Acquisition by PETRONAS delivers shareholder value CALGARY, July

31, 2012 /CNW/ - - Progress Energy Resources Corp. ("Progress" or

the "Company") announces results for the second quarter of 2012

(the "Quarter"). Capital investment in the Quarter was $21.4

million, net to Progress or $82.6 million, gross including the

North Montney Joint Venture ("NMJV"). In the Quarter, capital

expenditures were prioritized to the NMJV, and the Company's

proprietary North Montney properties in British Columbia. On June

27, 2012 Progress entered into an arrangement agreement (the

"Arrangement") with PETRONAS International Corporation Ltd.

("PICL") and PETRONAS Carigali Canada Ltd. ("PETRONAS Canada") for

the purchase by PETRONAS Canada of all of Progress' outstanding

common shares as amended on July 19, 2012. Further, on July

27, 2012 Progress announced it had entered into an amending

agreement with PICL and PETRONAS Canada to increase the

consideration payable for the common shares from $20.45 to $22.00

per common share. The increase in the consideration resulted

from Progress having received an unsolicited proposal from a third

party. The special meeting of holders of common shares and

debentures is scheduled to be held on August 28, 2012. It is

anticipated that the Arrangement will be completed in late

September subject to obtaining shareholder and Court approval and

the required governmental and regulatory approvals and satisfying

other usual and customary conditions contained in the arrangement

agreement. PETRONAS Canada has filed an application for review with

the Director of Investments under the Investment Canada Act

(Canada) and the Minister of Industry's review of the arrangement

is in progress. PETRONAS Canada and Progress have jointly requested

that the Commissioner of Competition issue an advance ruling

certificate ("ARC") or, in the event the Commissioner of

Competition will not issue an ARC, she issue a waiver of the

parties' obligation to notify and supply information under Part IX

of the Competition Act (Canada) ("Waiver"), or a Waiver and no

action letter confirming, in writing, that she does not, at that

time, intend to make an application under Section 92 of the

Competition Act (Canada), in respect of the arrangement.

Highlights -- On June 27, 2012 entered into an arrangement

agreement for the purchase by PETRONAS Canada of all of Progress'

