STEP Energy Services Ltd. (TSX:STEP) (STEP) is reporting continued

improvement in its balance sheet, an update on its 2024 capital

budget, and is providing an operational update.

Balance Sheet and 2024 Capital

Budget

We are pleased to announce that Net debt1 at the

close of Q4 2023 is expected to meet STEP’s year-end corporate

target of less than $100 million, continuing the deleveraging trend

that has seen debt come down from $310 million in 2018.

Deleveraging has been a strategic priority for STEP and a means to

return value to shareholders – the first phase of STEP’s

shareholder return strategy. STEP intends to continue to reduce

leverage into 2024.

STEP is also announcing its full-year 2024

capital budget of $119.8 million, an increase from the preliminary

capital budget of $60 million announced on November 1, 2023. The

full-year budget includes $69.8 million of optimization capital and

$50 million of sustaining capital. The $59.8 million of additional

optimization capital will facilitate a number of growth initiatives

for STEP including expansion of its Tier 4 dual fuel strategy that

will add a second fleet in Canada and the first fleet in U.S. by

the second quarter of 2024, investing in additional Canadian sand

and logistics infrastructure and providing capital to reactivate

additional deep coiled tubing units in Canada and the U.S. to meet

expected 2024 demand.

Operational Update and

Outlook

Fracturing activity across major North American

oil and gas regions slowed in Q4 2023 as operators prioritize

capital discipline over adding capital to their 2023 budgets.

STEP’s Canadian fracturing operations

experienced lower utilization in Q4 relative to Q3 as clients

across the basin exhausted their 2023 budgets and did not bring

capital forward from 2024. STEP’s Q4 U.S. fracturing results will

be negatively affected by the cancellation of remaining work scope

for one fracturing crew following the acquisition of STEP’s

long-time client as well as the deferral of work from December into

the first quarter for another crew. Coiled tubing activity in both

Canada and the U.S. will also experience lower utilization in the

fourth quarter relative to the third quarter due to seasonal

slowdown.

STEP will use the down time in the fourth

quarter to prepare for a highly utilized first quarter in Canada

and the U.S. Fracturing and coiled tubing crews are expected to

begin mobilizing in late December in anticipation of operations

beginning in the early days of January.

NON-IFRS MEASURES

This press release includes terms and

performance measures commonly used in the oilfield services

industry that are not defined under IFRS. The terms presented are

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. These non-IFRS

measures have no standardized meaning under IFRS and therefore may

not be comparable to similar measures presented by other issuers.

The non-IFRS measure should be read in conjunction with STEP’s

quarterly financial statements and annual financial statements and

the accompanying notes thereto.

“Net debt” is equal to loans and borrowings

before deferred financing charges less cash and cash equivalents

and CCS derivatives. The data presented is intended to provide

additional information about items on the statement of financial

position and should not be considered in isolation or as a

substitute for measures prepared in accordance with IFRS.

A table representing the composition of the

non-IFRS financial measure of Net debt can be found in STEP’s

Management Discussion and Analysis for the third quarter of 2023

dated as of September 30, 2023 (under “Non-IFRS Measures and

Ratios”) which is available on SEDAR+ (www.sedarplus.ca) and

incorporated herein by reference.

FORWARD-LOOKING INFORMATION &

STATEMENTS AND FUTURE-ORIENTED FINANCIAL INFORMATION AND FINANCIAL

OUTLOOKS

Certain statements contained in this press

release constitute “forward-looking statements” or “forward-looking

information” within the meaning of applicable securities laws

(collectively, “forward-looking statements”). These statements

relate to the expectations of management about future events,

results of operations and STEP’s future performance (both

operational and financial) and business prospects. All statements

other than statements of historical fact are forward-looking

statements. The use of any of the words “expects”, “expected”,

“guidance”, “intends”, “opportunity”, “may”, “project”, “should”,

and similar expressions are intended to identify forward-looking

statements. These statements involve known and unknown risks,

uncertainties, and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking statements. While STEP believes the expectations

reflected in the forward-looking statements included in this press

release are reasonable, such statements are not guarantees of

future performance or outcomes and may prove to be incorrect and

should not be unduly relied upon.

In particular, but without limitation, this

press release contains forward-looking statements pertaining to:

anticipated Net debt levels, STEP’s intent to continue to reduce

leverage, anticipated spending, expected Q4 2024 fracturing

results, expected coiled tubing activity, and expected mobilization

dates.

