RioCan Real Estate Investment Trust Announces Refinements to its Executive Compensation Program

12 December 2023 - 12:30AM

Business Wire

The Board of Trustees (the “Board”) of RioCan Real Estate

Investment Trust (“RioCan” or the “Trust”) (TSX: REI.UN) today

announced that it has made refinements to further align executive

compensation with unitholder experience. Subsequent to the

non-binding advisory say-on-pay resolution receiving 75.97% support

at the Trust’s 2023 annual and special meeting of unitholders, the

Board and its People, Culture and Compensation Committee (the

“Committee”) undertook a thorough review of the Trust’s executive

compensation program and conducted an extensive unitholder outreach

initiative.

“The Board and Committee sought unitholder feedback on RioCan’s

executive compensation program. Through our unitholder outreach

initiative, we engaged in meaningful discussions and have taken

important steps to address our unitholders’ feedback. These changes

will be effective January 1, 2024,” said Jane Marshall, Chair of

the Committee. “We would like to extend our sincerest gratitude to

the unitholders who took the time to meet with us. We remain

committed to ensuring that our executive compensation program

continues to link pay with performance and create long-term

unitholder value by attracting and retaining talented

executives.”

Between July and November, members of the Committee and the

Board met with and solicited feedback from RioCan’s largest

unitholders. The Committee reached out to the majority of the

Trust’s 40 largest unitholders, representing approximately 39% of

RioCan’s outstanding units. To date, the Committee has held 16

meetings with unitholders, representing approximately 23.53% of

RioCan’s outstanding units. The Board and Committee intend to

continue their leading unitholder outreach program. Since its

establishment in 2020, Board members have held 71 meetings with

unitholders. The outreach program is a critical element of RioCan’s

overall investor relations program and demonstrates RioCan’s

ongoing commitment to facilitating meaningful communication with

its unitholders and its willingness to respond to the feedback of

its Unitholders on governance and compensation related issues.

As a result of the outreach program, the Board and Management

have committed to refining the Trust’s compensation program,

beginning in 2024. Below is a summary of the changes:

- Double trigger Senior Executive REU Plan: RioCan’s

Senior Executive REU Plan (the “REU Plan”) will be amended to

require a ‘double trigger’ before permitting REUs to vest upon a

change of control. This change means that executive REUs will now

require both a termination of the executive’s employment and a

change of control to trigger vesting which aligns RioCan with

equity plan best-practices.

- Cliff vesting for REUs: The REU Plan will be amended

such that REUs will vest 100% following a three-year performance

cycle. This change puts further emphasis on the creation of

long-term unitholder value.

- Modified peer group: The Committee worked with its

independent compensation consultant to redevelop RioCan’s peer

group for both compensation and performance measurement to replace

peers in the utility sector with more business-relevant peers.

RioCan will provide enhanced proxy disclosure of the rationale for

the selection of the companies in its peer group.

- Increased focus on ESG: Further focus will continue to

be put on establishing short- and long-term compensation metrics

that are directly linked to achieving the Trust’s environmental

objectives, as well as certain key social and governance objectives

that the Board determines to be important.

- Enhanced disclosure: RioCan commits to providing

enhanced disclosure in its management information circular,

including with respect to the different applications of funds from

operations in RioCan’s Executive Management Bonus Plan and

long-term incentive program and to the individual objectives within

each executive’s scorecard.

Additional details will be provided in RioCan’s Management

Information Circular prior to the 2024 annual meeting of

unitholders. RioCan remains committed to year-round and meaningful

engagement with unitholders. The Committee will continue to assess

the Trust’s executive compensation program to align with business

goals and unitholder interests.

About RioCan

RioCan is one of Canada’s largest real estate investment trusts.

RioCan owns, manages and develops retail-focused, increasingly

mixed-use properties located in prime, high-density

transit-oriented areas where Canadians want to shop, live and work.

As at September 30, 2023, our portfolio is comprised of 192

properties with an aggregate net leasable area of approximately

33.6 million square feet (at RioCan's interest) including office,

residential rental and 10 development properties. To learn more

about us, please visit www.riocan.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231211760065/en/

RioCan Kim Lee Vice President, Investor Relations (416)

646-8326

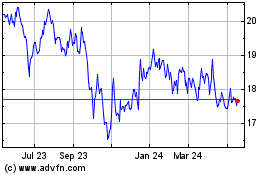

RioCan Real Estate Inves... (TSX:REI.UN)

Historical Stock Chart

From Mar 2024 to Apr 2024

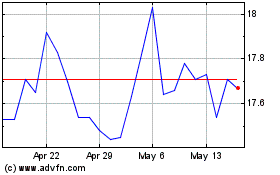

RioCan Real Estate Inves... (TSX:REI.UN)

Historical Stock Chart

From Apr 2023 to Apr 2024