outstanding common shares at a cash price of $20.45 per share, as

amended on July 19, 2012; -- On July 26, 2012 entered into an

amending agreement to the arrangement agreement dated June 27,

2012, as amended on July 19, 2012, with PICL and PETRONAS Canada

for the purchase of all Progress' common shares at a cash price of

$22.00 per share; -- The LNG Export Joint Venture ("LEJV") between

Progress and PETRONAS Canada selected a site for the planned LNG

export facility in Prince Rupert, British Columbia at Lelu Island,

subject to further feasibility study; -- Generated cash flow of

$27.8 million in the Quarter or $0.12 per share, diluted; --

Production averaged 44,641 barrels of oil equivalent ("boe") per

day in the Quarter, up 10 percent as compared to the second quarter

of 2011; volumes for the Quarter were impacted by the previously

announced planned shut-ins and the deferral of tie-ins and

completions representing approximately 10 to 15 percent of

production; -- Drilled a total of 5 Montney horizontal wells (3.5

net) during the Quarter; the Company expects to complete these

wells in the third quarter; Agreement for Purchase by PETRONAS As

previously announced, Progress and PETRONAS Canada entered into an

arrangement agreement for the purchase by PETRONAS Canada of

all of Progress' outstanding common shares at a cash price of

$20.45 per share, as amended on July 19, 2012. On July 26,

2012, Progress, PICL and PETRONAS Canada entered into a further

amending agreement which increases the consideration to be paid for

the outstanding common shares of Progress from $20.45 to $22.00 per

share. As a result of the increase in the consideration

payable from the common shares, and assuming an effective date of

September 25, 2012, the cash consideration under the arrangement

for each $1,000 principal amount of Progress 5.25 percent

Convertible Unsecured Subordinated Debentures of Progress due

October 31, 2014 (the "2014 Debentures") and 5.75 percent series B

Convertible Unsecured Subordinated Debentures of Progress due June

30, 2016 (the "2016 Debentures"), and excluding accrued interest

and notional interest, will now be increased to approximately

$1,265 for the 2014 Debentures and $1,213 for the 2016

Debentures. The transaction has received the unanimous

approval of Progress' Board of Directors and determined to

recommend that Progress' shareholders and debentureholders vote in

favour of the arrangement. Completion of the transaction is

subject to customary closing conditions including receipt of court,

shareholder and regulatory approvals. An information circular

regarding the arrangement was mailed to holders of common shares

and debentures on July 25, 2012; and a copy of the arrangement

agreement, and amendments thereto, and the information circular and

related documents are available at www.sedar.com. A special meeting

of holders of common shares and debentures will be held on August

28, 2012, at which Progress shareholders will be asked to vote on

the transaction and the completion of the transaction will require

the approval of two-thirds of the votes cast by shareholders in

person or by proxy at the meeting. The holders of the 2014

Debentures and the 2016 Debentures will also be asked to vote on

the transaction, although completion of the transaction is not

conditional on such approvals. North Montney Joint Venture

Progress, along with its joint venture partner, has begun

aggressively developing the NMJV properties at Altares, Lily and

Kahta. Gross capital spending on the NMJV in the Quarter was

$71.6 million ($8.9 net to Progress) comprised principally of

drilling and completions and facilities expenditures. Three

horizontal Montney wells (1.5 net) were drilled in the Quarter,

with two horizontals targeting the upper Montney at Altares and one

targeting the middle Montney at Lily. The first NMJV production was

brought on stream in mid-May through newly constructed facilities

at Lily. As part of the total consideration of $1.07 billion that

PETRONAS Canada paid to acquire a 50% working interest in the

Altares, Lily and Kahta properties, $802.5 million will be paid in

the form of a capital carry over the next three to five

years. At the end of the Quarter, the remaining capital carry

balance was approximately $718 million. The detailed feasibility

study ("DFS") for the LNG Export Joint Venture ("LEJV") is

proceeding along on schedule and is expected to be completed as

planned by the end of August. A preferred site has been selected

and the LEJV entered into an agreement with the Prince Rupert Port

Authority that grants the LEJV the exclusive right to conduct

further feasibility and investigative studies on Lelu Island.

Concurrent with the DFS on the LNG facility, two major pipeline

companies are participating in a detailed feasibility study to

develop a pipeline solution to deliver natural gas from the NMJV to

the anticipated LNG facility on the west coast. The pipeline

DFS is expected to be completed in early September. Financial

Strength Cash flow for the Quarter was $27.8 million or $0.12 per

share, diluted. Capital investment was $82.6 million gross ($21.4

million net). As at June 30, 2012, the Company had drawn

$46.5 million on its $650 million revolving credit facility.

Debt-to-total capitalization as at June 30, 2012 was eight percent.

Progress' average realized natural gas price in the Quarter was

$1.91 per thousand cubic feet, excluding the impact of the

Company's hedging program. Royalty rates averaged 2.2 percent

in the Quarter as a result of lower natural gas prices, and credits

received relating to Alberta's gas cost allowance and British

Columbia's producer cost of service program. Progress expects

royalties to average seven percent in 2012 based on current

commodity prices. Operating costs averaged $5.81 per boe in

the Quarter reflecting the Company's continued focus on operational

efficiencies and maximization of volumes through existing

facilities. Dividend Reinvestment Program In accordance with the

terms of the arrangement agreement with PETRONAS Canada, Progress

common shares will not be made available for issuance from

treasury, nor will additional Progress common shares be purchased

on the market in connection with Progress' dividend reinvestment

plan. Consolidated Financial Statements and MD&A Second Quarter

2012 Consolidated Financial Statements and Notes to the

Consolidated Financial Statements and Management's Discussion and

Analysis for Progress Energy Resources Corp. have been filed on

SEDAR (www.sedar.com) under Progress Energy Resources Corp. and can

also be accessed on the Company's website at

www.progressenergy.com. Progress is a Calgary based energy Company

primarily focused on natural gas exploration, development and

production in northeast British Columbia and northwest Alberta.

Common shares of Progress are listed on the Toronto Stock Exchange

under the symbol PRQ. Special Meeting of Security holders Progress'

Special Meeting of shareholders and debentureholders is scheduled

for Tuesday, August 28, 2012 at 3:00 p.m., Calgary time, in the

McMurray Room of the Calgary Petroleum Club, 319-5(th) Avenue S.W.

Calgary, Alberta. Three Months Ended Six Months Ended June 30 June

30 2012 2011 2012 2011 FINANCIAL HIGHLIGHTS Income Statement ($

thousands, except per share amounts) Petroleum and natural gas

revenue 81,474 117,340 184,488 234,455 Cash flow1 27,809 54,618

69,087 117,940 Per share - diluted 0.12 0.24 0.29 0.52 Cash

dividends declared2 23,530 23,184 47,007 46,271 Per share 0.10 0.10

0.20 0.20 Balance Sheet($ thousands) Working capital deficiency

25,117 14,209 25,117 14,209 (surplus) Bank debt 46,516 - 46,516 -

Convertible debentures 361,932 424,761 361,932 424,761 Total debt

433,565 438,970 433,565 438,970 Capital expenditures 21,421 46,037

137,424 186,377 Property dispositions (66) (18,316) (13,249)

(35,344) OPERATIONAL HIGHLIGHTS Average Daily Production Natural

gas (mcf/d) 226,125 209,202 232,750 221,278 Crude oil (bbls/d)