The forward-looking information and statements

contained in this press release reflect several material factors

and expectations and assumptions of STEP including, without

limitation: the general continuance of current or, where

applicable, assumed industry conditions; client activity levels and

spending; the effect of inflation on the cost of goods and

equipment; pricing of STEP’s services; predictable effect of

seasonal weather on STEP’s operations; STEP’s ability to market

successfully to current and new clients; the effect of competition

on STEP; STEP’s ability to utilize its equipment; STEP’s ability to

collect on trade and other receivables; STEP’s ability to obtain

and retain qualified staff and equipment in a timely and

cost-effective manner; levels of deployable equipment in the

marketplace; future capital expenditures to be made by STEP; future

funding sources for STEP’s capital program; STEP’s future debt

levels; the availability of unused credit capacity on STEP’s credit

lines. STEP believes the material factors, expectations, and

assumptions reflected in the forward-looking information and

statements are reasonable, but no assurance can be given that these

factors, expectations, and assumptions will prove correct.

This press release also contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about STEP’s expected 2023 and 2024 revenues

and Net debt levels, all of which are subject to the same

assumptions, risk factors, limitations, and qualifications as set

forth in the above paragraphs. In addition, the expected Net debt

at end of Q4 2023 is based on STEP’s internally generated monthly

financial statements for the month of November 2023 and the

assumption that these internally generated monthly financial

statements will not differ materially from the third quarter 2023

financial statements. The actual results of operations of STEP and

the resulting financial results and Net debt will likely vary from

the amounts set forth in this press release and such variation may

be material. STEP and its management believe that the FOFI has been

prepared on a reasonable basis, reflecting management's best

estimates and judgments as of the date hereof; however, because

this information is subjective and subject to numerous risks, it

should not be relied on as necessarily indicative of future

results.

The forward-looking information and FOFI

contained in this press release speak only as of the date of the

document, and none of STEP or its subsidiaries assumes any

obligation to publicly update or revise them to reflect new events

or circumstances, except as may be required pursuant to applicable

laws. Actual results could also differ materially from those

anticipated in these forward‐looking statements and FOFI due to the

risk factors set forth under the heading “Risk Factors” in STEP’s

Annual Information Form for the year ended December 31, 2022, dated

March 1, 2023.

ABOUT STEP

STEP is an energy services company that provides

coiled tubing, fluid and nitrogen pumping and hydraulic fracturing

solutions. Our combination of modern equipment along with our

commitment to safety and quality execution has differentiated STEP

in plays where wells are deeper, have longer laterals and higher

pressures. STEP has a high-performance, safety-focused culture and

its experienced technical office and field professionals are

committed to providing innovative, reliable and cost-effective

solutions to its clients.

Founded in 2011 as a specialized deep capacity

coiled tubing company, STEP has grown into a North American service

provider delivering completion and stimulation services to

exploration and production (“E&P”) companies in Canada and the

U.S. Our Canadian services are focused in the Western Canadian

Sedimentary Basin (“WCSB”), while in the U.S., our fracturing and

coiled tubing services are focused in the Permian and Eagle Ford in

Texas, the Uinta-Piceance and Niobrara-DJ basins in Colorado and

the Bakken in North Dakota.

Our four core values; Safety,

Trust, Execution and

Possibilities inspire our team of professionals to

provide differentiated levels of service, with a goal of flawless

execution and an unwavering focus on safety.

For more information please contact:

| Steve GlanvillePresident and

Chief Executive OfficerTelephone: 403-457-1772Email:

investor_relations@step-es.comWeb:

www.stepenergyservices.com |

|

Klaas DeemterChief Financial

OfficerTelephone: 403-457-1772 |

1 Net debt is a non-IFRS financial measure, which is not defined

and does not have a standardized meaning under IFRS. See “Non-IFRS

Measures” below.

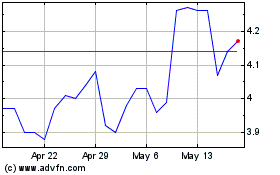

STEP Energy Services (TSX:STEP)

Historical Stock Chart

From Jan 2025 to Feb 2025

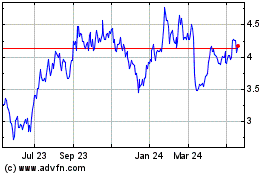

STEP Energy Services (TSX:STEP)

Historical Stock Chart

From Feb 2024 to Feb 2025