per share were $0.80 per share

compared to $0.23 per share last year due to the factors noted

above. Adjusted net earnings2, which excludes the after-tax impact

of the Non-Comparable Factors, increased $13.3 million compared to

last year driven by earnings gains in Canadian Operations and

International Operations.

Further information on the financial results is

available in the Company's 2021 first quarter Report to

Shareholders, Management's Discussion and Analysis and unaudited

interim period condensed consolidated financial statements which

can be found in the investor section of the Company's website at

www.northwest.ca.

First Quarter Conference

Call

North West will host a conference call results

on June 9, 2021 at 2:00 p.m. (Central Time). To access the

call, please dial 416-340-2217 or 800-806-5484 with a pass code of

5505897. The conference call will be archived and can be accessed

by dialing 905-694-9451 or 800-408-3053 with a pass code of 2146067

on or before July 10, 2021.

Notice to

Readers

Certain forward-looking statements are made in

this news release, within the meaning of applicable securities

laws. These statements reflect North West's current expectations

and are based on information currently available to management. The

words may, will, should, believe, expect, plan, anticipate, intend,

estimate, predict, potential, continue, or the negative of these

terms, identify forward-looking matters. These statements speak

only as of the date of this press release. The actual results could

differ materially from those anticipated in these forward-looking

statements.

Reliance should not be placed on forward-looking

statements because they involve known and unknown risks,

uncertainties and other factors, which may cause the actual

results, performance, capital expenditures or achievements of North

West to differ materially from anticipated future results,

performance, capital expenditures or achievement expressed or

implied by such forward-looking statements, including the Company's

intentions regarding a normal course issuer bid, the anticipated

impact of the COVID-19 pandemic on the Company's operations and the

Company's related business continuity plans and the realization of

expected savings from administrative cost reduction plans. Factors

that could cause actual results to differ materially from those set

forth in the forward-looking statements include, but are not

limited to, business performance, fluctuations in interest rates

and currency values, legislative and regulatory developments, legal

developments, the occurrence of weather-related and other natural

catastrophes, changes in tax laws, and those risks and

uncertainties detailed in the section entitled Risk Factors in

North West's Management's Discussion and Analysis and Annual

Information Form, both for the year-ended

January 31, 2021. The preceding list is not an exhaustive

list of possible factors. These and other factors should be

considered carefully and readers are cautioned not to place undue

reliance on these forward-looking statements. North West undertakes

no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, other than as required by applicable law.

Company

Profile

The North West Company Inc., through its

subsidiaries, is a leading retailer of food and everyday products

and services to rural communities and urban neighbourhoods in

Canada, Alaska, the South Pacific and the Caribbean. North West

operates 212 stores under the trading names Northern, NorthMart,

Giant Tiger, Alaska Commercial Company, Cost-U-Less and RiteWay

Food Markets and has annualized sales of approximately CDN$2.0

billion.

The common shares of North West

trade on the Toronto Stock Exchange under the symbol

NWC.

For more information

contact:

Edward Kennedy, President and Chief Executive

Officer, The North West Company Inc. Phone 204-934-1482; fax

204-934-1317; email ekennedy@northwest.ca

John King, Executive Vice-President and Chief

Financial Officer, The North West Company Inc. Phone 204-934-1397;

fax 204-934-1317; email jking@northwest.ca

1 Excluding the impact of foreign exchange2 See

Non-GAAP Measures Section of Management's Discussion &

Analysis

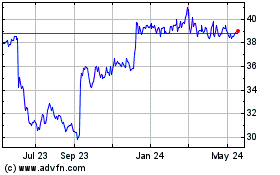

The North West (TSX:NWC)

Historical Stock Chart

From Dec 2024 to Jan 2025

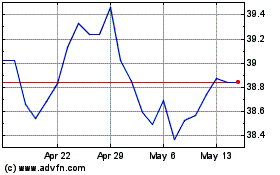

The North West (TSX:NWC)

Historical Stock Chart

From Jan 2024 to Jan 2025