2,724 2,122 2,549 2,078 Natural gas liquids (bbls/d) 4,230 3,747

4,363 3,579 Total daily production (boe/d) 44,641 40,736 45,704

42,537 Average Realized Prices Natural gas ($/mcf) 1.91 3.91 2.24

3.88 Crude oil ($/bbl) 81.29 99.21 86.72 91.27 Natural gas liquids

($/bbl) 55.90 66.57 61.21 67.18 Wells Drilled, Net 3.5 1.8 18.3

24.5 (1) Represents cash flow from operating activities before

changes in non-cash working capital. (2) The dividends declared

include distributions and dividends that grantees are entitled to

on the vesting of the Share Unit Plan, the Long Term Incentive Plan

and the Performance Unit Incentive Plan. Advisory

Regarding Forward-Looking Statements This press release and

financial highlights table (collectively the "press release")

contains forward-looking statements and forward-looking information

within the meaning of applicable securities laws. The use of any of

the words "expect", "anticipate", "continue", "estimate",

"objective", "ongoing", "may", "will", "project", "should",

"believe", "plans", "intends" and similar expressions are intended

to identify forward-looking information or statements. In

particular, forward looking statements in this press release

include, but are not limited to, expected timing of drilling of

wells; statements with respect to the focus of capital expenditure;

anticipated timing of completion of pipeline DFS; the anticipated

timing of the completion of the transactions contemplated by the

Arrangement Agreement and the timing of the meeting of Shareholders

and Debentureholders; completion of planned facility expansions and

the timing thereof; average royalty rates for 2012; expected

commodity prices and industry conditions; and statements regarding

the completion of the arrangement, the timing of the meeting and

the anticipated results therefrom The forward-looking statements

and information are based on certain key expectations and

assumptions made by Progress, including, amoung other things,

expectations and assumptions concerning prevailing commodity prices

and exchange rates, applicable royalty rates and tax laws; future

well production rates; reserve and resource volumes; the

performance of existing wells; the success obtained in drilling new

wells; the sufficiency of budgeted capital expenditures in carrying

out planned activities; the availability and cost of labour and

services and future operating costs; and the ability to obtain all

required regulatory approvals for the transaction, including, but

not limited to, shareholder, Court and regulatory approvals.

Although Progress believes that the expectations and assumptions on

which such forward-looking statements and information are based are

reasonable, undue reliance should not be placed on the forward

looking statements and information because Progress can give no

assurance that they will prove to be correct. Since forward-looking

statements and information address future events and conditions, by

their very nature they involve inherent risks and uncertainties.

Actual results could differ materially from those currently

anticipated due to a number of factors and risks. These include,

but are not limited to, the risks associated with the oil and gas

industry in general such as operational risks in development,

exploration and production; delays or changes in plans with respect

to exploration or development projects or capital expenditures; the

uncertainty of reserve and resource estimates; the uncertainty of

estimates and projections relating to reserves, resources,

production, costs and expenses; health, safety and environmental

risks; commodity price and exchange rate fluctuations; marketing

and transportation; loss of markets; environmental risks;

competition; incorrect assessment of the value of acquisitions;

failure to realize the anticipated benefits of acquisitions;

ability to access sufficient capital from internal and external

sources; changes in legislation, including but not limited to tax

laws, royalties and environmental regulations; the risk that the

transaction may not close when planned or at all or on the terms

and conditions set forth in the arrangement agreement; and the

failure to obtain the necessary shareholder, Court, regulatory and

other third party approvals required in order to proceed with the

transaction. Readers are cautioned that the foregoing list of

factors is not exhaustive. Additional information on these and

other factors that could affect the operations or financial results

of Progress are included in reports on file with applicable

securities regulatory authorities and may be accessed through the

SEDAR website (www.sedar.com). Management has included the above

summary of assumptions and risks related to forward-looking

information provided in this press release in order to provide

securityholders with a more complete perspective on the Company's

future operations and such information may not be appropriate for

other purposes. The Company's actual results, performance or

achievement could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no

assurance can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do so, what benefits that the Company will derive there

from. Readers are cautioned that the foregoing lists of

factors are not exhaustive. These forward-looking statements

are made as of the date of this press release and the Company

disclaims any intent or obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or results or otherwise, other than as required by

applicable securities laws. Barrels of Oil Equivalent "Boe" means

barrel of oil equivalent on the basis of 1 boe to 6,000 cubic feet

of natural gas. Boe's may be misleading, particularly if used in

isolation. A boe conversion ratio of 1 boe for 6,000 cubic feet of

natural gas is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead. Given that the value ratio based

on the current price of crude oil as compared to natural gas is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value. Progress Energy

Resources Corp. CONTACT: Greg Kist, Vice President, Marketing,

Corporate and GovernmentRelationsProgress Energy Resources

Corp.403-539-1809 gkist@progressenergy.com.Kurtis Barrett, Analyst,

Investor Relations and MarketingProgress Energy Resources

Corp.403-539-1843 kbarrett@progressenergy.com.

Copyright

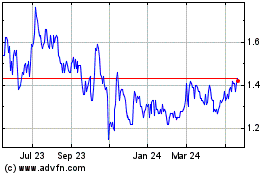

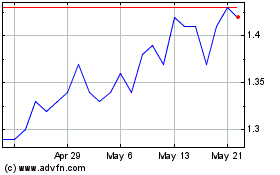

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From Jan 2025 to Feb 2025

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From Feb 2024 to Feb 2025